Best Info About Bank Interest In Balance Sheet Gold Nest Company Income Statement

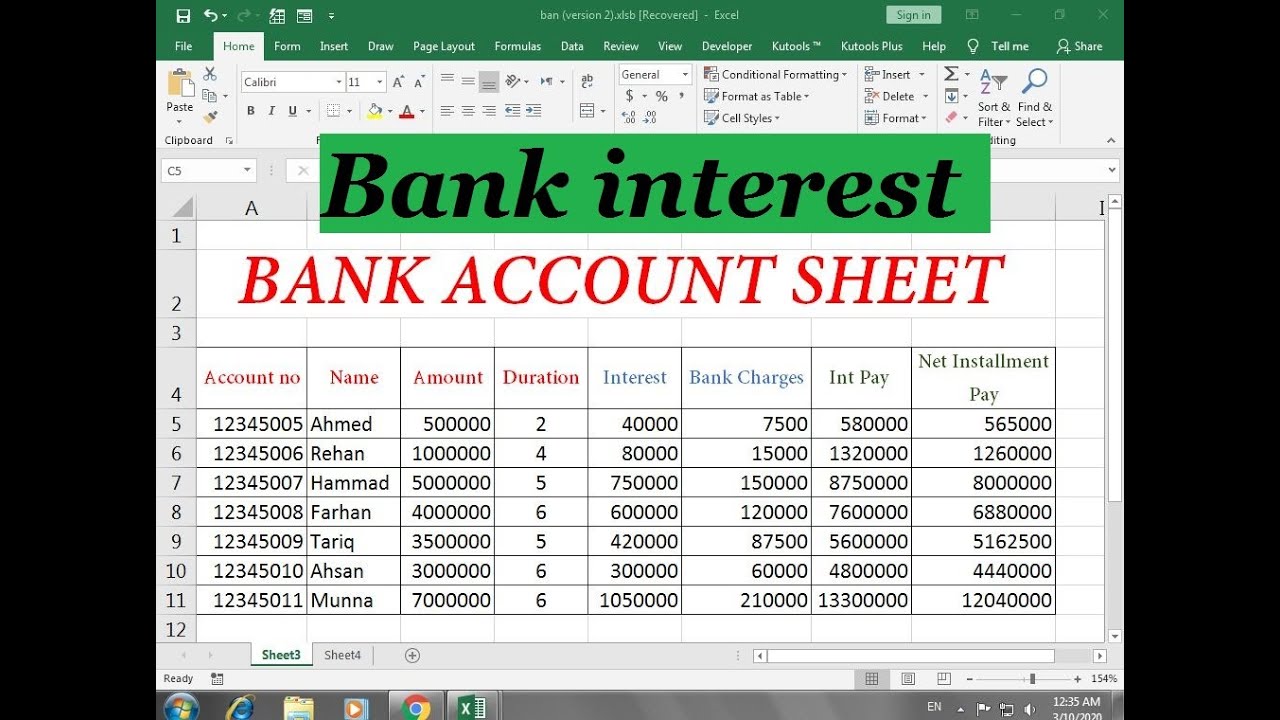

Most banks provide this table in their annual 10k statement.

