What Everybody Ought To Know About Provision For Bad Debts Accounting Standard Fab Financial Statements

Accounting for doubtful debts.

Provision for bad debts accounting standard. The internal revenue service (irs) allows businesses to write off bad debt on schedule c of tax form 1040 if they previously reported it as income. The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts. The provision for bad debt is estimated each year at the end of the accounting period.

Settlement is expected to result in an outflow of resources (payment) contingent liability: This way the matching principle of accounting is followed and no gaap is violated. Ias 37 stipulates the criteria for provisions which must be met for a.

All the paragraphs have equal. The event of bad debts must be recorded in the accrual accounting. Present obligation as a result of past events 2.

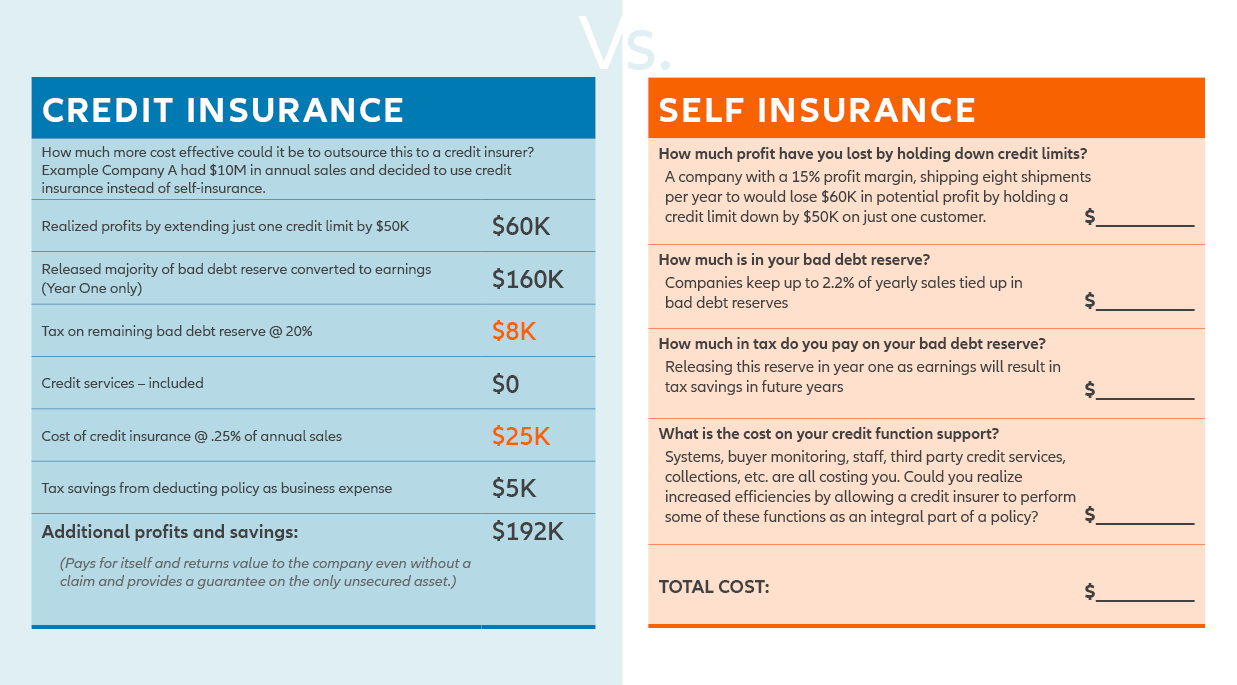

Staff involved in calculating and reporting. A bad debt provision is also known as the allowance for doubtful accounts, the allowance for uncollectible accounts, or the allowance for bad debts. This is where ias 37 is used to ensure that companies report only those provisions that meet certain criteria.

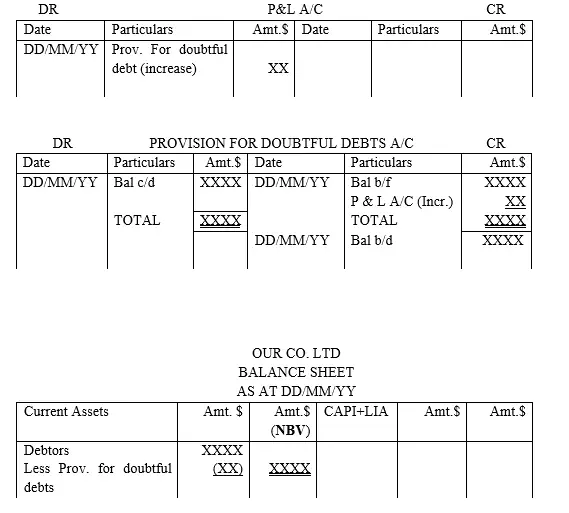

A possible obligation depending on whether some uncertain future event occurs, or 2. Substantial degree of estimation. The process by which the university identifies, calculates and reports on provision for doubtful debts and writes off bad debts;

