Lessons I Learned From Tips About Projected Cash Flow Statement Format In Excel Financial Balance Sheet

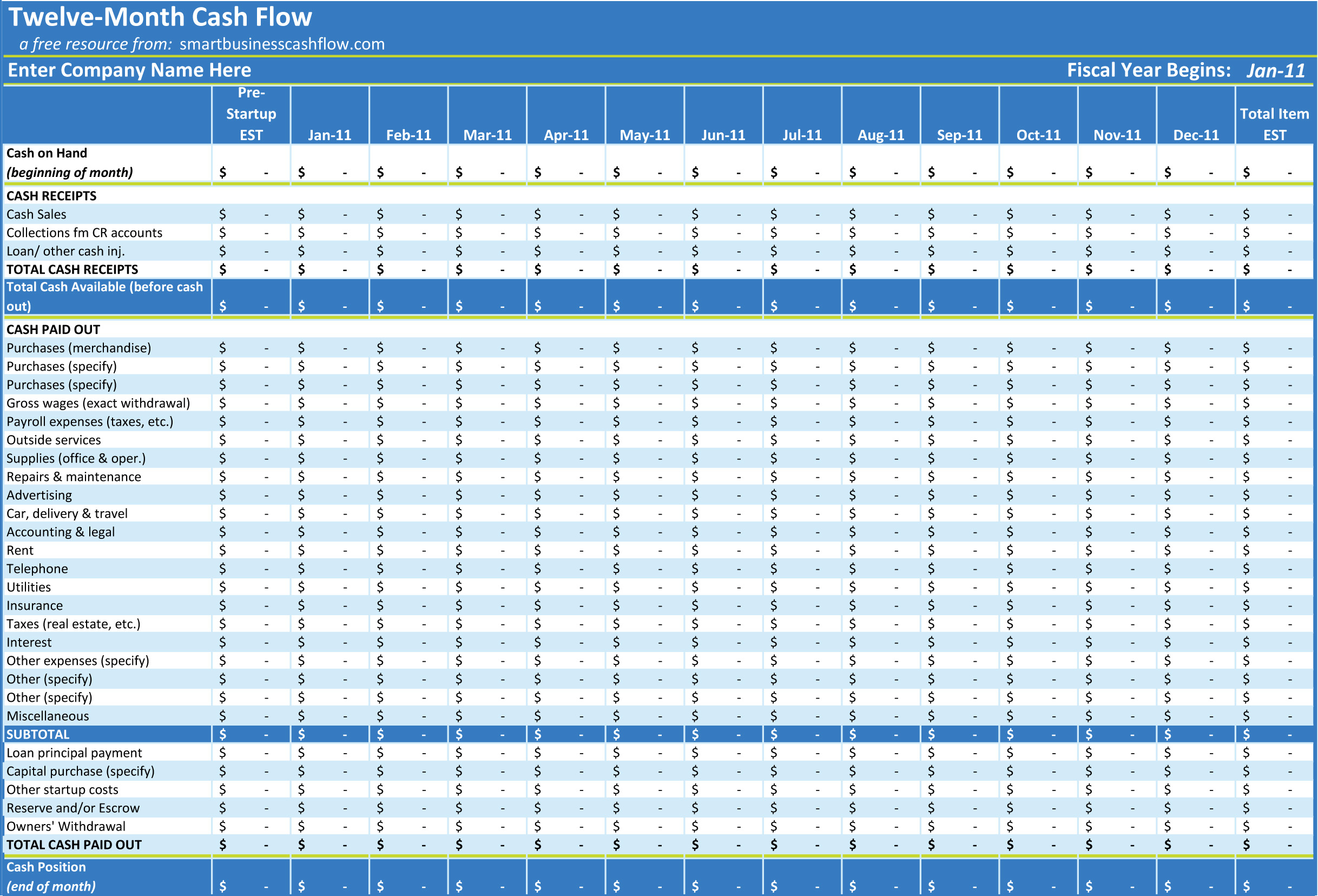

Record time intervals first, enter the time periods.

