Great Tips About Ending Cash Balance On Flow Statement Other Comprehensive Income

Click here to learn more.

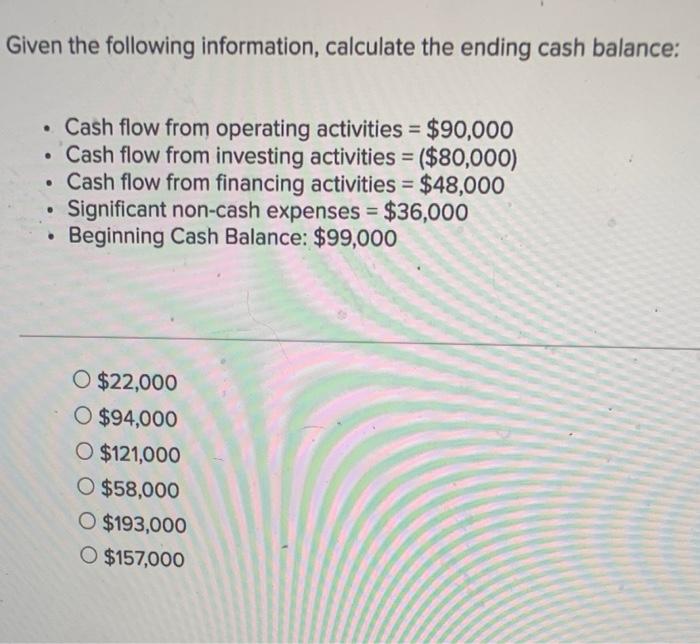

Ending cash balance on cash flow statement. The net cash flows from the first three steps are combined to be total net cash flow. An increase in the cash balances from the beginning of the year would be called positive cash flow. Finance what is a cash flow statement?

