Fabulous Info About Comprehensive Income Is Equal To Ca Balance Sheet

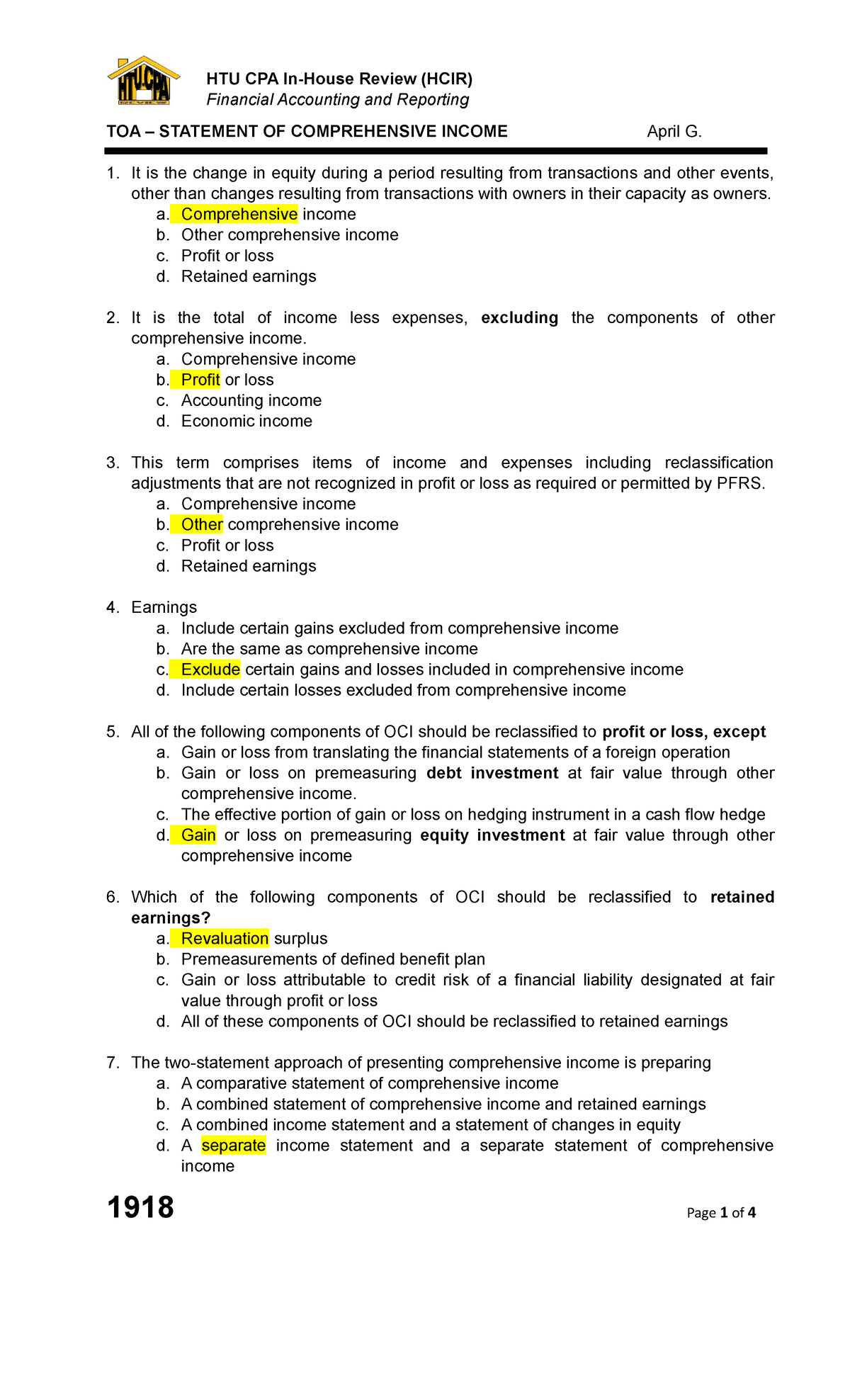

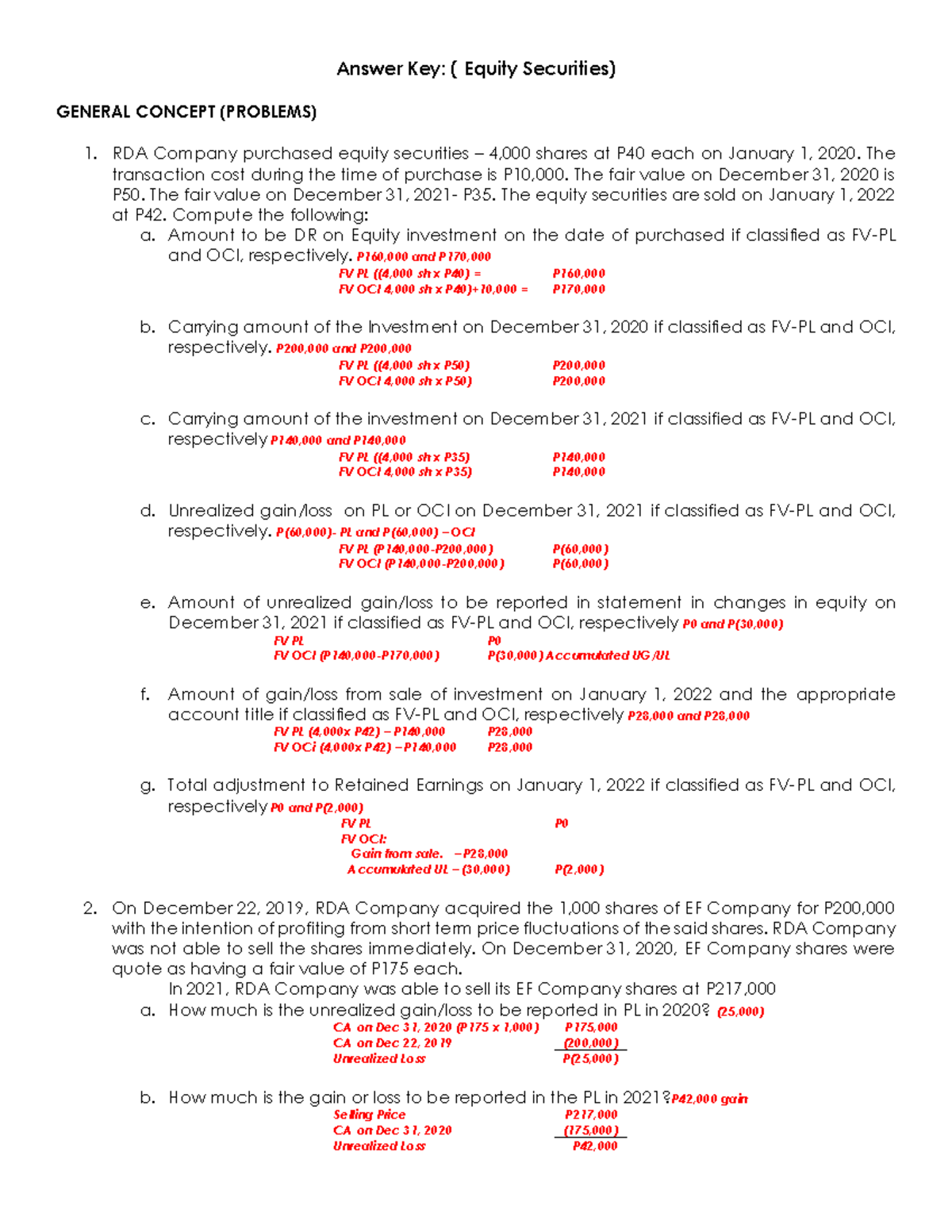

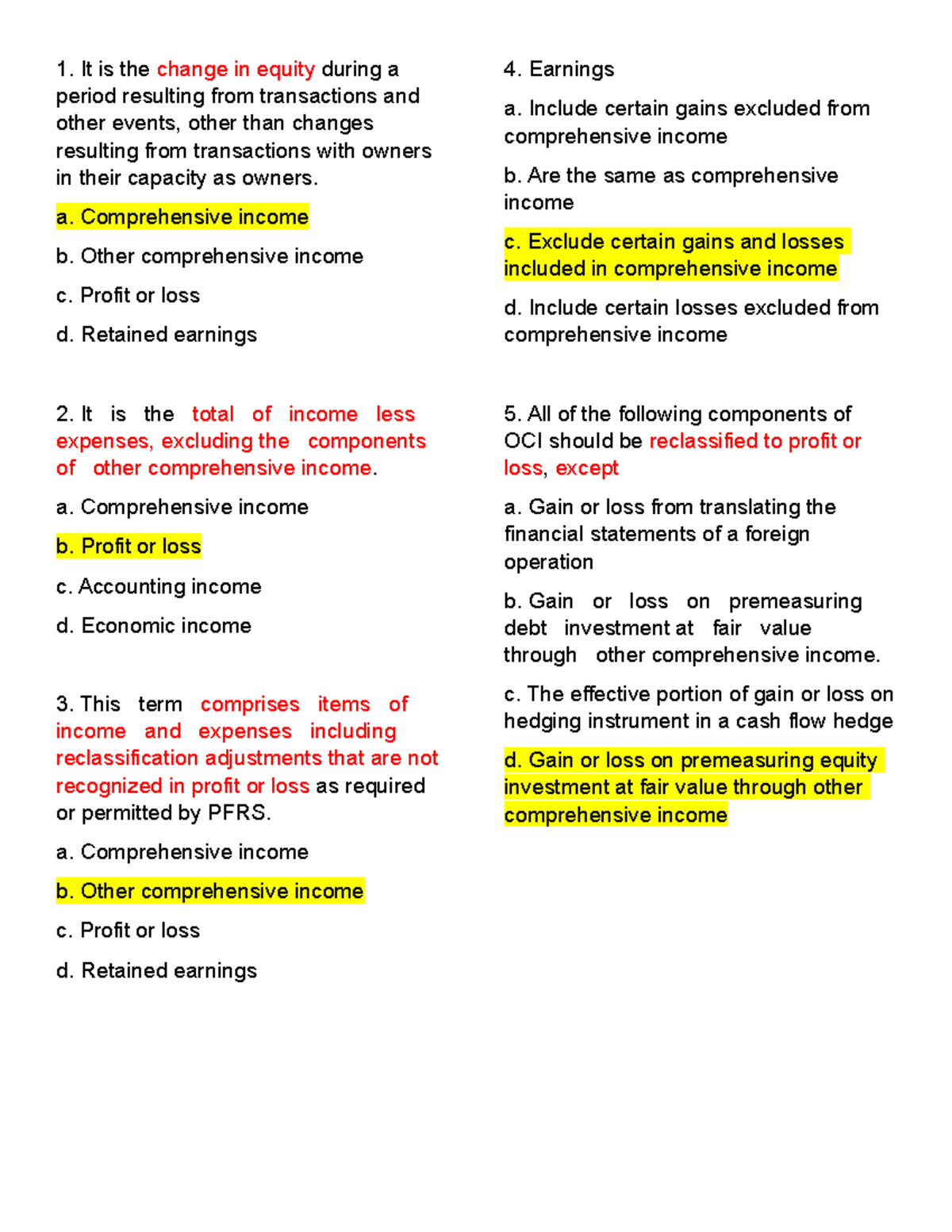

