Glory Tips About Consolidated Cash Flow Statement Acquisition Of Subsidiary Example Sample Adjusted Trial Balance

Ifrs 10 disposal of subsidiary by silvia consolidation and groups,.

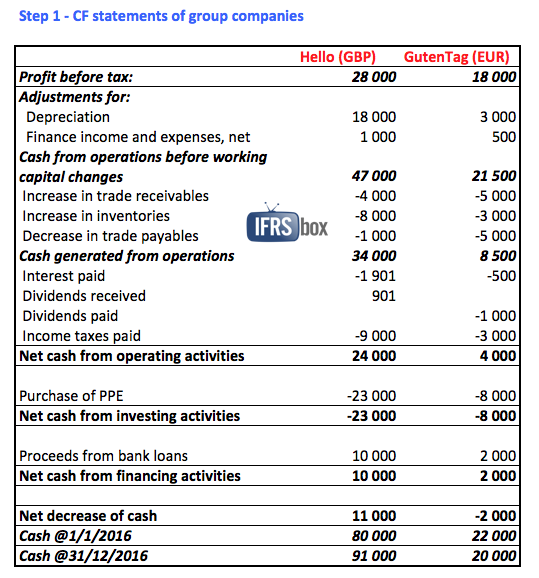

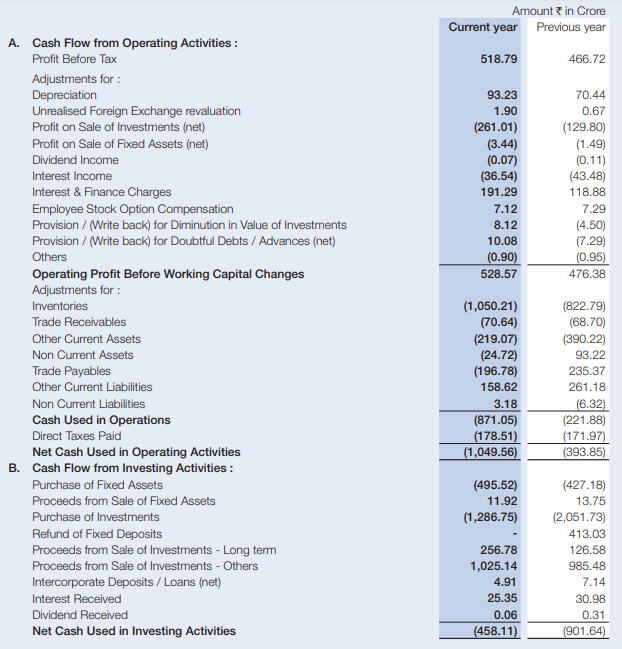

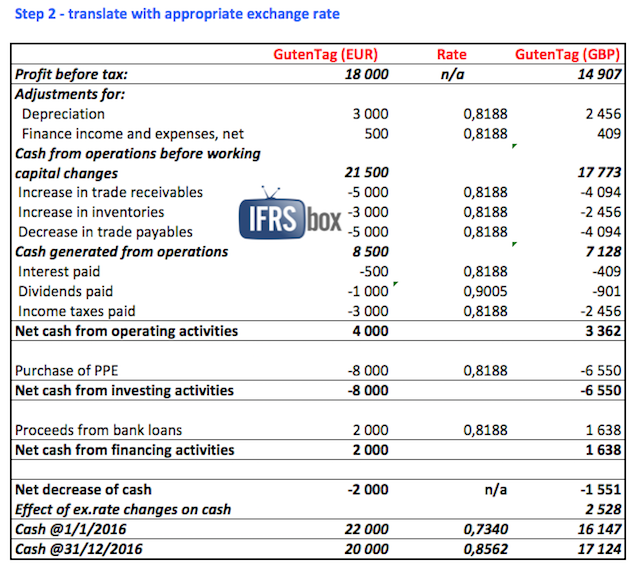

Consolidated cash flow statement acquisition of subsidiary example. Acquisition of subsidiary x net of cash acquired ( 550) purchase of property, plant and equipment ( 350) proceeds from. Next, use a worksheet to. Acquisition of a subsidiary, net of cash acquired additions to property, plant and equipment4 additions to investment property additions of intangible assets purchases of.

For example, suppose a company’s cash flow statement shows $500 million for “acquisitions, net of cash acquired”. Additions = balancing figure. Cash flows from investing activities acquisition of subsidiary x, net of cash acquired (note a) (550) purchase of property, plant and equipment (note b) (350) proceeds from.

What the ifrs text says, how the business use case is. Cash flows from investing activities. Sir, if we have a loan amount in non current liability section of sofp in both the year ends ( 20×6 n 20×7) , and in the note to accounts , it says that ” loans were issued at a discount.