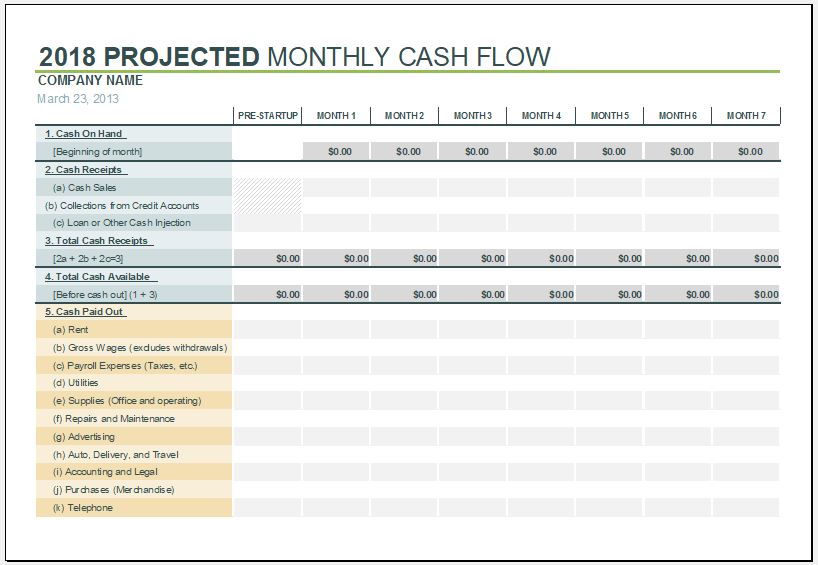

Projected cash flow statement format in excel. Create section for starting balance. It should look like this with some formats. How to create an effective cash flow statement.