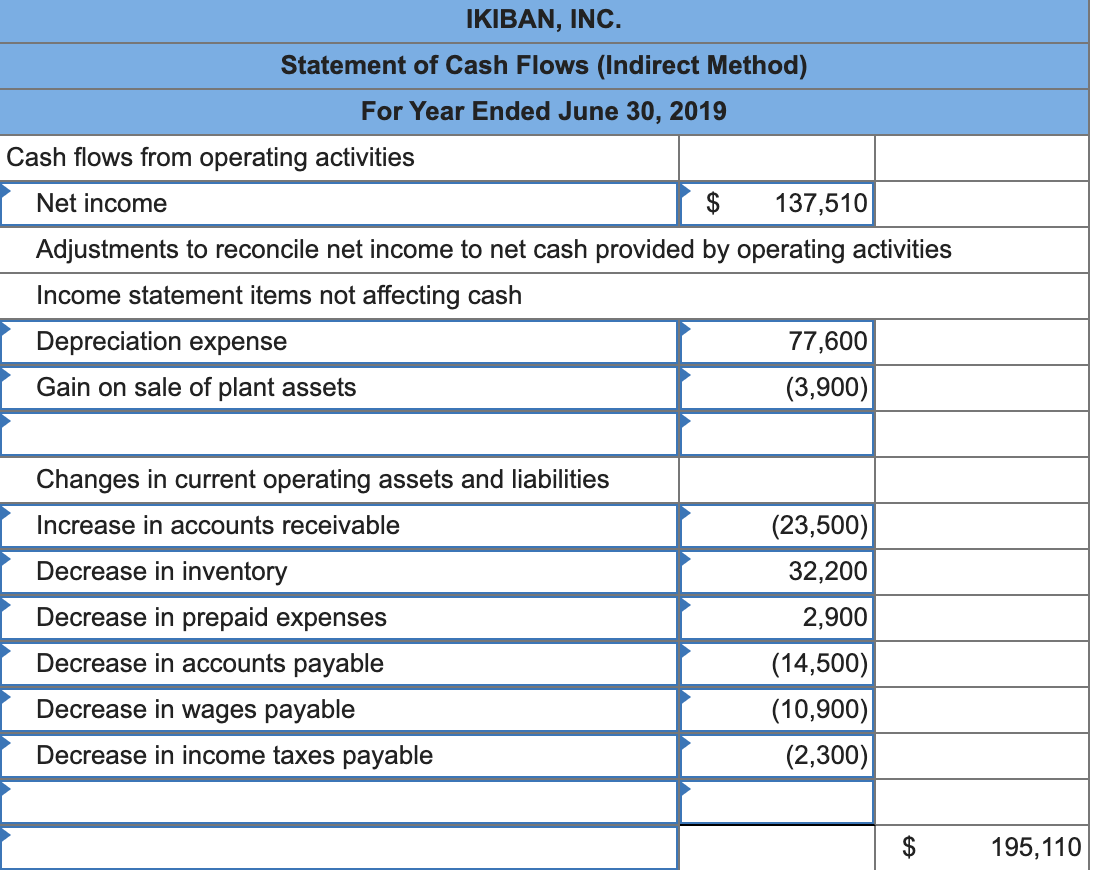

To reconcile beginning and ending cash balances: It also reconciles beginning and ending cash and cash equivalents account balances. In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to.

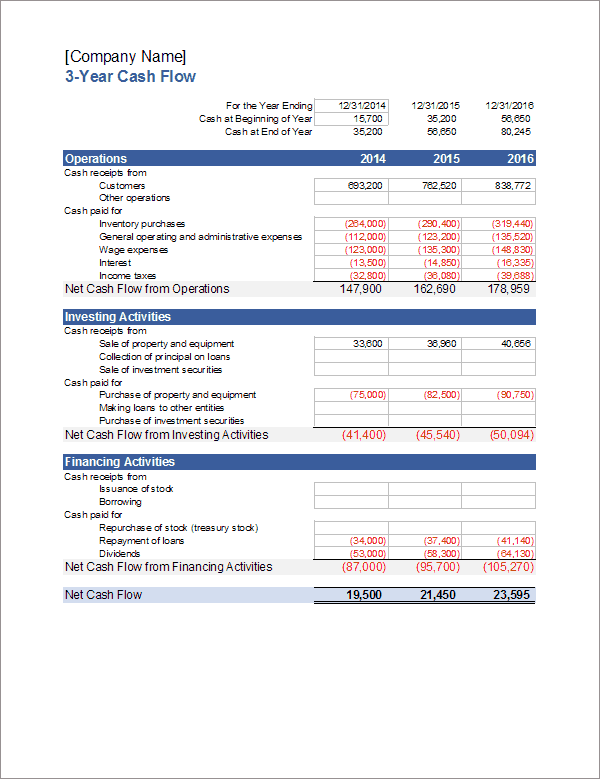

The traditional definition of cash flow is the amount a company’s cash balance increases or decreases during a specific period. Adjusting entries, financial statements, balance sheet, income statement, cash flow statement, working capital and liquidity, financial ratios, bank reconciliation, and payroll accounting. The income statement, balance sheet, and statement of cash flows are required financial statements.

