Unique Info About Financial Statement Standards Increase In Current Assets Cash Flow

20 february 2024.

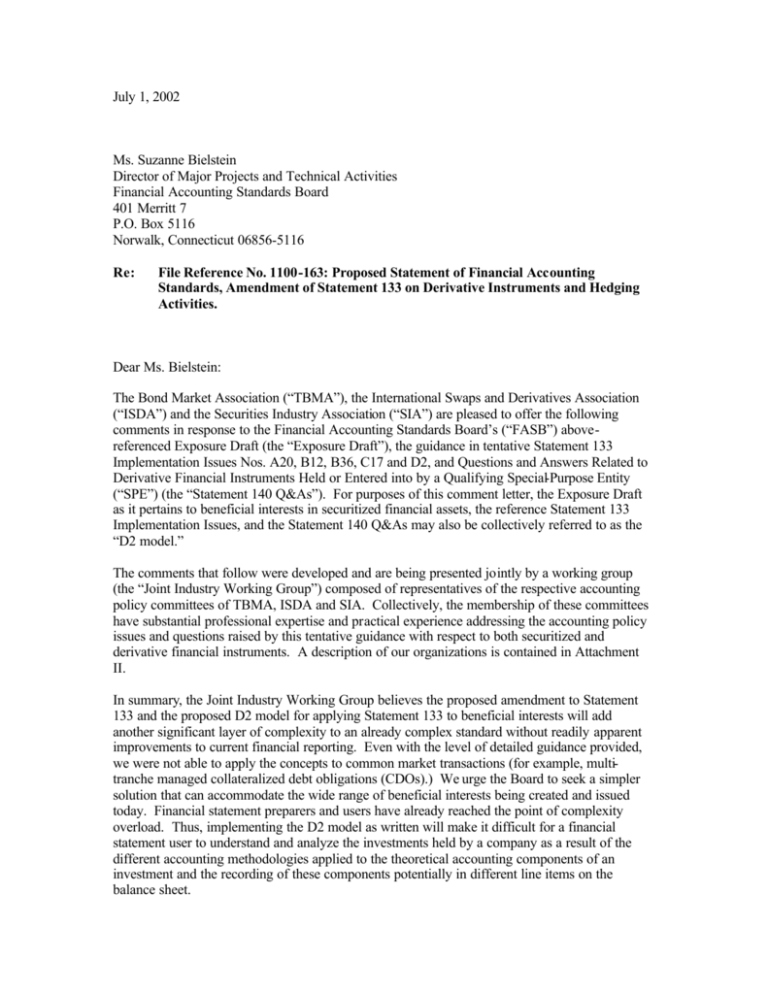

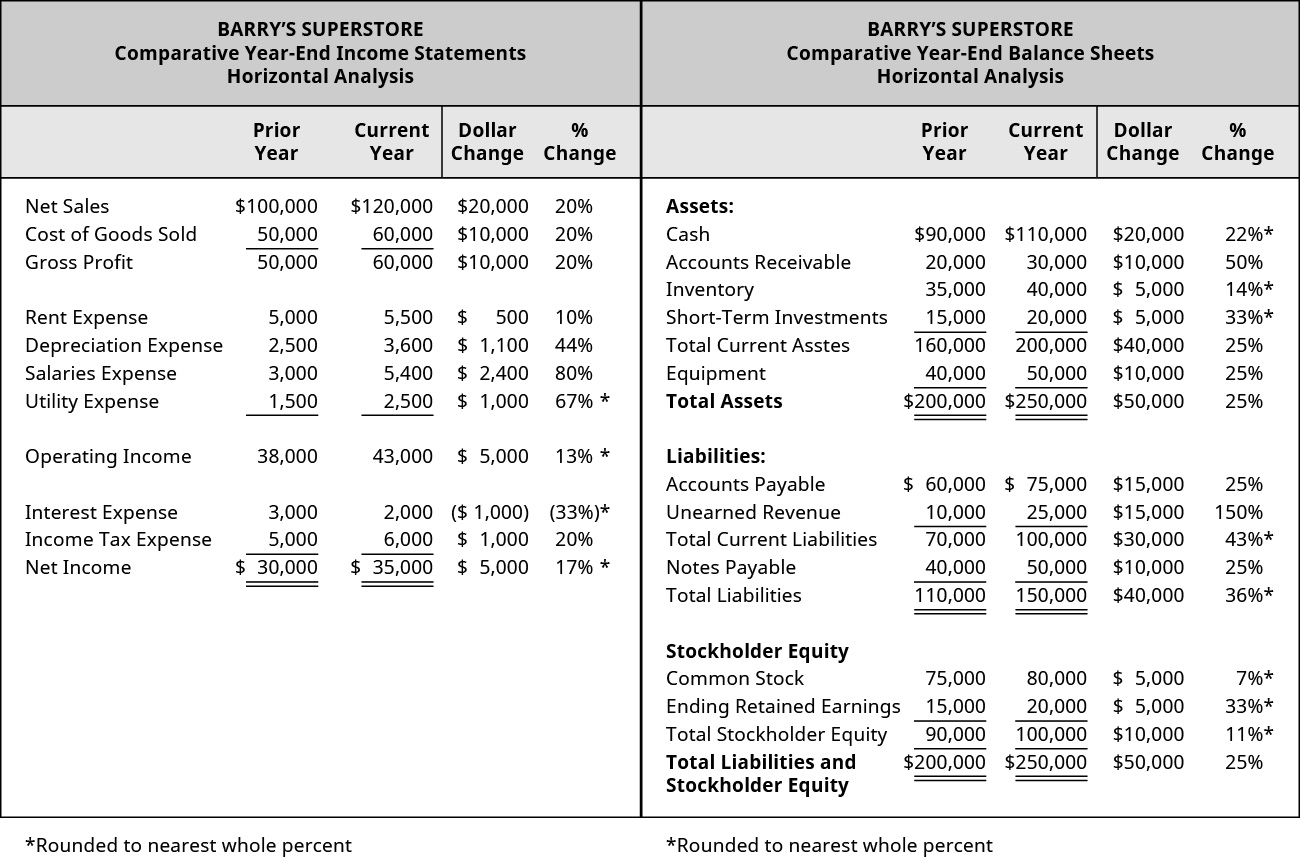