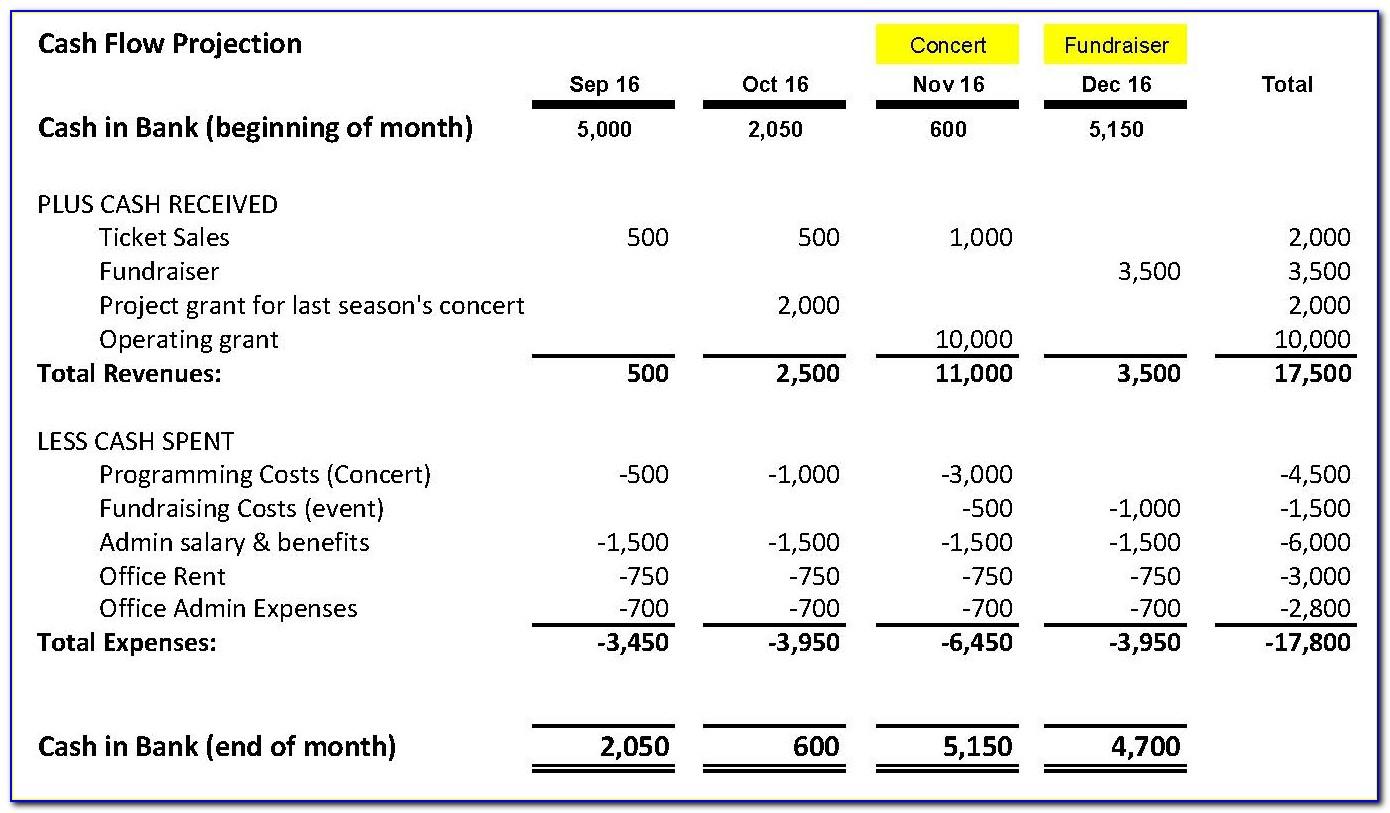

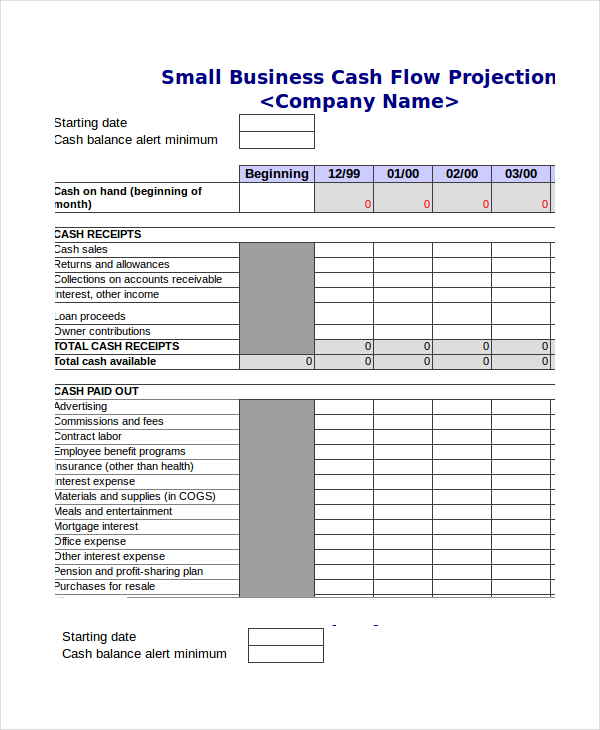

In this dataset, we will list the financials for each year in two columns: Enter your name and email in the form below and download the free template now! Cash flow projection are even more important as they help to understand not only your current liquidity, but also your probable cash flow position in months and years to come.

