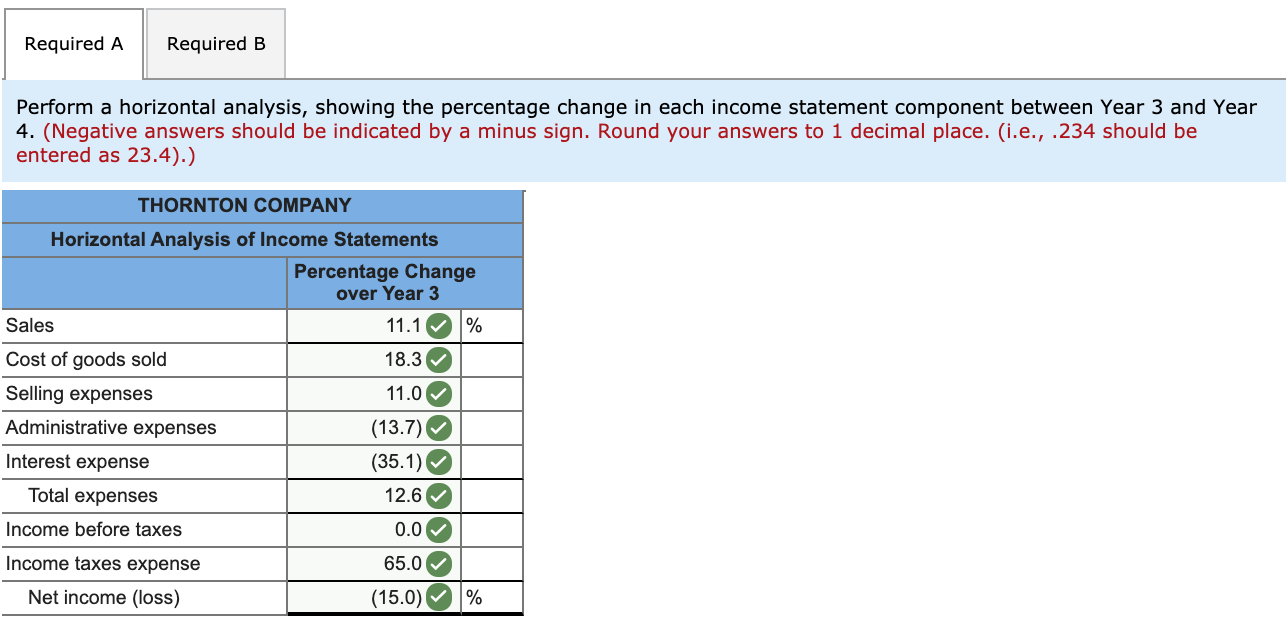

Unique Tips About Administrative Expenses In Income Statement Grant Thornton Illustrative Financial Statements 2019

