Who Else Wants Info About Accounting For Investments Gaap Cost Of Goods Sold In Annual Report

The investment management industry is unique.

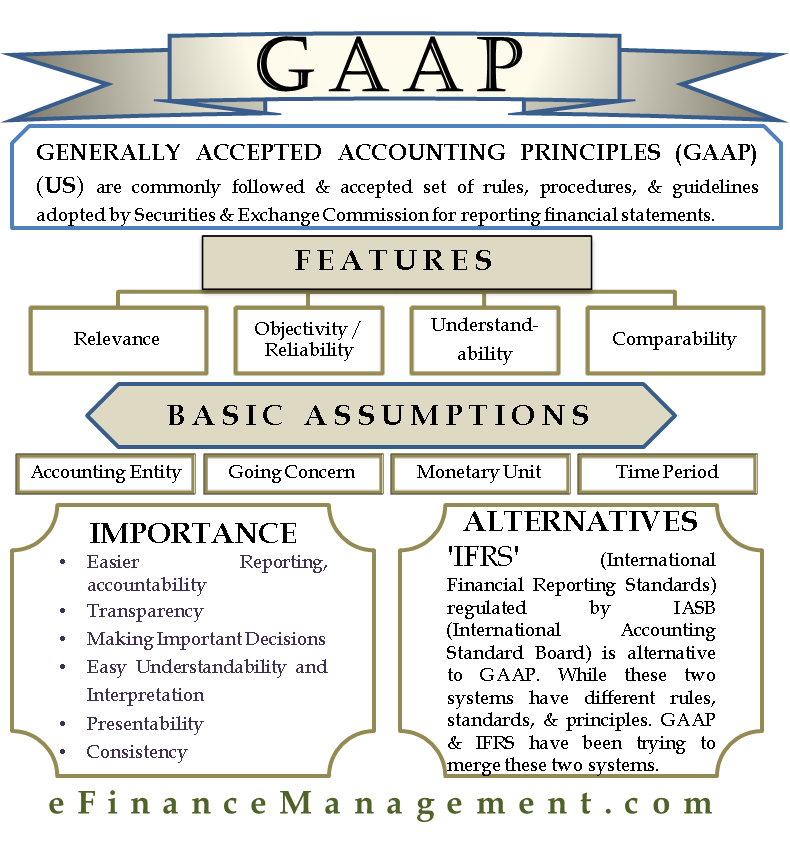

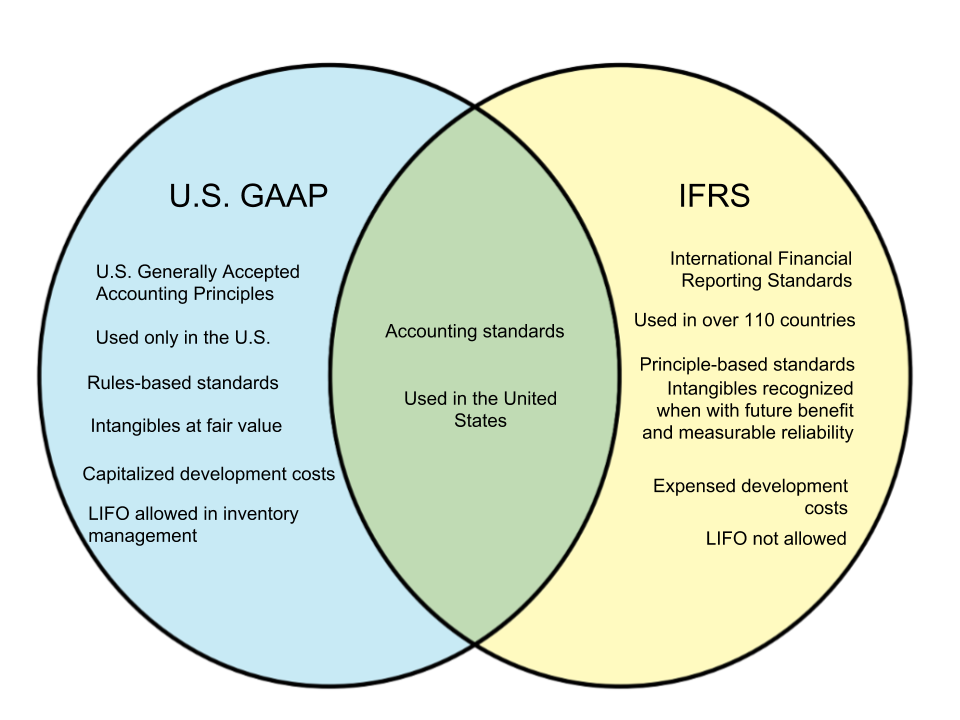

Accounting for investments gaap. Us gaap is more restrictive than ifrs accounting standards regarding the types of investments that are subject to the scope of the equity method guidance (i.e., under us. When accounting standards codification topic 606 (asc 606), revenue from contracts with customers, took effect in 2019 for private companies, many government. Apply the reporting requirements for.

Therefore, if the shares of bayless are worth $28,000 at december 31, year. It is an entity that does both of the following:. Identify the us gaap principles applicable to investment funds;

