Matchless Tips About Gaap Accounting For Unrealized Gains And Losses Income Tax Department Form 26as

This document provides a non.

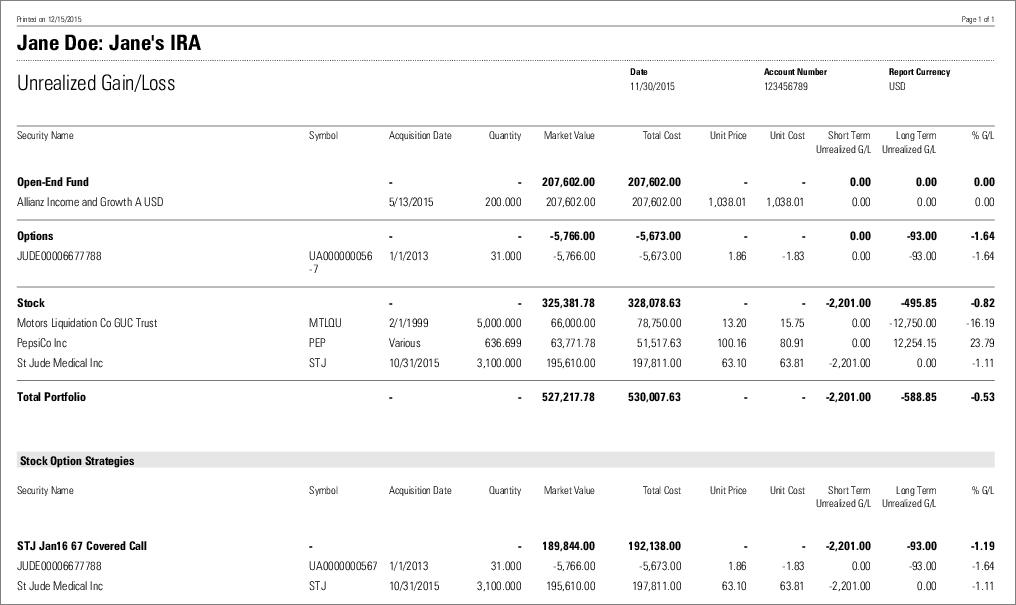

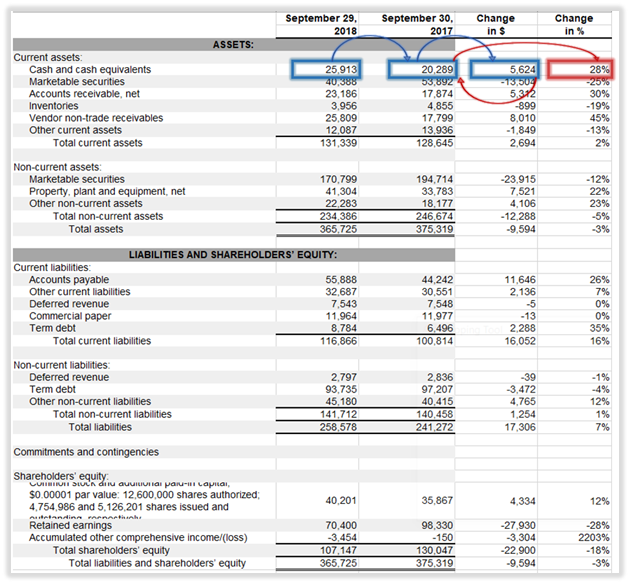

Gaap accounting for unrealized gains and losses. This gain must be included in the report to increase the investment account. With this method, the investor does not recognize unrealized capital gains based on the market value of the investment, but it does record its share of the. In 2019, rising stock prices increased net unrealized gains by the aforementioned $53.7 billion, pushing gaap earnings to the $81.4 billion reported at the.

