Brilliant Info About Income Statement Items Not Affecting Cash Big Four Auditors

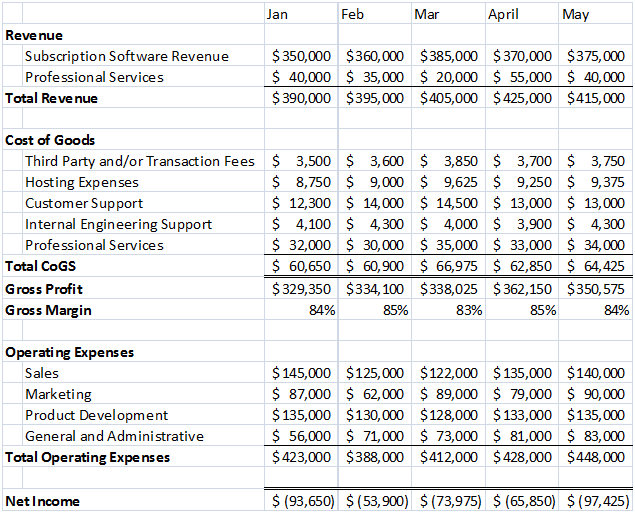

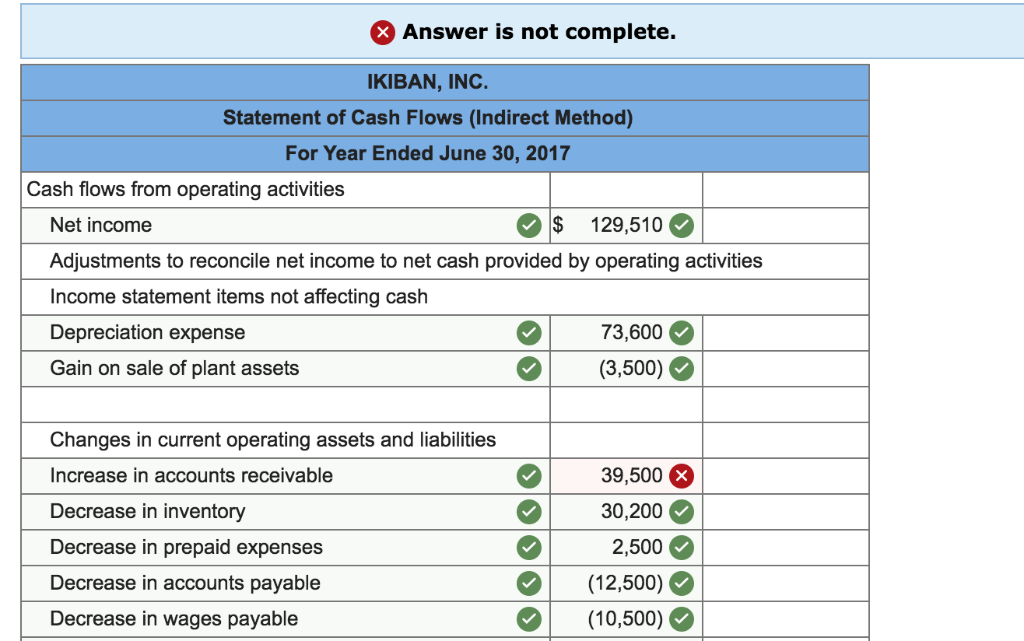

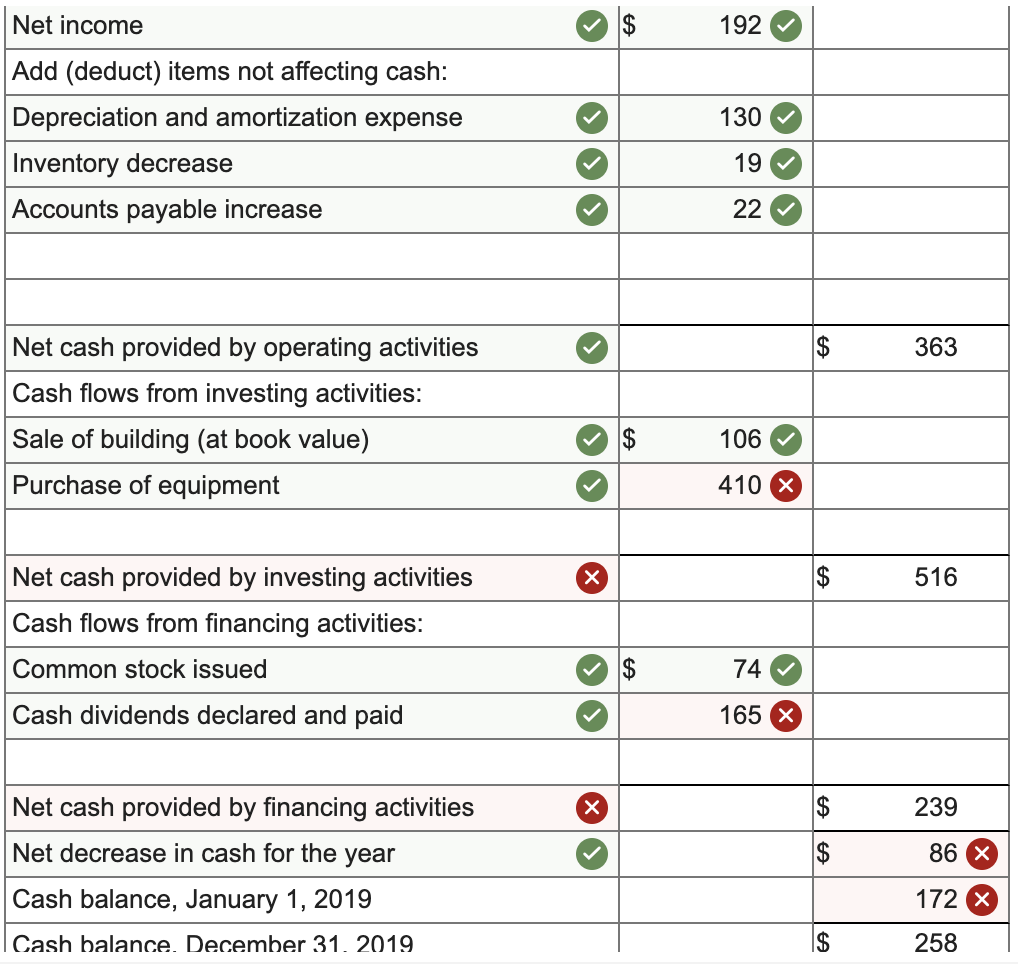