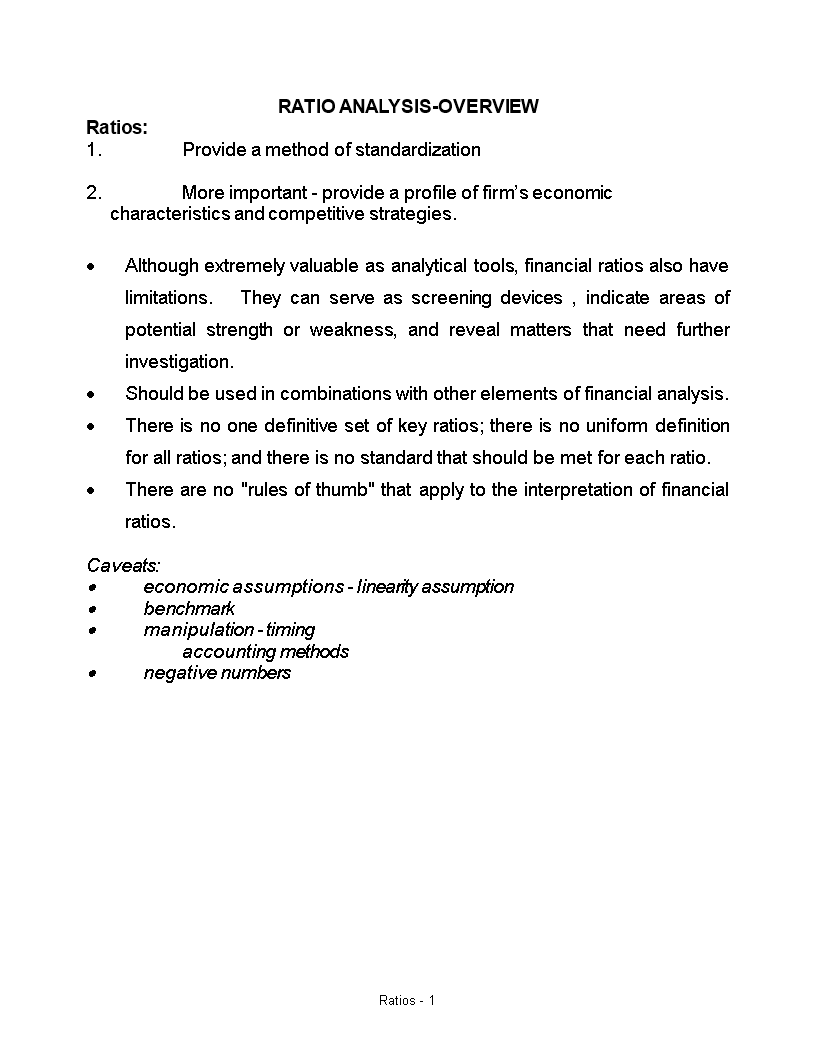

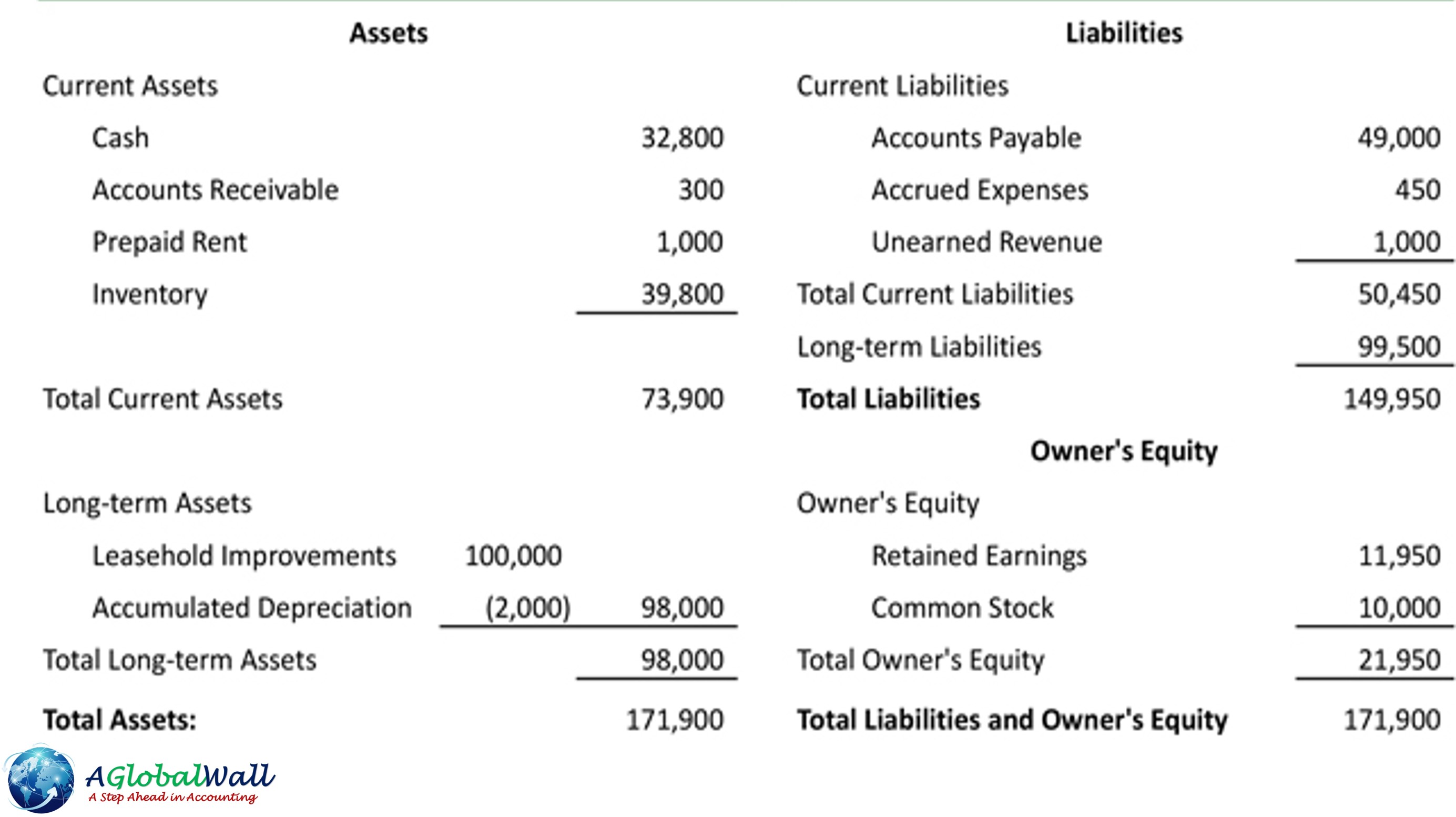

Financial statement standards. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. Asc 205, presentation of financial statements, provides the baseline authoritative guidance for presentation of financial statements for all us gaap reporting entities. Entities identify the potential financial statement impacts for their business.