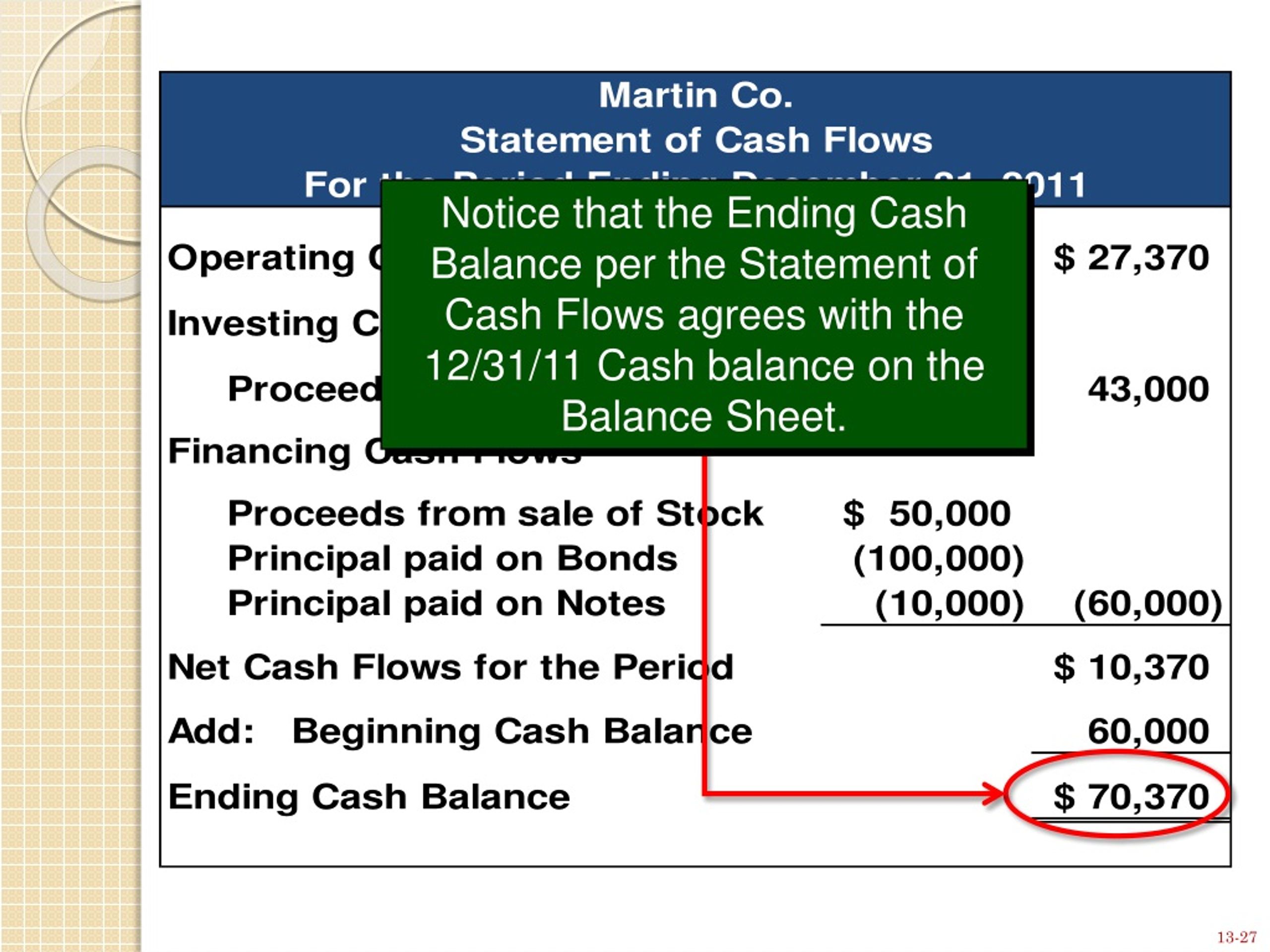

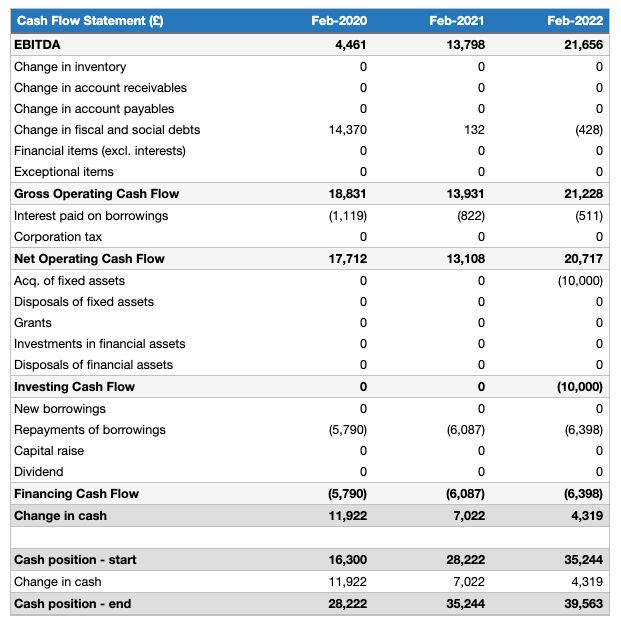

At the bottom of the cash flow statement, the three sections are summed to total a $3.5 billion increase in cash and cash equivalents over the course of the reporting period. A balance sheet lists a company's assets, liabilities, and shareholders' equity at a point in time, typically at the end of a period, such as the end of a quarter or year. We’ll go over definitions, calculations, and examples together.