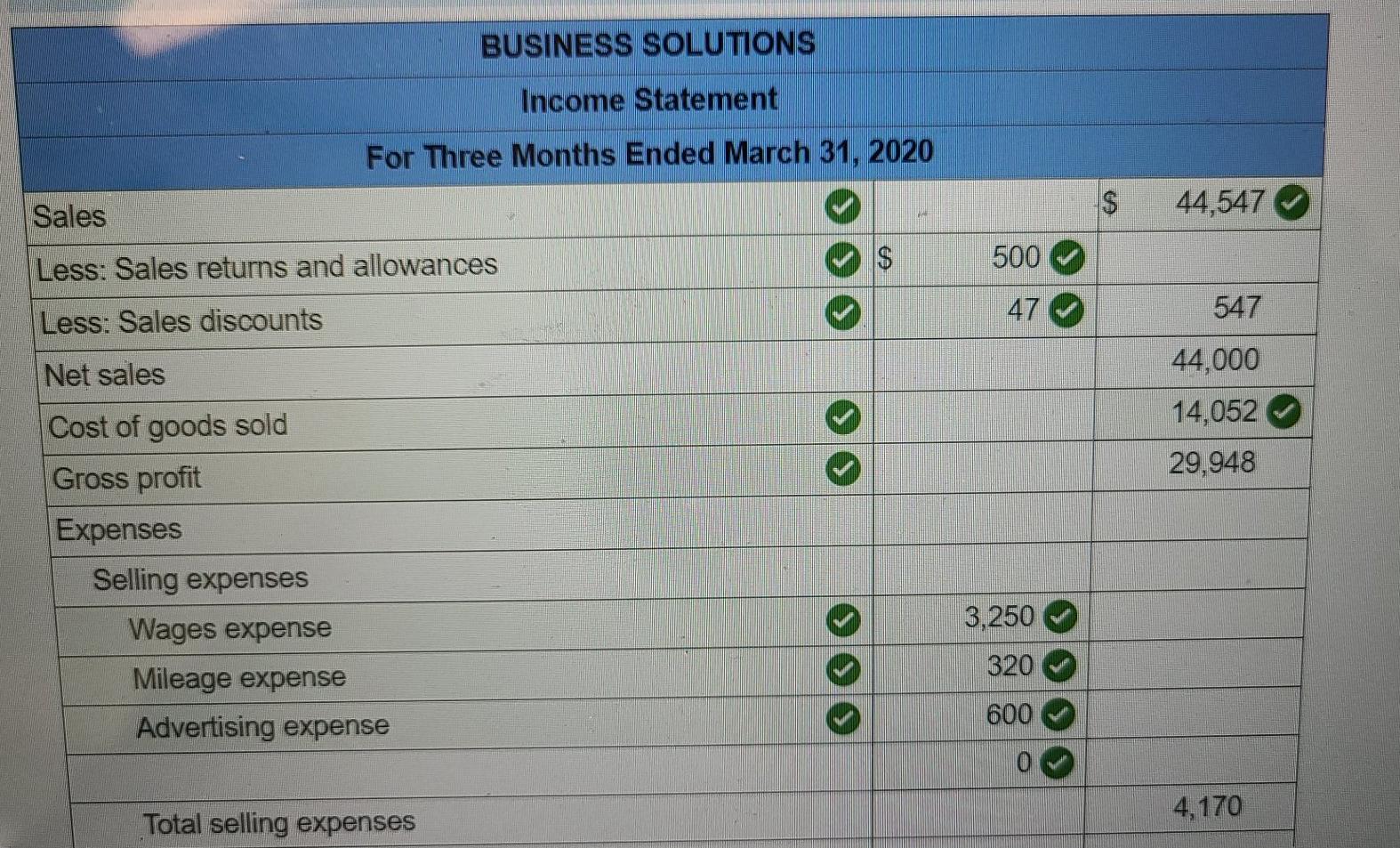

Administrative expenses can be found on the income statement for the period upon which they occurred.

