Inspirating Tips About Debit Credit Balance Sheet Bank Explained Bakery Cash Flow Statement

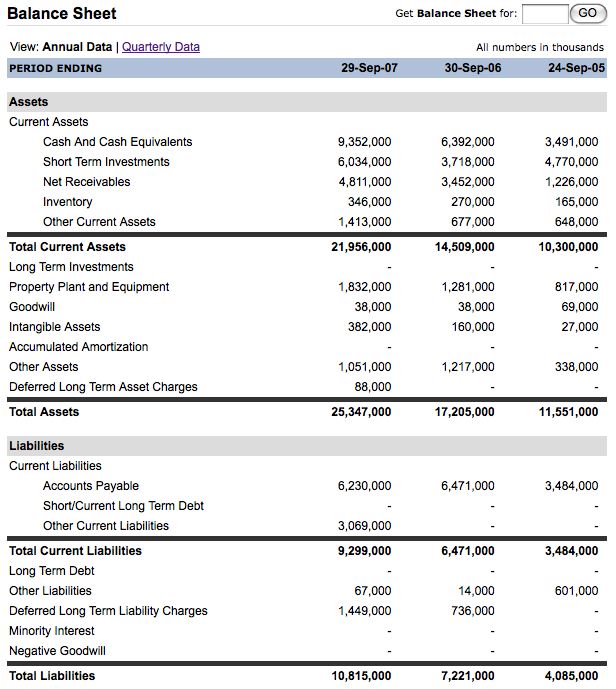

Accounts such as cash, investment securities, and loans receivable are reported as assets on the bank's balance sheet.

