Painstaking Lessons Of Tips About 30 Journal Entries With Ledger And Trial Balance Gst What To Include In A Financial Report

15,000 with 18% gst 4.

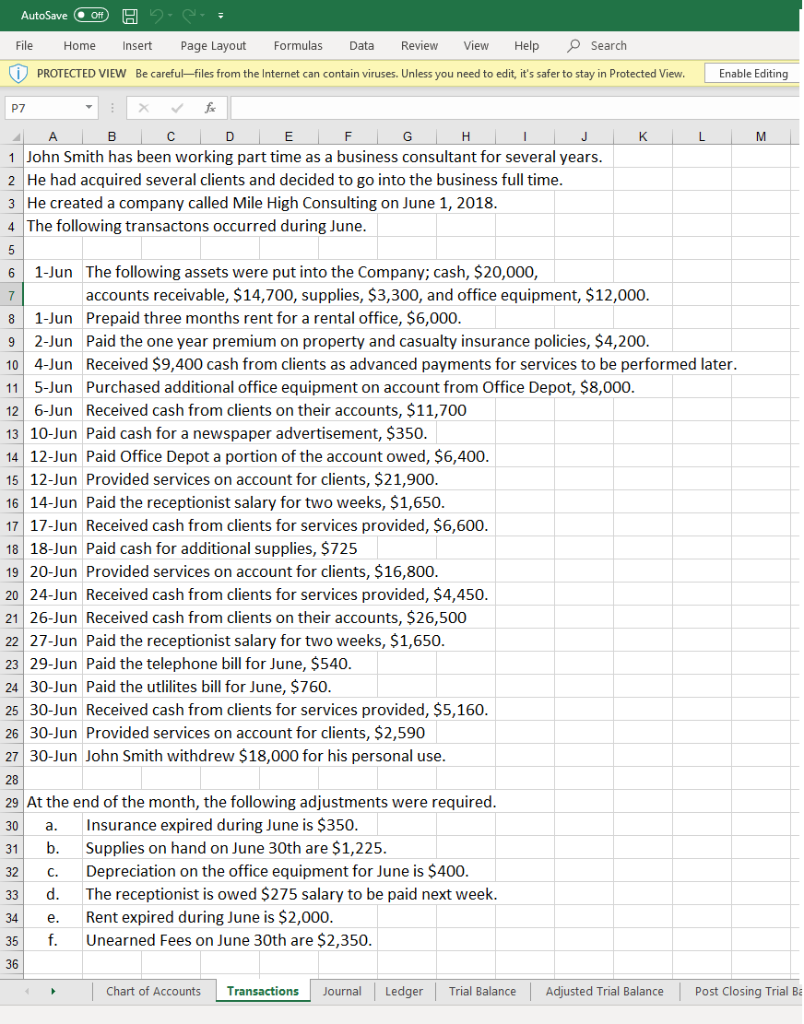

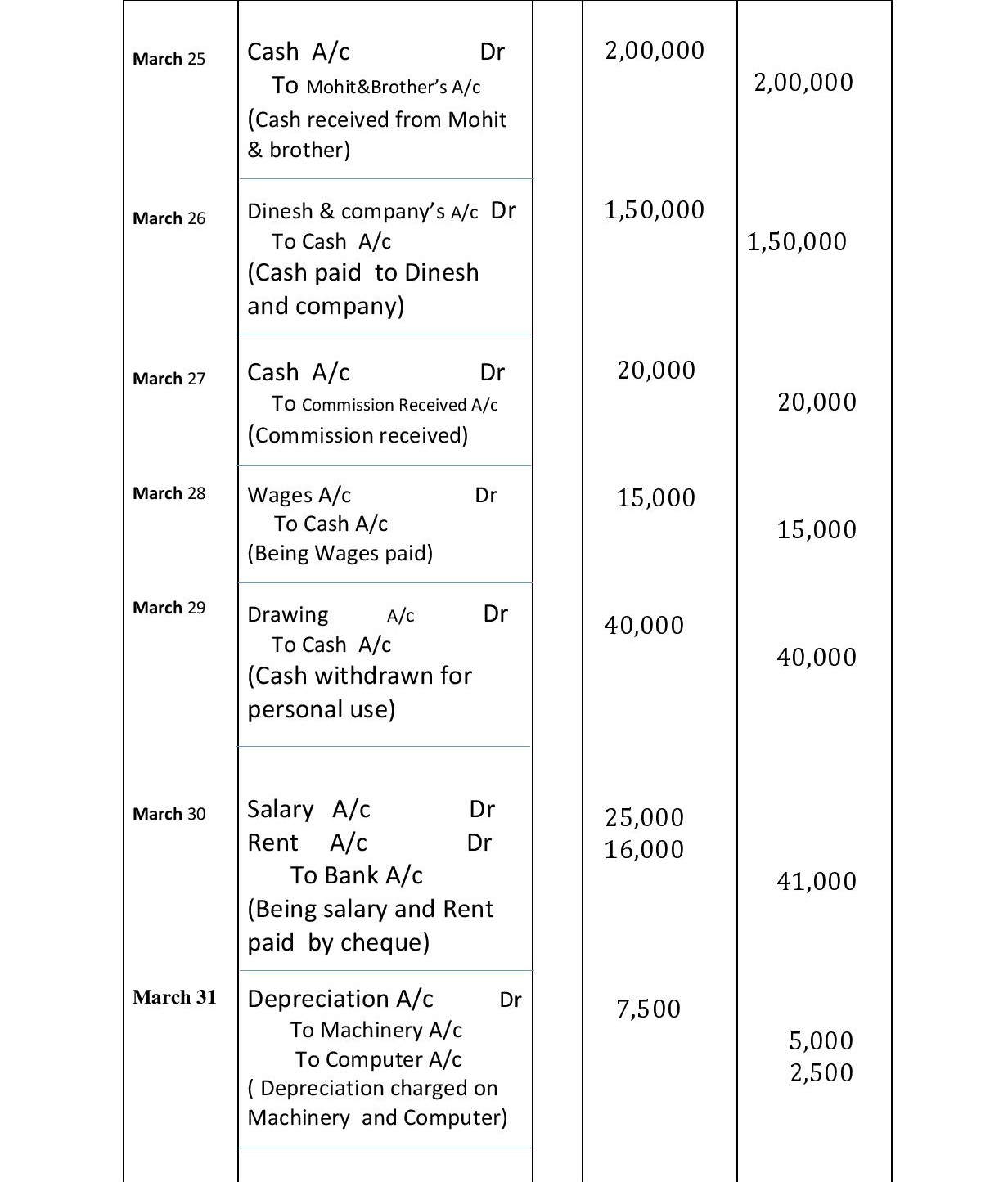

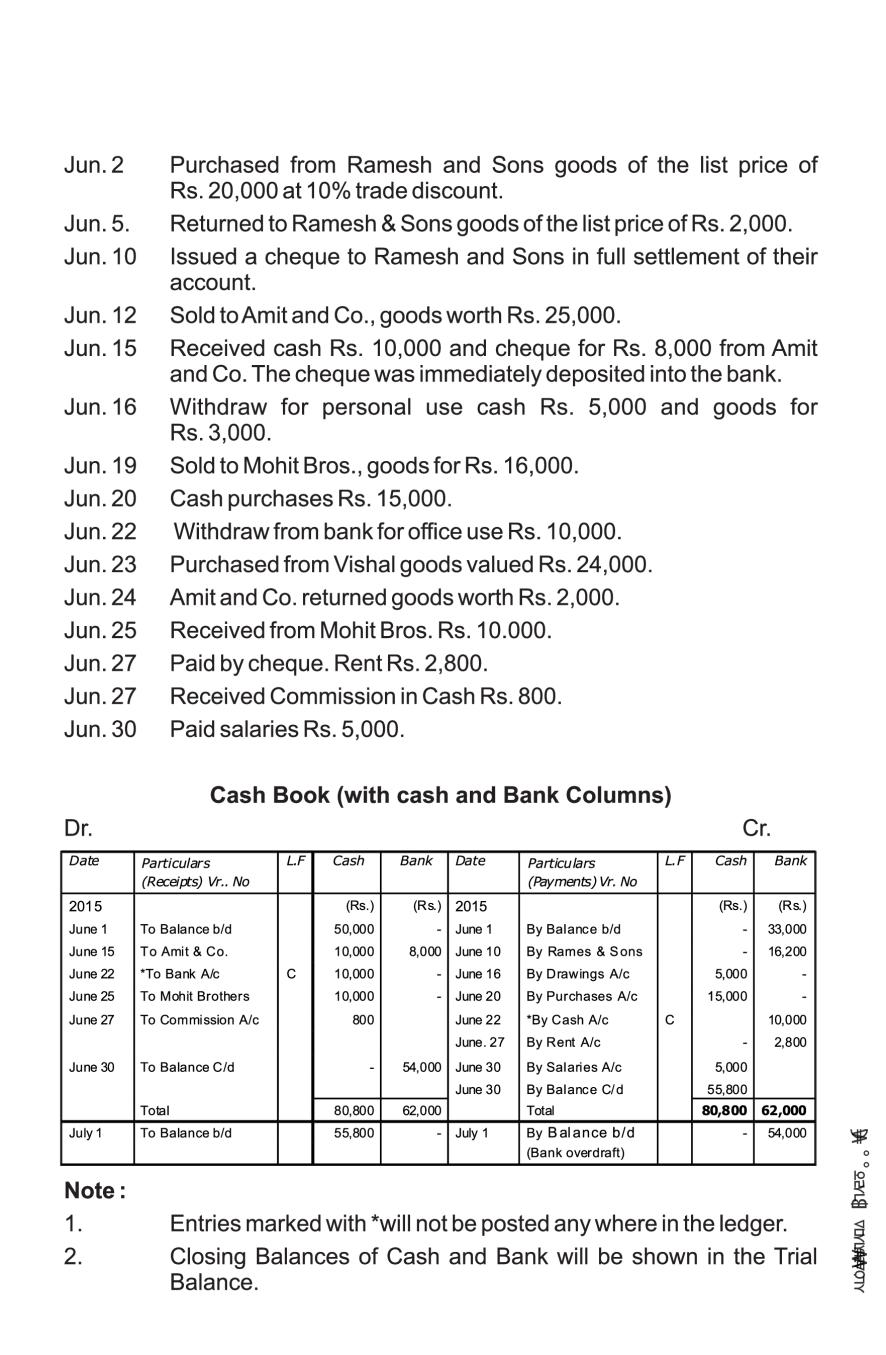

