Perfect Tips About Loan Payable In Balance Sheet Projected Income Statement Definition

Credit of $2,000 to cash;

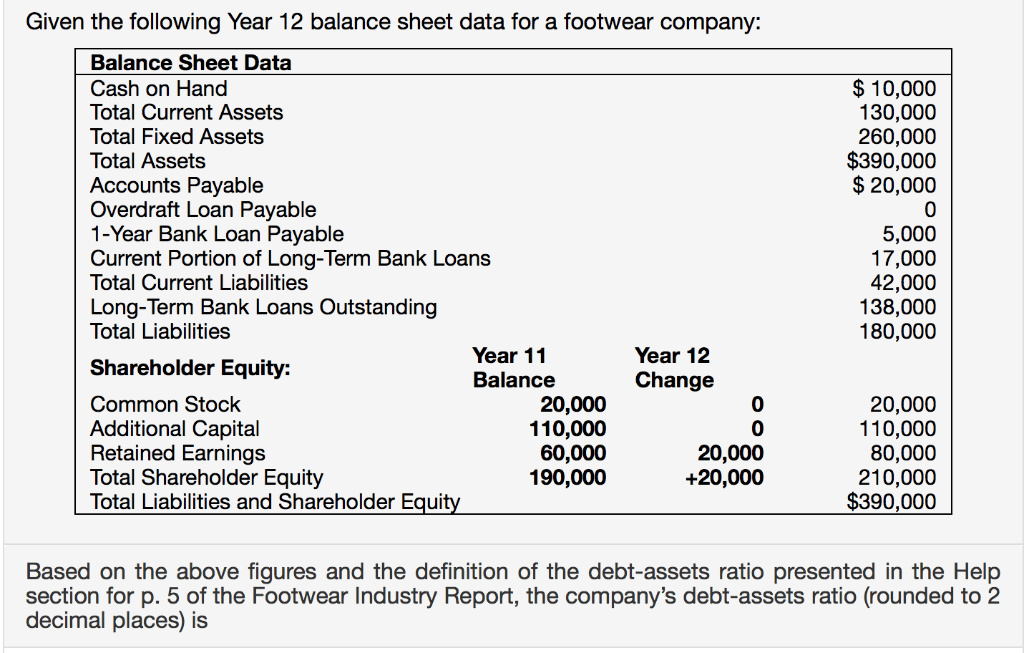

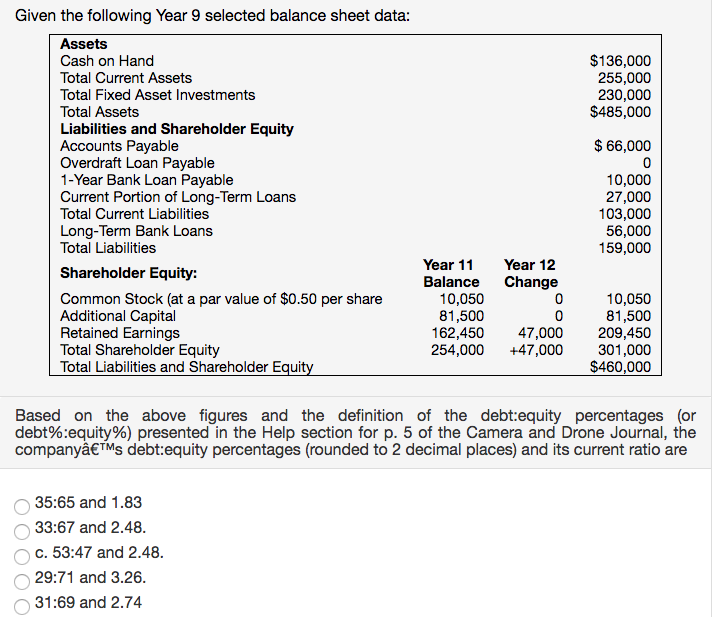

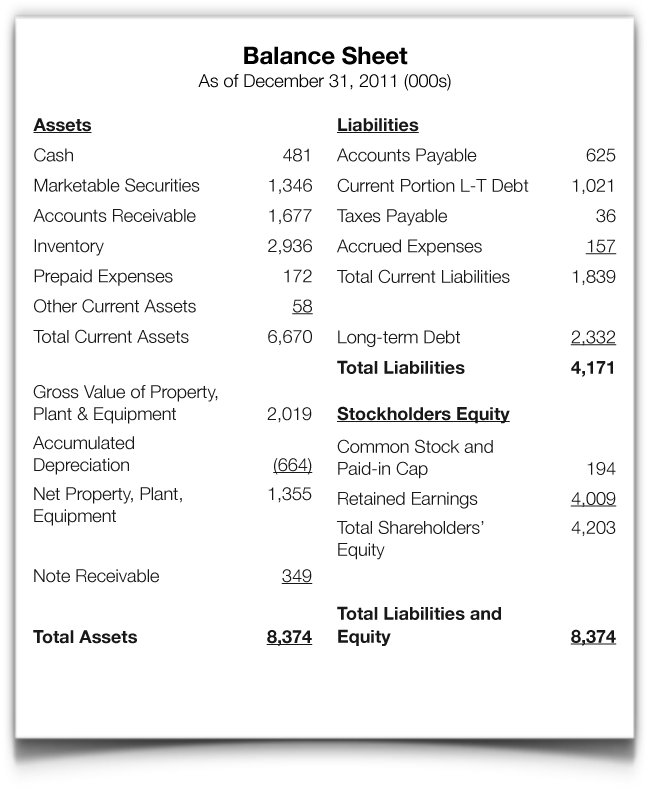

Loan payable in balance sheet. When a note’s maturity is. Additionally, they are classified as current liabilities when the amounts are due within a year. Assuming all liabilities were settled on the due date, calculate:

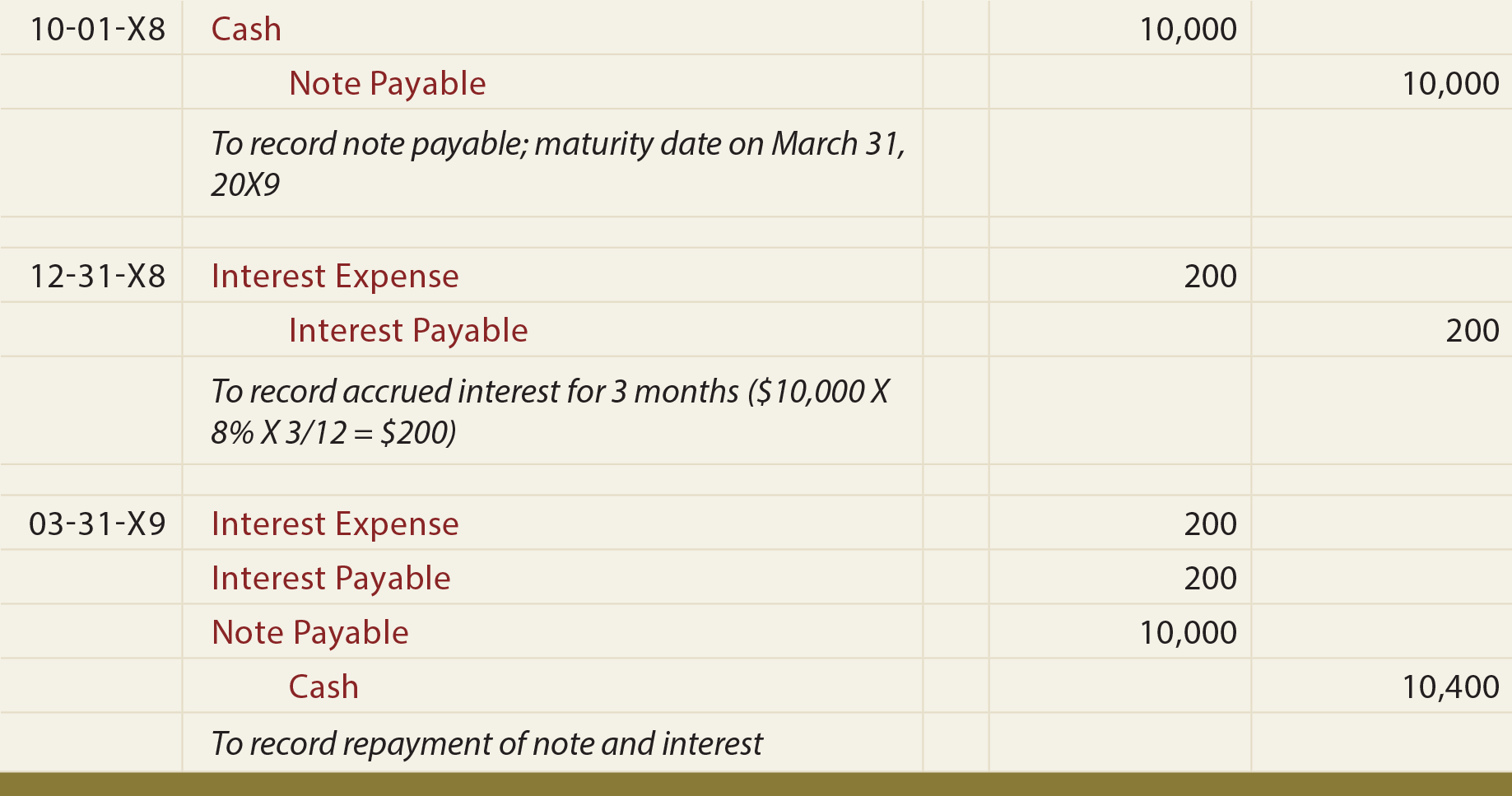

The size of the entry equals the accrued interest from the date of the loan until dec. Classification of loan payable balances. How to amortize and record the discounted notes payable with a lump sum payment (ballon payment) when it comes due using the effective interest rate method (.

The company's entry to record the loan payment will be: When you see a negative number for a loan, this indicates that there is a credit balance. The account mortgage loan payable contains the principal amount owed on a mortgage loan.

Typical adjusting entries include a balance sheet account for interest. The credit balance in the. Definition of loan principal payment when a company borrows money from its bank, the amount received is recorded with a debit to cash and a credit to a liability account, such.

Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest expense (an expense account) credit of $4,000 to cash (an asset account) the. Decreases the loan owing on the balance sheet; The balance sheet.

Its liabilities (specifically, the long. Definition of a mortgage loan payable. If the principal on a loan is payable within the next year, it is classified on the balance sheet as a current.

Notes payable appear as liabilities on a balance sheet. Notes payable is a liability account that reports the amount of principal owed as of the balance sheet date. Presentation of a loan payable.

On the december 2011 balance sheet, the $10,200 that is principal due in the next 12 months will be the loan payable, current portion. (any interest incurred but not yet paid as of. Interest expense to be recognized in the income statements for the years ended 30 june 20x1, 30 june 20x2 and 30 june 20x3.

The loan requires the interest to be paid at the end of every month. Major categories of loans or receivables should be presented. Which means, the company paid.

A loan on a balance sheet is a liability. Loan payables to be recognized in the balance sheets as at 30 june. Presentation of mortgage loan payable.