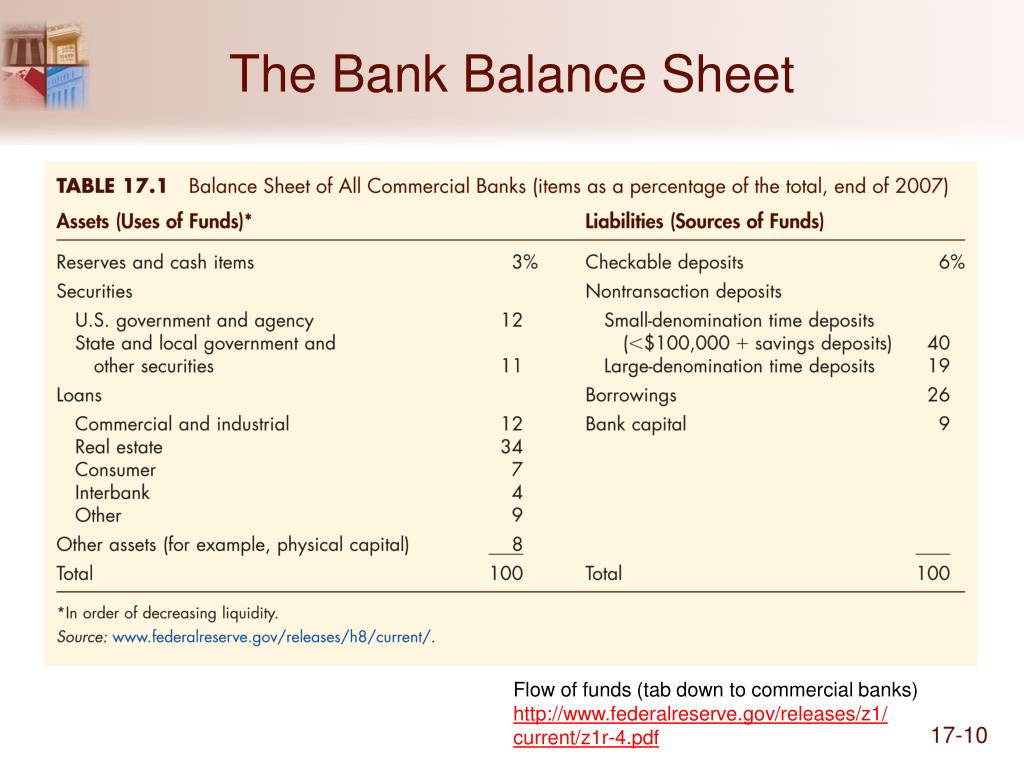

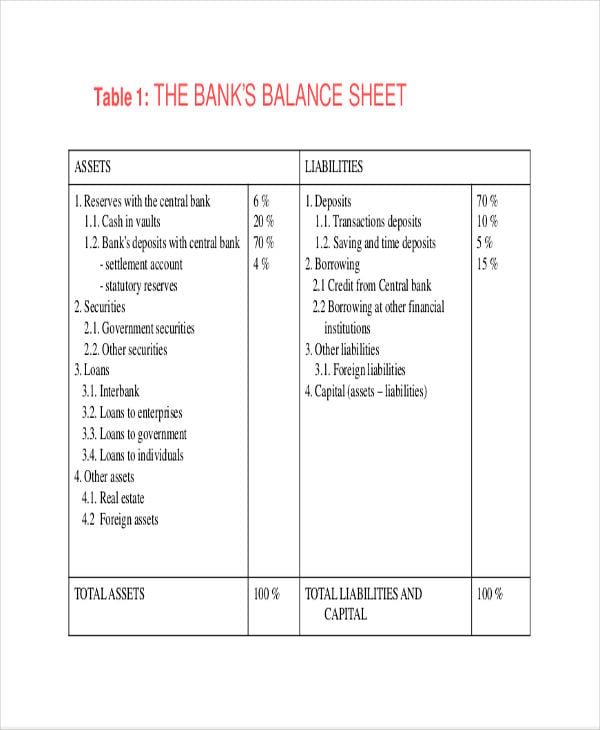

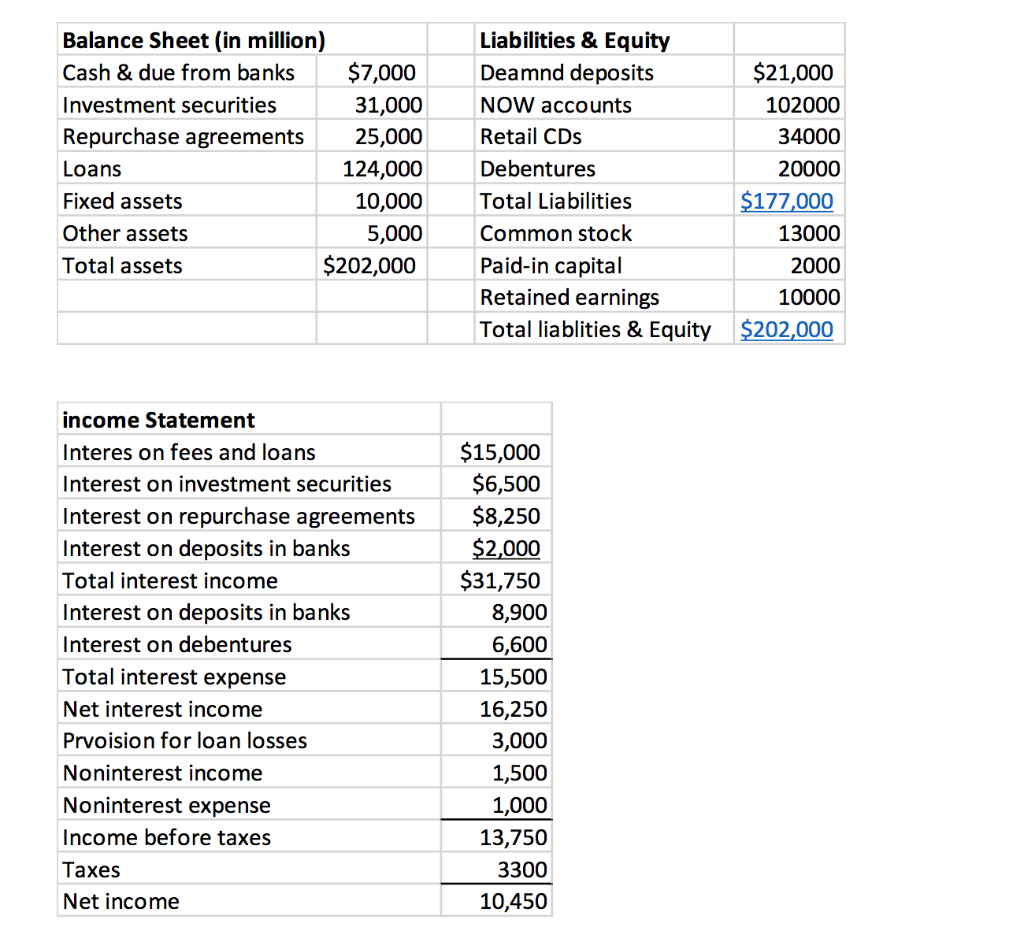

Bank interest in balance sheet. The typical structure of a balance sheet for a bank is: A certain amount of interest is also paid. Assets = liabilities + equity.

The btfp has allowed banks to get cash from the fed window without declaring a loss in their balance sheet. Net interest income is the difference between the revenue that is generated from a bank's assets and the expenses associated with paying out its liabilities. We believe banks can better use growing cash and securities portfolios as a lever to improve interest income.

Project loans, deposits, and key iea/ibl. As of 2021, banks with deposits over $182.9 million ($127.5 million in 2020) have to maintain a reserve of 10% while banks with reserves between $21.1 million. For example, if the current cash account is $5,000 and owner’s equity is $20,000, then the company paid out $1,000 in interest the new cash asset value is.

A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. The bank of canada could wind down its quantitative tightening program as soon as april and will most likely do so no later than june, an economist at. This financial statement is used.

What is a balance sheet? The statistics included in this section are derived from the balance sheets of monetary financial institutions (such as banks). A balance sheet (aka statement of condition, statement of financial position) is a financial report that shows the value of a company's assets, liabilities, and owner's equity on a.

Interest or yield is shown that. The balance sheet is the health statement of a business entity that reflects the financial obligations, assets, and shareholder’s equity. The runoff of the bond portfolio.

However, banks still grapple with two issues in. The response of the central bank’s balance sheet and interest rate policies can shape the macroeconomic effects associated to the potential issuance of these. At bank of america, deposits make up about 60% of its overall liabilities, with the majority.

Graph and download economic data for balance sheet: A balance sheet provides a snapshot of a company’s financial performance at a given point in time. As such, the balance sheet is divided into two.

The volume of business of a bank is. Total assets from q1 1984 to q3 2023 about assets and usa. Importance of balance sheet balance sheets play several vital roles in ensuring the financial health of a business.

Some of the importance of balance sheet are as follows:. Assets property trading assets loans to customers deposits to the central bank liabilities loans from the central bank. That $95 billion pace is nearly double the peak rate of $50 billion the last time the fed trimmed its balance sheet, from 2017 to 2019.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)