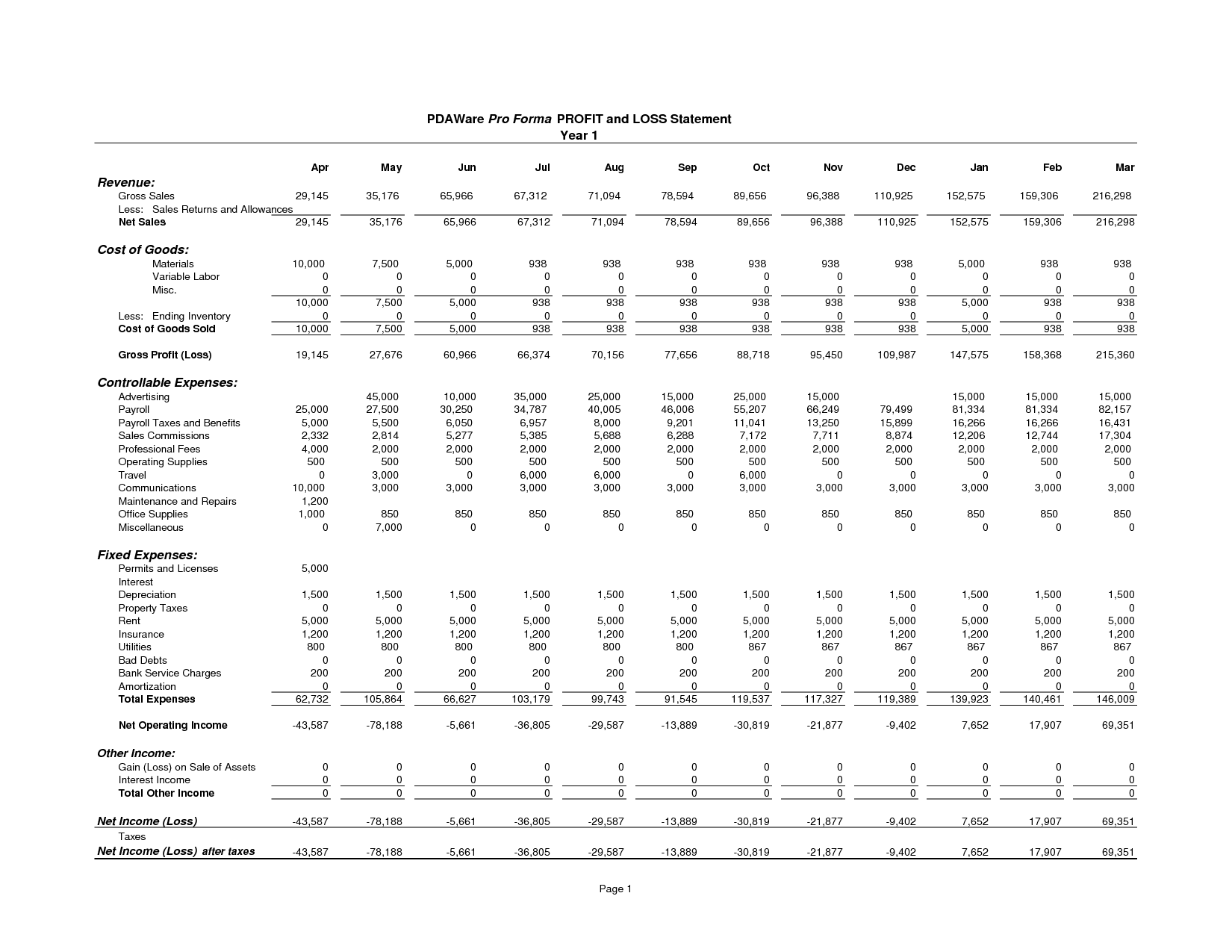

Heartwarming Info About Describe Balance Sheet Simplified Profit And Loss Statement

The liabilities section reflects how those.

