Best Info About Minority Interest In Consolidation Difference Between Profit And Loss Account Balance Sheet

For accounting purposes, noncontrolling interest is classified as equity and shows up on the balance sheet of the company that owns the majority interest in the subsidiary.

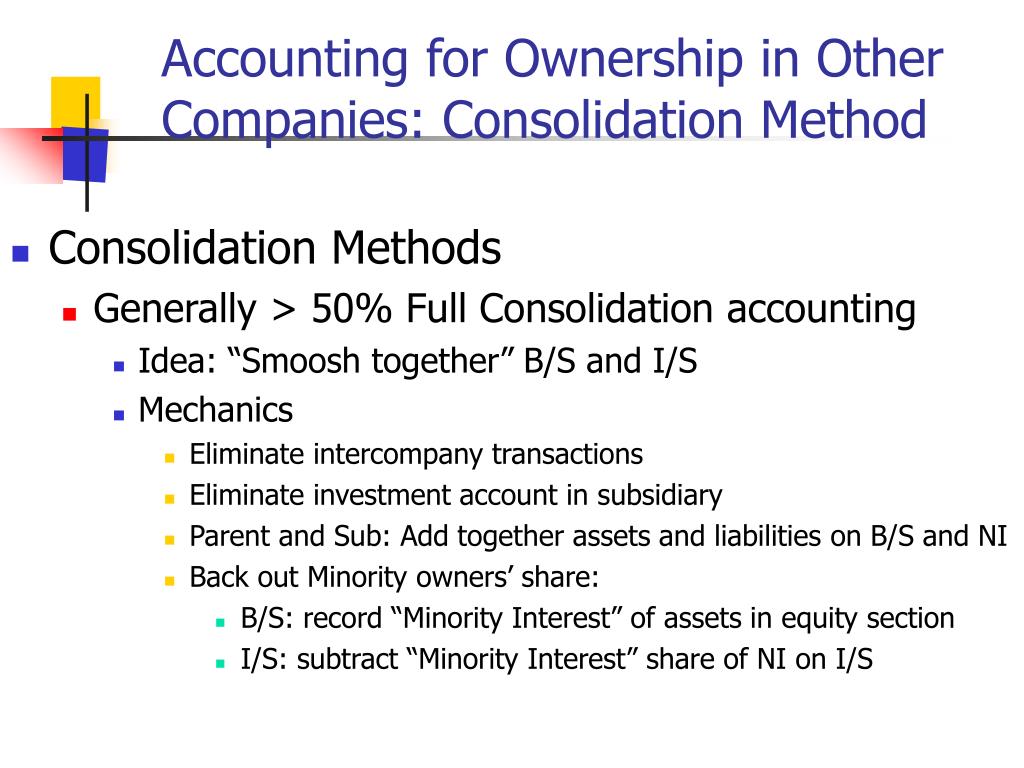

Minority interest in consolidation. In other words, the nci tracks what happens to the 30% of sub co.’s net income and dividends that do not belong to parent co. Universal music group nv is buying a minority stake in chord, a company that owns more than 60,000 songs, including ones written by artists like the weeknd, john legend and. The paper also demonstrates that for purchased subsidiaries, minority interest in consolidated retained earnings includes unamortized write‐ups of identifiable net assets and goodwill arising from purchase‐type business combinations.