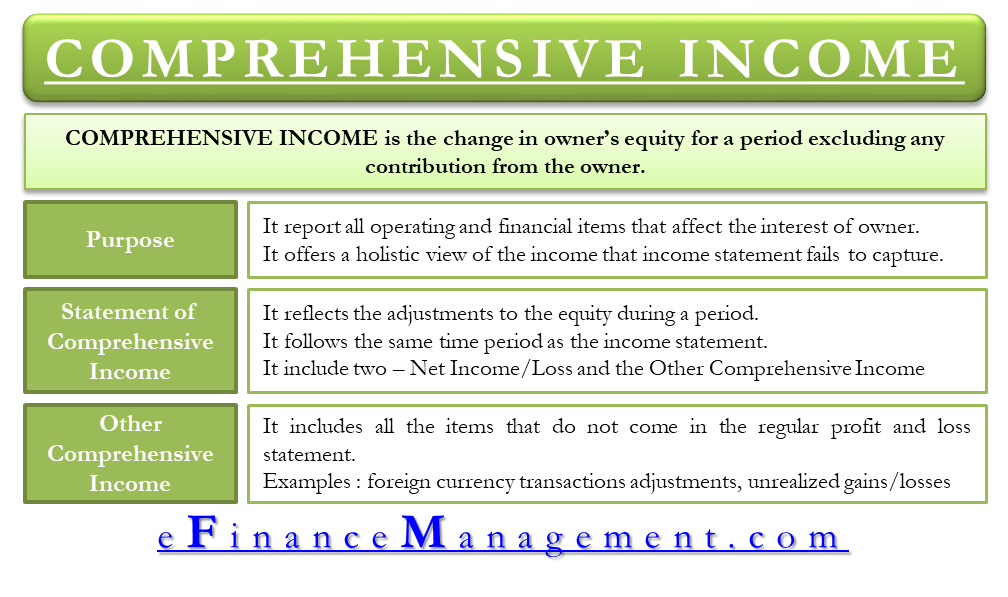

It includes all changes in equity during a period except those resulting from investments by owners and distribution to owners.

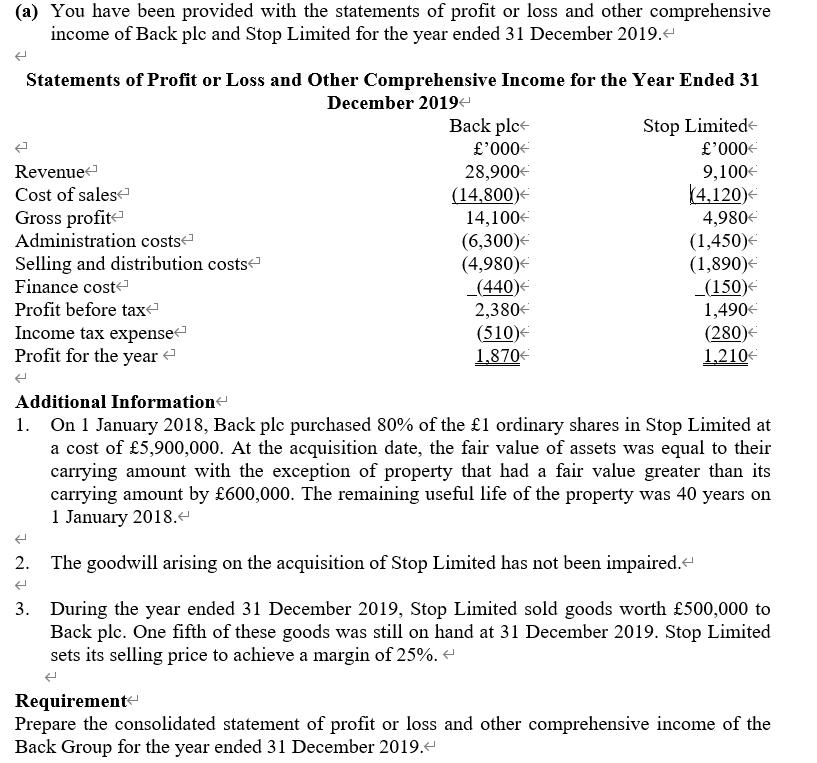

Comprehensive income is equal to. The statement of retained earnings includes two key parts: A) revenues minus expenses plus gains minus losses. As detailed in biddle et al.

We add industry dummies in order to address for the cross. Examples include money that is earned, as well as unearned income. A more complete view of a company's income and revenues is shown by comprehensive income.