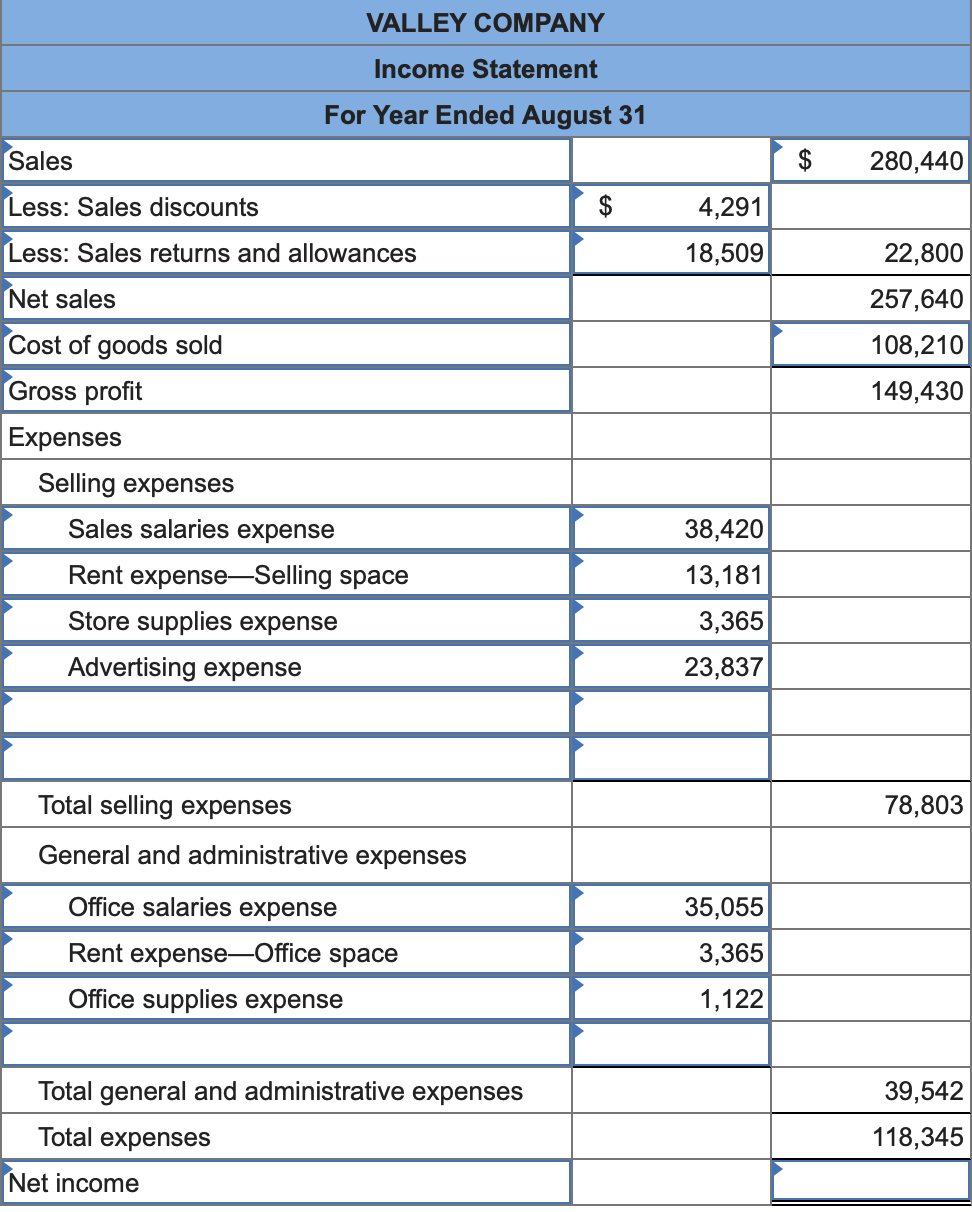

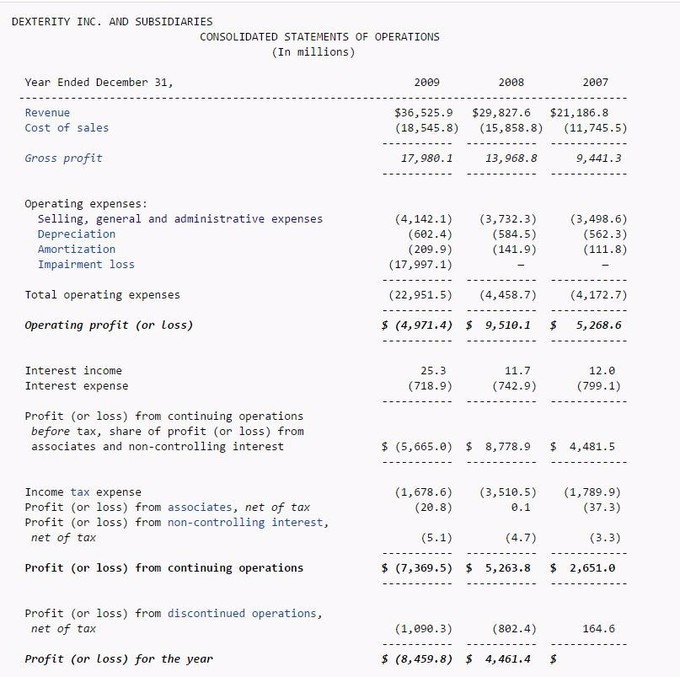

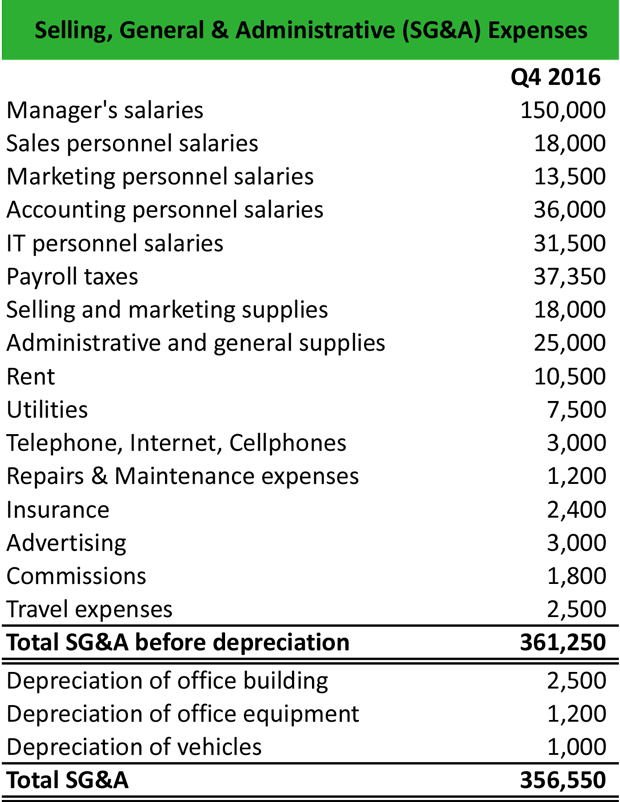

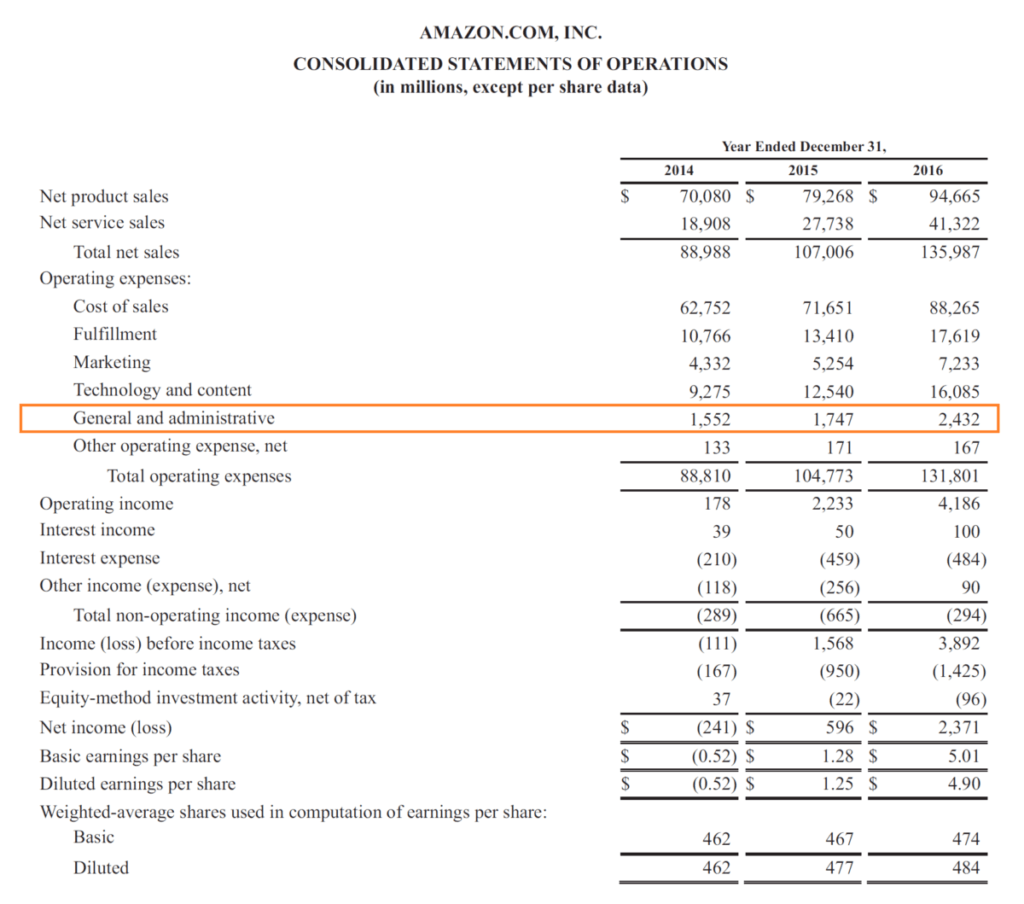

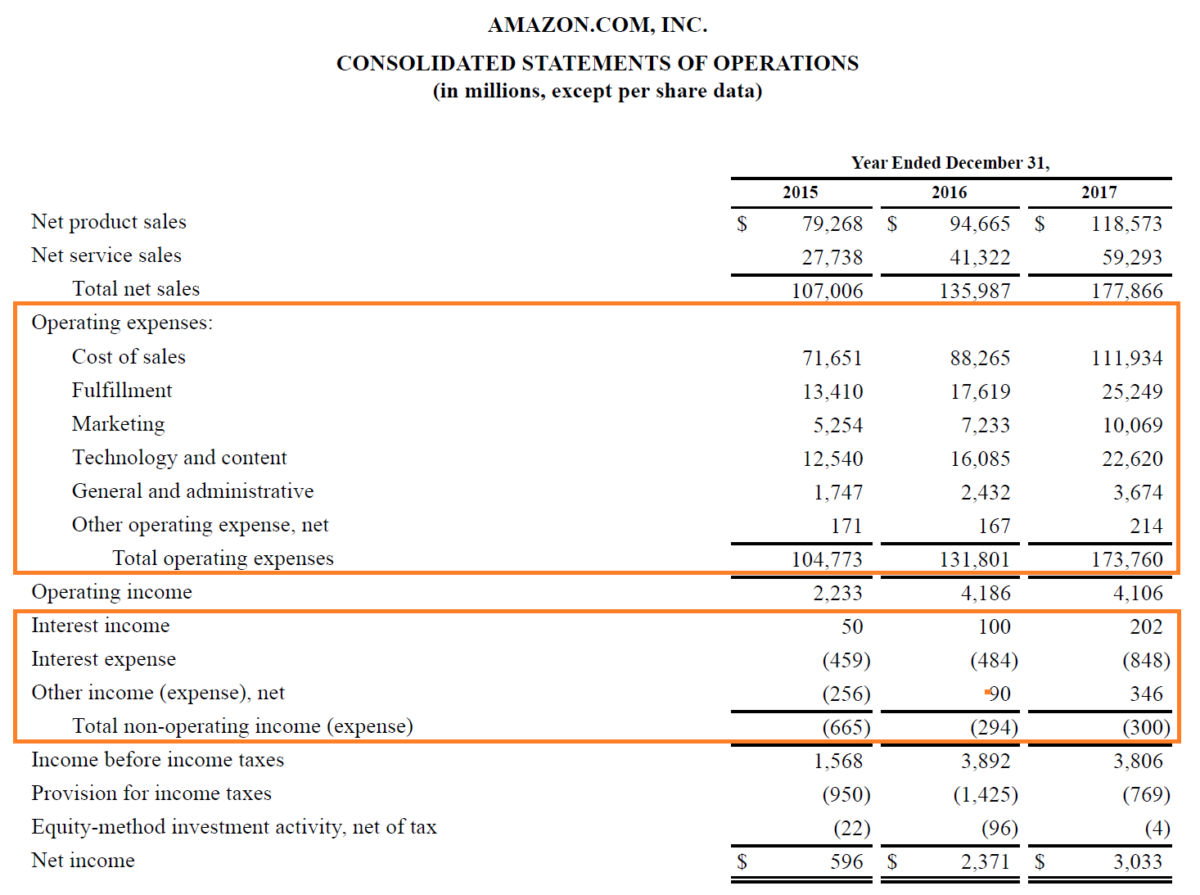

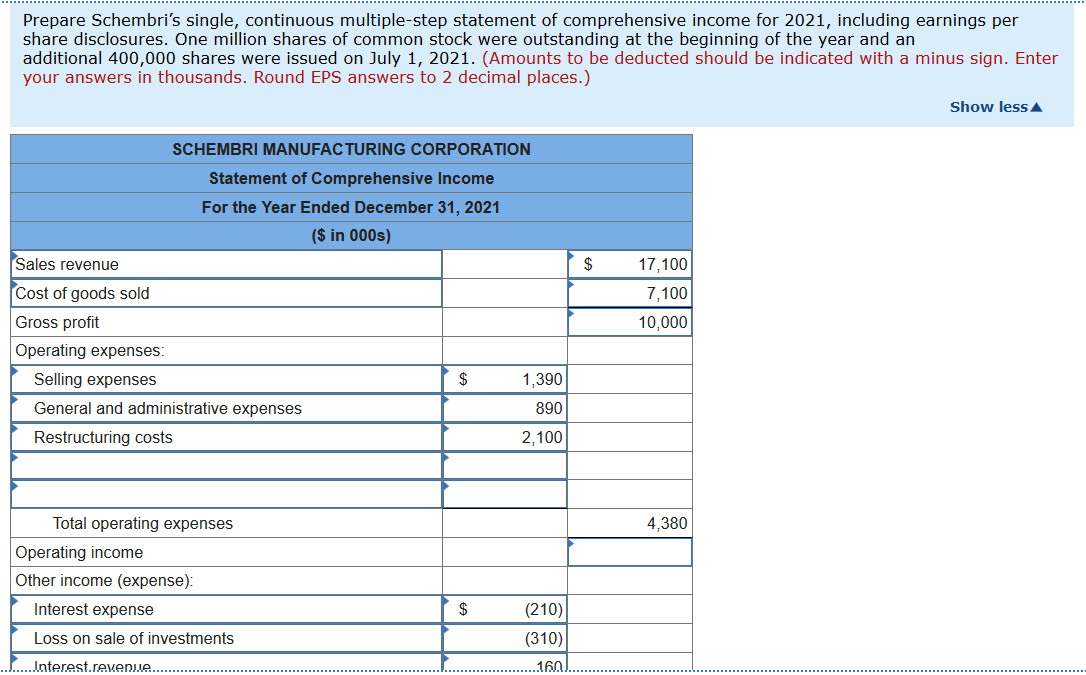

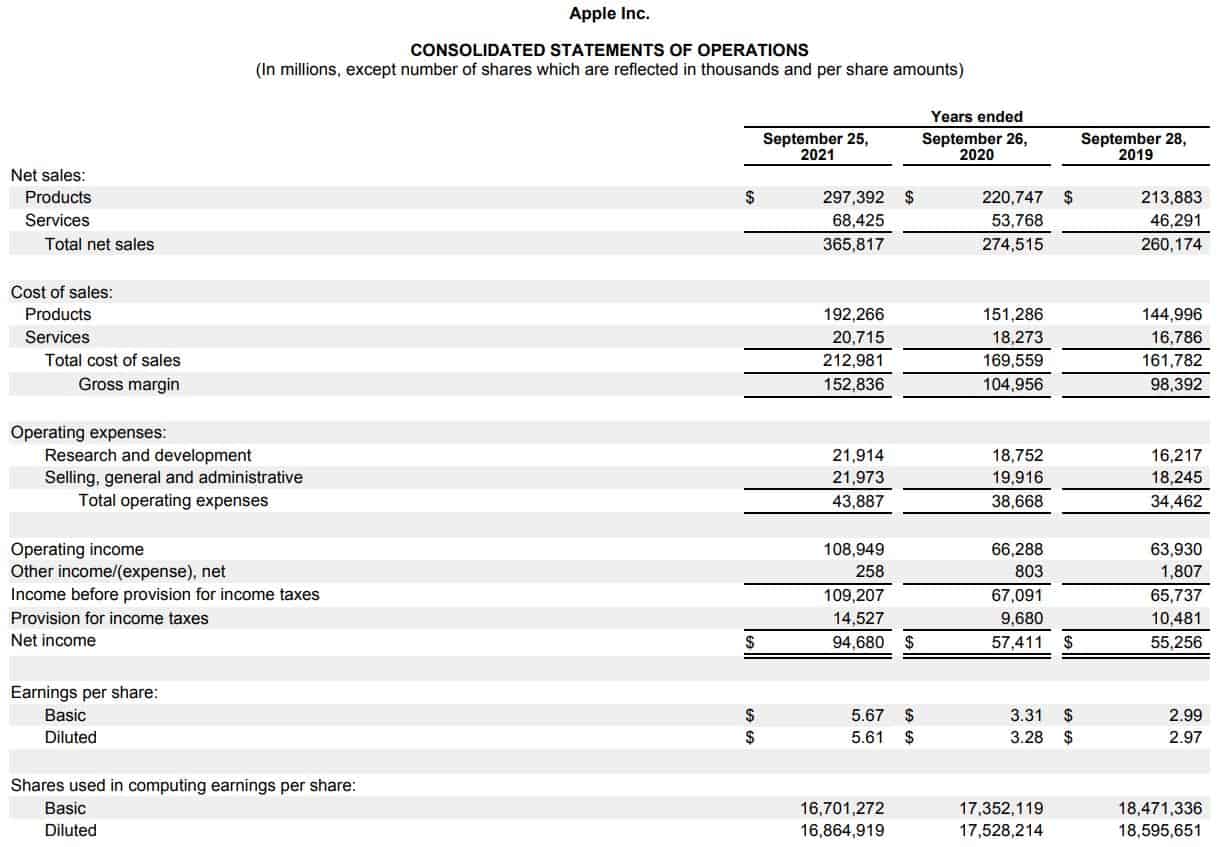

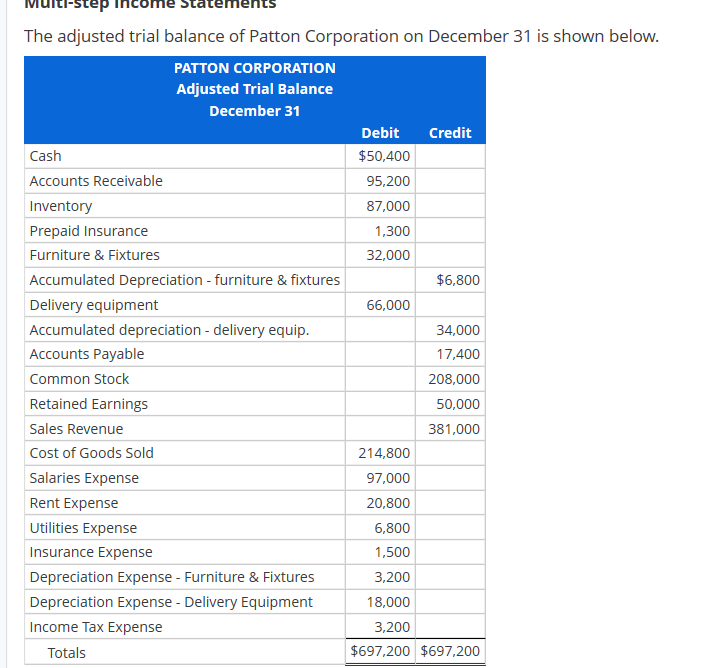

Administrative expenses in income statement. Selling, general, and administrative expenses are reported in a company’s income statement and represent any overheads