Stunning Tips About Balance Sheet Equity And Liabilities Thyssenkrupp Financial Statements

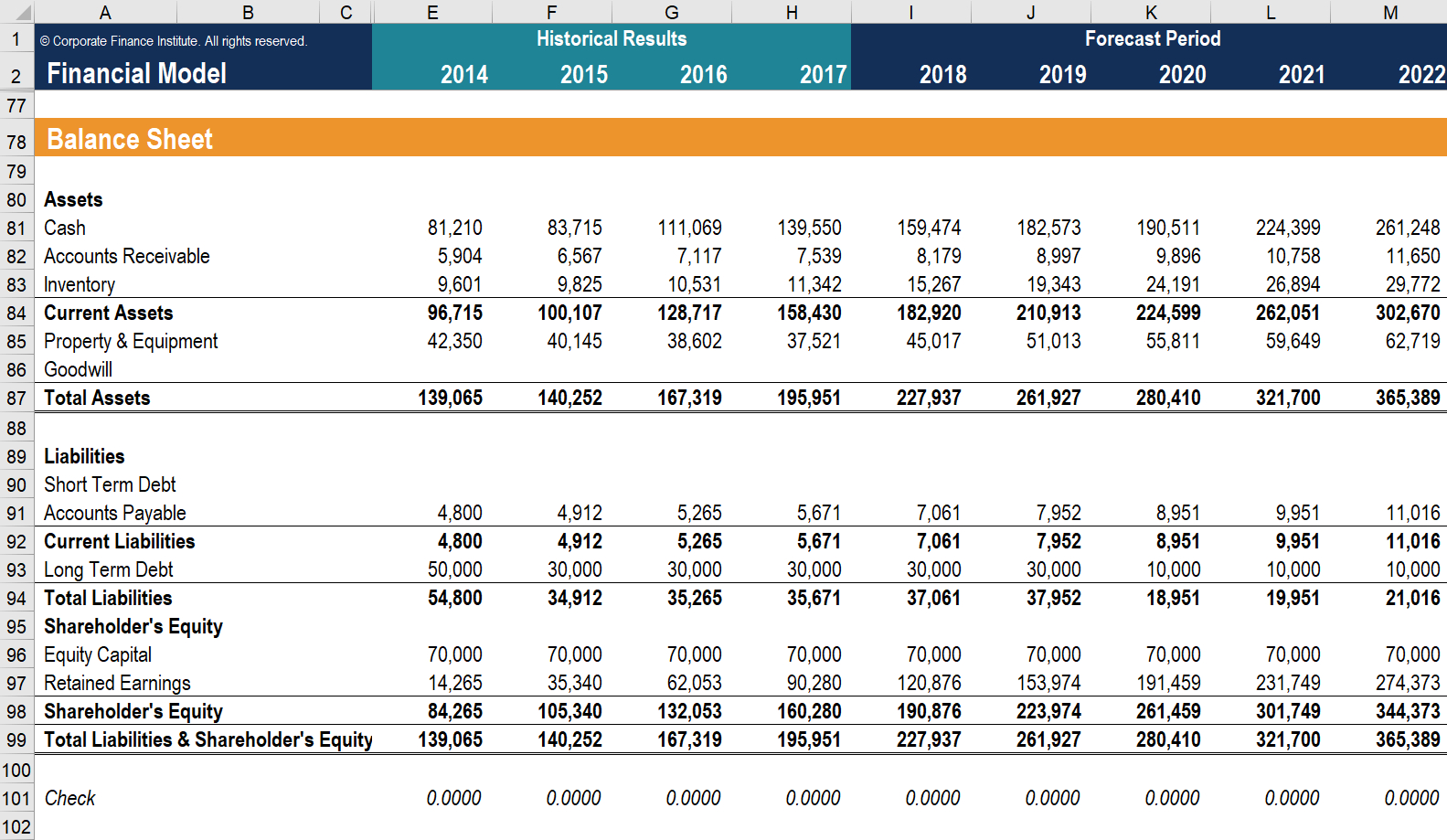

Businesses typically prepare and distribute their balance sheet at the end of a reporting period, such as monthly, quarterly or annually.