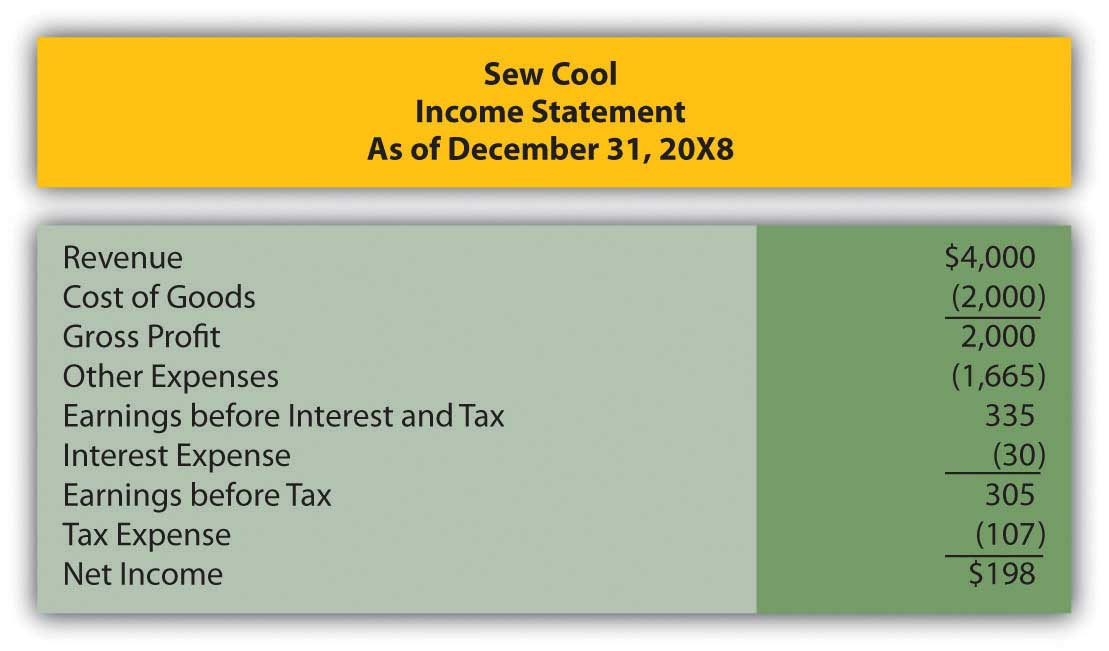

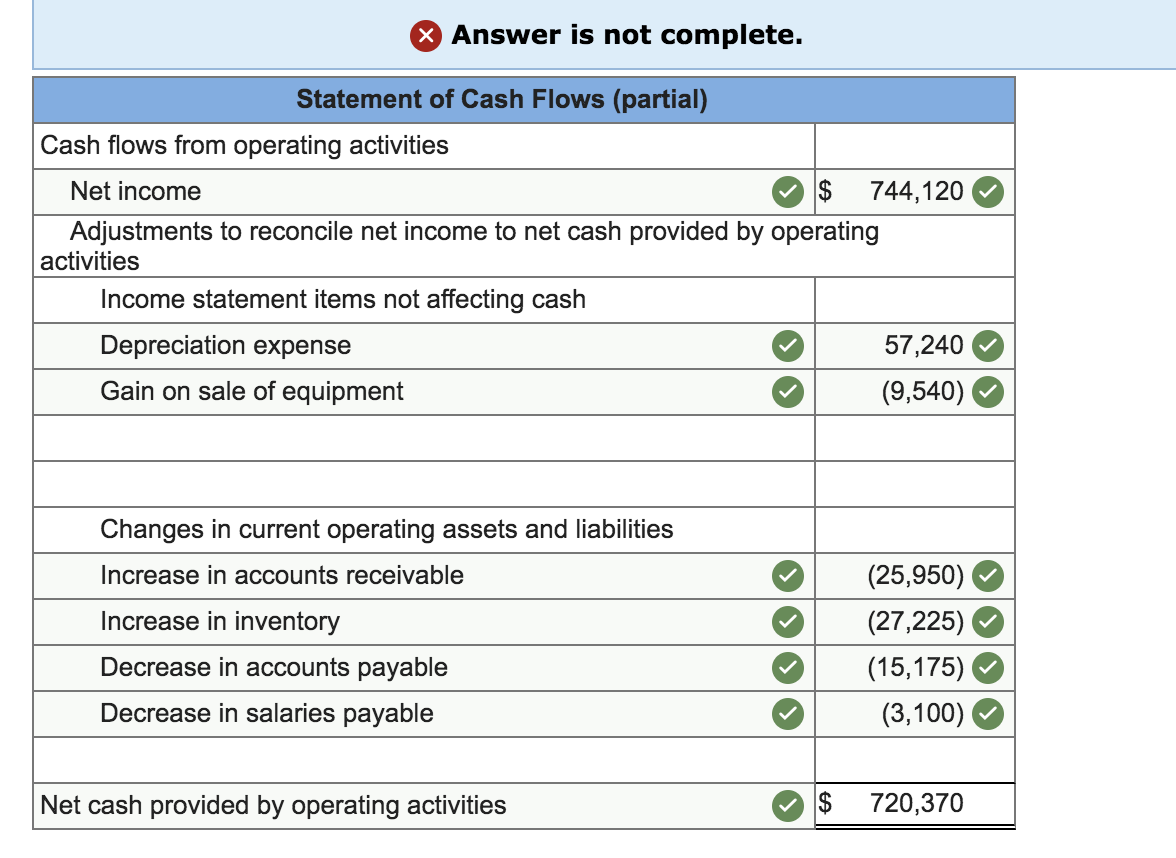

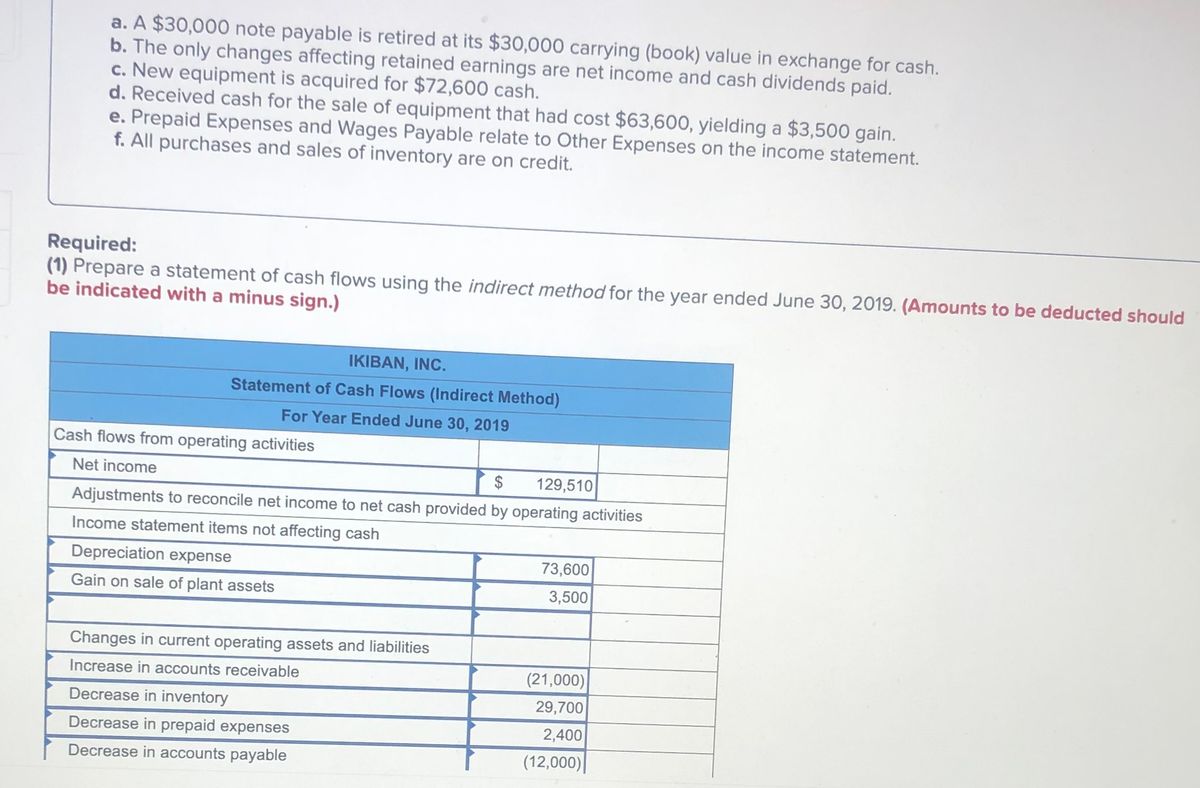

Statement of cash flows (indirect method) for current year ended december 31 cash flows from operating.