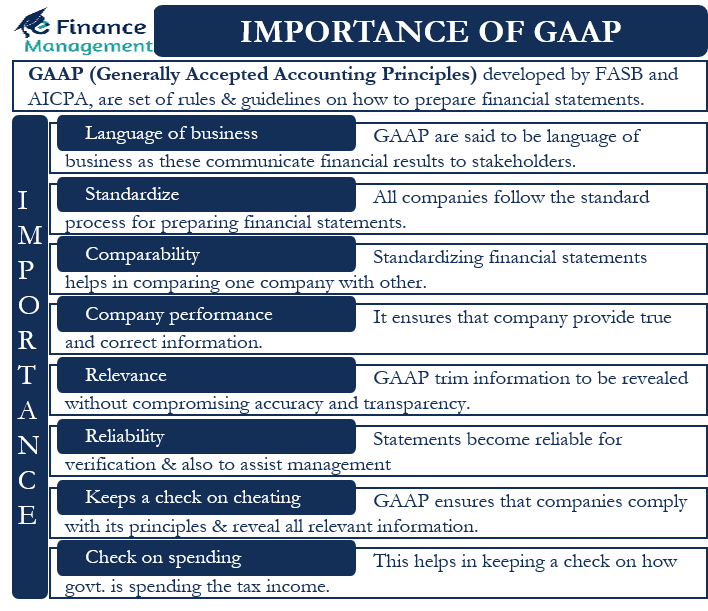

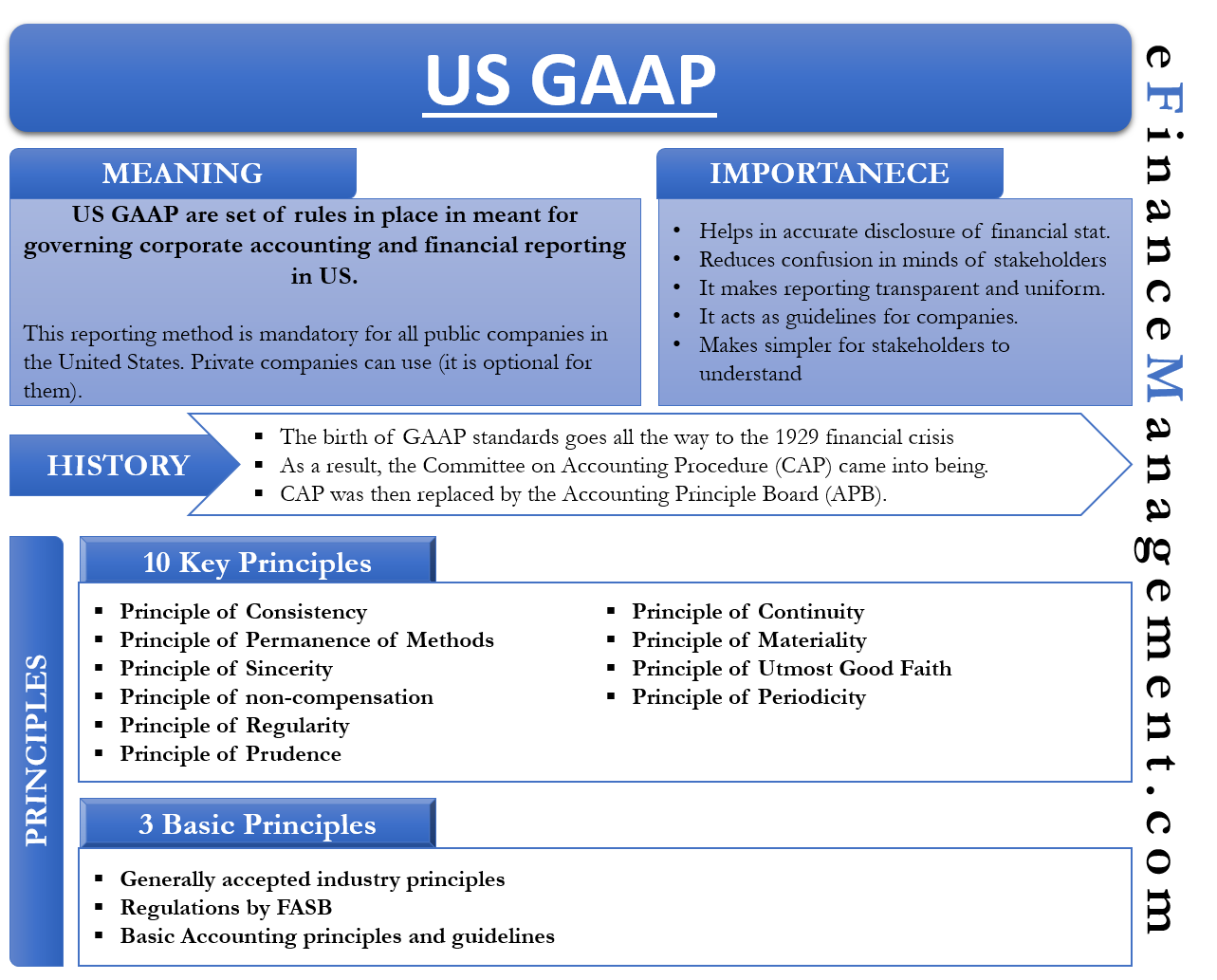

You have probably heard of stock investments, and the term “investment” may lead you to immediately envision stocks, bonds, and mutual funds. Gaap stands for generally accepted accounting principles and are standards set by the fasb that companies must comply with when building financial. The company reported gaap net income (loss) of $ (38.9) million or $ (0.72) per diluted common share and distributable earnings (1) of $58.4 million or $1.06 per.

An investment company is an entity with the following fundamental characteristics: Differentiate the principles of us gaap and lux gaap for investment funds; Posted on sep 08, 2020 by vicky hale, cpa | tags:

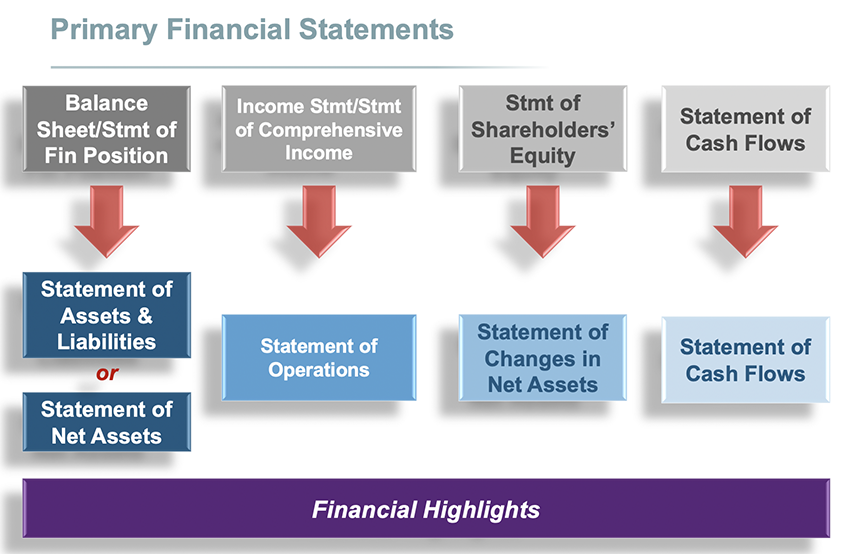

The following fasb accounting standards updates (asus) were issued since wiley gaap 2019 and through june 2020. Their requirements are incorporated into this edition. Specifically, from an accounting perspective an investment is an asset.

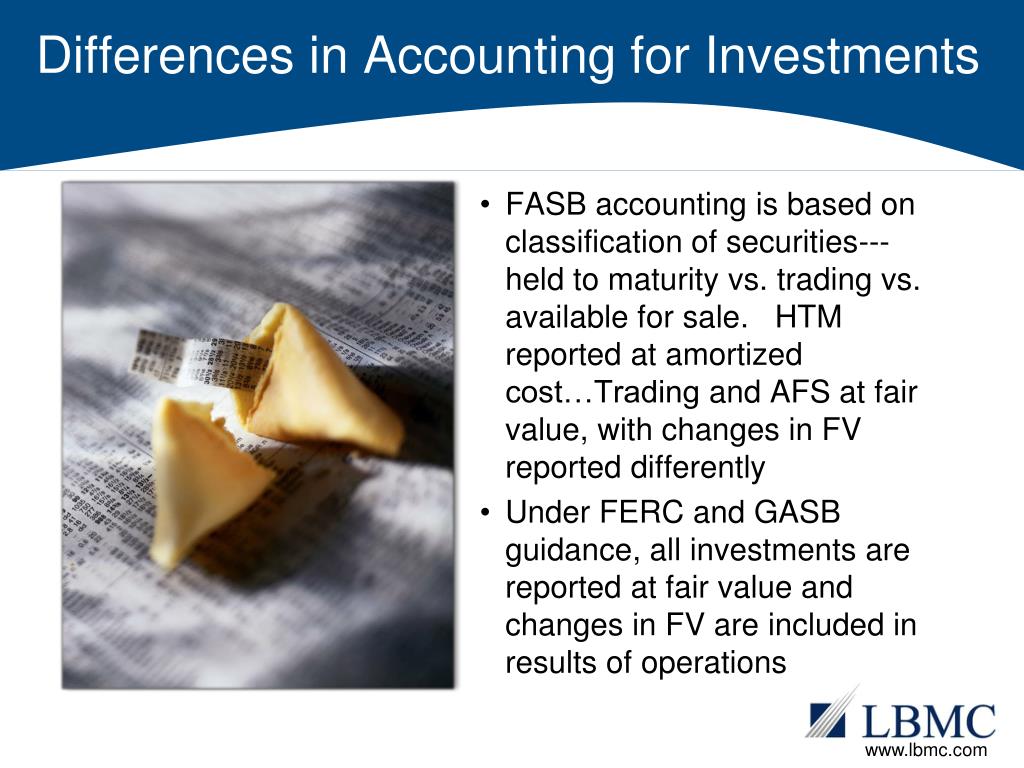

The accounting and financial reporting requirements for investments in debt and equity securities under us gaap continues to be an area of focus and. Equity method investments and joint ventures ; For limited partnerships and limited liability companies with separate capital accounts, the equity method of accounting must be used if an investor owns more than 5% of the.

Under us gaap, the classification is dictated by the legal form of the instruments. The exact type of accounting depends on the intent of the. While this line of thinking is correct, accountants view investments as this and much more.

