Marvelous Tips About Cash Flow Statement Indirect Method Solved Examples Ifrs 16 Transition Adjustment Tax

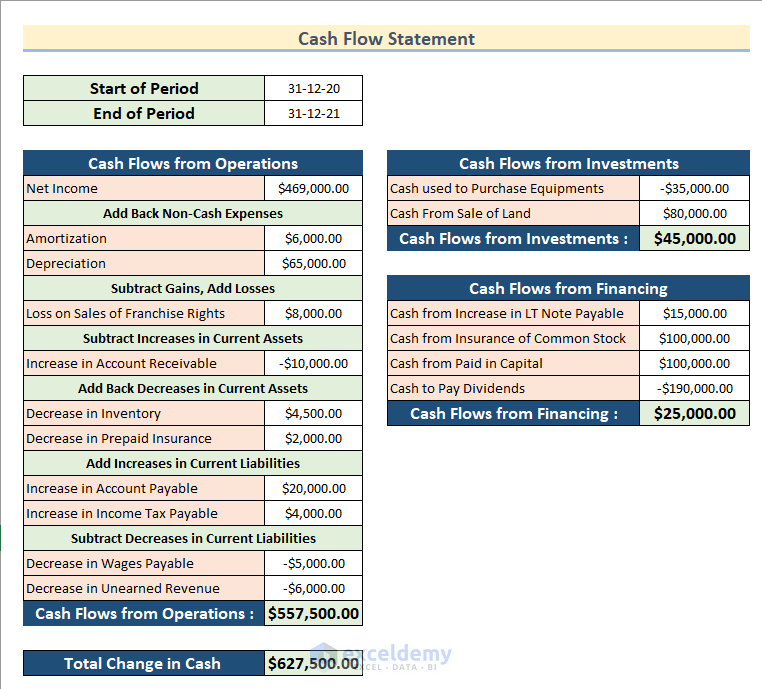

As we have seen in the example, the starting point for calculating the cash flow with the indirect method is the turnover.

Cash flow statement indirect method solved examples. For example, lowry locomotion constructs the following statement of cash flows using the indirect method: Creating the cash flow statement using the indirect method is considered one of the most challenging exercises in finance since it requires thorough knowledge of accounting methodologies, the company’s business model, debt calculations, tax calculations, and the way in which these items fit together. Examples from ias 7 representing ways in which the requirements of ias 7 for the presentation of the statements of cash flows and segment information for cash flows might be met using detailed xbrl tagging.

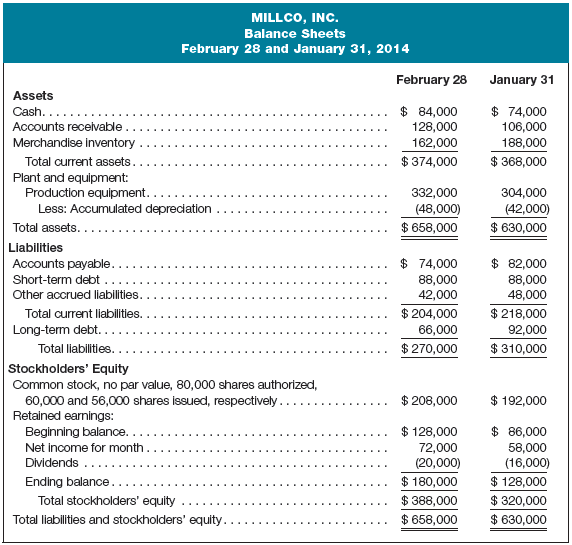

The indirect method seeks to determine actual cash flow. In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to. In our examples below, we’ll use the indirect method of calculating cash flow.

This allows cash inflows and outflows to be depicted with accuracy for the period. Steps of operating activities section of the cash flows statement by using indirect method: You will also get to learn the full format of the indirec.

Steps for solving example: Example of the indirect method under the accrual method of accounting, revenue is recognized when earned, not necessarily when cash is received. These adjustments include deducting realized gains and other adding back realized losses to the net income total.

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. To do this, it reverts the accounting method from accrual to cash accounting. This short lecture explains the cashflow statement problem solving with indirect method through some easy example formats.

There are two ways to prepare the cash flow statements. Suzanne kvilhaug the cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Breaking the process down can help.

This episode of accounting basics for beginners is part 3 covering indirect method cash flow accounting. A cash flow statement contains three sections; Operating activities, investing activities and financing activities.

This statement will include information about the company’s operating, investing, and financing activities. Such as depreciation, amortization, interest expenses, loss on sales of fixed assets and investment. Begin with net income from the income statement.

You can list gains or losses on each line below this figure, adding or subtracting their totals from the net income as you go. Apply all adjustments on the respected items which are connected to the accounts. For example, a customer used $100 in credit for a purchase.

P & l account and other necessary account. Using the indirect method to prepare a cash flow statement might seem intimidating. In this lesson, we go through a thorough example of the indirect method of the cash flow statement.