Brilliant Strategies Of Info About Bank Overdraft In Balance Sheet Trucking Company

Bank overdrafts are not common.

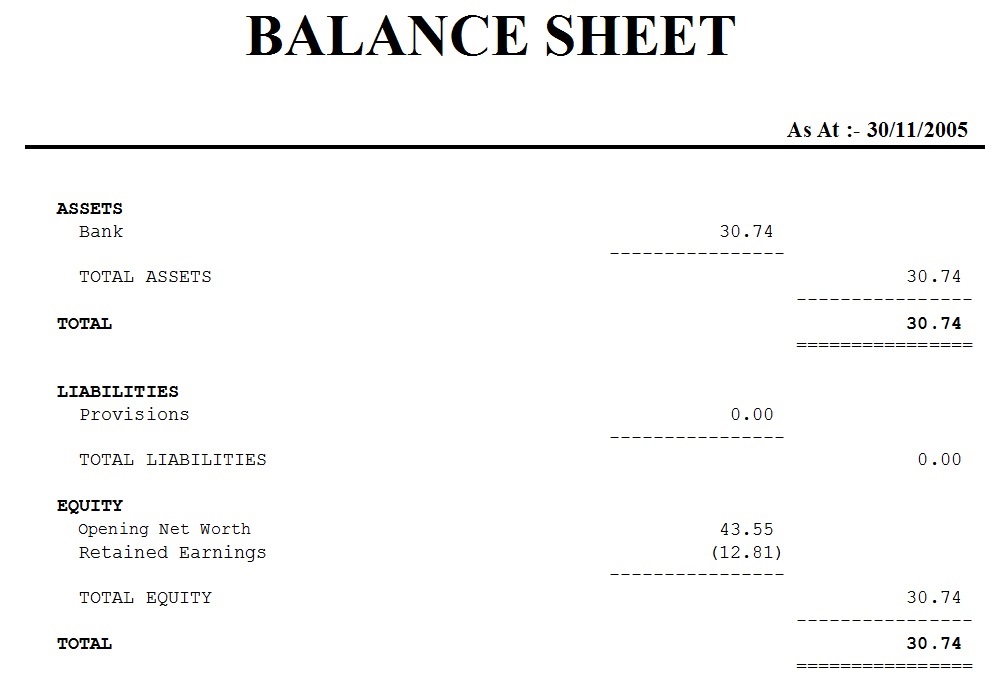

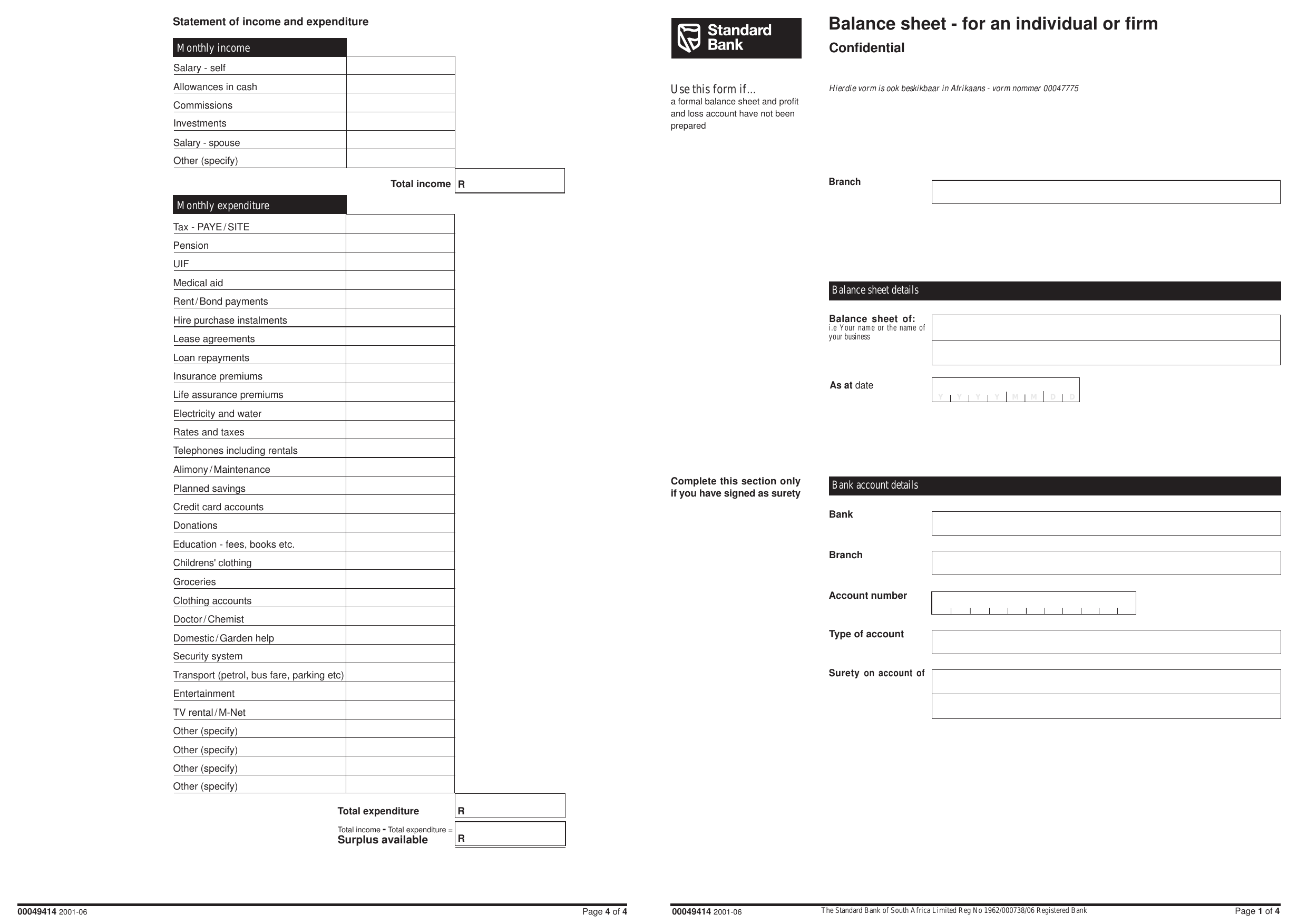

Bank overdraft in balance sheet. In some cases, businesses treat a bank overdraft in the balance sheet as an asset or an operating expense, especially if they expect to pay back and reverse the. If there is not a sufficient balance in the cash and cash equivalent, the. However, in the statement of cash flows,.