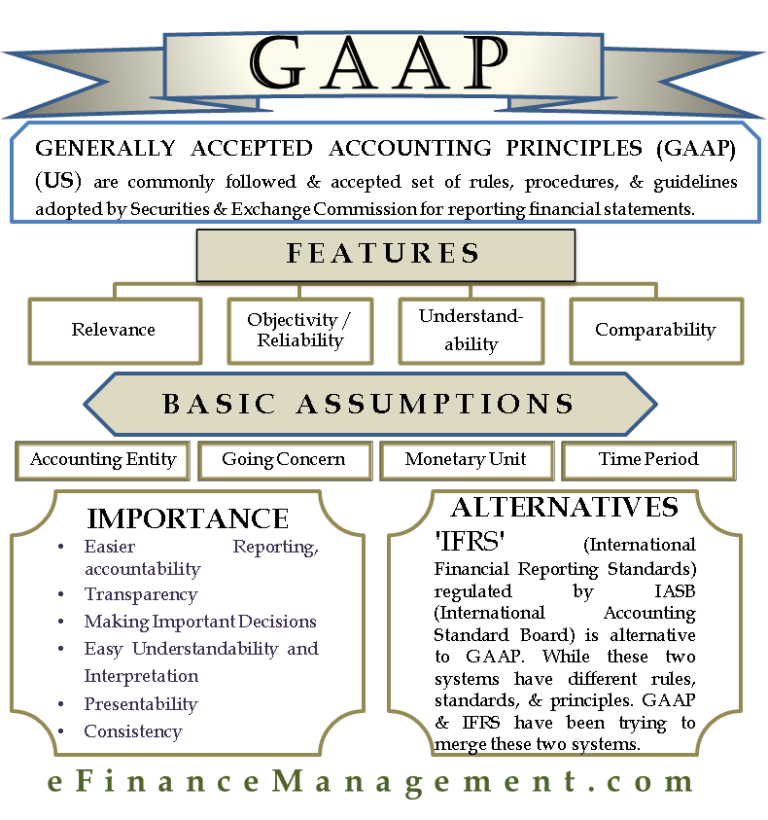

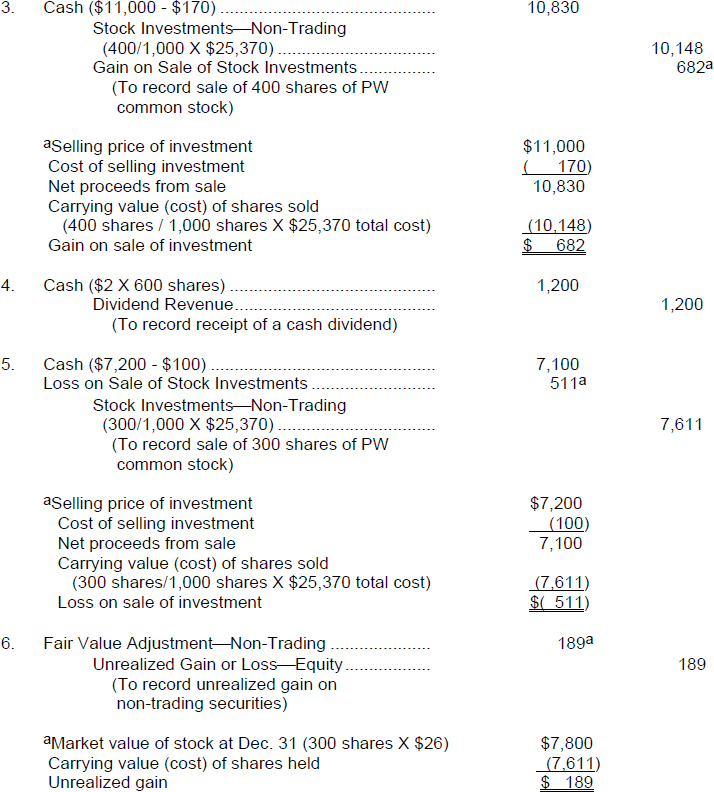

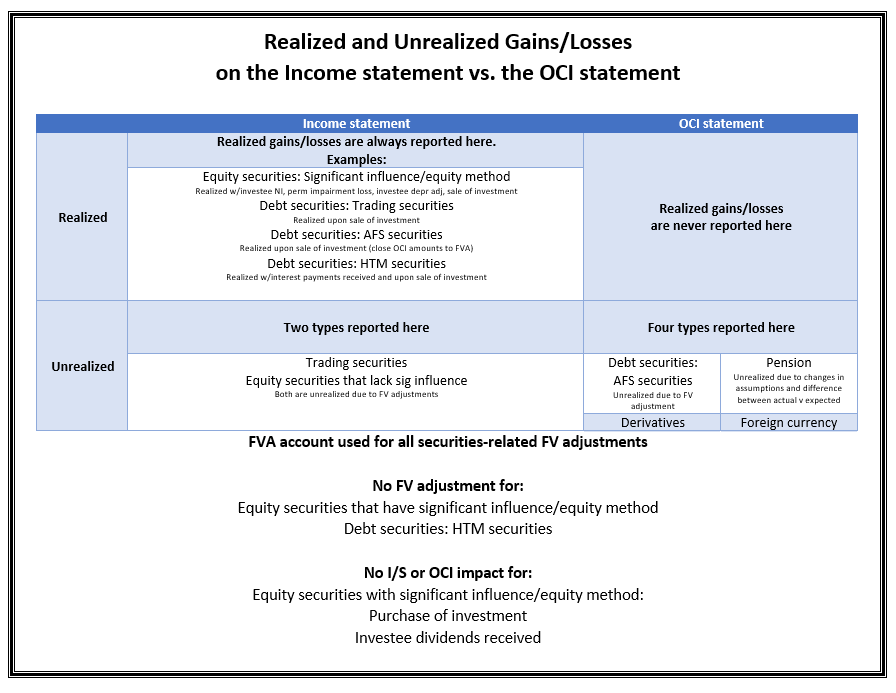

The purpose of this article is to provide a brief overview of these possibilities. The us gaap accounting treatment of unrealized gains depends on the type of investment a company holds. The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income.