Clearly label assets and liabilities related to the discontinued operation. Statement on examination principles related to valuation discrimination and bias in residential lending. Record quarterly revenue of $22.1 billion, up 22% from q3, up 265% from year ago.

With macroeconomic, geopolitical, and regulatory pressures. Our main task is to maintain price stability in the euro area and so preserve. Ias 1 was reissued in september 2007 and applies to annual periods beginning on or after 1 january 2009.

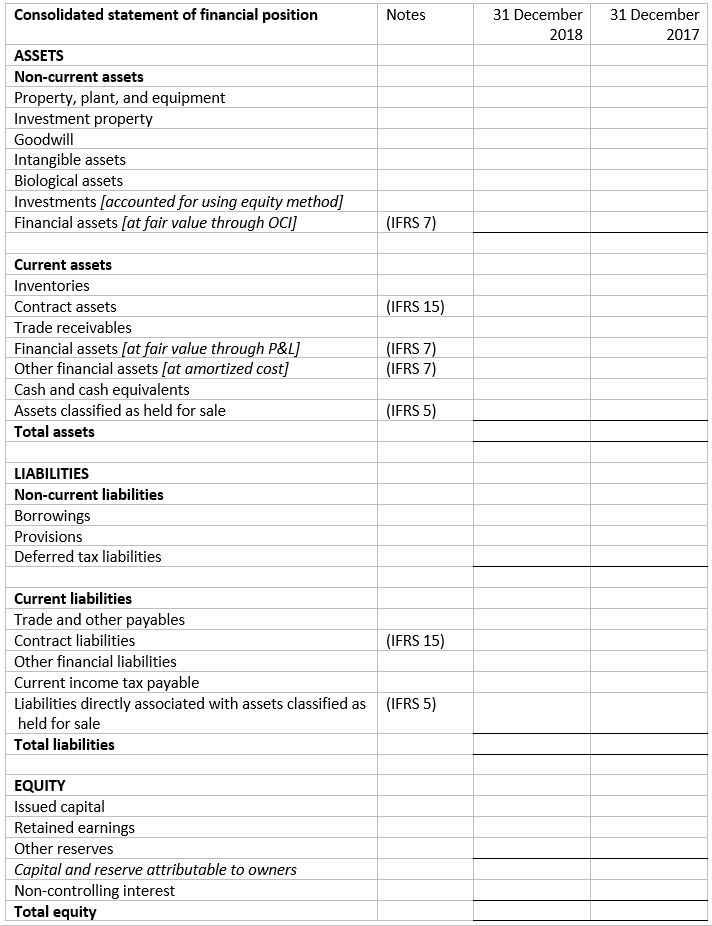

Under eu rules, listed companies (those whose securities are traded on an eu regulated market) must prepare their consolidated financial statements in accordance with a single set of international standards called international financial reporting standards (ifrs accounting standards). These three statements together show the assets and liabilities of a. In april 2001 the international accounting standards board (board) adopted ias 1 presentation of financial statements, which had originally been issued by the international accounting standards committee in september 1997.ias 1 presentation of financial statements replaced ias 1 disclosure of accounting policies (issued in.

The audit report is a document containing the auditor’s opinion on whether a company’s financial statements comply with accounting standards and are free from material misstatements. Illustrative disclosures, which illustrate one possible format for financial statements,. This standard applies equally to all entities, including those that present consolidated financial statements in accordance with ifrs 10.

Iso standards are essential for the banking and finance sector, as they provide a common framework for the exchange of information, transactions and services, covering aspects such as payment cards, securities, messaging, identification, and risk management. Effective january 1, 2011, earlier application is permitted. Record quarterly data center revenue of $18.4 billion, up 27% from q3, up 409% from year ago.

International financial reporting standards, commonly called ifrs, are accounting standards issued by the ifrs foundation and the international accounting standards board (iasb). Vanguard was ultimately excused from the hearing. By adopting these standards, financial institutions can enhance.