Cash overdraft in balance sheet. An overdraft (also known as a bank overdraft) generally means that the amount of a company's checks being presented at the bank for payment exceeded the amount on. See an example of how.

Bank overdraft is adjusted with the cash and cash equivalent. America’s three biggest consumer banks saw their overdraft fee revenues fall 25% in 2023. Or you can also include the amount in.

Under ifrs accounting standards, bank overdrafts are generally 6 presented as liabilities on the balance sheet. Basically, an overdraft means that the bank allows customers to borrow a set amount of money. The balance sheet items are average balances for each line item rather than the balance at the end of the period.

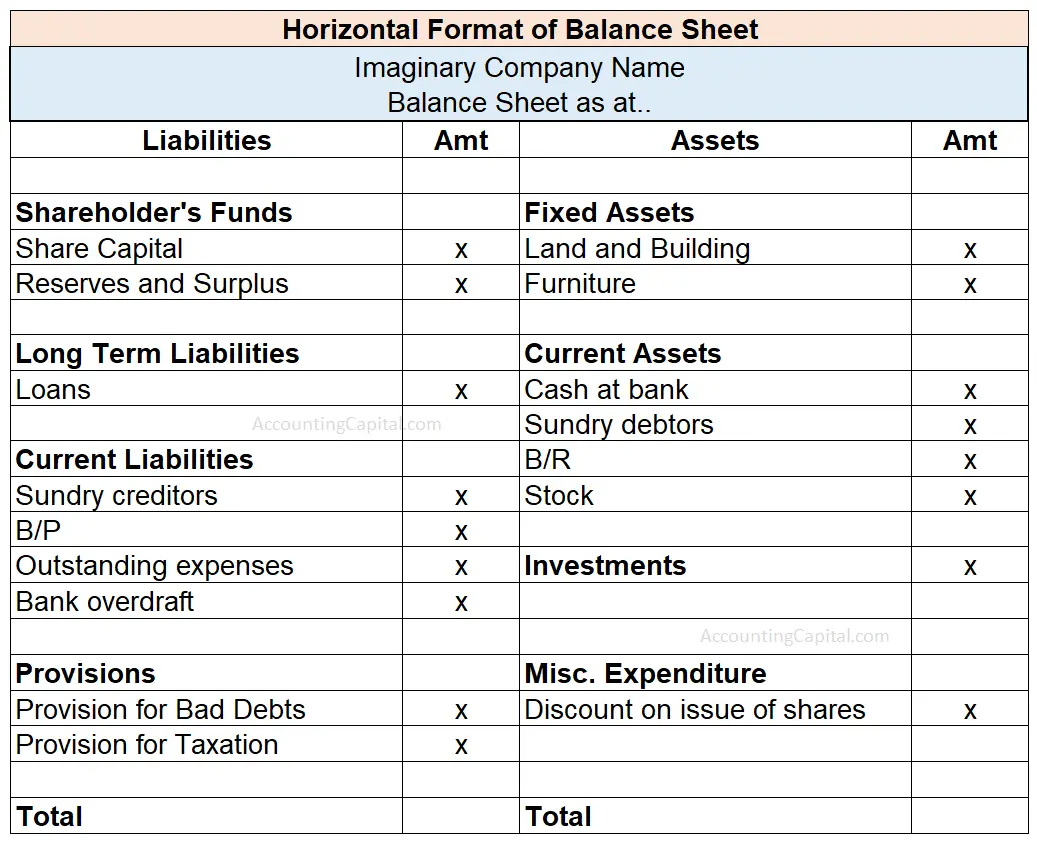

Book overdrafts—representing outstanding checks in excess of funds on deposit—should be classified as liabilities at the balance sheet date. Morgan chase, bank of america and. Generally, the bank overdraft in the balance sheet will be reported as a bank overdraft double entry.

A bank overdraft or simply overdraft is a credit facility offered by banks. It is an unsecured form of credit that is. Learn what bank overdraft is, how it is reported in the balance sheet and the statement of cash flows, and how it differs from book overdraft.

By definition, a bank overdraft is a type of financial instrument provided by the bank to its trustworthy customers in the form of an extended credit facility, once the actual bank. Presentation in the balance sheet. Bank indebtedness or bank overdraft:

A book overdraft represents the amount of outstanding checks in excess of funds on deposit for a particular bank account, resulting in a credit cash balance reported on an. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Find the best banks of 2024.

By pymnts | february 11, 2024. There is interest on the loan, and there is typically a fee per. Average balances provide a framework for.

Bank overdraft is a type of financial instrument that is provided to some customers by the bank in the form of an extended credit facility. The profit and loss shows what has happened over a certain period of time, whilst the balance sheet is a snapshot of the financial standing of a business at a.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

![Solved [34 marks] Question 2 Statement of Cash Flows Set](https://media.cheggcdn.com/media/aa2/aa2fb3f8-596e-4c8e-8a90-7697dc8a1212/phpIToR6o.png)