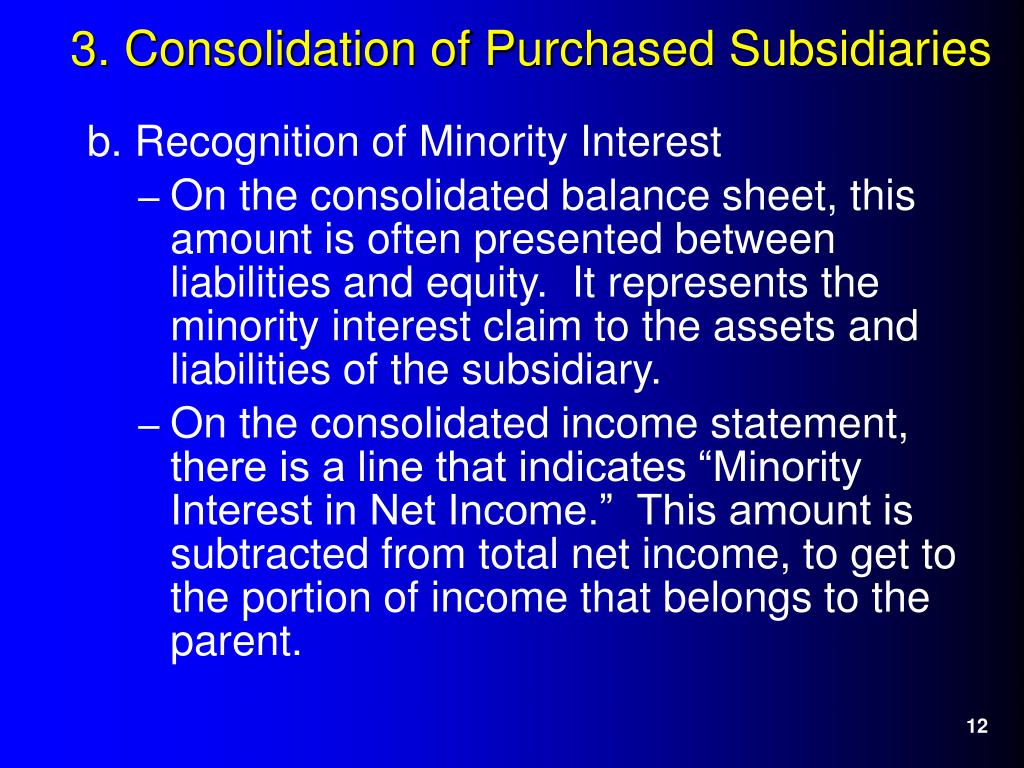

Profit/loss of the minority interest should also be shown separately, instead of leaving it to be deducted from the consolidated income statement. As 21, consolidated financial statements, defines minority interest as that part of the net results of operations and of the net assets of a subsidiary attributable to interests which are not owned, directly or indirectly through subsidiary(ies), by the parent. In the balance sheet, the first is to calculate the net asset value (also known as book value) of the subsidiary company.