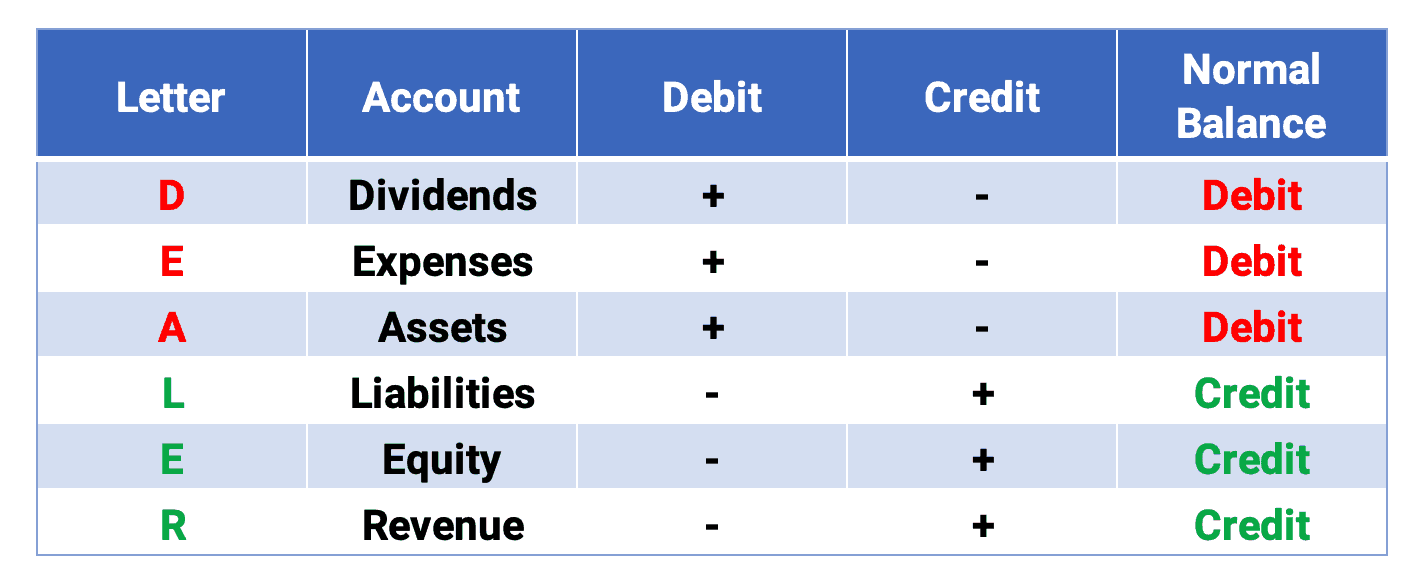

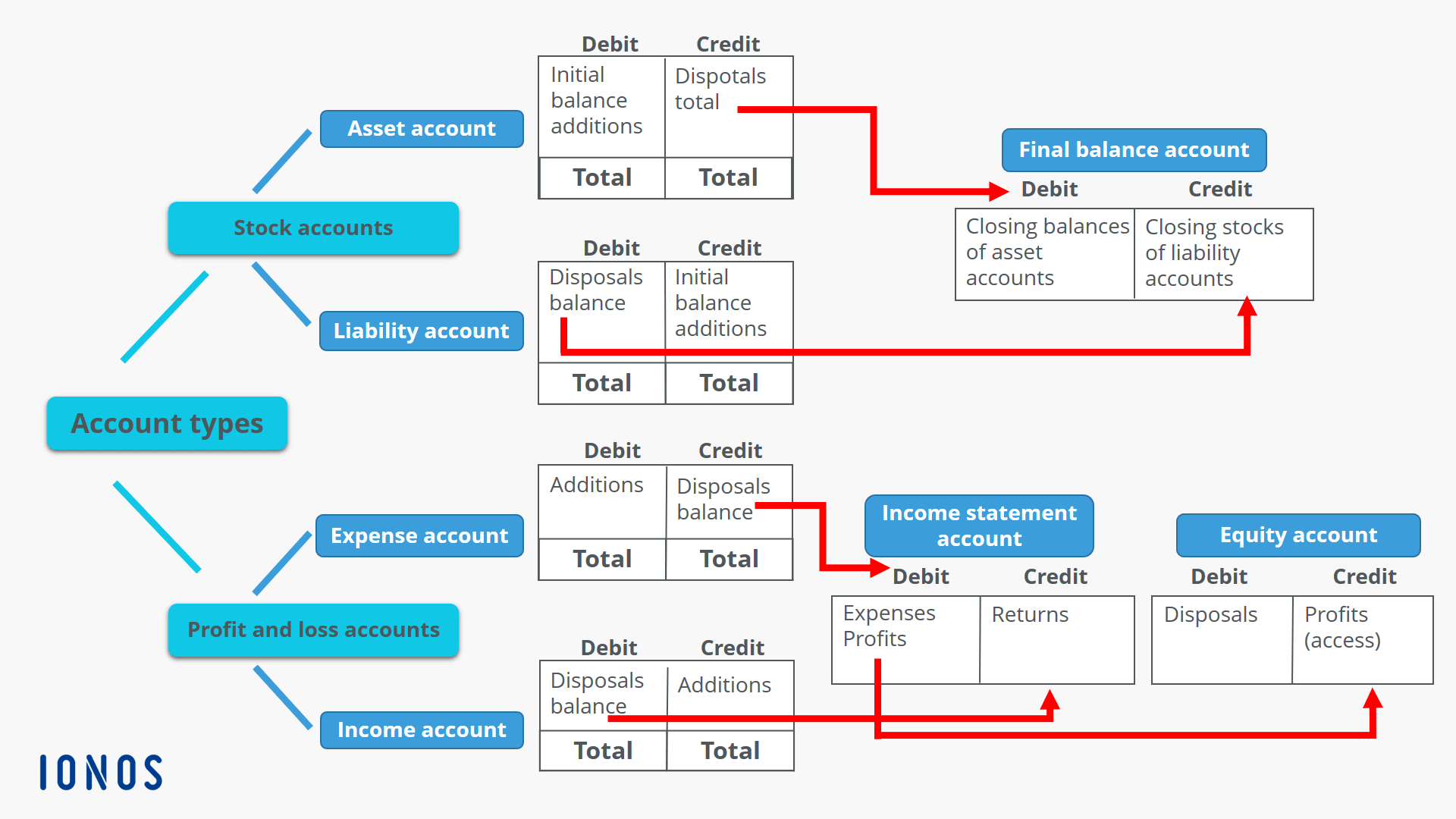

Debit credit balance sheet bank balance sheet explained. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. This discussion defines debits and credits and how using these tools keeps the balance sheet formula in balance. Debit balance account type credit limit interest rate.