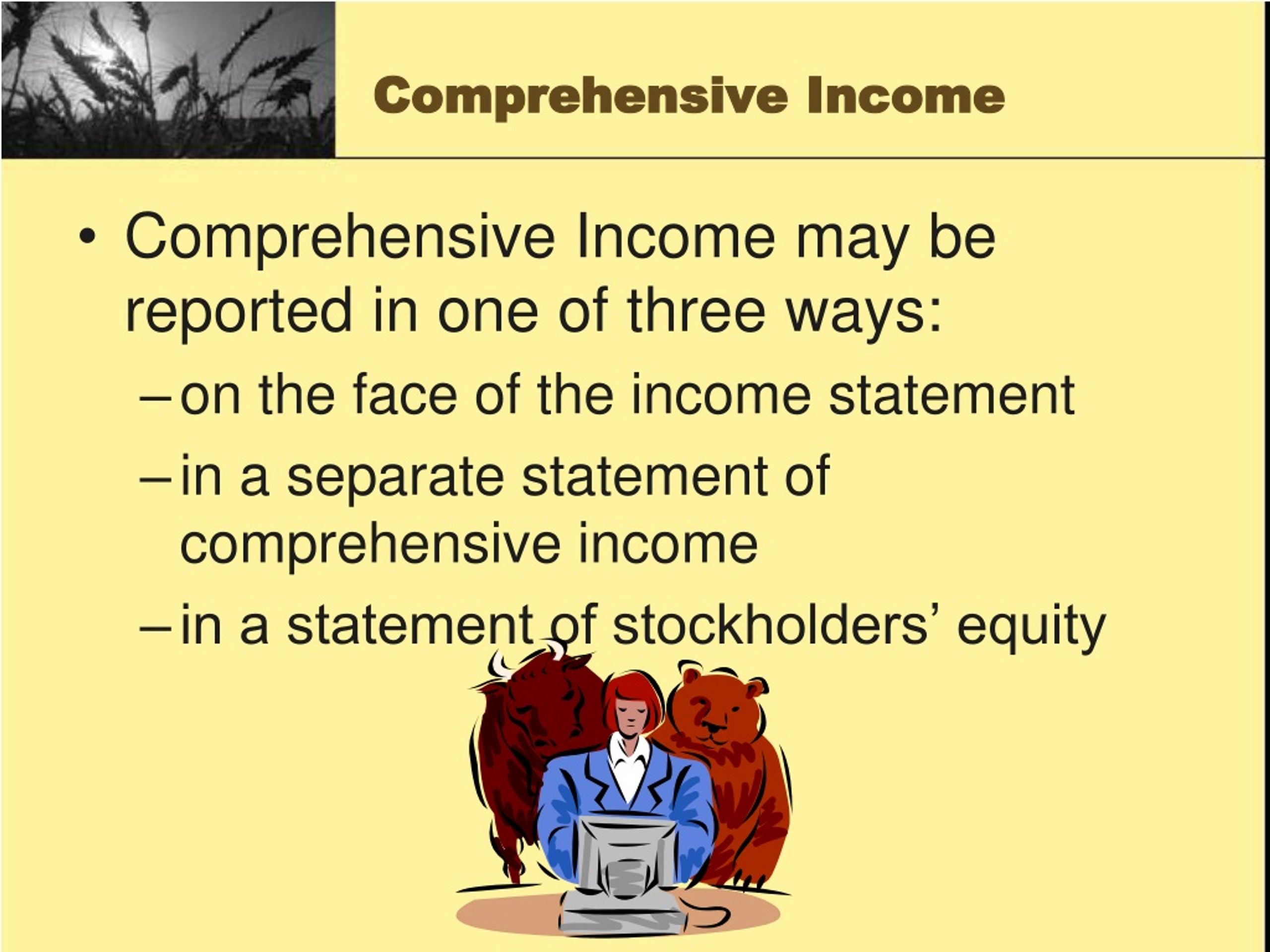

Revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners. 130 allows three format choices for reporting comprehensive income (ci); Lewis what is comprehensive income?

Abstract and figures. Comprehensive income comprises both of the. Comprehensive income is a figure that represents the combined net income and other comprehensive income of a company.

Loss is a dummy variable equal to 1 if the firm reported a loss in year t, or 0 otherwise. Reporting entities should present each of the components of other comprehensive income separately, based on their nature, in the statement of. Comprehensive income is equal to net income plus other comprehensive income.

As described in statement of financial accounting concepts no. Comprehensive income is the profit or loss in a company’s investments during a specific time period. The comprehensive income consists of two sections:

Revenues minus expenses plus gains minus losses. The statement should be classified and aggregated in a manner that makes it understandable and comparable. Oci consists of revenues, expenses, gains, and losses to be included in comprehensive income but excluded from net income.

B) revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners. Companies use it to measure the changes in their equity over a certain period, and it includes net and unrealized income to provide a more comprehensive understanding of a company's value. Comprehensive income includes net income and oci.

These amounts cannot be included on a company’s income statement because the investments are still in play. The sum total of comprehensive income, also known as accumulated other comprehensive income, is calculated by adding net income to other comprehensive income. Testing h 1:

It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners. Comprehensive income includes both net income and unrealized gains and losses a company incurs in the current period. Comprehensive income statements let businesses record the earnings they get from all sources.

:max_bytes(150000):strip_icc()/comprehensiveincome_final-2ff1de7967204cd2a69a4ab5b8778fff.png)