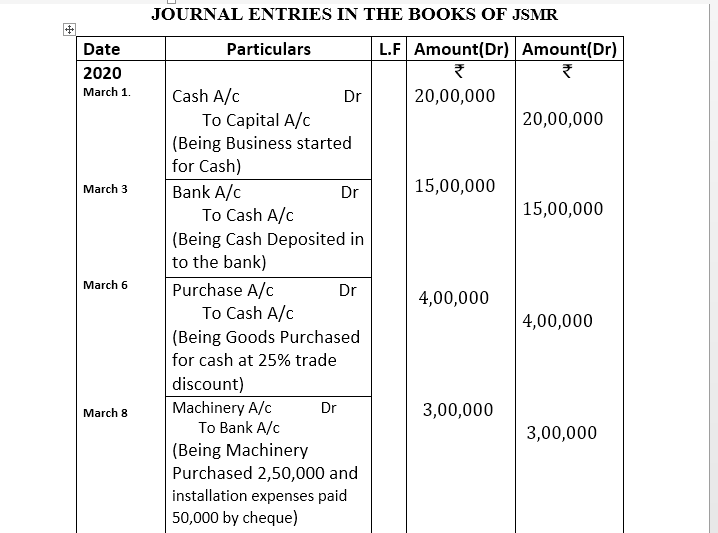

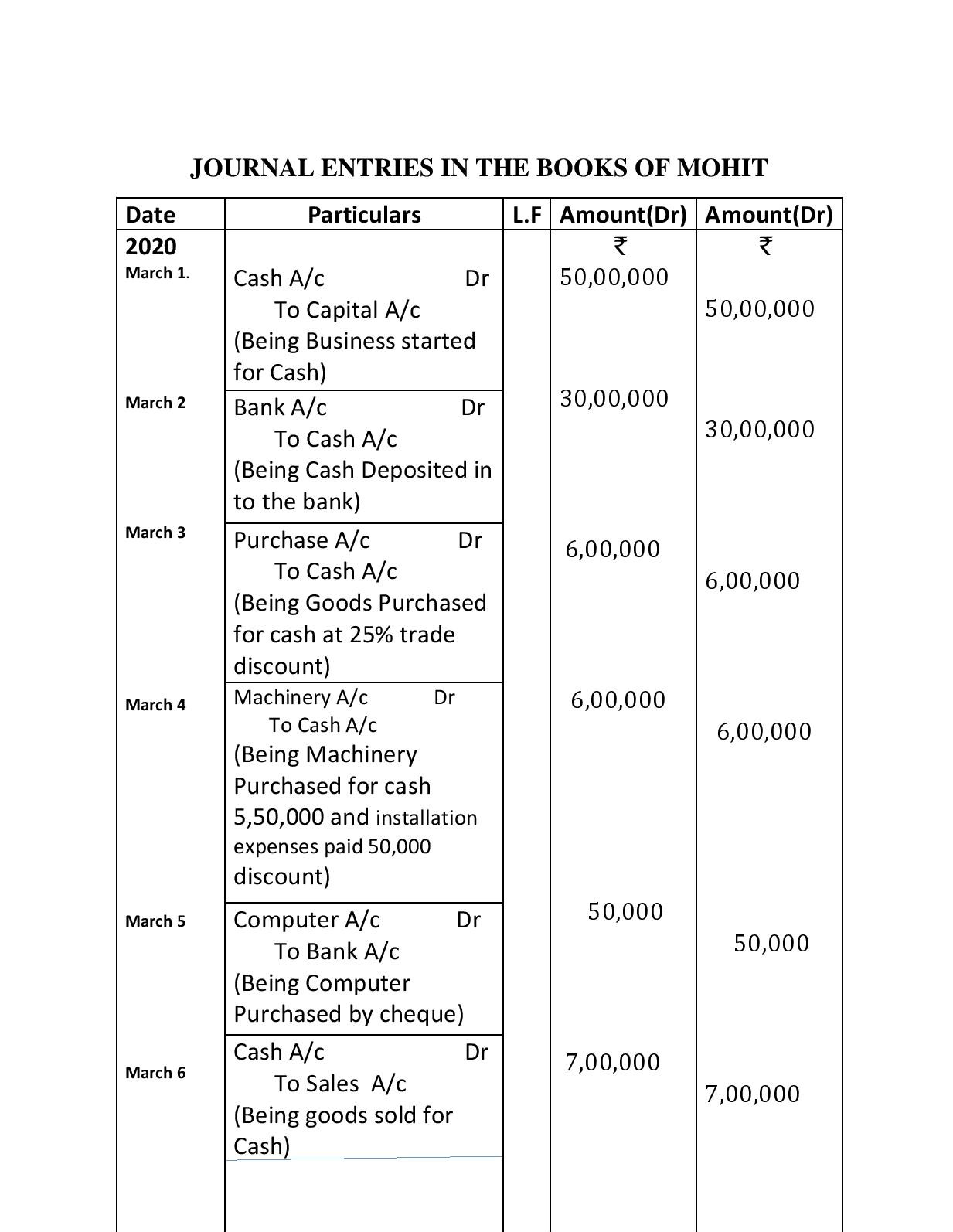

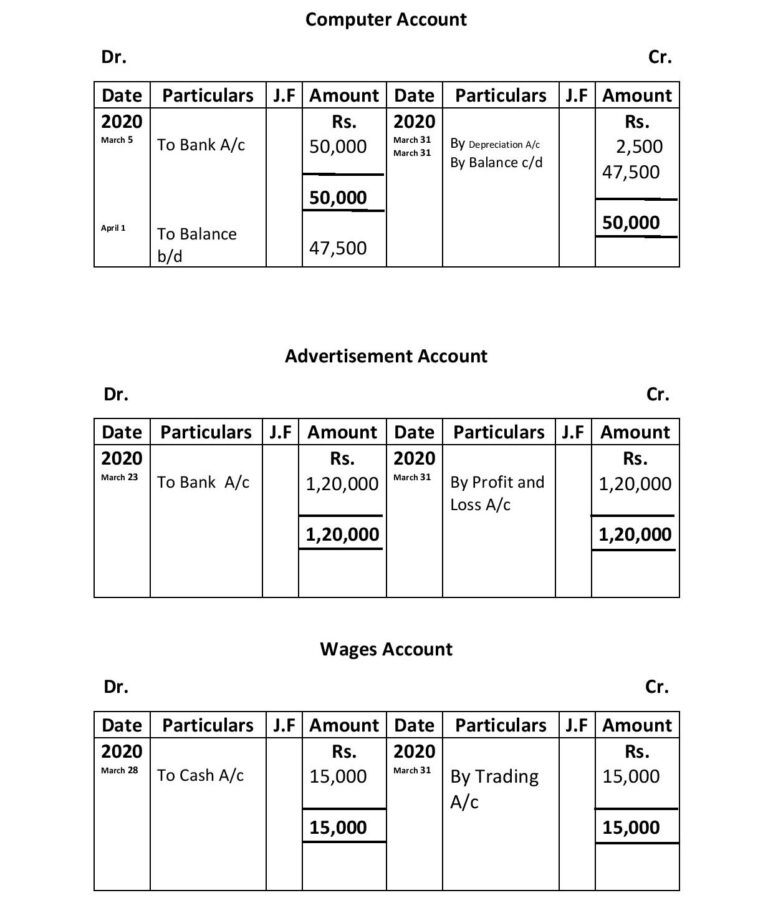