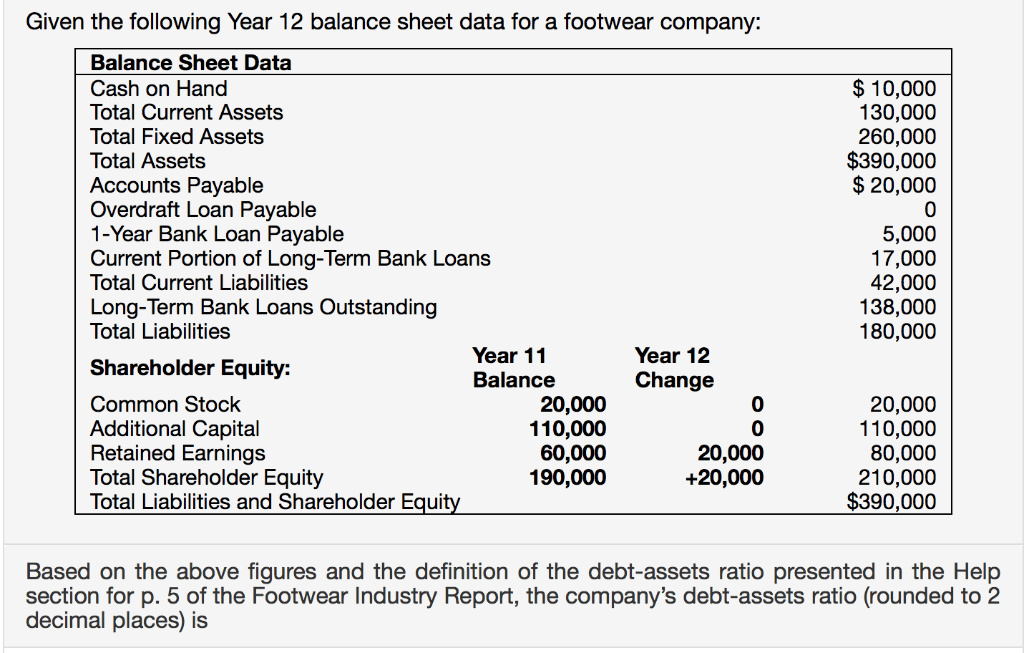

Normal debit and credit balances for the accounts. In bank accounts, a debit balance may indicate different things depending on the account type. The balance sheet is derived using the accounting equation.

Normal debit and credit balances for the accounts, examples of debits and credits in a sole proprietorship. Similarly, if the company sells an item in its stock (asset) at $100, it will decrease the asset balance by $100 since it is. In the process you will deepen your understanding of debits, credits, and the balance sheet.

You’ll find a cheat sheet that explains debits and credits and a number of examples that explain the concepts. When they increase in value, we debit the account. For the books to remain balanced, debits must always equal credits.

In a balance sheet, asset. That rule reverses for the liabilities side of the sheet. Debits and credits explained debit entries reflect an increase in assets or a decrease in liabilities, while credit entries reflect a decrease in assets or an increase in liabilities.