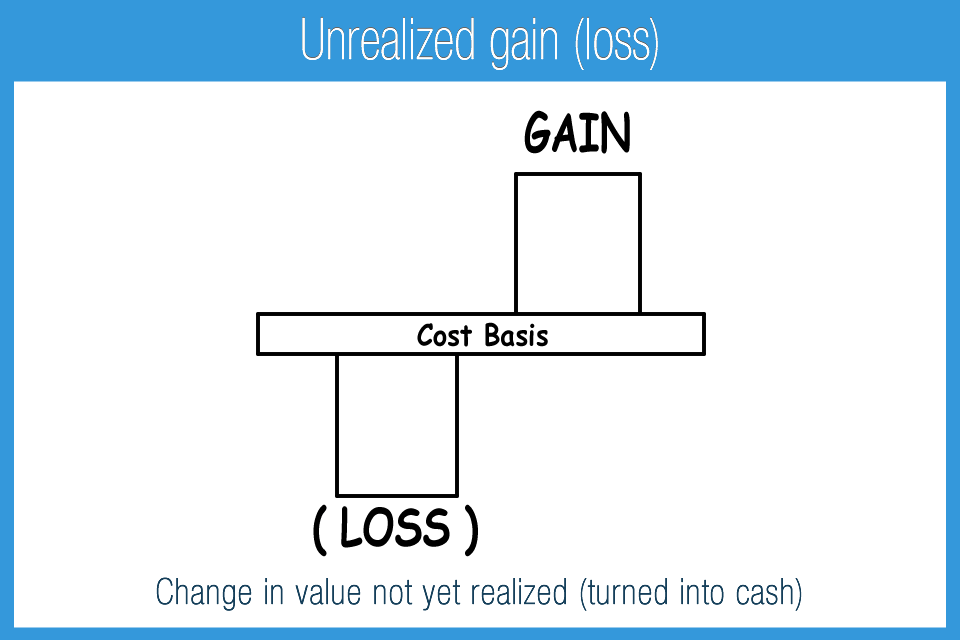

The amendments on changes in unrealized gains and losses, the range and weighted average of significant unobservable inputs used to develop level 3 fair value. An unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open stock position. View a — first report the unrealized gain or loss as a.