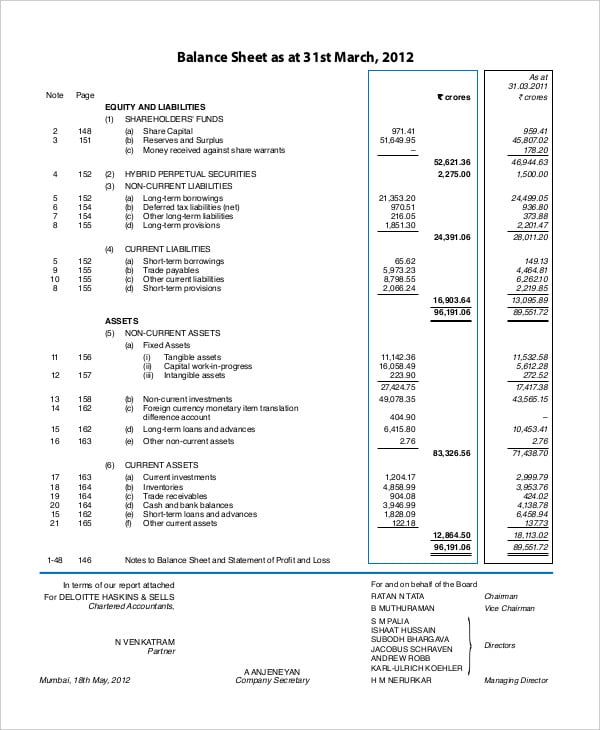

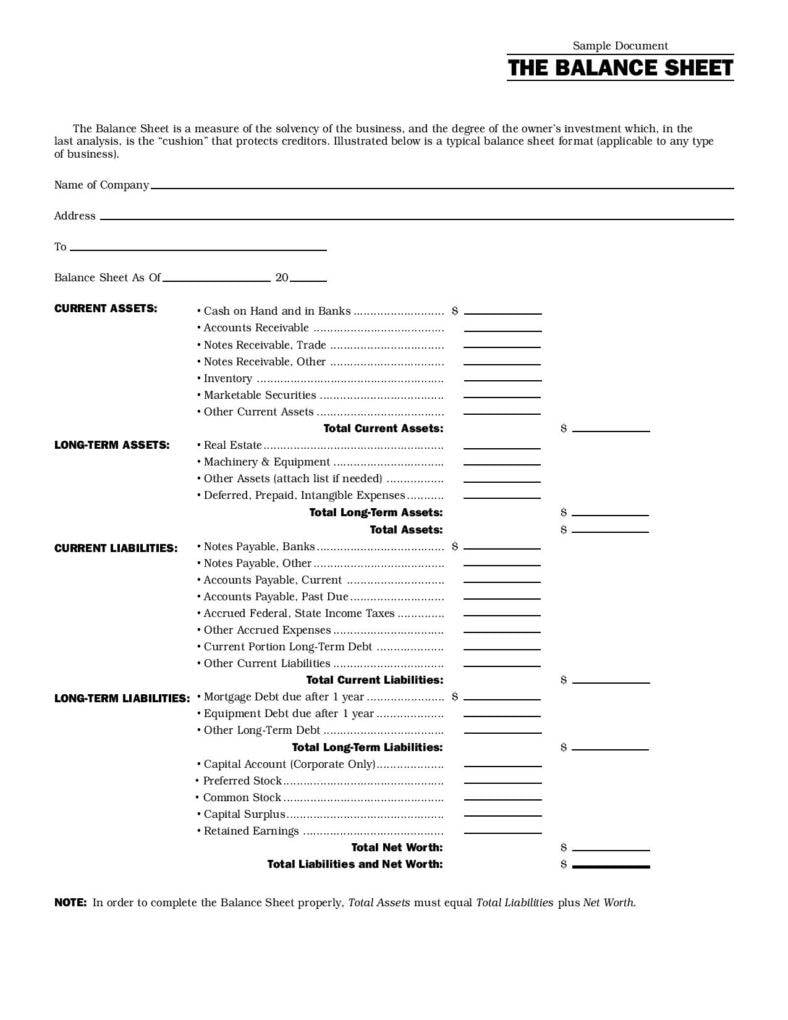

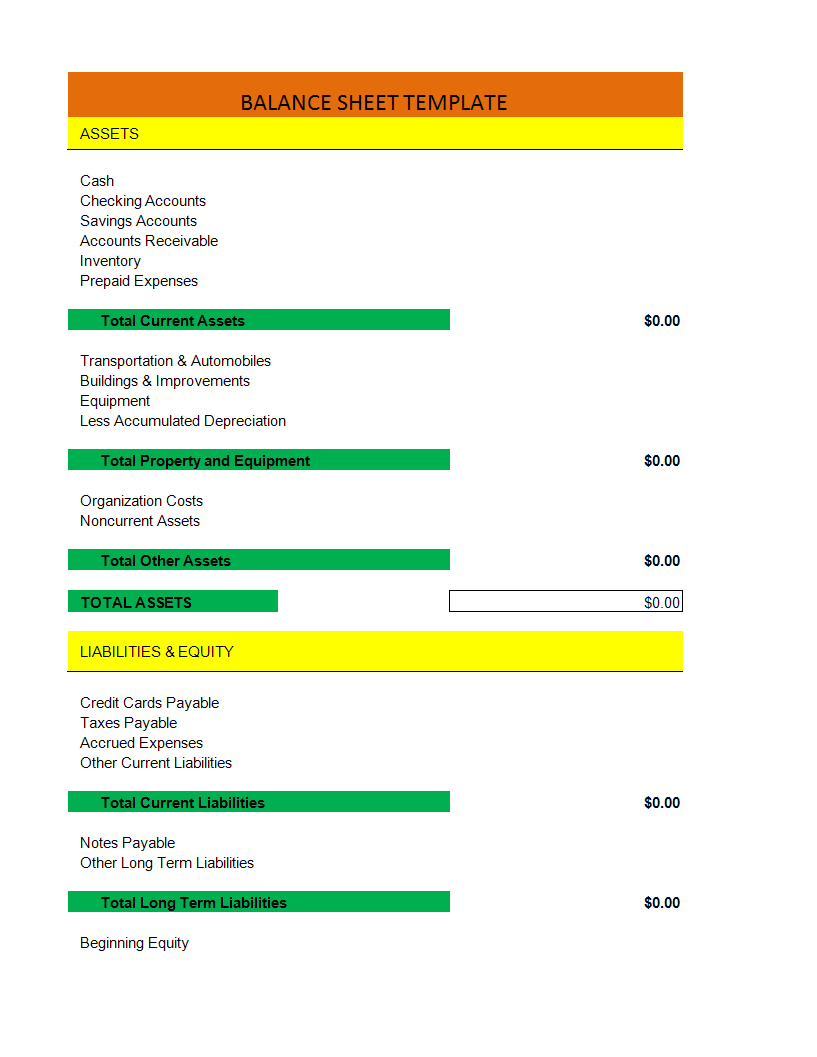

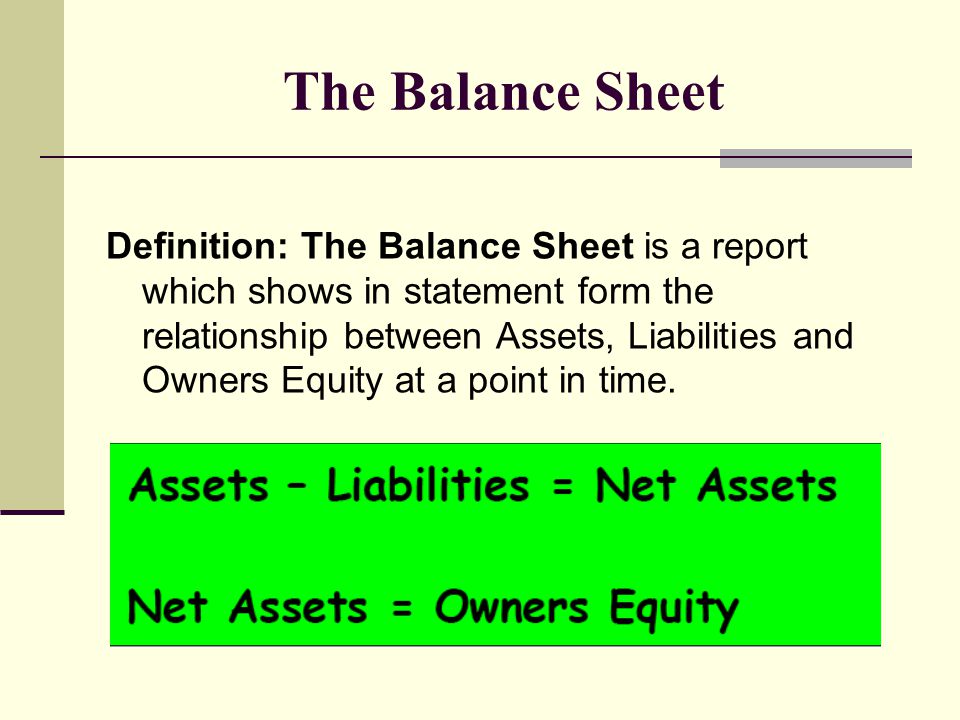

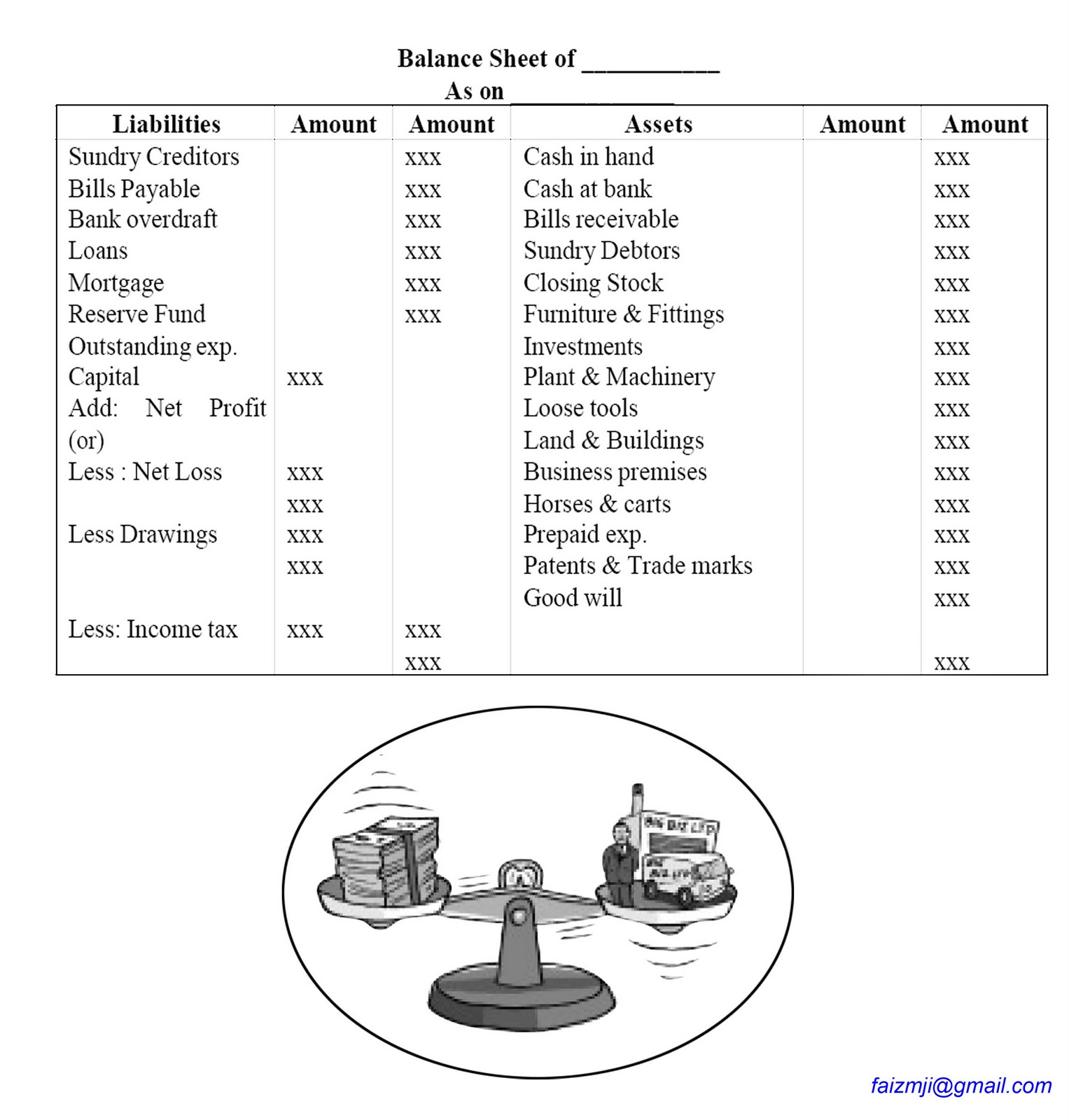

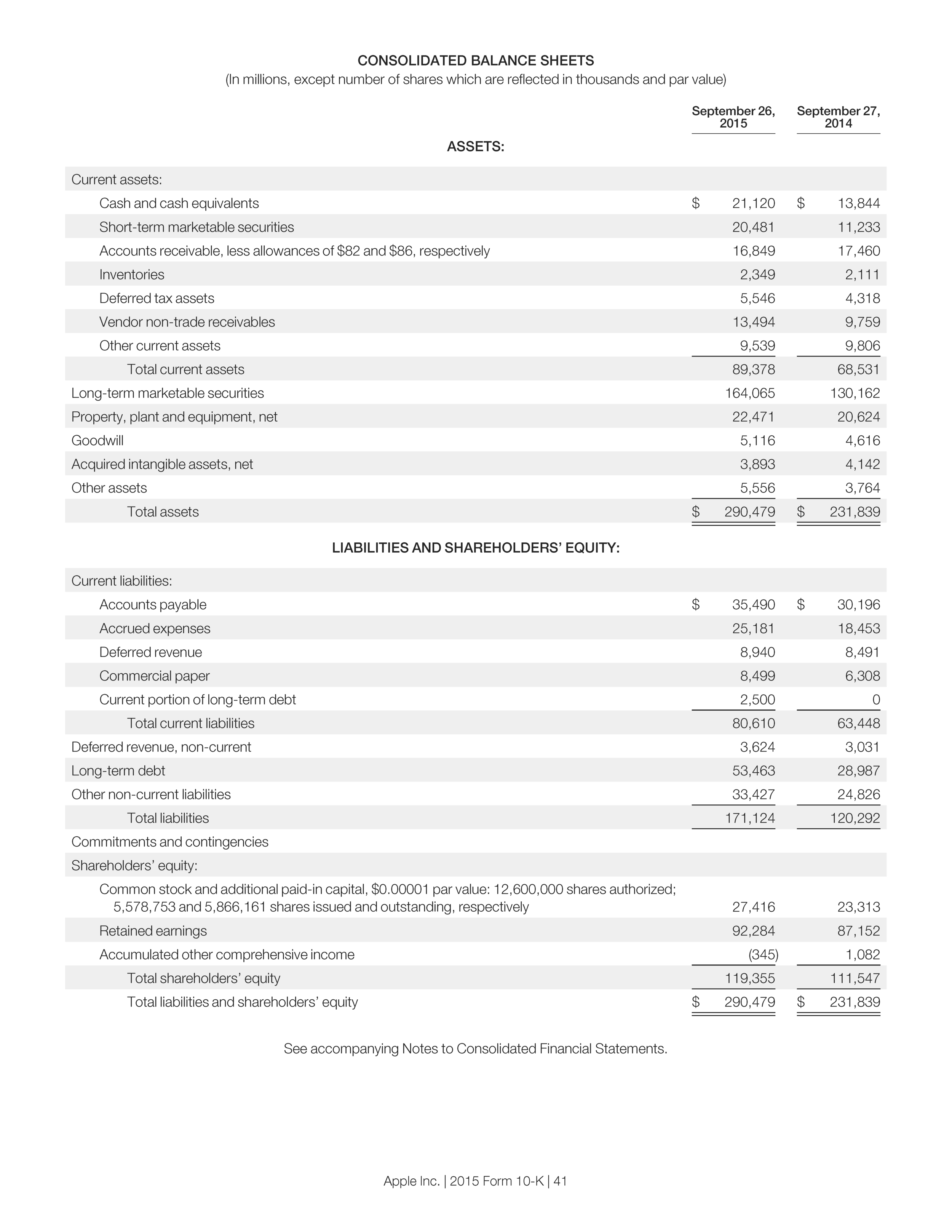

Describe balance sheet. The balance sheet is one of the three main financial statements , along with the income statement and cash flow statement. While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. A balance sheet is a financial document that shows a company's current assets, liabilities, and stockholders' equity.

The balance sheet provides a snapshot of the overall financial condition of your company at a specific point in time. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. What is a balance sheet?

Also referred to as the statement of financial position, a company's balance sheet provides information on what the company is worth from a book value perspective. The balance sheet is one of the three financial statements businesses use to measure their financial performance. This made the older, lower.

Balance sheets provide the basis for. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.

The balance sheet shows assets, liabilities, and shareholders' equity. Balance sheet the balance sheet displays the company’s assets, liabilities, and shareholders’ equity at a point in time. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). Total assets should equal the sum of total liabilities and shareholders' equity. A balance sheet is a type of financial statement.

Assets + liabilities = shareholders’ equity. The two sides of the balance sheet must balance: At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader.

Assets = liabilities + equity. A balance sheet lists a company’s assets, liabilities, and owner’s equity at a specific point in time. Assets = liabilities + equity.

A balance sheet covers a company’s assets as defined by. The fed has been reducing the size of its holdings since 2022. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. It can also be referred to as a statement of net worth or a statement of financial position. Then you need a balance sheet.