The Secret Of Info About Relationship Between Income Statement Balance Sheet And Cash Flow The Reports Quizlet

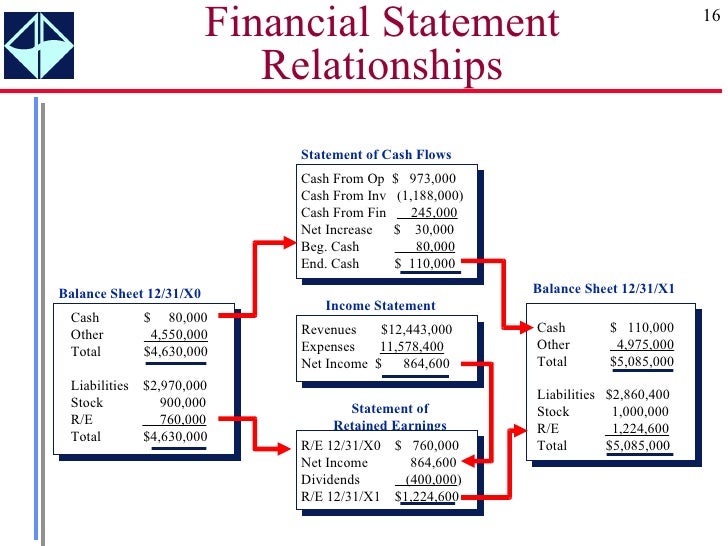

In describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate, we discussed the function of and the basic characteristics of the statement of cash flows.

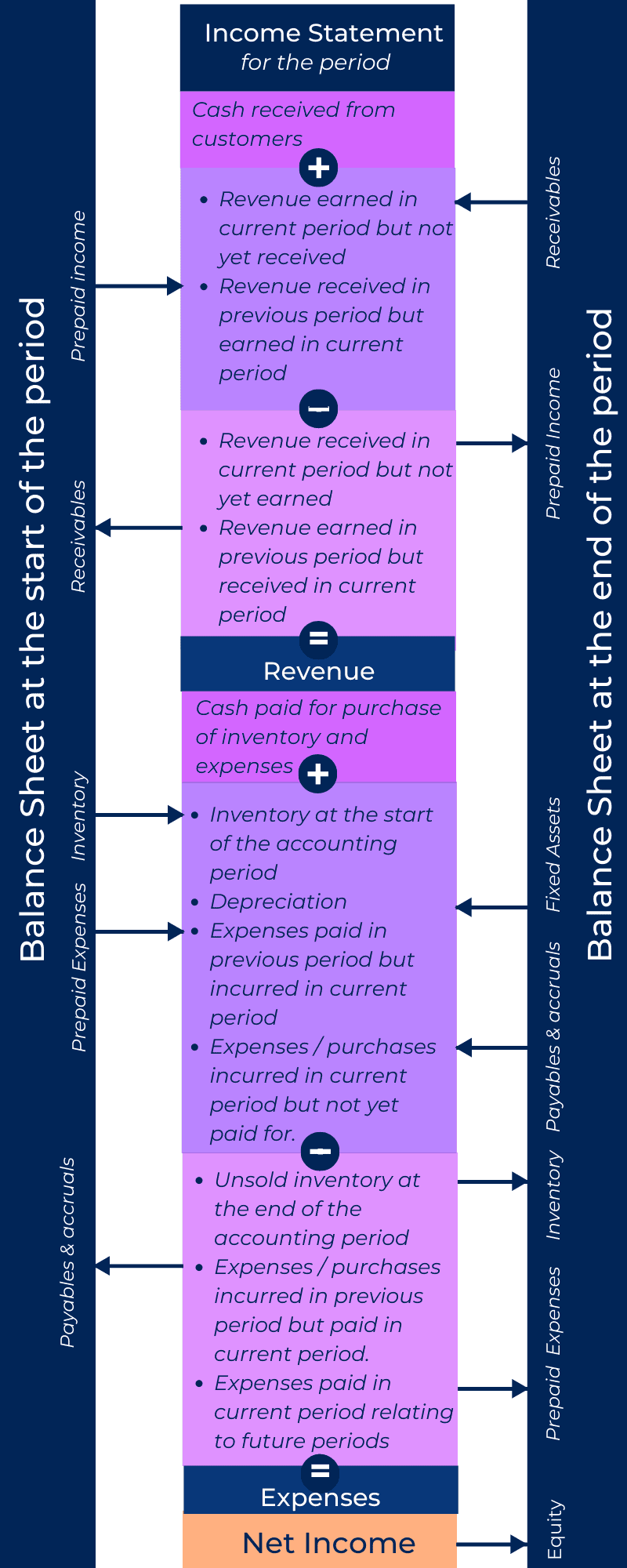

Relationship between income statement balance sheet and cash flow. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet. What is an income statement? Balance sheet and income statement relationship (video) | khan academy course:

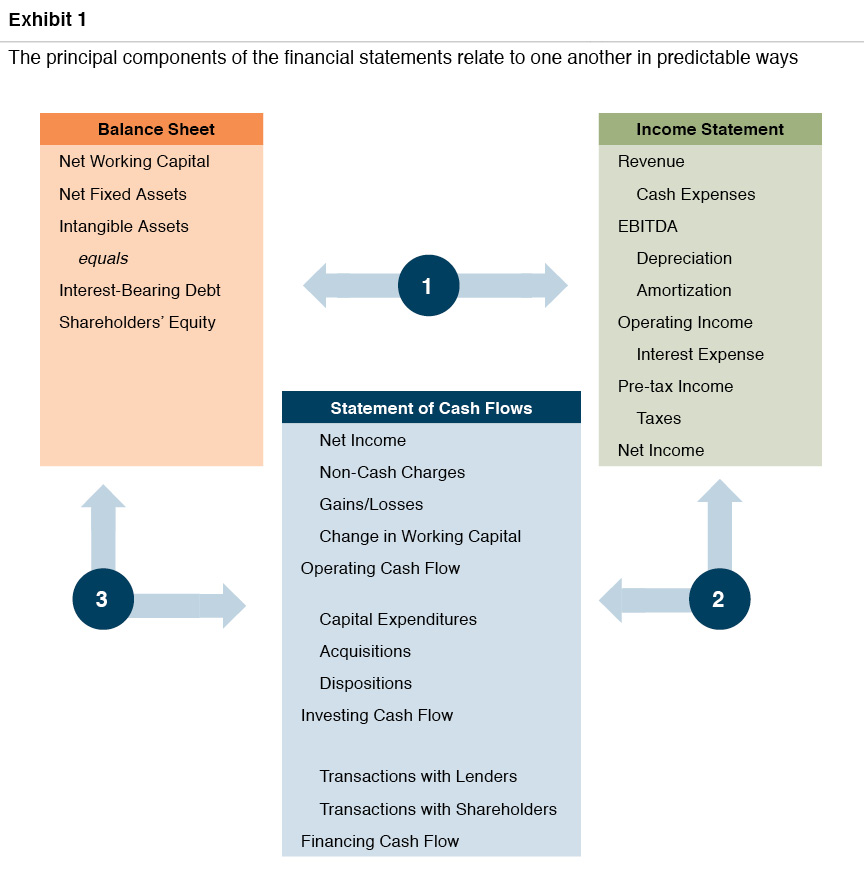

Analyzing these three financial statements is one of the key steps when creating a financial model. The ascent knowledge accounting what is the difference between income statement, balance sheet,. These three financial statements are intricately linked to one another.