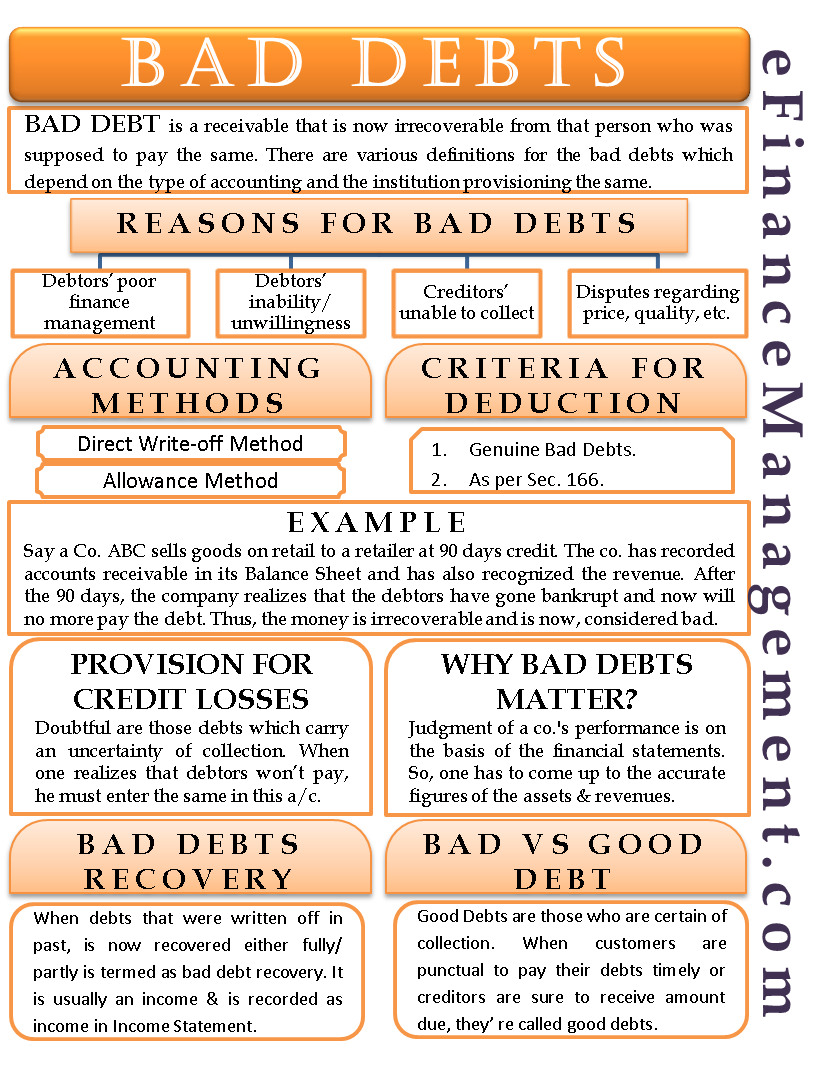

It is done because the amount of loss is impossible to. The provision for doubtful debts is the. The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision.

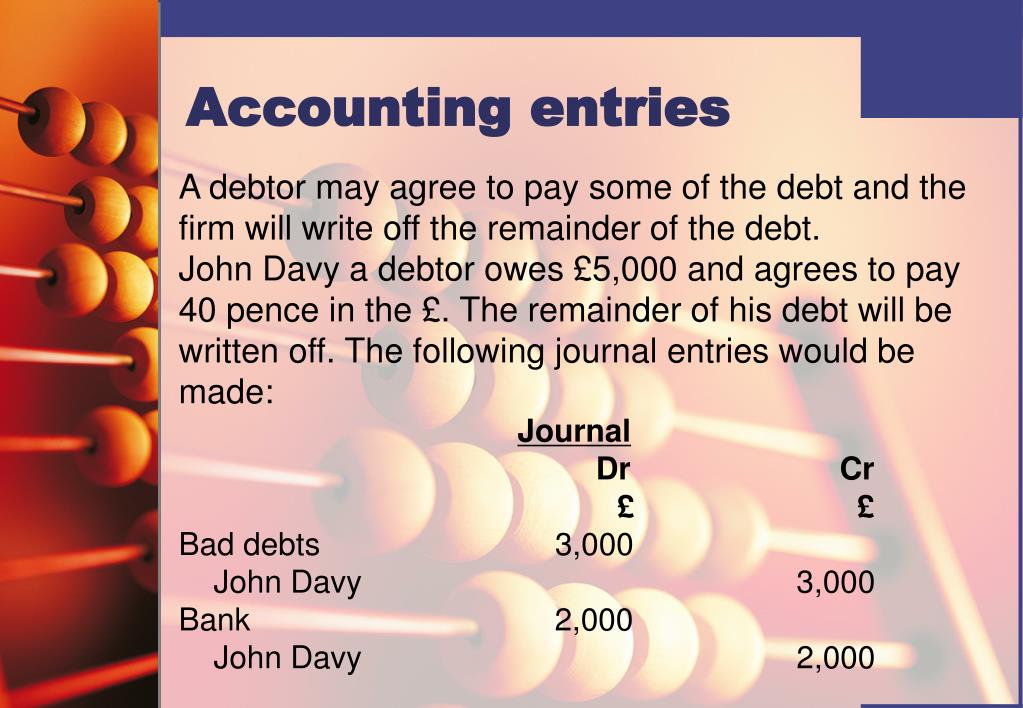

There are several ways to make the. Recoverability of some receivables may be doubtful although not definitely irrecoverable. This article sets out the accounting treatment for the impairment of trade receivables/debtors.

Provision for bad debts is the estimated percentage of total doubtful debt that must be written off during the next year. The term ‘provision’ is also used in the context of items such as depreciation, impairment of assets and doubtful debts: Show the journal and the corresponding accounting entries in the respective ledger accounts and prepare the balance sheet extract to show the debtor monetary status.

The provision for bad debts is now, in effect, governed by ias 39,. This standard should be applied in accounting for provisions and contingent liabilities and in dealing with contingent assets, except: A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in.

The allowance for doubtful debts is created by. Provision:a liability of uncertain timing or amount.