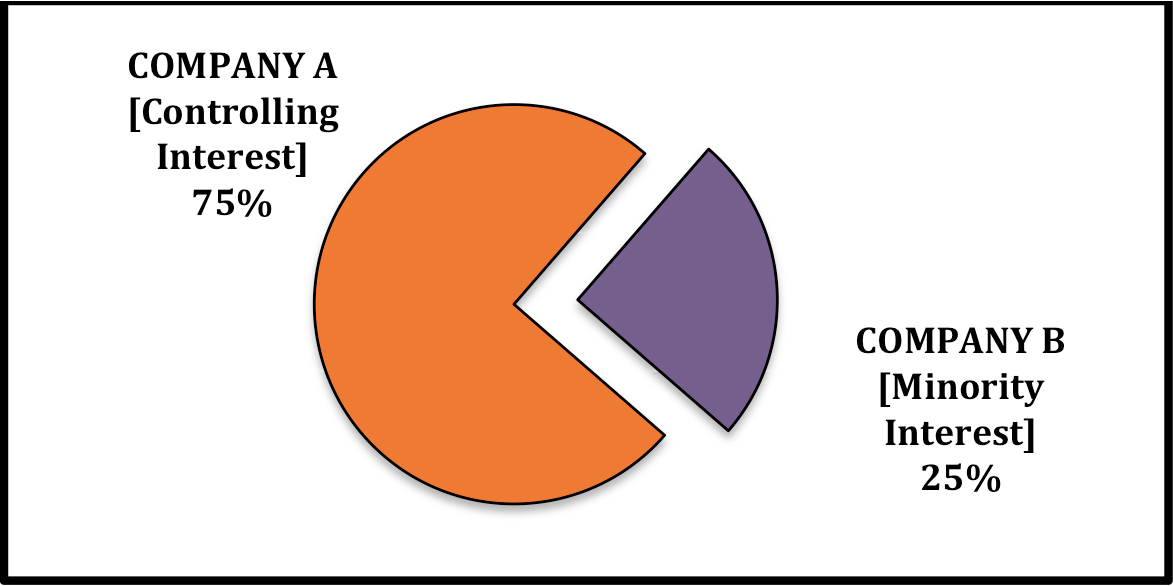

Key definitions [ias 27.4] consolidated financial statements: Minority interest, or noncontrolling interest (nci), represents an ownership stake of less than 50% in a company (hence the term minority, or noncontrolling ). The development of relevant corporate theories of equity.

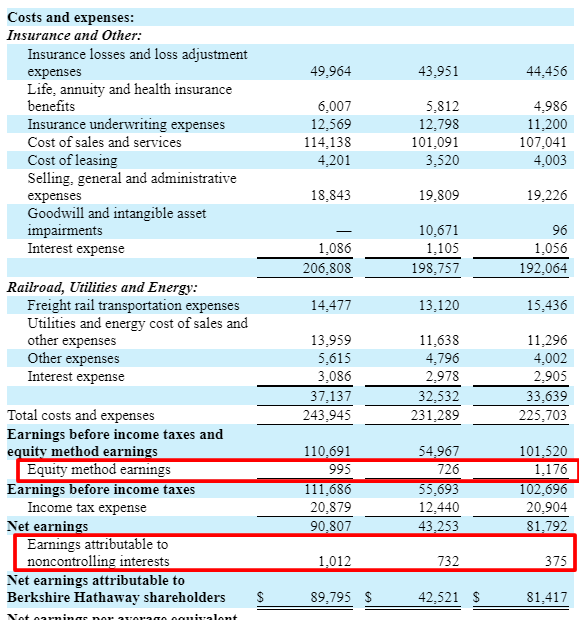

Will acquire remaining shares of p&r liftcars that are not already owned by company. The impact of the minority interest needs to be shown in both the consolidated balance sheet and consolidated income statement. An entity, including an unincorporated entity such as a partnership, that is controlled by.

In the consolidated profit and loss, account minority interest is the proportion of the results for the year that relate to the minority holdings. Consolidated financial statements are often referred to as ‘group accounts’. Minority interests arise in many situations, like for example the use of local partners or the partial flotation of locally incorporated subsidiaries.

Also, minority interest is reported on the consolidated income statement as a share of profit belonging to minority shareholders. What is the definition of minority interest? In the consolidated balance sheet, the minority interest should be shown within equity, but separate from the parent’s shareholders’ equity.

Login or create a forever free account to read this news. Minority interests generally range between 20% and 30% of the company's equity, compared to the majority interest of over 50%. Consolidation of a subsidiary initiates when control is gained and concludes when control is lost (ifrs 10.20,b88).

You can use this simple example to understand: The financial statements of a group presented as those of a single economic entity. This brief article looks at how to prepare a consolidated statement of financial position.

What does minority interest mean? Just recently, general atlantic grabbed the spotlight in both the private equity and infrastructure sectors by strategically acquiring actis (1).in a similar vein, last month, blackrock (2) sealed a substantial $12.5 billion cash and share deal with global infrastructure partners. The parent company consolidates the financial results of the.

Traces the evolution of concepts of minority interest from the early 1900s to the present. Consolidated financial statements purport to report income, financial position, and cash flows of a parent company and its subsidiaries as if the group were a single company with one or more. John legend in 2019.

:max_bytes(150000):strip_icc()/minorityinterest.asp-final-475f54d83de048da860a1b8919fc2a74.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_To_Calculate_Minority_Interest_Oct_2020-01-54830679f6a34b8581810db05d008661.jpg)