How is investment property accounting under ias 40 different from us gaap? Ifrs standards provide specific guidance on investment property; Generally accepted accounting principles, or gaap, are standards that encompass the details, complexities, and legalities of business and corporate.

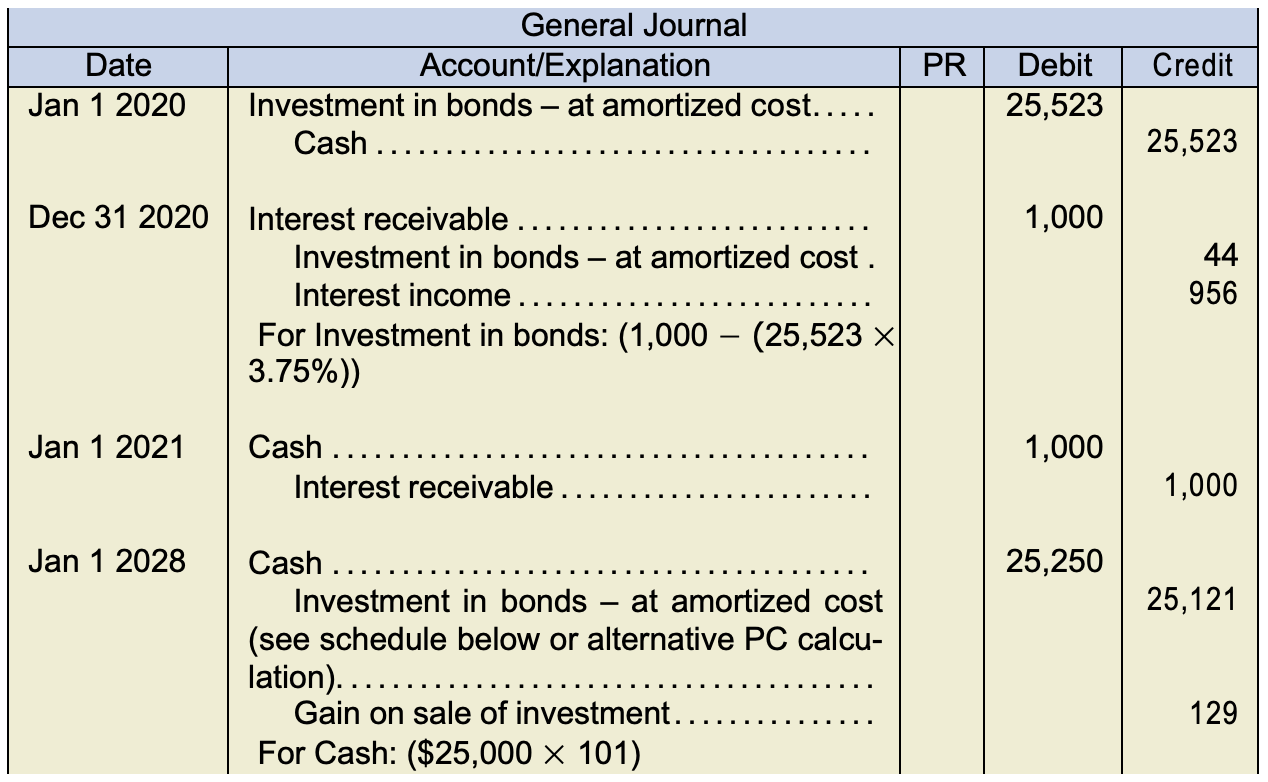

The accounting for investments occurs when funds are paid for an investment instrument. Under ssap 19, investment properties are required to be included on the balance sheet at open market value and are not subject to depreciation. Gaap requires investments in trading securities to be reported on the balance sheet at fair value.

![Generally Accepted Accounting Principles [GAAP]](https://imgv2-1-f.scribdassets.com/img/document/52419450/original/5ee38de30b/1588588902?v=1)