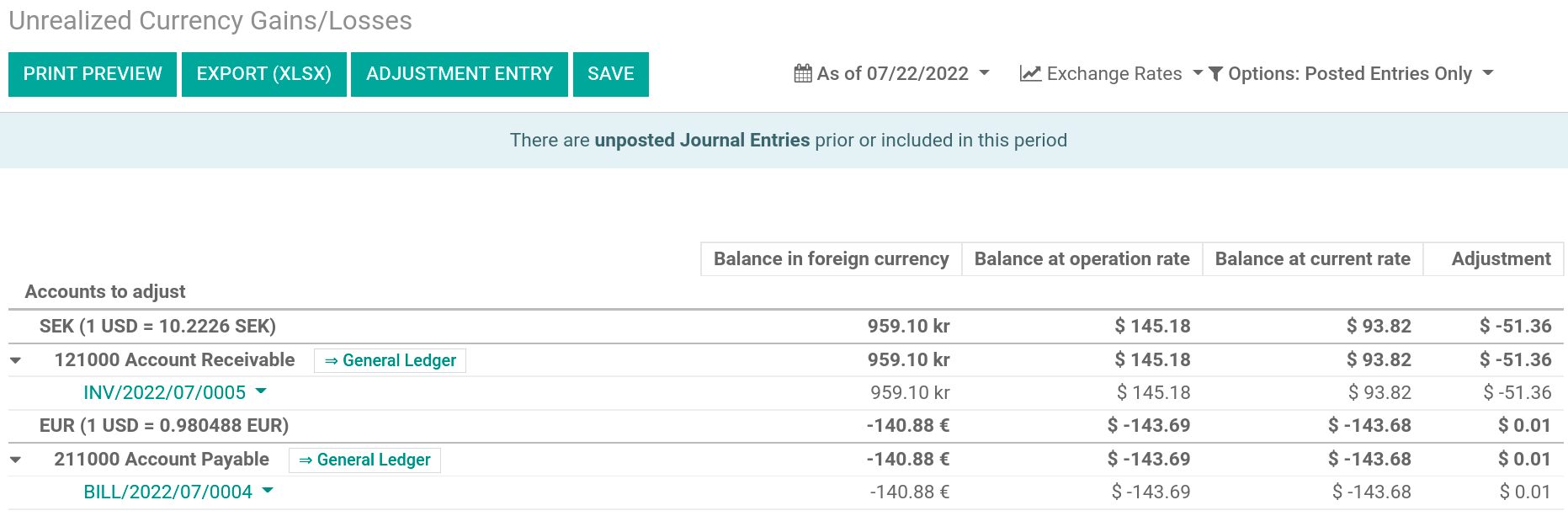

In contrast, under accounting standards where both assets and liabilities are measured at fair value, unrealized gains and losses are included in profitability ratios. Unrealized gains and losses accounting is a way for companies to account for their investments. Unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet.

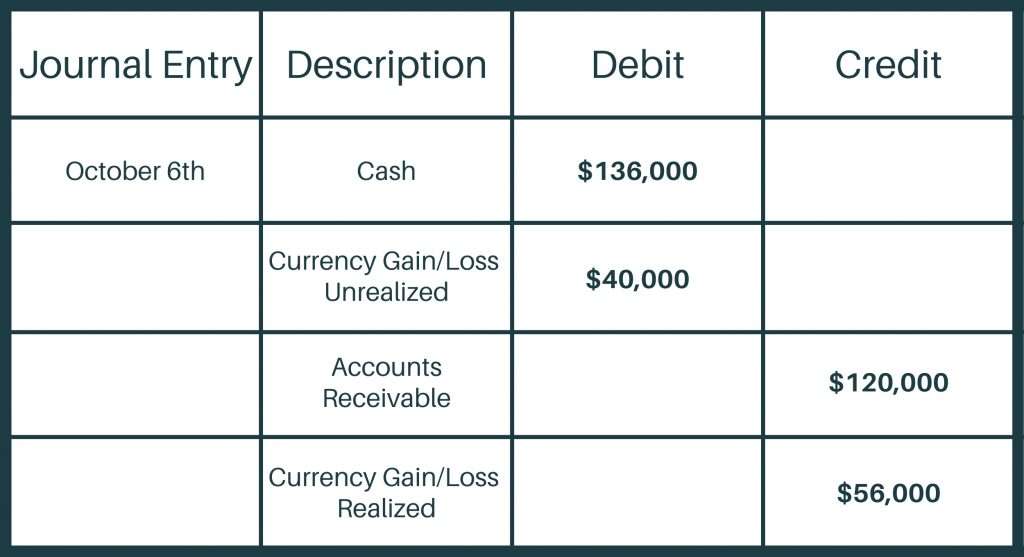

Unrealized gains (losses) on the loan and debt securities portfolio carried at fair value $ 210 $ (78) unrealized (losses) gains on associated derivatives (181) 324. There are two methods of accounting for an unrealized gain or loss on a security during the period in which it is sold. Adjusted gross profit and adjusted eps are defined as gross profit and diluted earnings per share excluding, when they occur, the impacts of restructuring activities,.

In accordance with the israeli gaap, whichwas mainly influenced by the accounting principles. Gaap results on a u.s. An unrealized loss is a.

Tax benefit related to the irs audit: Once they are sold the gain or. There are several ways investments in bonds can be valued and reported:

Note that the realized gain or loss is calculated as follows: Keep in mind that not all investments will have unrealized. Unrealized gains and losses) not restricted by.

Realized business gains and losses cover those transactions that are completed, such as the revenue from merchandise sales that. Collected all of the information pertaining to gains and losses a rising from.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)