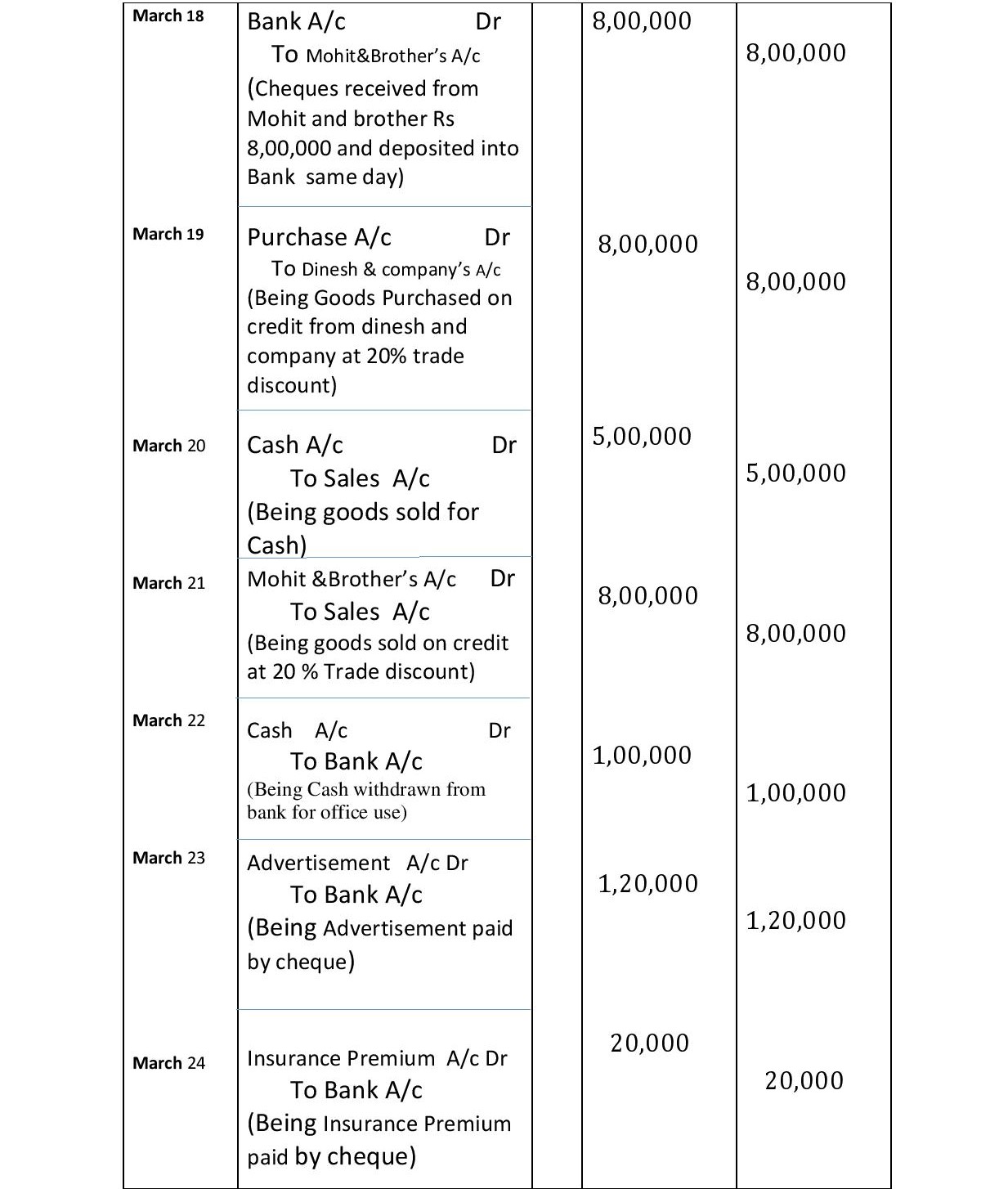

30 journal entries with ledger and trial balance with gst. The debtor is a company’s asset, and assets are always debited in the trial balance. Pass the journal entries post them into the ledger,. Gaurav jangra journal, ledger and trial balance (financial accounting) in this article, we will discuss the basic concepts of financial accounting i.e.