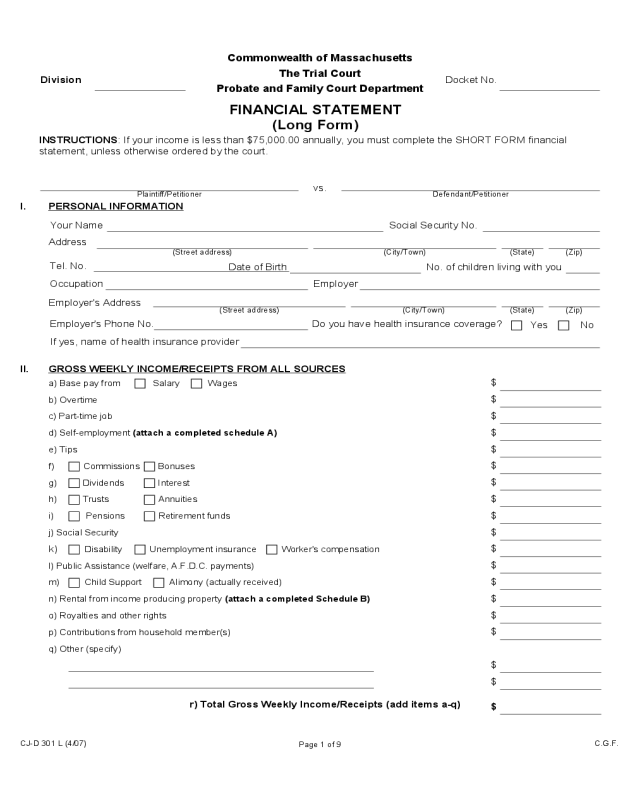

The federal financial institutions examination council (ffiec), 1 on behalf of its member entities, is issuing this statement to communicate principles for the examination of supervised institutions’ And those that present separate financial statements in accordance with ias 27. The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows.

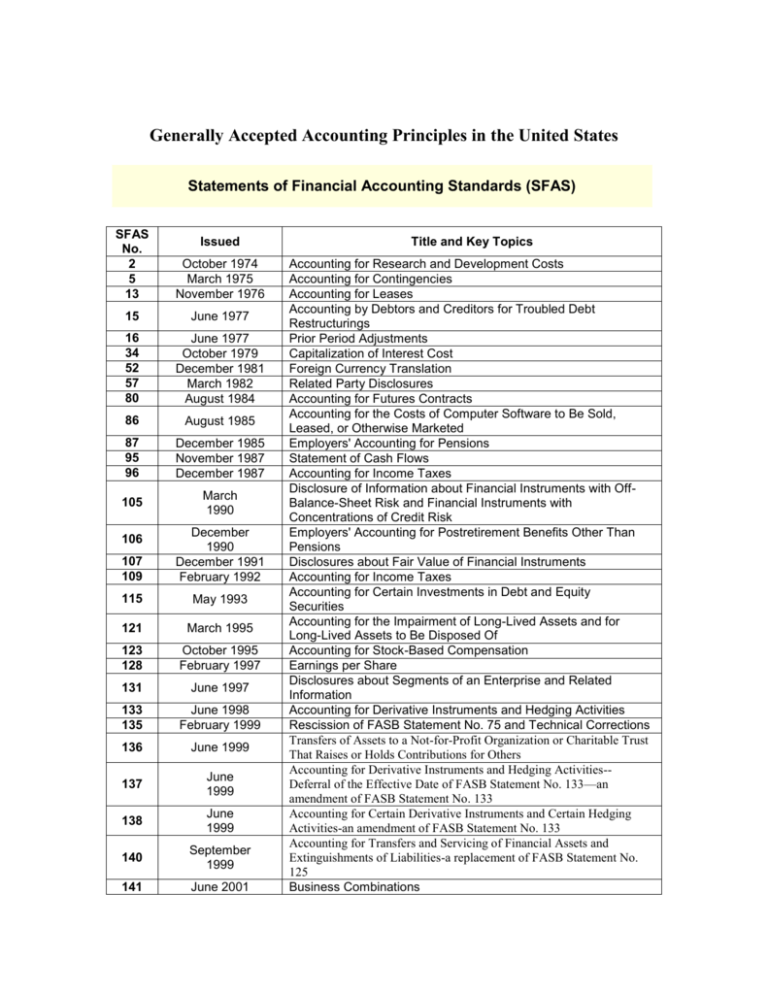

Disclosure checklist, which identifies the disclosures that may be required based on currently effective standards;; Generally accepted accounting principles (gaap). Related impact assessments and feedback statements to the following.

Our guides to financial statements help you to prepare financial statements in accordance with ifrs accounting standards. A statement of financial accounting standards (sfas) is a formal document issued by the financial accounting standards board (fasb), which. This helps anyone looking at the financial statements to quickly see what parts of the company are no longer active.

![[PDF] International Financial Reporting Standards and the quality of](https://d3i71xaburhd42.cloudfront.net/3595875def416feb4cbb3f39c06d21013a800cdb/8-Table2-1.png)