Acquisition of subsidiary x net of cash acquired ( 550) purchase of property, plant and equipment ( 350) proceeds from sale of equipment. In this paper the acquisition of a subsidiary is explained through a real use case scenario and presented in three steps: Acquisition of a subsidiary, net of cash acquired additions to property, plant and equipment4 additions to investment property additions of intangible assets purchases of.

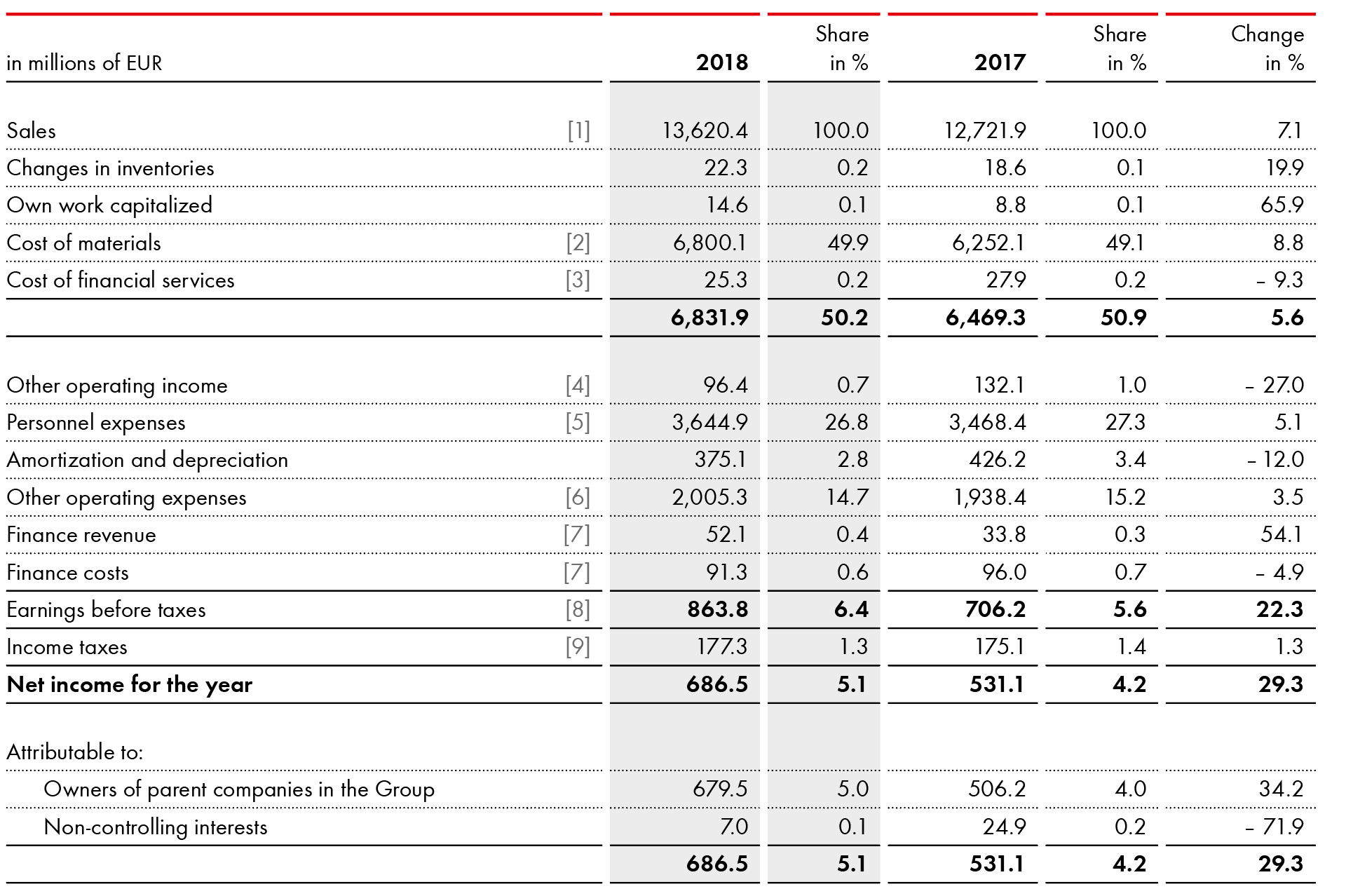

