Perfect Info About Cash Flow Statement Under Indirect Method Wwe Financial Statements

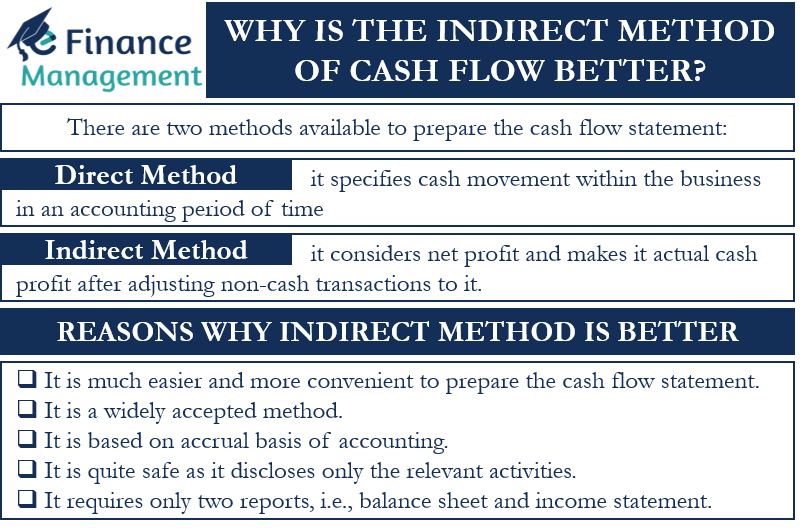

A company can choose the indirect method or the direct method.

Cash flow statement under indirect method. The indirect method reports cash flows from operating activities into categories such as: Indirect method of preparing cash flow statement. The indirect method is adopted by many companies for the preparation of cash flow statements because it is simple, and less work is required.

Not all captions are applicable to all reporting entities. The indirect method of cash flow is one of two cash flow methods used in accounting. Cash flow statements include three sections:

Operating, investing and financing will be the same. The indirect method, as the name implies, looks at cash flow indirectly. Determine net cash flows from operating activities.

The indirect method requires combining information from the company’s income statement (or profit and loss statement) and its balance sheet. The financial accounting standards board. The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities.

Try our free cash flow calculator You can gather this information from the company’s balance sheet and income statement. The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources.

Determine net cash flows from operating activities. Identify cash flows using the indirect method the indirect method adjusts net income (rather than adjusting individual items in the income statement) for (1) changes in current assets (other than cash) and current liabilities, and (2) items that were included in net income but did not affect cash. Operating activities, investing activities and financing activities.

Add back noncash expenses, such as depreciation, amortization, and depletion. Instead, most companies use the indirect method to prepare the statement of cash flows. The statement of cash flows is prepared by following these steps:

The operating cash flows section of the statement of cash flows under the indirect method would appear something like this: Add back noncash expenses, such as depreciation, amortization, and depletion. The indirect method is based on accrual accounting and is generally the best technique since most businesses use accrual accounting in their bookkeeping.

Whichever method be used, the end result under all three activities i.e. With this method, you can determine precisely how much money you’ve spent and brought in, how much you should have on hand, and get a solid grasp of your business’s financial stability over a given period. The cash flow statement indirect method is one way to present a company’s total cash flow.

Profit before interest and income taxes. In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow. The direct method for preparing a statement of cash flows lists cash inflows and outflows as they occur.

![Cash Flow Statement Indirect Method [Explained & Example]](https://learnaccountingskills.com/wp-content/uploads/2023/01/cash-flow-statement-indirect-method-1024x538.jpg)

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)