Have A Info About Total Cash Flow From Operating Activities 3 Types Of Audit Reports

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

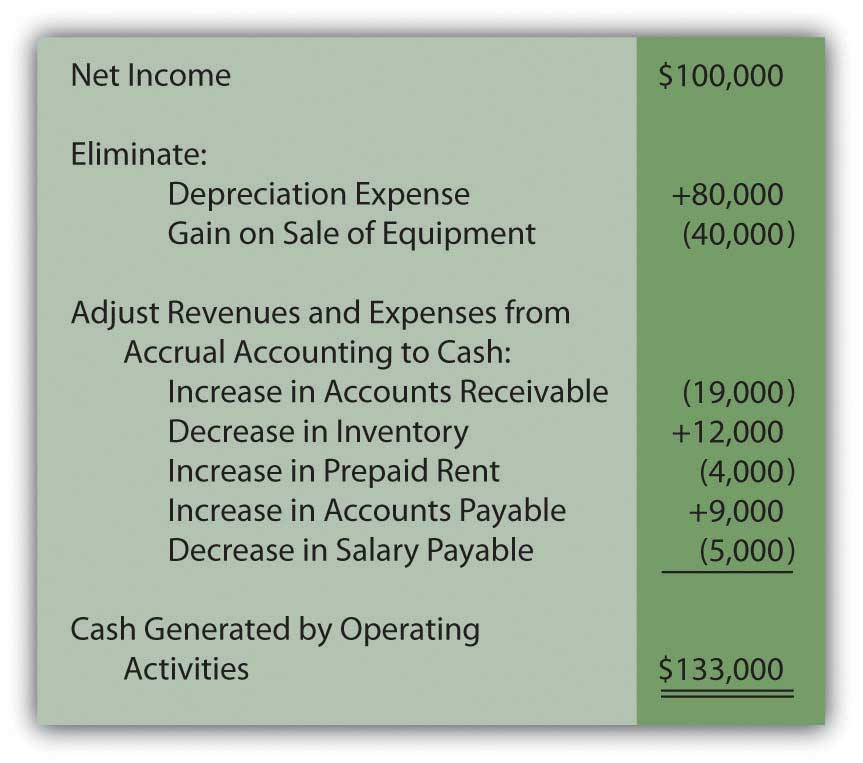

Michael j boyle fact checked by jared ecker net income is the profit a company has earned for a period, while cash flow from operating activities measures, in part, the cash going in.