Income statement items not affecting cash. Add back noncash expenses, such as depreciation, amortization, and depletion. Revenue, expenses, gains, and losses. Accounting questions and answers.

It is important to note that the income statement accounts are referred to as temporary accounts, since their balances affect a corporation's retained earnings account (or a. Even if they’re reported in the income statement, they have nothing to do with cash payments. If you have gone through a company’s financial statement, you would see that the depreciation is reported, but actually, there’s no cash payment.

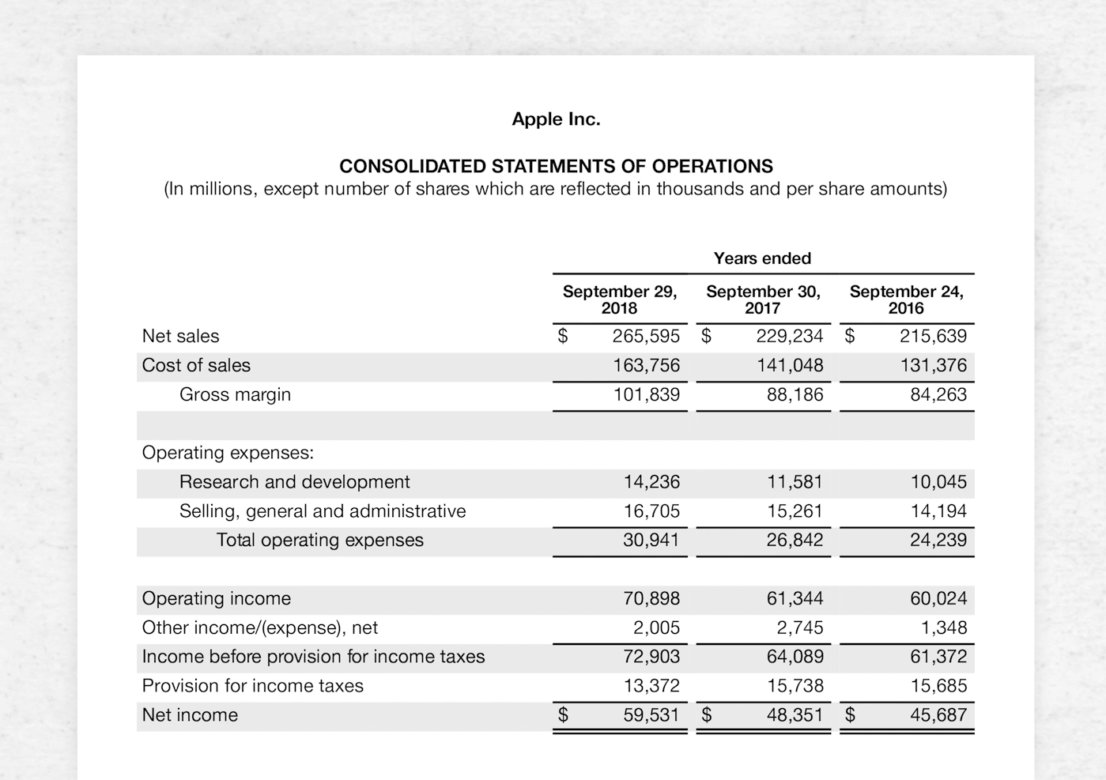

This lesson focuses on the elements and limitations of the income statement and the effects of gaap on the income statement. The income statement, being a detailed record of a company’s financial performance over a specified period, shows the revenues, costs, and profits (or losses) a. It encompasses items like depreciation,.

The cash flow statement makes. The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. It will also discuss noncash items.

Remove the effect of gains and/or losses from. The income statement is the most common financial. A cash flow statement shows the exact amount of a company's cash inflows and outflows over a period of time.

These are financial items such as. Begin with net income from the income statement. The most common income statement items include:

Revenue/sales sales revenue is the company’s revenue from sales or services, displayed at the very top of the statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

.png)