Outstanding Tips About Cash Flow By Direct Method S Corporation Financial Statements Examples

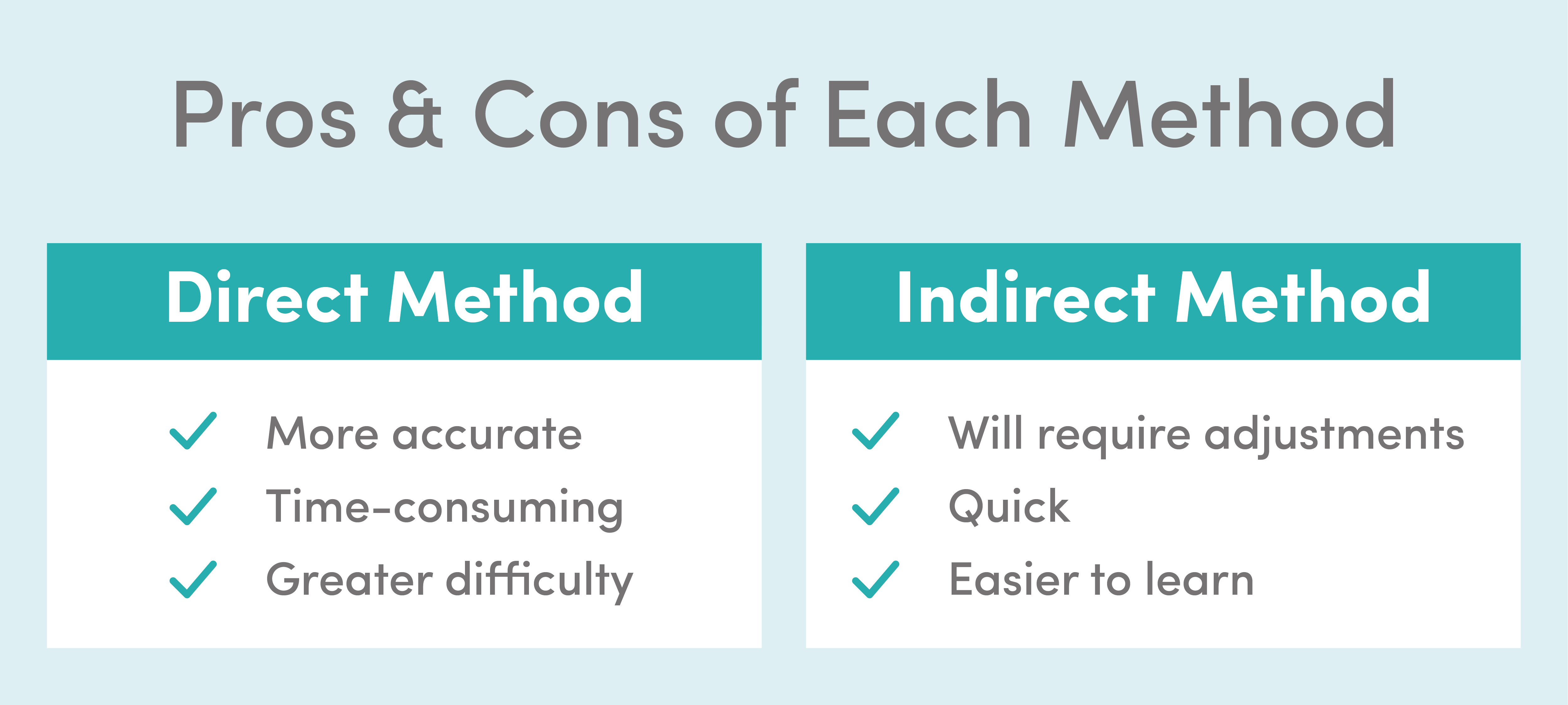

As mentioned earlier, the only difference when applying the direct method, as opposed to the indirect method, is in the operating activities section;

Cash flow by direct method. For the direct method categories are based on the nature of the cash flows. In contrast, the direct cash flow method only measures cash received. The direct cash flow method is based on cash accounting principles, not accrual.

The direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. The direct method uses cash basis accounting and tracks the cash inflows and outflows of the operational activities. As mentioned earlier, the only difference when applying the direct method, as opposed to the indirect method, is in the operating activities section;

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. For instance, assume that sales are stated at $100,000 on an accrual basis. The cash flow is calculated by netting the inflows and outflows.

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. What is the direct method? The direct method is one of the two methods used while preparing a cash flow statement.

An introduction to the direct method. It does so by grouping cash transactions into major classes of cash receipts and cash payments. The direct method is also known as the income statement method.