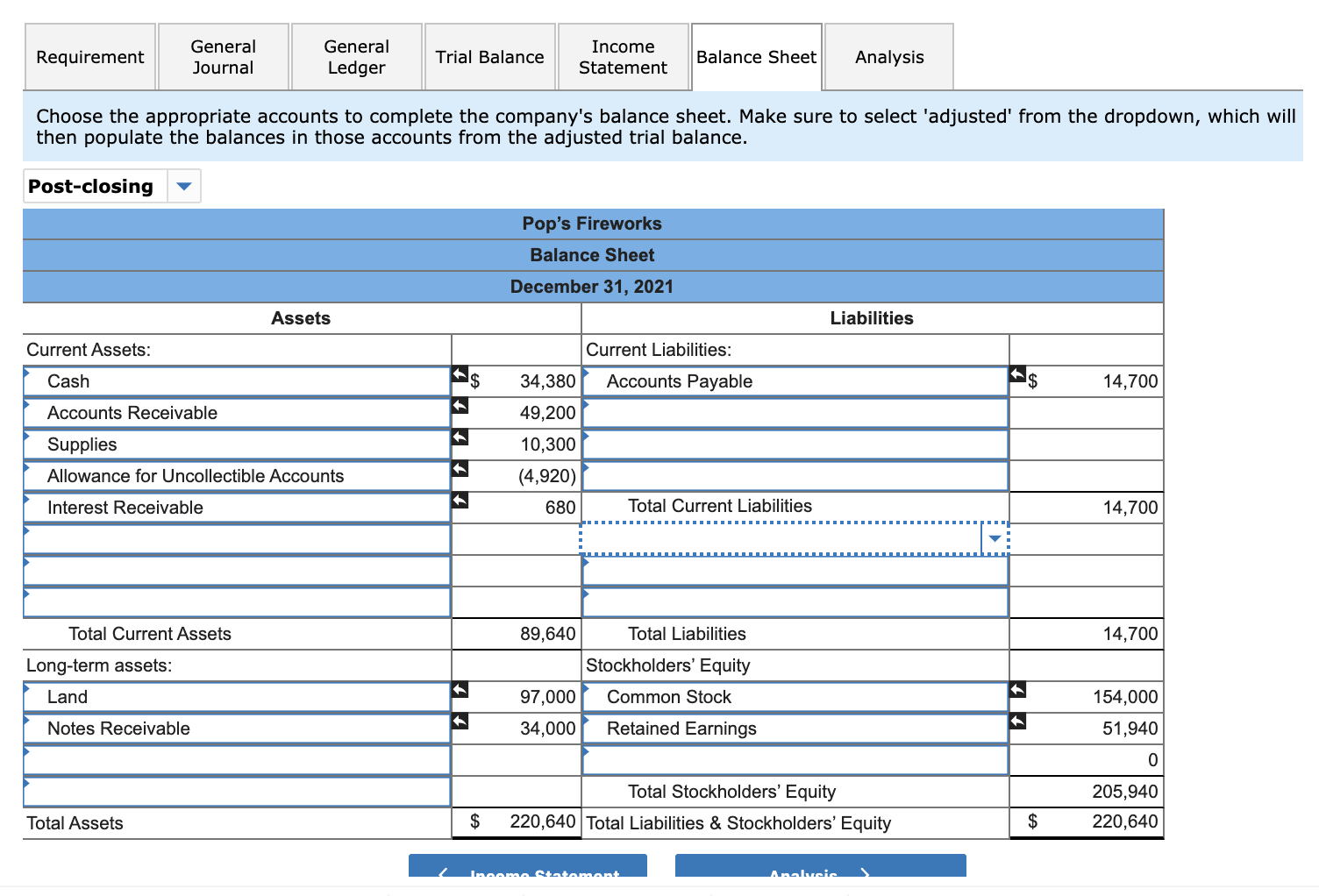

Gst also introduces a concept called the electronic ledgers. Under the gst number search regime, the taxpayer is required to maintain the following accounts which is said to be gst payable journal entry in the tally and. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

15 transactions with their journal entries, ledger and trial balance to prepare project. As specified earlier, trial balance is prepared to check the accuracy of the debit and credit balances of various accounts of ledger. 10,000 with 18% gst 2.

This is where the need of journal entries is the most, so that they can be posted to ledger accounts. June 15, 2020 dr. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

A journal entry shows all the effects of a business transaction as expressed in debit (s) and credit (s). Both the debit and credit. Trading and profit and loss account.

Once you register for gst in the government portal, you will get access to 3 types of. 5,000 with 12% gst 3. Trial balance is a summary statement where the balance of.

Pass the journal entries (which should have at least 30 transactions (without gst), post them into the ledger, closing the books of accounts prepare a. The trial balance is a statement.