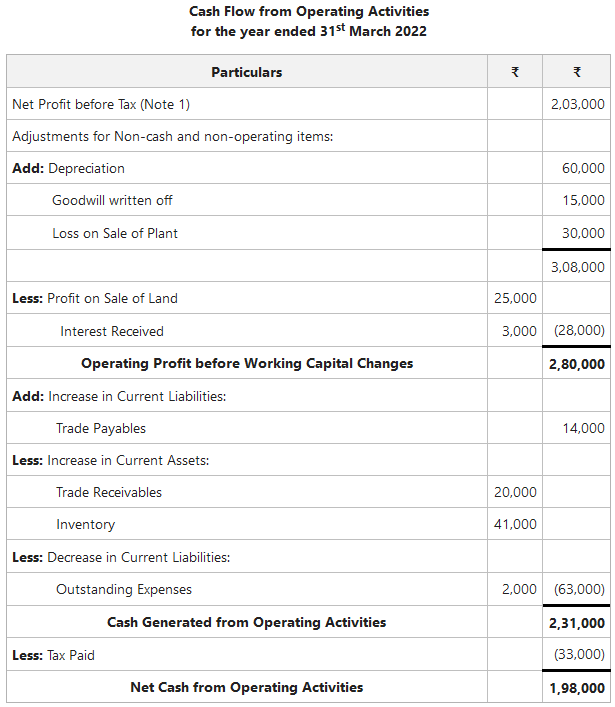

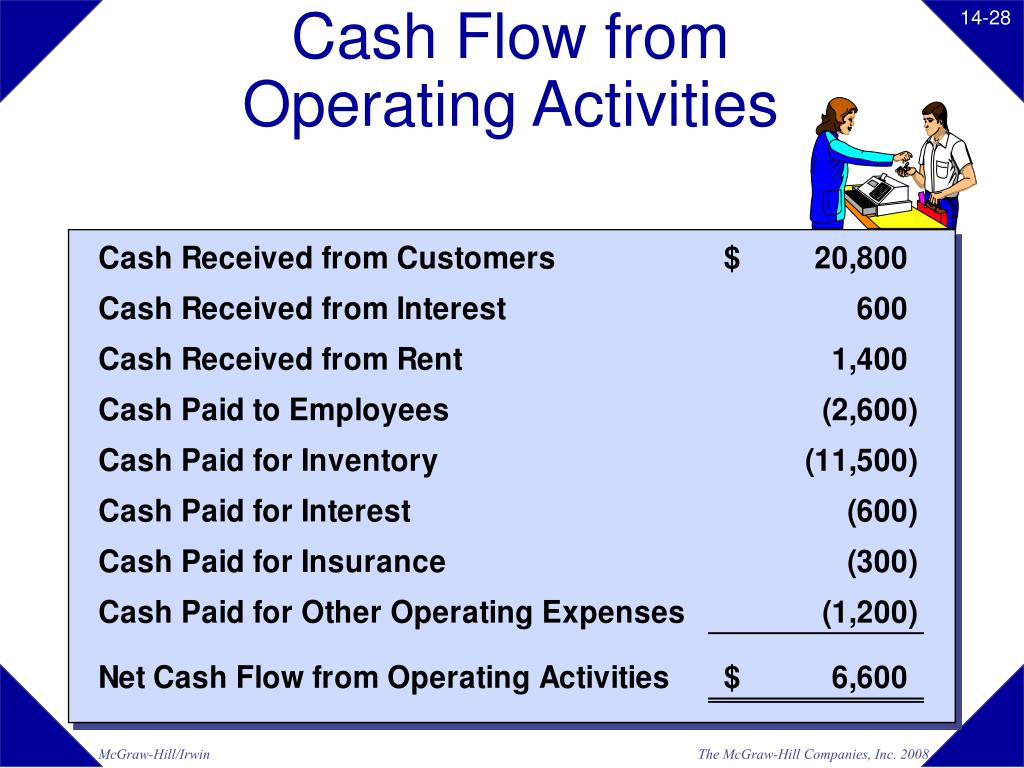

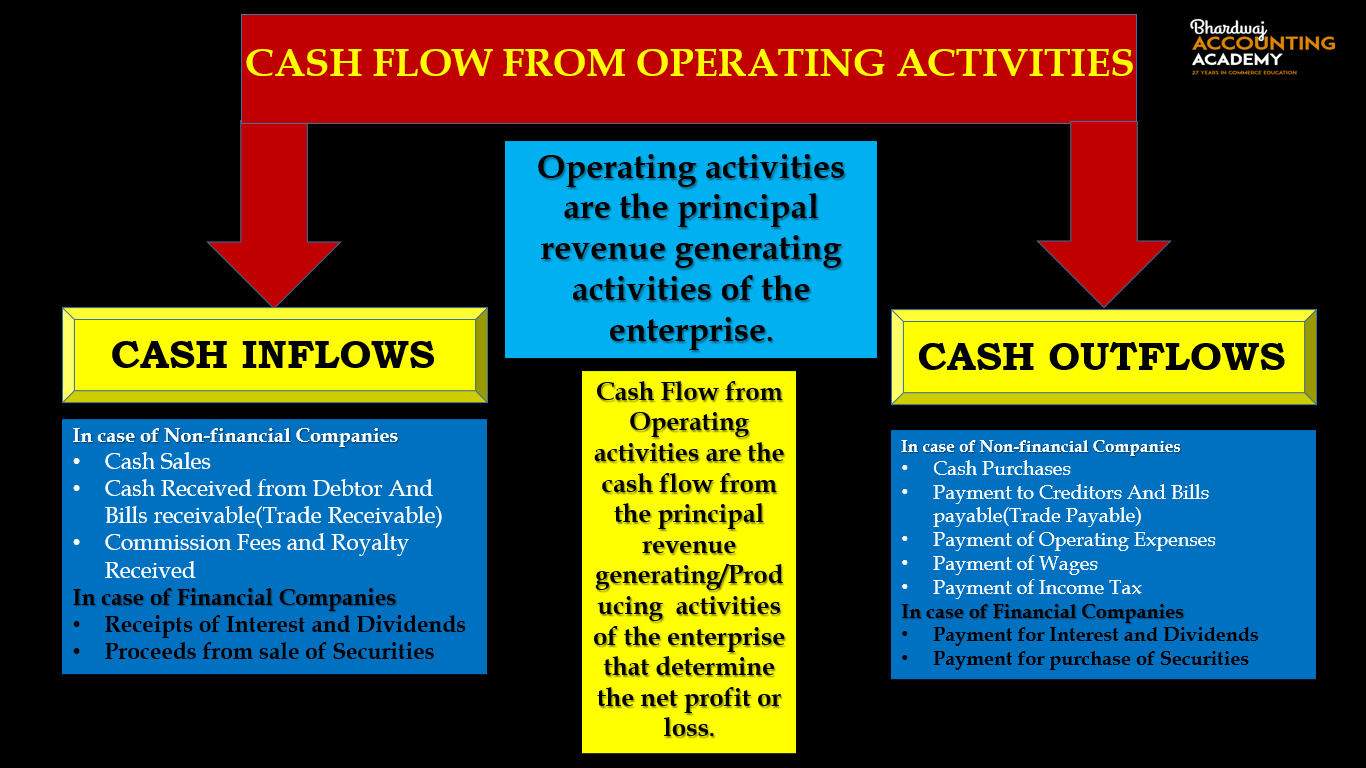

Total cash flow from operating activities. Cash flow from operating activities. Cash flow is the movement of money in and out of a business during a specific accounting period. Cash flow from operating activities is an important part of the cash flow statement.

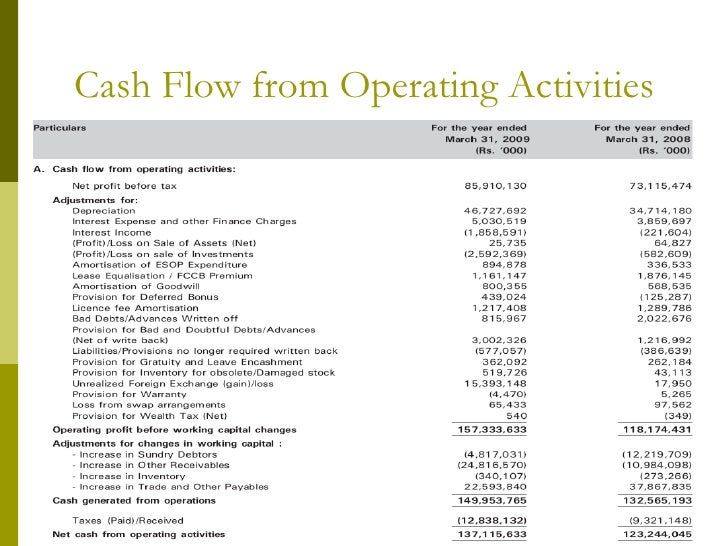

Net cash provided by operating activities for the fourth quarter of 2023 was $90.4 million, while capital expenditures totaled $10.0 million, leading to free cash flow of $80.4 million. Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a. The operating cash flow part of the cash flow statement starts with the net income in the indirect method and cash receipts in the direct method.

Businesses can calculate the net cash flow from operating activities (cfo) using: Find out how to calculate cash flow from operating activities. Cash payments to suppliers for goods and services.

Cash flow from operations formula (indirect method) = $170,000 + $0 + 14,500 + $4000 = $188,500. Operating cash flow indicates whether a company can generate sufficient. Under the direct method, the information contained in the company's accounting records is used to.

An overview of these methods is given below. Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Using these figures, you can work out the total like so:

Is cash flow from operating activities before changes in working capital in excess of cash capital expenditures. Begin with net income from the income statement. When reviewing your financing statements, you’ll find either a negative or positive cash flow, depending on whether your company spends more than it makes or makes more than it spends.

Add back noncash expenses, such as depreciation, amortization, and depletion. Cash flow from operating activities formula the “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first. Direct method operating cash flow formula:

This is the formula for calculating the total cash outflow from all the activities: Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. During the three months ended december 31, 2023, net cash provided by operating activities was $543.3mm and net income was $301.6mm ($6.93 /diluted share).

Cash flow from operations example. Ias 7, statement of cash flows This formula is simple to compute, and it’s often ideal for smaller businesses, partnerships, and sole proprietors.

The ocf calculation will always include the following three components: Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting. Operating activities = £10,000 investing activities = £20,000 financing activities = £15,000.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

-Formula.jpg)