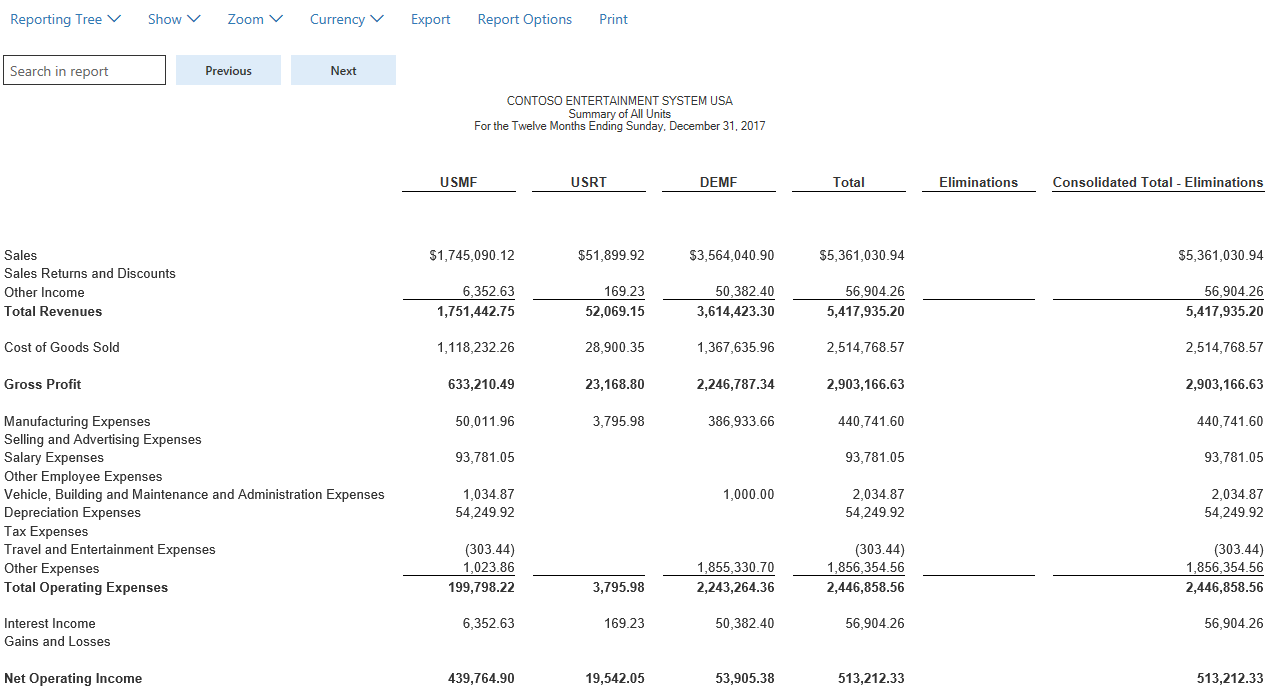

The first way is to create consolidated subsidiary financial statements. The consolidated method for subsidiary accounting. This factsheet provides an overview and refresher, including practical examples and legislative references when consolidations are undertaken under frs 102, the.

This means the company used $500. The consolidated method is usually preferred over the equity method if the percentage the parent company. Consolidated statements of cash flows.