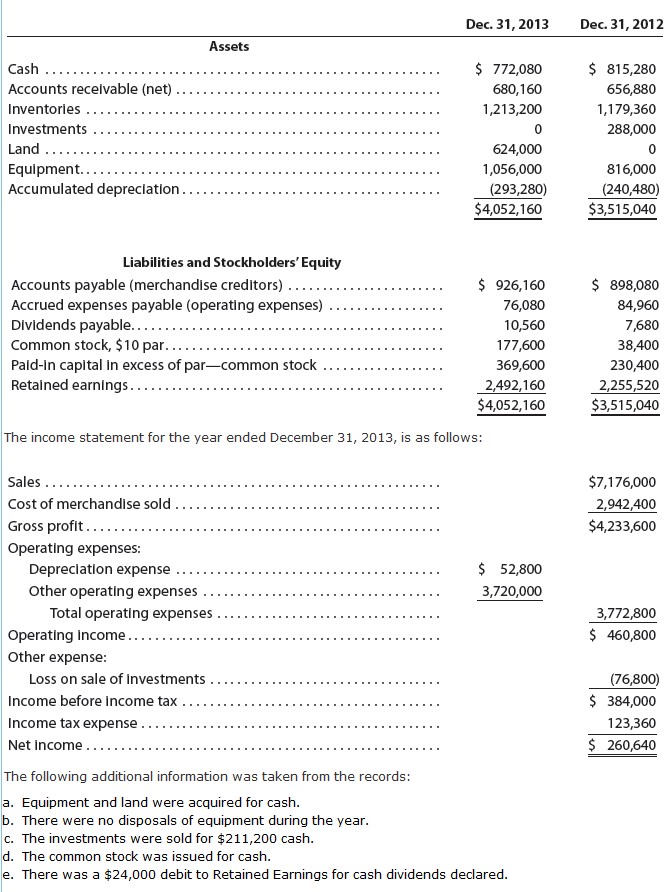

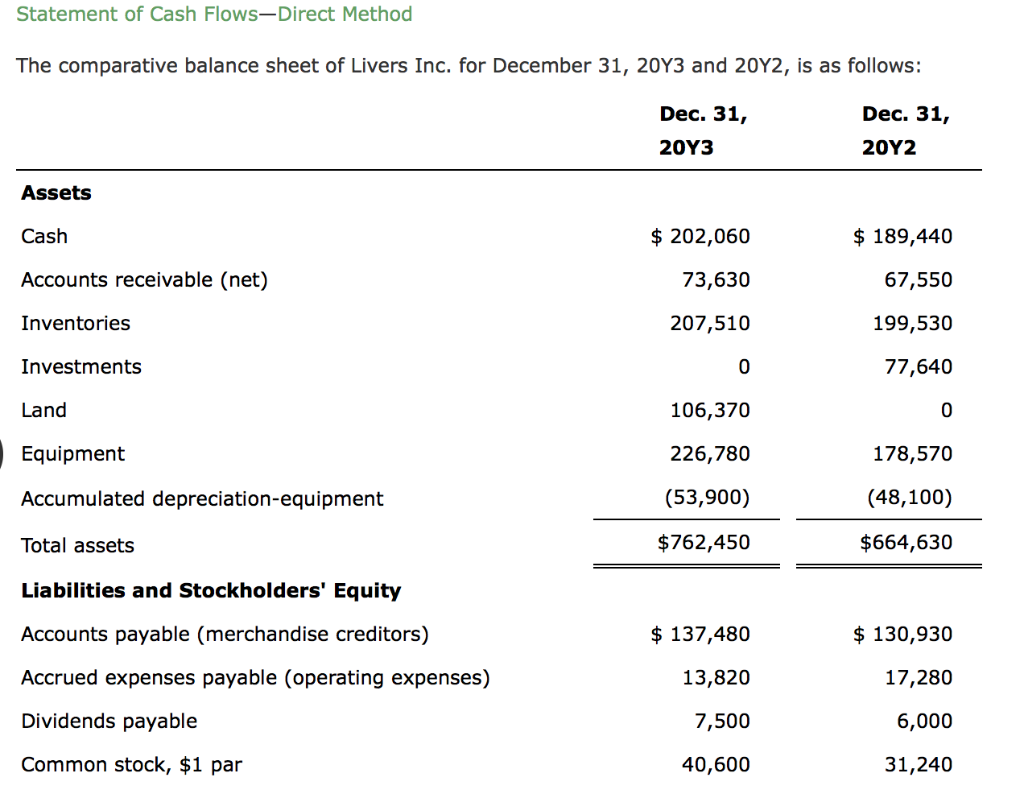

Direct method example from the following information, calculate the net cash flow from operating activities (cfo). The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source. Unlike the indirect method, it directly reports each major cash inflow and outflow, offering a.

The direct method details where cash comes from and where it goes. The direct method is one of two accounting treatments used to generate a cash flow statement. This method shows a company’s total operating, financing, and investing cash flow over a set period.

This usually comes from customers and cash payments or outflows, such as payments to suppliers. Preparing a statement of cash flows: The statement of cash flows direct method uses actual cash inflows and outflows from the.

With the indirect method the cash flows are based on the income statement and changes in each current asset and liability account, except cash. Using the direct method the cash flow from operating activities is calculated using cash receipts from sales, interest and dividends, and cash payments for expenses, interest and. Most companies operate with accrual accounting practices, meaning that the direct method is not as commonly utilized.

The direct method of cash flow statement format presents a clear picture of a company’s cash flow. The direct method or the indirect method. The direct method is also called the income statement method.