included in a company’s core operating. In accounting, administration expenses are listed on the income statement as operating expenses. Revenue minus expenses equals profit or loss.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. General and administrative expenses (g&a expenses) are a fundamental aspect of a business’s financial structure and play a. Importance of managing g&a expenses.

They are one of three kinds of expense that make up a. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. These costs tend not to be directly related to the production of goods or services of a business and.

General and administrative expenses, or g&a expenses, are operating expenses that do not involve the production or sale of goods and services. As a business scales and grows, like in the case of a tech startup,. This includes sales, cost of goods sold, and the variable piece of selling and administrative expenses.

The category of selling, general, and administrative expenses (sg&a) in a company's income statement includes all general and administrative expenses (g&a). As seen before with best buy, macy's gross profit of $2.14 billion dramatically differs from its net income of $43 million, due to sg&a costs, interest. It can also be referred to as a profit and loss (p&l).

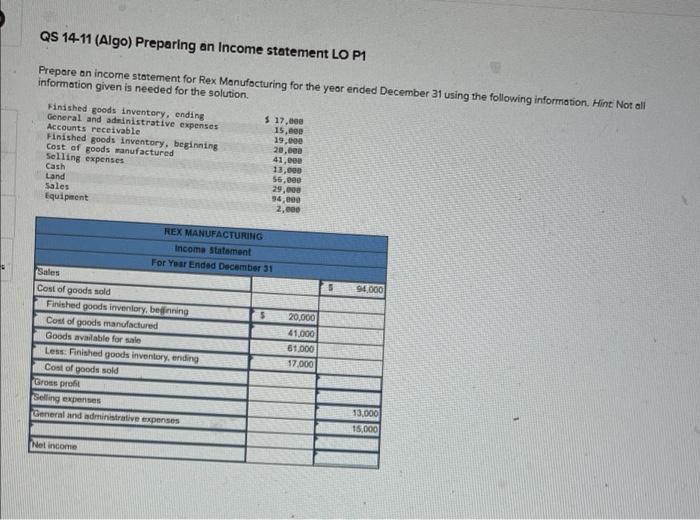

Administrative expenses are often included in an expense. Selling, general & administrative expenses. An income statement is another name for a profit and loss statement (p&l).

This typically includes employee salaries, office space rent, utilities, office supplies, insurance, and other overhead costs. Administrative expenses are recorded as part of the operating expenses section of an income statement. They may be integrated with selling expenses.

Other expenses are those which don't fit. A type of indirect cost, g&a. General and administrative expenses appear in the income statement immediately below the cost of goods sold.

The income statement presents revenue, expenses, and net income. For example, legal, accounting, clerical work, and information technology. Administrative expenses may include salaries of senior management and the costs associated with general services or supplies;

An income statement is one of the three major financial statements that report a company’s financial performance over a specific accounting period. Administrative expenses are part of the operating expenses (along with selling expenses).