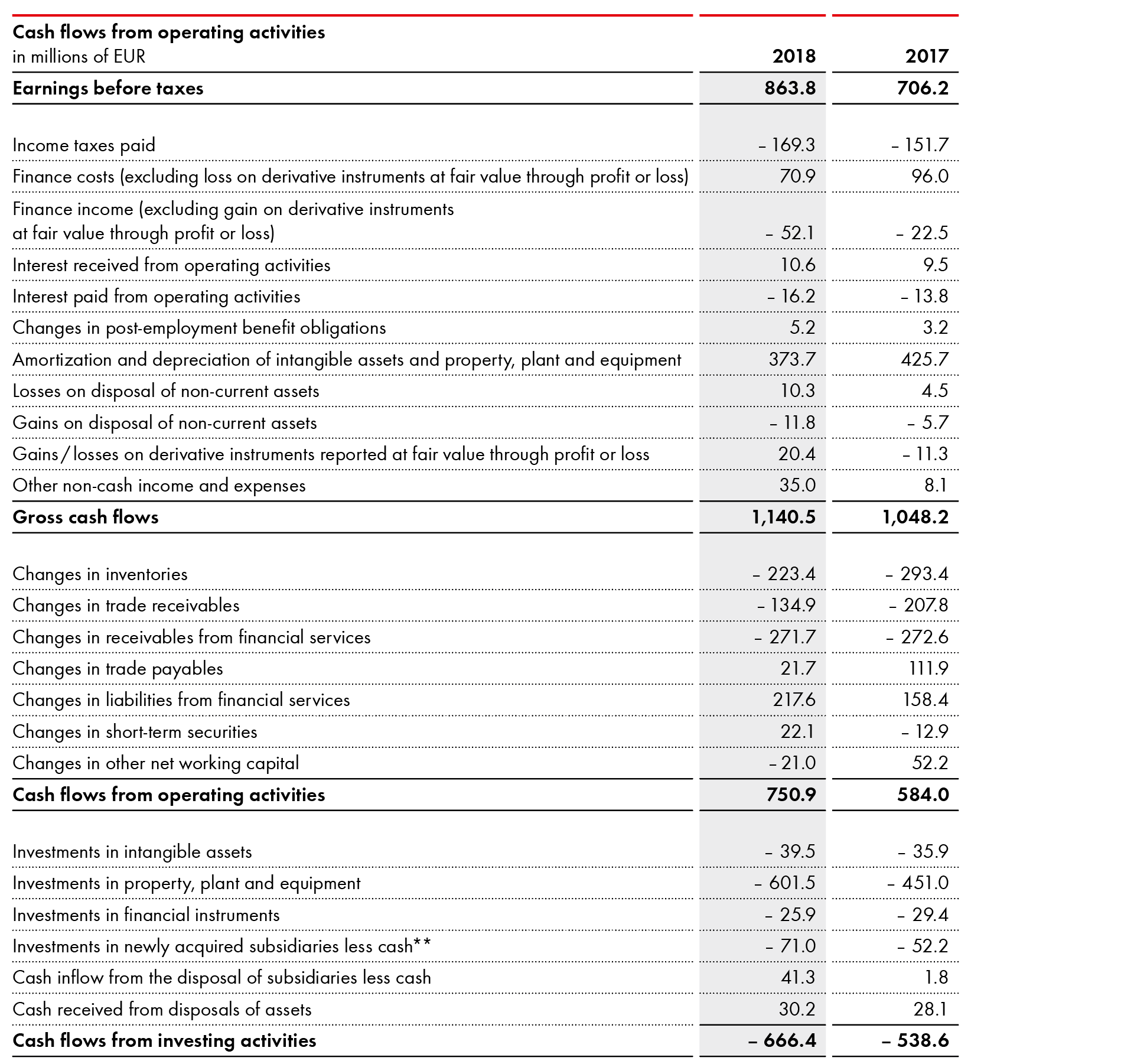

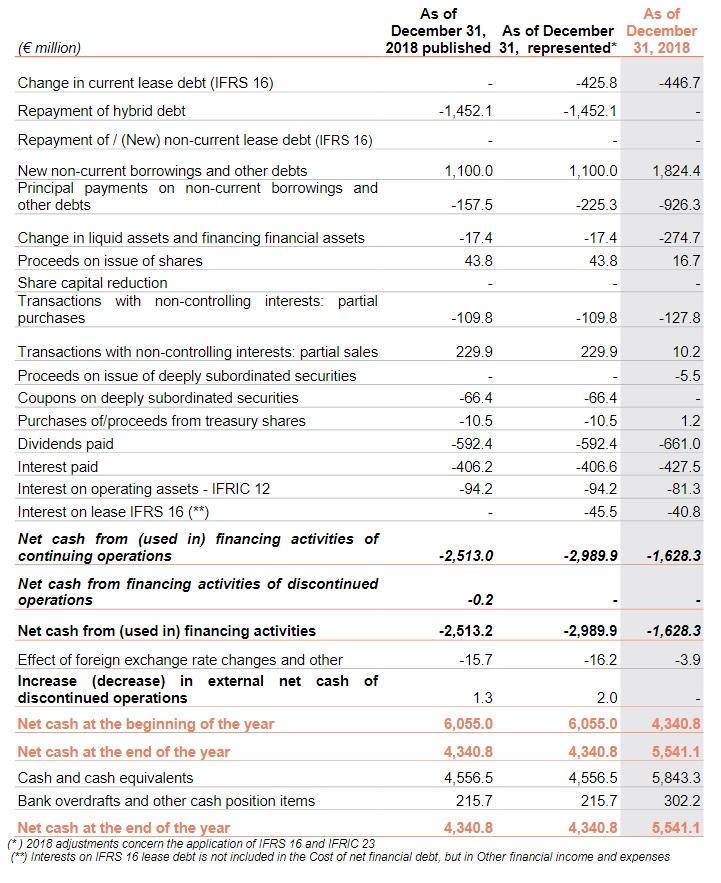

Cash flows from investing activities. However, preparing a consolidated statement of cash flows does introduce several accounting issues. There are primarily three ways to report ownership interest between companies.

Consolidated cash flow statement for parent company purchasing subsidiary company for cash, reporting requirements demonstrated thru calculations for. The above consolidated statements of cash flows should be read in conjunction with the accompanying notes. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the.

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)