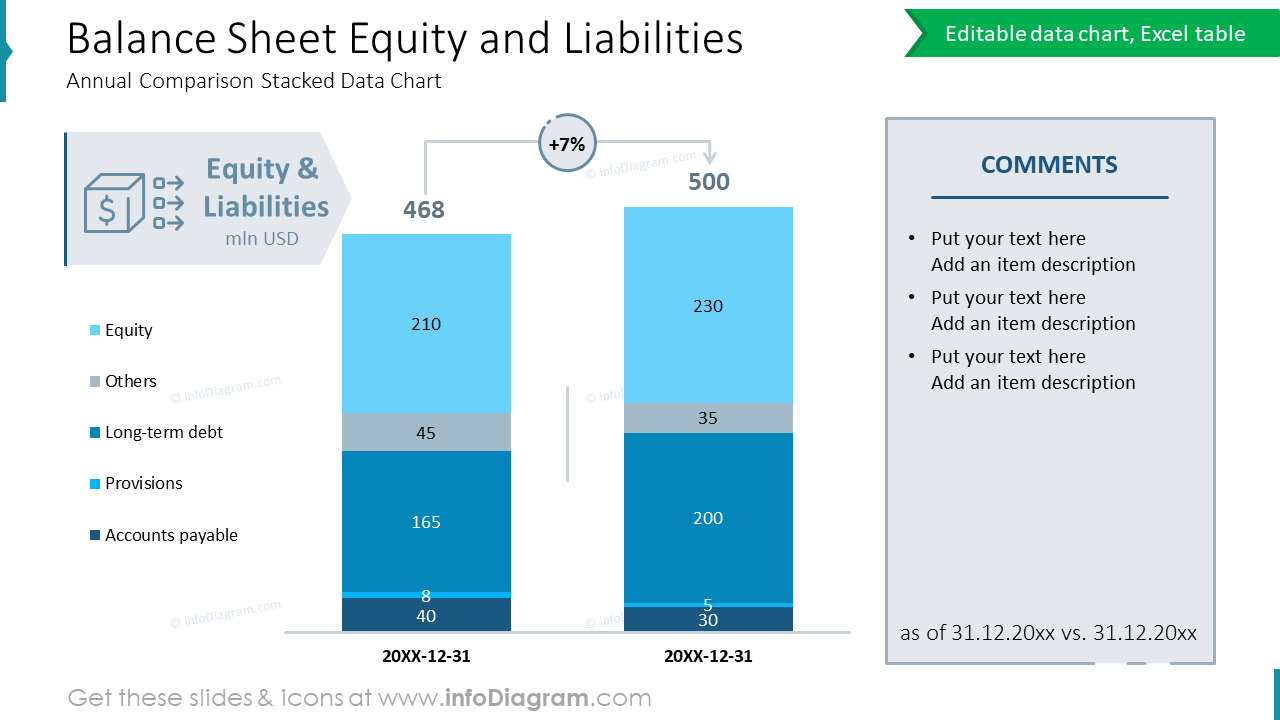

Balance sheet equity and liabilities. Equity is made up of two main components: The balance sheet is one of the financial statements through which a company presents the shareholders’ equity, liabilities, and assets at a particular time. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth).

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.the main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. Assets are things that a company owns that have value. This is a list of what the company owes.

Investing experts view the balance sheet as a snapshot of a company's health at a certain point in time. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Let’s take the equation we used above to calculate a company’s equity:

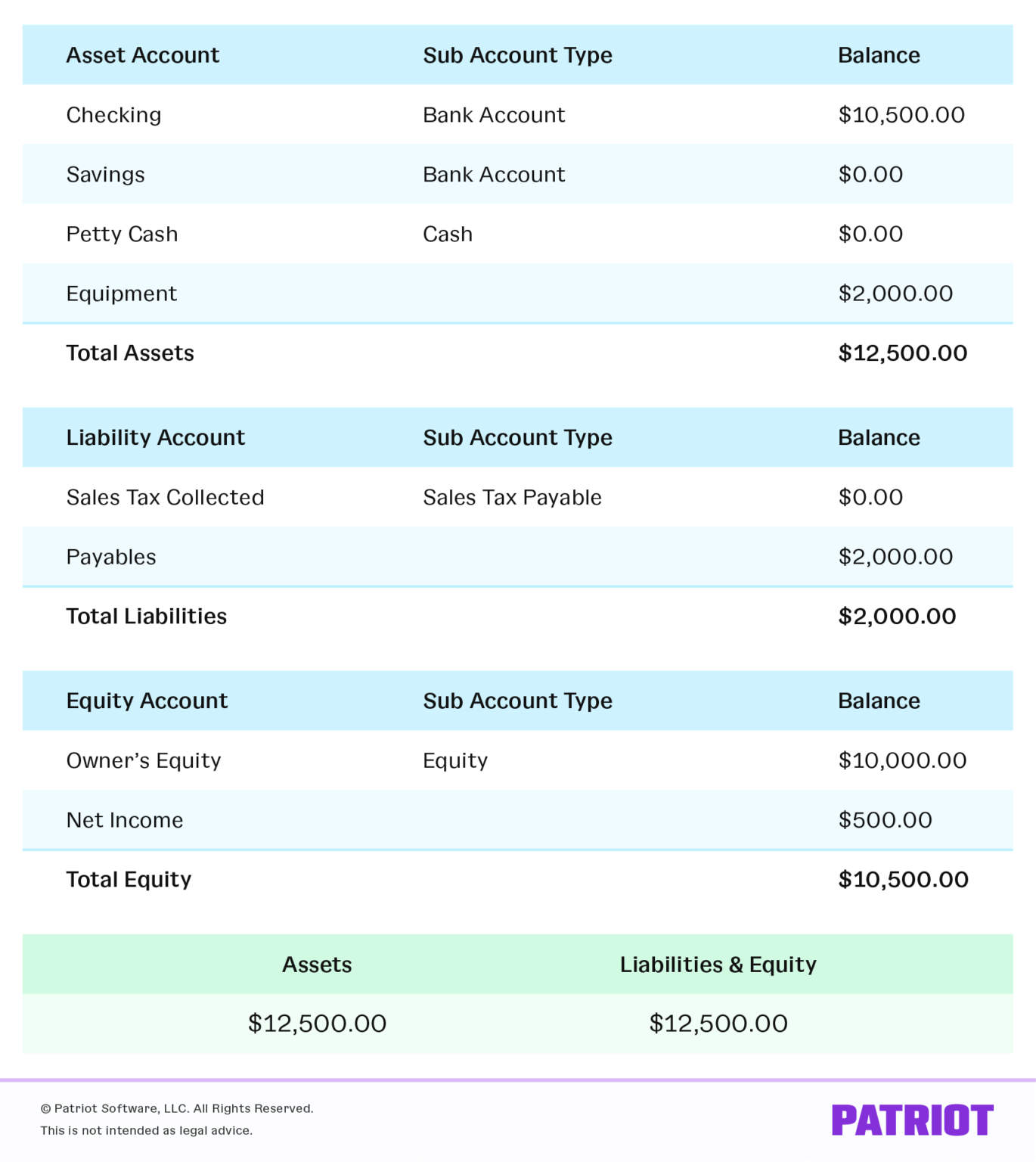

It can also be referred to as a statement of net worth or a statement of financial position. This typically means they can either be sold or used by the company to make products or provide services that can be sold. While the balance sheet can be.

The name balance sheet is based on the fact that assets will equal liabilities and shareholders' equity every time. Equity instruments and retained earnings. Equity is the owners’ residual interest in the assets of a company, net of its liabilities.

Assets (valuable rights owned by the company), liabilities (funds provided by outside lenders and other. Liabilities are debts owed to other parties. Balance sheet, financial statement that describes the resources under a company’s control on a specified date and indicates where they have come from.

Stated differently, every asset has a claim against it—by creditors and/or owners. Get the annual and quarterly balance sheets for lordstown motors corp. All the cash generated by the company belongs to someone on the right hand side of the balance sheet.

What is a balance sheet? Balance sheets include assets, liabilities, and shareholders' equity.

Balance sheets show assets, liabilities, and equity in a financial snapshot. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Shareholders' equity is the portion of the business that is owned by the shareholders.

Understanding balance sheets the assets on the balance sheet. The classified balance sheet is thus broken down into three sections; Equity instruments include capital stock, which is the amount that has been received in relation to the corporation’s sale of shares.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)