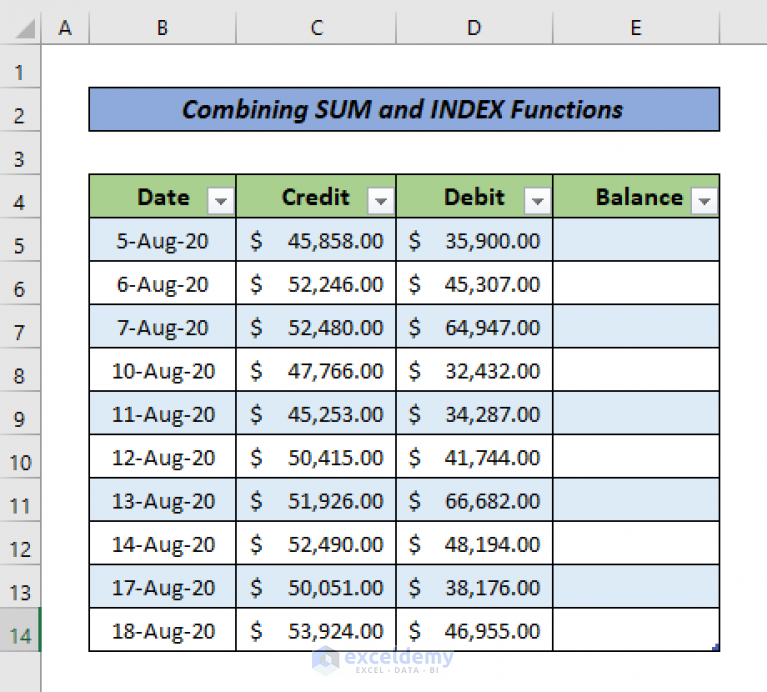

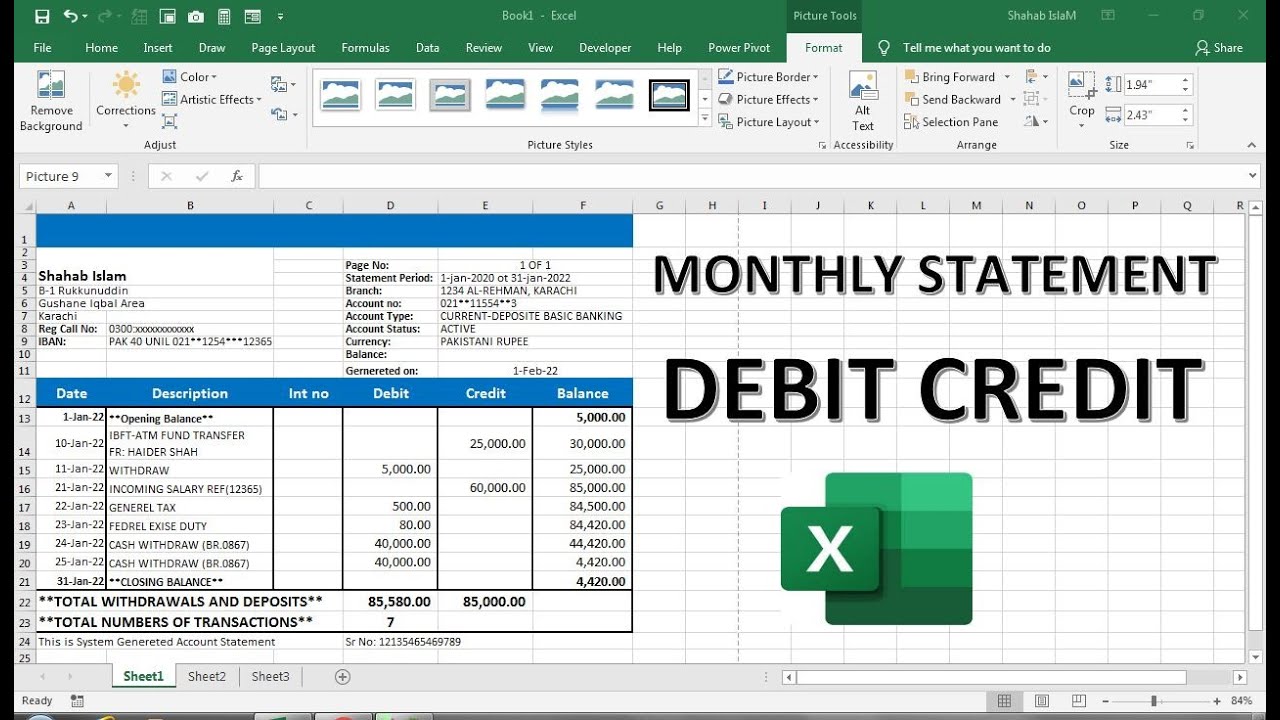

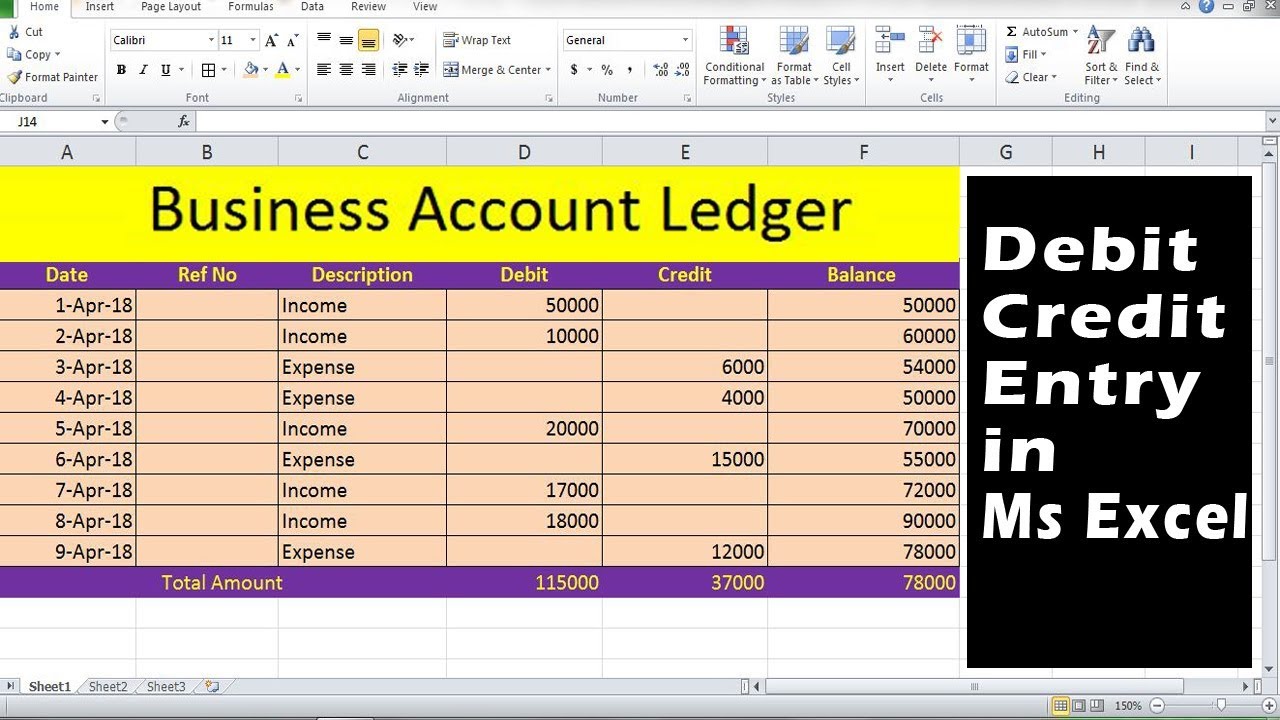

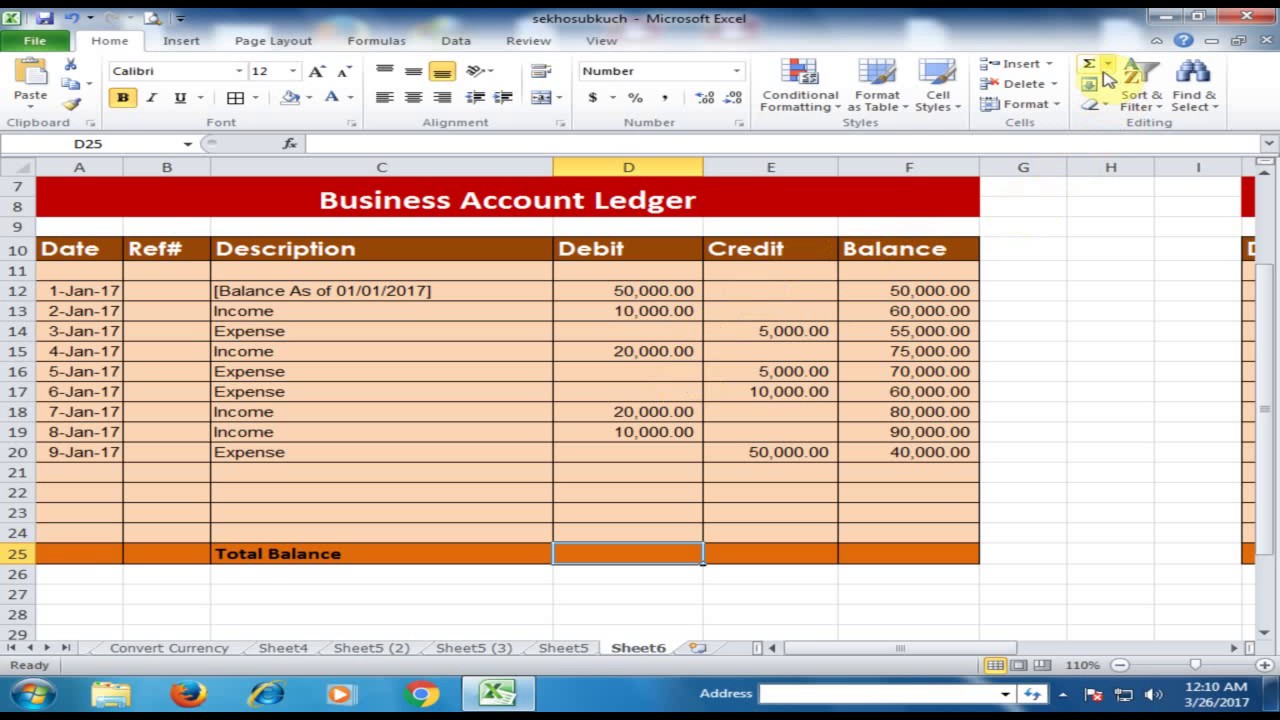

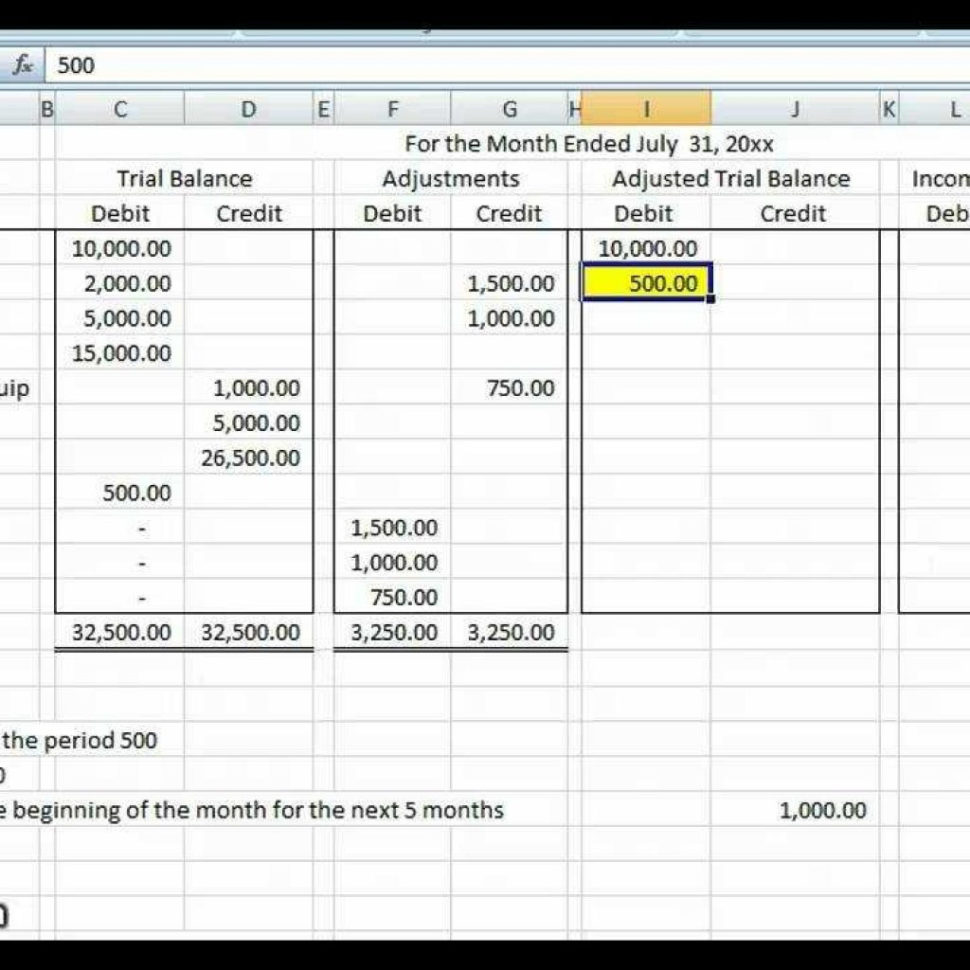

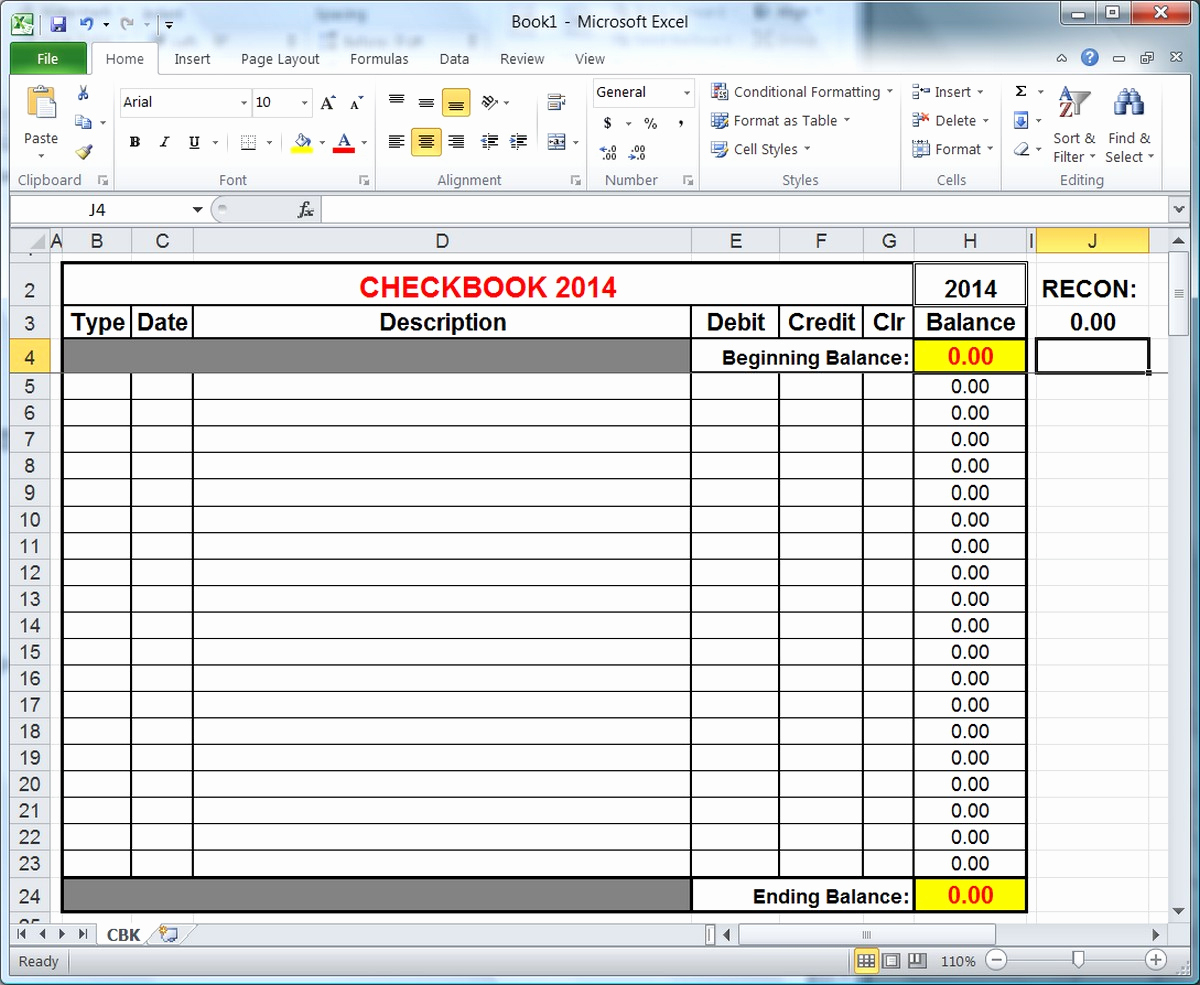

Excel formulas named sum, offset, and index will be used to calculate the balance sheet. The format of the basic accounting equation can help you understand the normal or expected balances for. We will now return to the format of the balance sheet and the basic accounting equation:

The bank in column c and column d tells you what balance you should deposit and withdraw from your account. So we record them together in one entry. For example, debit increases the balance of the asset side of the balance sheet.

Part 1introduction, pertinent facts relating to debits and credits part 2normal debit and credit balances for the accounts, examples of debits and credits in a sole proprietorship part 3examples of debits and credits in a corporation The balance sheet is also commonly referred to as the statement of financial position. How to reconcile debits and credits in excel?

How debits and credits affect liability accounts It summarizes a company's assets, liabilities, and owners' equity. A debit entry increases the balance on the asset side, while a credit entry reduces the balance.

A debit to the balance sheet is good (increasing an asset or reducing a liability) a debit to the profit and loss is bad (increasing an expense or reducing income) a credit to the balance sheet is bad (reducing an asset or increasing a liability) a credit to the profit and loss is good (increasing income or reducing an expense) Bookkeeping basics explained hub accounting august 18, 2023 debits and credits are used in a company’s bookkeeping in order for its books to balance. For example, if the company purchases equipment worth $10,000 using a check, it will increase the asset balance by $10,000.