Unique Info About Link Between Balance Sheet And Cash Flow Statement Mfc Financial Statements

Learn the intricate workings of linking the three financial statements:

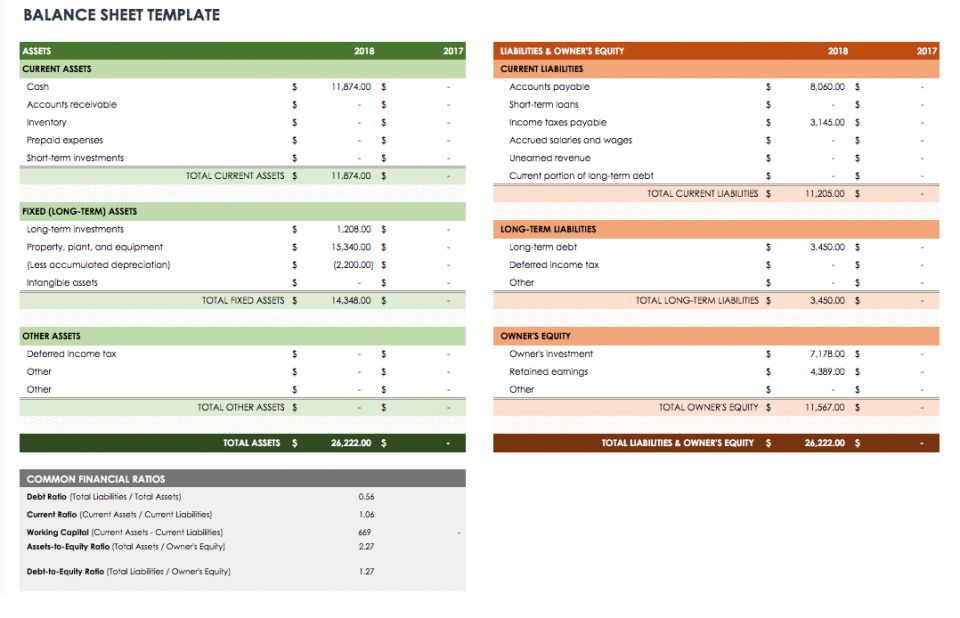

Link between balance sheet and cash flow statement. At the same time, a cash flow statement tracks the inflow and outflow of cash over a period, providing insights into a company’s liquidity and cash management. These three financial statements are intricately linked to one another. The balance sheet provides the information about the company’s financial position.

Cash flow typically a simple cash flow statement for a business is along the following lines. The three primary financial statements of a business — the balance sheet, the income statement, and the statement of cash flows — are intertwined and interdependent. On the contrary cash flow statement provides the information about the company’s liquidity and stability.

The statement of cash flows acts as a bridge between the income statement and balance sheet by. The biggest difference between a balance sheet and cash flow statement is businesses's financial information in each report. Why do shareholders need financial statements?

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Remember the interconnectivity between p&l and balance sheet. The cash flow statement shows the cash inflows and outflows for a company during a period.

What’s the difference between a cash flow statement and an income statement? The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. Net debt and financing as of december 31, 2023, safran’s balance sheet exhibits a €374 million net cash position (vs.