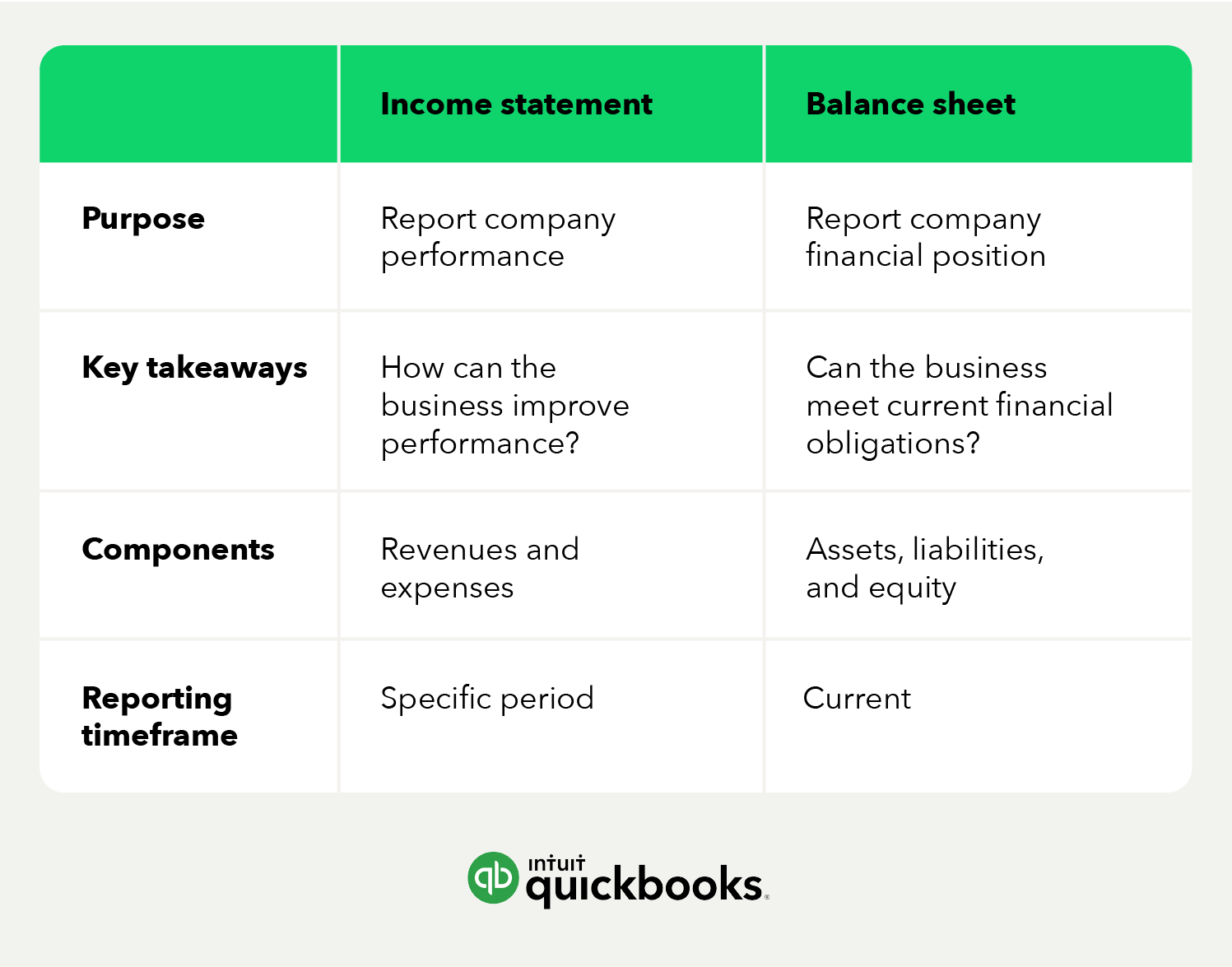

In this article, we explain what income statements, balance sheets and cash flow are, share how companies use them to determine their financial health and show what makes them different from one another. The beginning and ending balance sheet amounts of cash and cash equivalents are linked through the cash flow statement. Finance and capital markets > unit 5 lesson 2:

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. Linkages of the cash flow statement with the income statement and the balance sheet. The income statement, balance sheet, and cash flow statement.