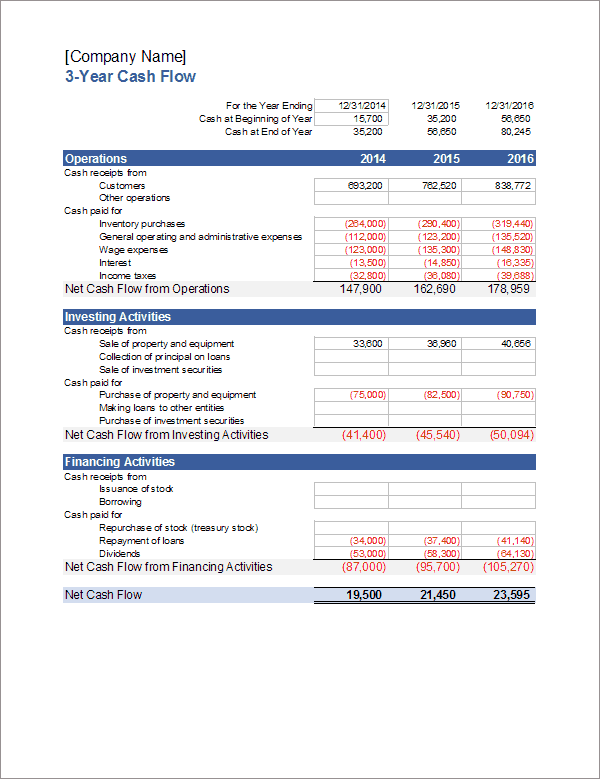

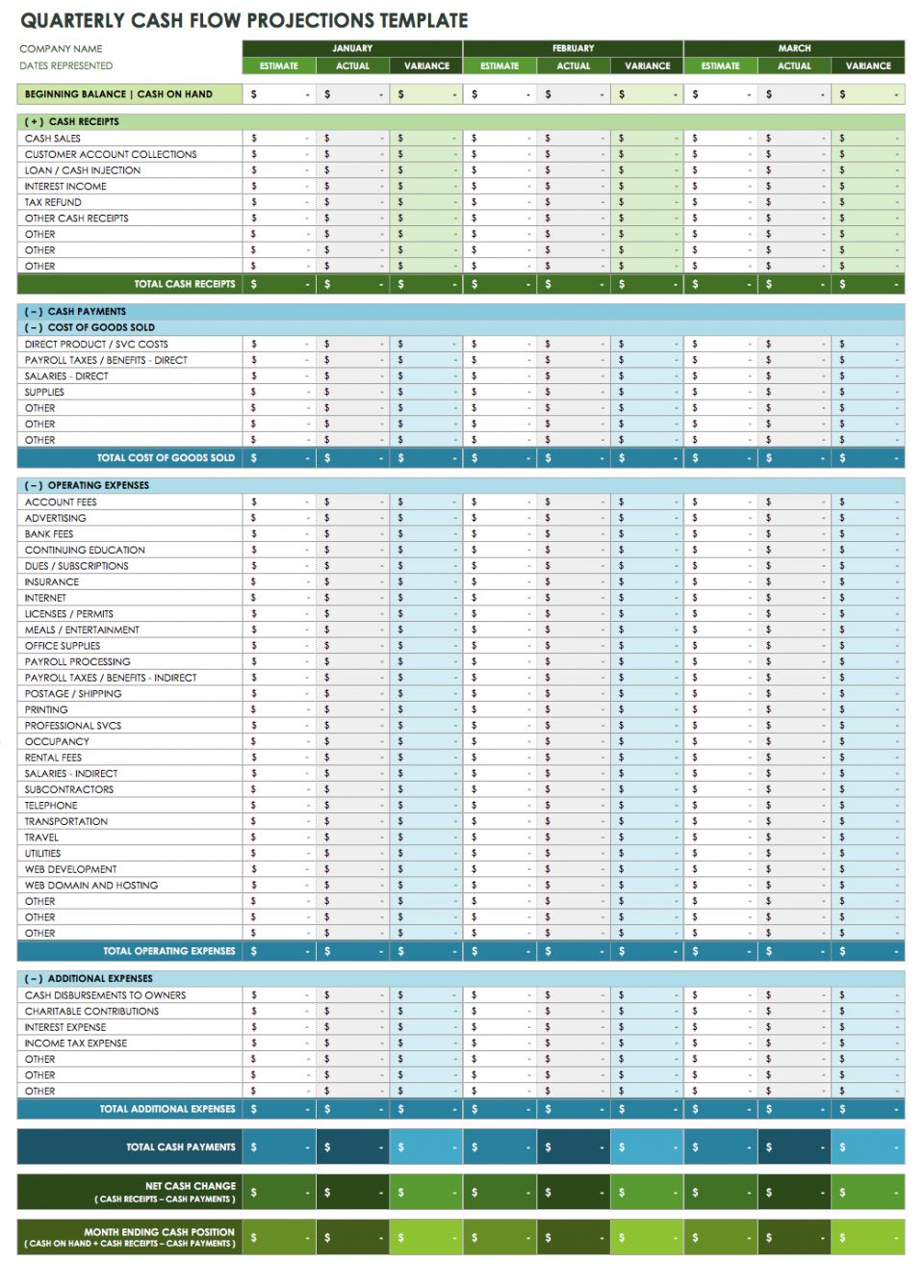

Don’t forget to include a profit and loss, a balance sheet and a cash flow statement when you create a cash flow forecast. Use this cash flow forecast template to create annual cash flow projections in excel for 5 annual periods. Components of a cash flow statement

Operating activities include buying and. So we need to enter months as time intervals. Gusto + jirav cash flow forecasting series.

Forecasting total cash inflows here we will demonstrate how to calculate total cash in. Cash flow projections are based on user defined monthly turnover, gross profit and expense values and automated calculations based on a series of user assumptions. First of all, let’s enter the time periods.

In the first line, create a reference to net income from the income statement tab. Download cash flow projection template in excel accounting a cash flow statement is a very critical tool for analyzing the current liquidity of any business venture. Leave one row empty for formatting, then write period beginning and period ending in the next two rows.

Use this cash flow projection template to compile monthly cash flow projections for 36 monthly periods in excel. Now let’s assume our cash entries will be at each month. At the top row, write down your [company name] cash flow statement.

Steps to prepare a projected cash flow statement: Title your first section “cash flow from operating activities”. Forecast expected payments to suppliers and vendors.

Numerous systematic and unsystematic risks exist that could prevent the projection. Dec 24, 2023 get free advanced excel exercises with solutions! Remove depreciation (for tangible assets) and amortization (for intangible assets) expenses on the income statement from the net income.

The closing cash balance for each month will be linked back to the balance sheet, shown as cash under current assets. Having a starting balance is essential for every cash flow. For example, the p&l statement presents the cash flow projections in a profit and loss statement accounting format.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)