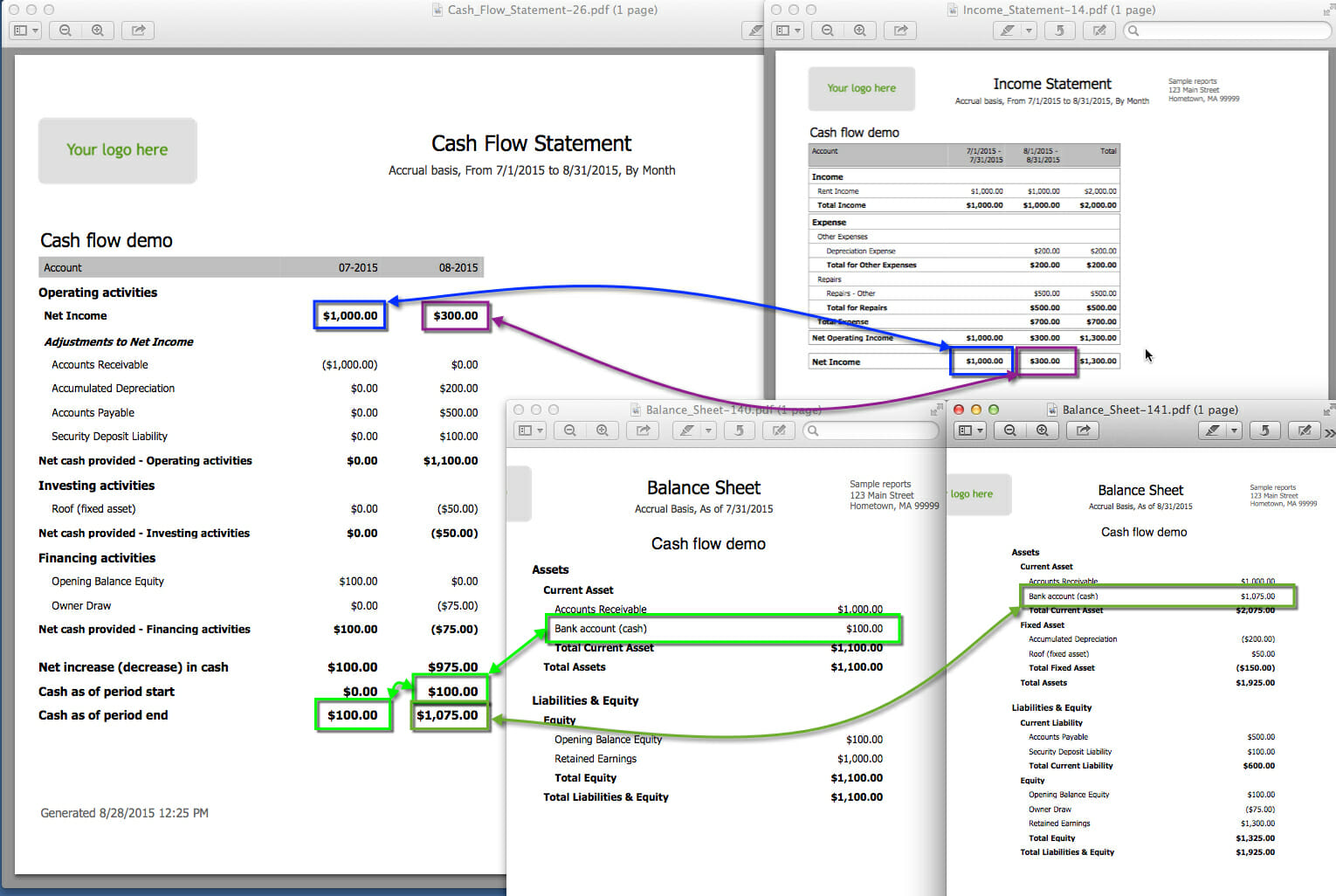

By analyzing these statements collectively, one can assess the company's profitability, liquidity, and overall financial health. The cash flow statement and income statement integrate with the corporate balance sheet. The cash flow statement is linked to the income statement by net profit or net loss, which is.

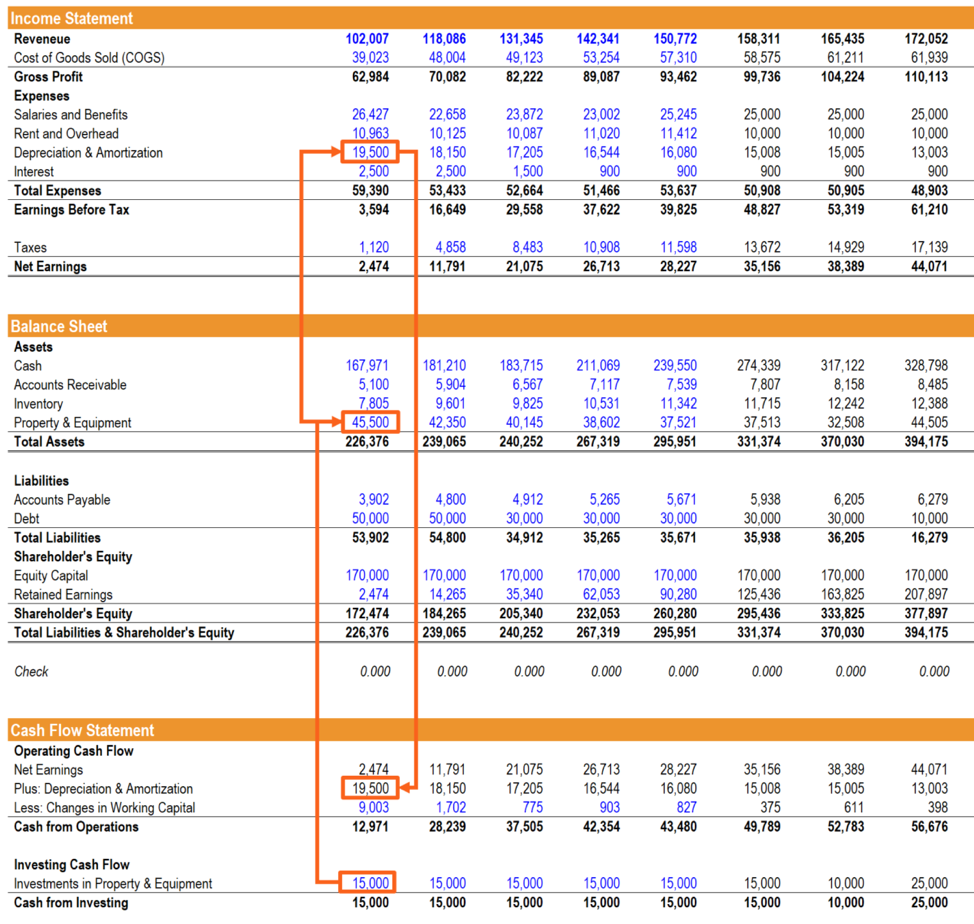

This article helps you grasp the relationship between important financial concepts like net income, retained earnings, depreciation, capex, working capital, and financing, all of which impact the three. The beginning and ending balance sheet amounts of cash and cash equivalents are linked through the cash flow statement. Net income & retained earnings.

The cash flow and balance sheet can be linked by looking at balance sheet movements. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The p&l and balance sheet are interconnected via the equity account in the balance sheet.

Net cash of €14 million as at december 31, 2022), as a result of a strong free cash flow generation, and including the dividend payment (of which €564 million to shareholders of the parent company on 2022 fiscal year. The most obvious connection between a balance sheet and an income statement is retained earnings. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

The cash flow statement is prepared on the basis of the balance sheet, but the balance sheet is not prepared on the basis of cash flow statement. Net income from the bottom of the income statement links to the balance sheet and cash flow statement. The cfs highlights a company's cash management, including how well it generates.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)