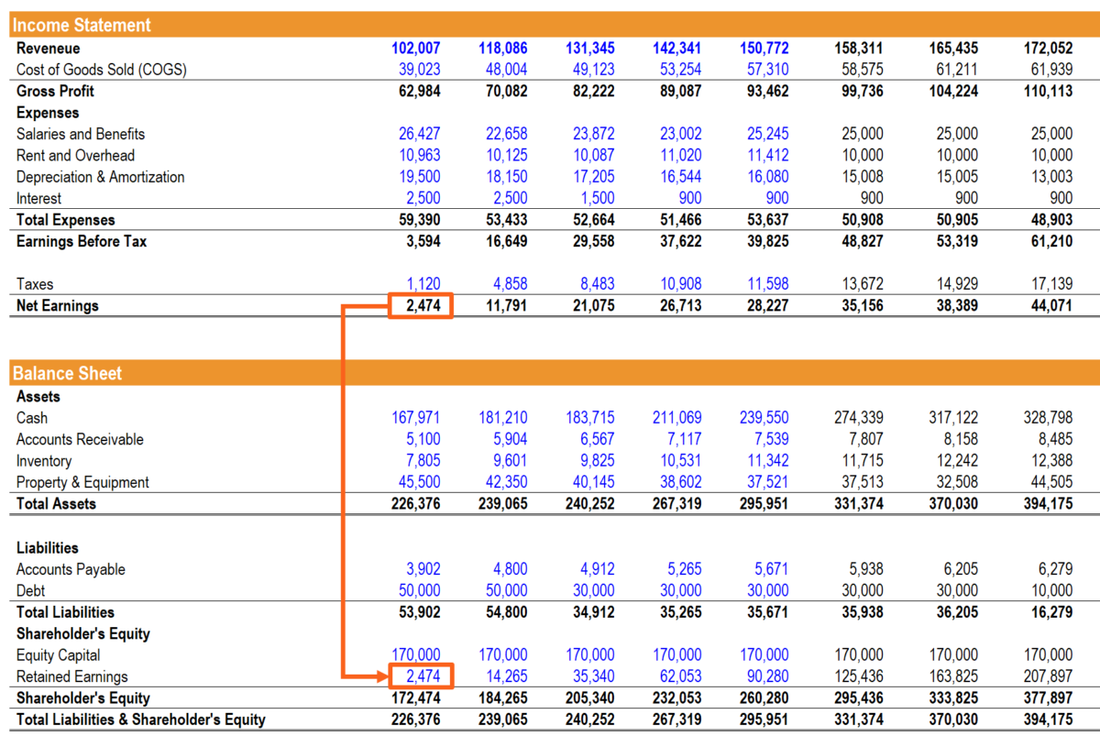

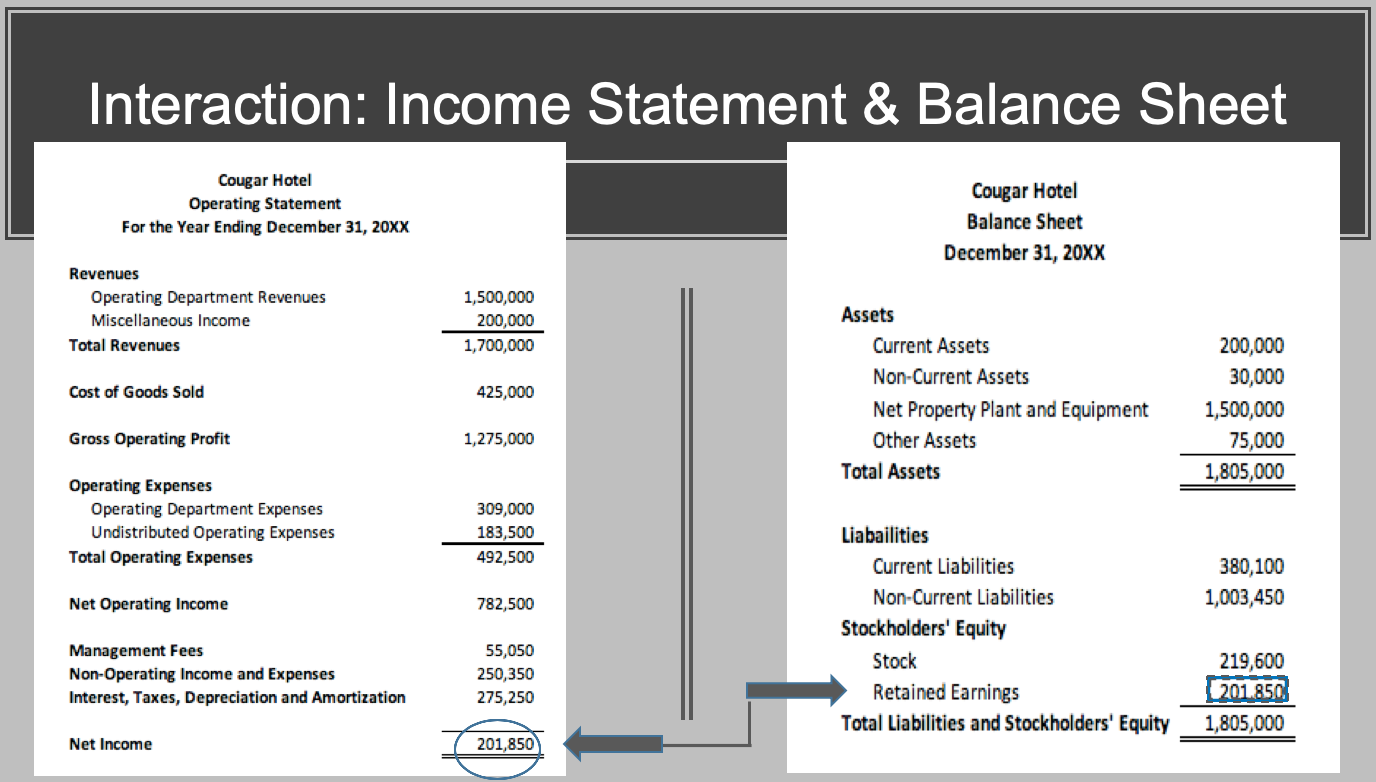

The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement. Why do shareholders need financial statements? Net income from the bottom of the income statement links to the balance sheet and cash flow statement.

The cash flow statement is linked to the income statement by net profit or net loss, which. All revenue and expense accounts are closed since they are temporary. During the period close process, all temporary accounts are closed to the income summary account, which is then closed to retained earnings.

What’s the difference between a cash flow statement and an income statement? Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial. The important linkages among the cash flow statement, income statement, and the balance sheet include the following:

The two are often assumed to be the same thing. It typically includes information on assets, liabilities, revenues, expenses, gains, and losses, and provides an overview of the financial health of the entity. On the other hand, a balance sheet indicates your business finances at one specific point in time.

An income statement is a measure of a company's profitability. Balance sheet, or statement of financial position, is directly related to the income statement, cash flow statement and statement of changes in equity. Its main aim is to calculate how much cash flow your business generated or losses within a given period.

The financial statements are used by. Do dividends go on the balance sheet? Whatever the business earns during an accounting period is accumulated as retained earnings in the balance sheet’s equity section.