To calculate your beginning cash balance for a cash flow statement, add all of the sums of capital available to your business at the beginning of the period covered by the statement. The time interval (period of time) covered in the scf is shown in its heading. The opening cash balance is last year’s closing cash balance.

It indicates how much cash the company generates after paying off all its expenses. Income statement example for yyz corp.* for the year ending dec. In the full statement, we can see that clear lake has net cash flow of $20,000.

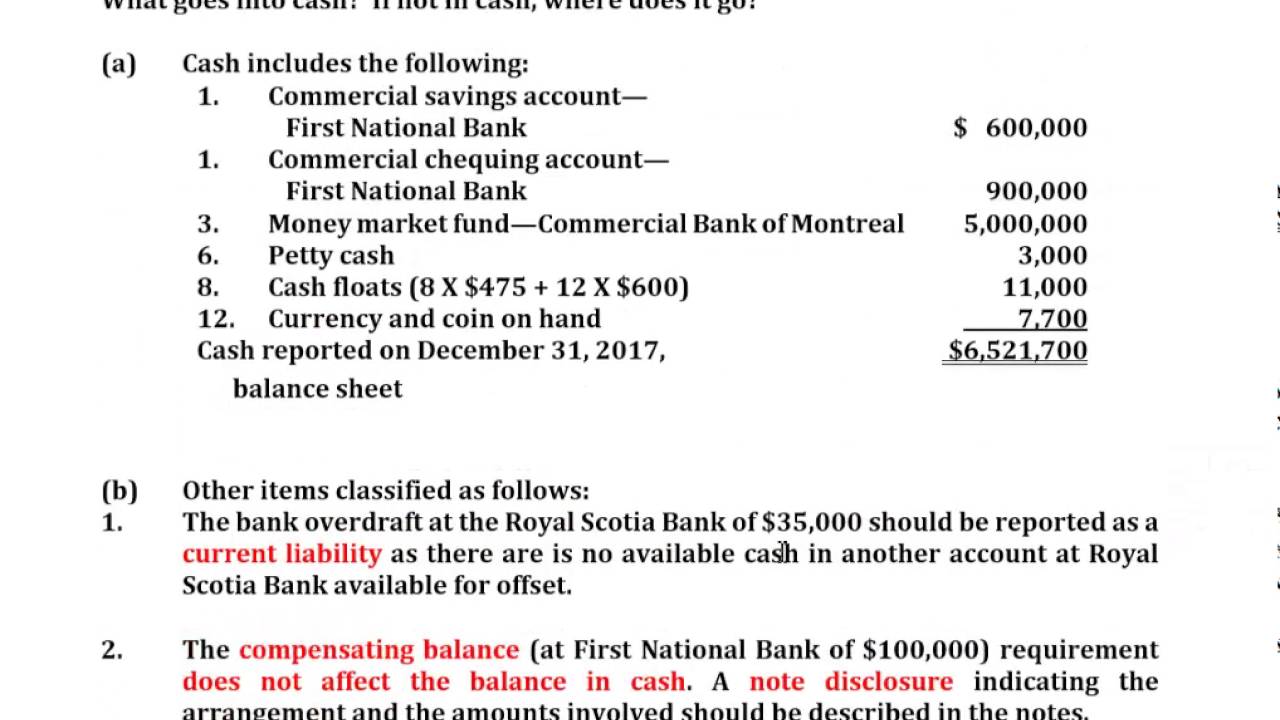

This figure represents the amount you have available at the very. What this cash flow statement tells us is that the ending cash balance is equal to the beginning cash balance plus cash receipts less cash payments. The ending cash balance stated on the cash flow statement becomes the cash balance recorded on the balance sheet for the current period.

Perform arithmetic calculations to determine the closing balance for the period. Having a positive cash flow means more money is coming in than going out of your business. Keep in mind that the ending cash amount on the statement of cash flows should be equal to the ending cash amount on the balance sheet.

The beginning cash balance was $90,000, making the ending cash balance $110,000 (see figure 5.19). Assuming the statement was prepared correctly, the sum should equal the ending cash balance on the balance sheet. The cfs measures how well a.

Total net cash flow added to the beginning cash balance equals the ending cash balance. Cash flow is a description of how and when cash (and cash equivalents) flow in and out of a business. The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)