Glory Tips About 24q Income Tax Tomtom Financial Statements

Employers submit it quarterly to the income tax department.

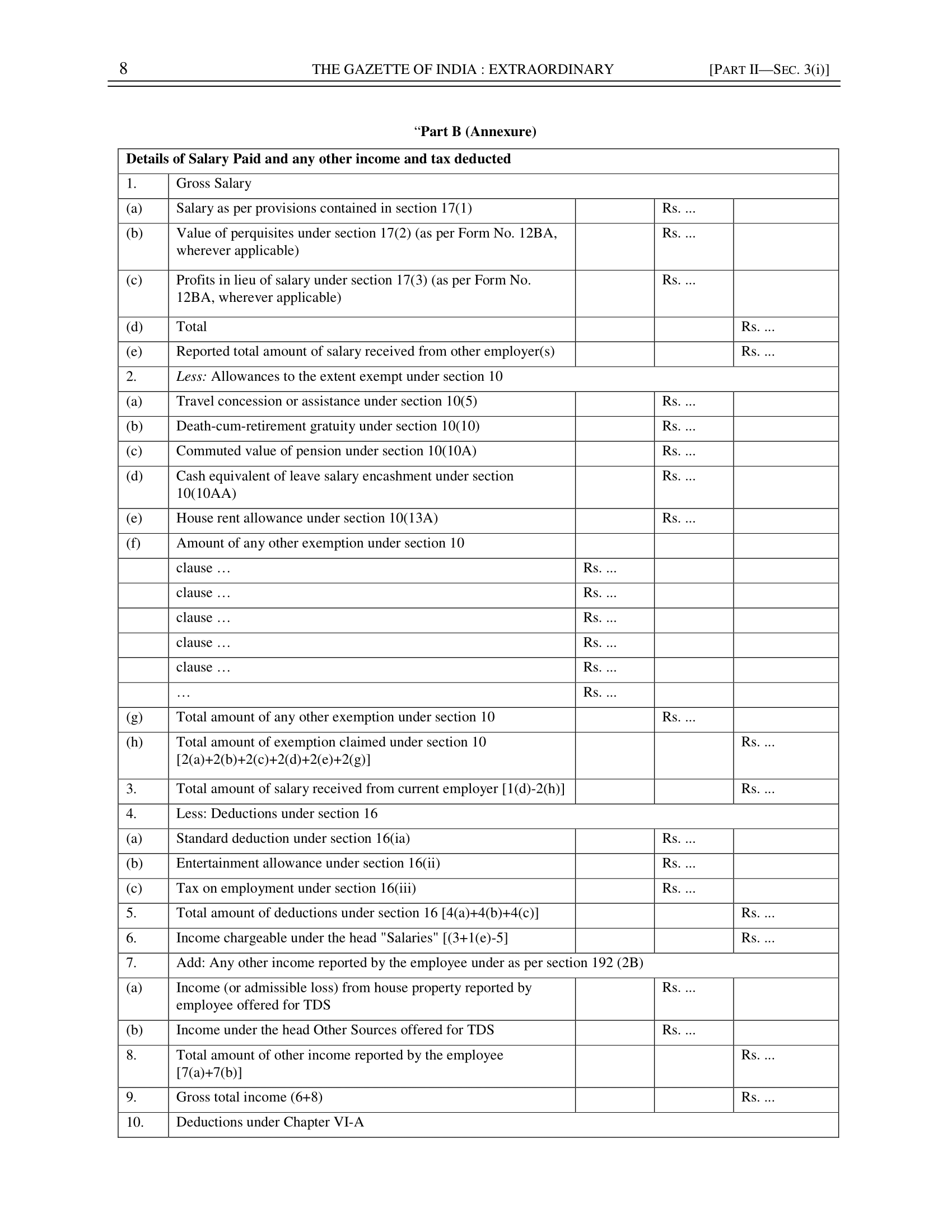

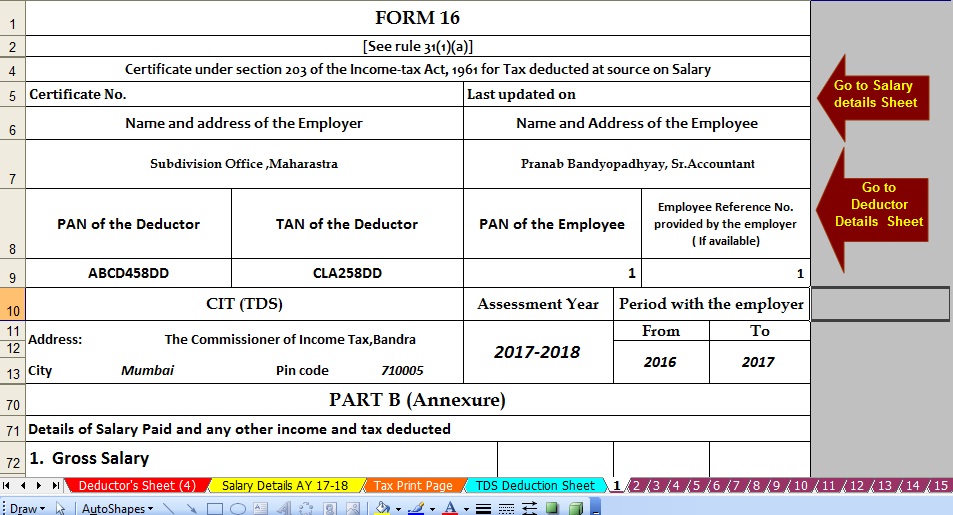

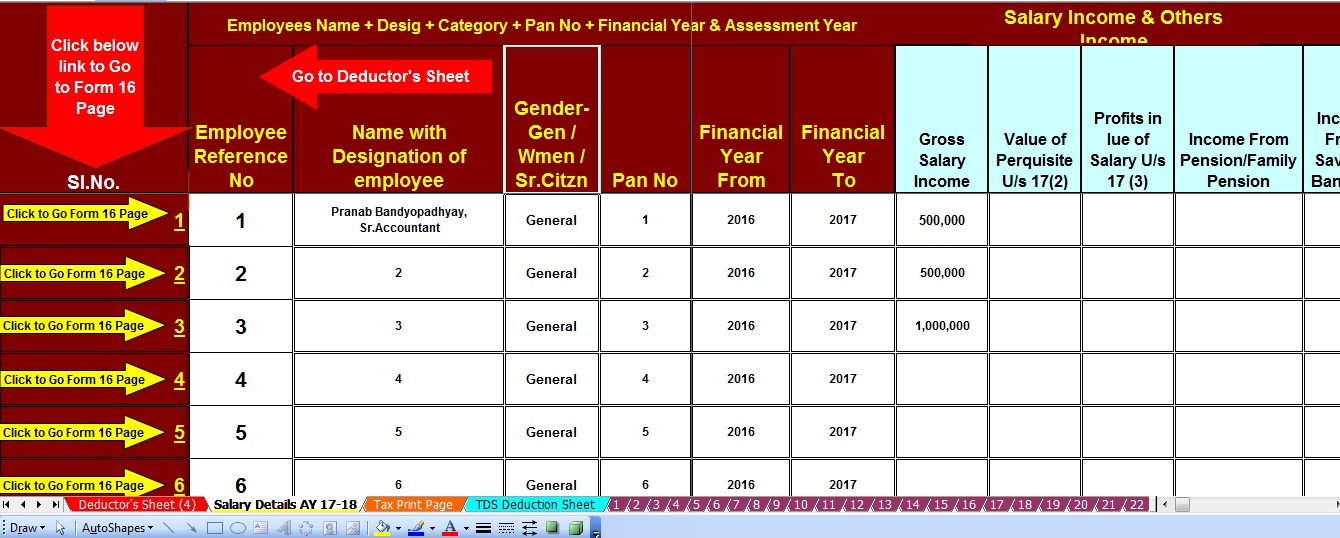

24q income tax. Details of salary paid to the employees and tds deducted on such payment is to be reported in 24q. What is form 24q? A quarterly statement reflecting details of the salary paid to the employees and tax deducted on salaries has to be filed by the employer in form 24q.

Form 24q is a statement for tds, which is used to report tds deducted details from salaries. Income‐tax relief under section 89, when salary, etc. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes.

Form 24q is a tds (tax deducted at source) return that is filed by an employer who deducts tds on salaries. Changes to the earned income tax credit (eitc). Introduction filing your form 24q tds (tax deducted at source) return for salary can be a daunting task, especially if you’re new to the process.

It contains the details of the deductor, the deductees, the challan and the. Form 24q tds on salary. Is paid in arrear or advance [3 4 8] net tax payable ( 35 plus 46 minus 3 7) [3 4 9] fo total amount of tax deducted at source by.

Tax deducted at source is the collection of income tax for indians. It contains details of tds. Checking your browser before accessing incometaxindia.gov.in this process is automatic.

While making salary payments to employees, an employer deducts tds under section 192 of the income tax act, 1961. What is form 24q? The collection and process of the tax is governed under the indian income tax.

Form 24q is a crucial element of tds (tax deducted at source) returns, especially concerning salary payments. Form 24q is required to be submitted on. You are required by income tax legislation to submit form 24q, tds return.

Marginal tax brackets for married couples filing jointly —$22,000 or less in taxable income — 10% of taxable income —$22,001 to $89,450 in taxable. A person who is liable to pay tax (deductor or the employer) of any kind to any other person (deductee or the employee in this case), deducts tax at source and. An employer deducts tds under section 192 of the income tax act, 1961, at the time of paying salary to an employee.

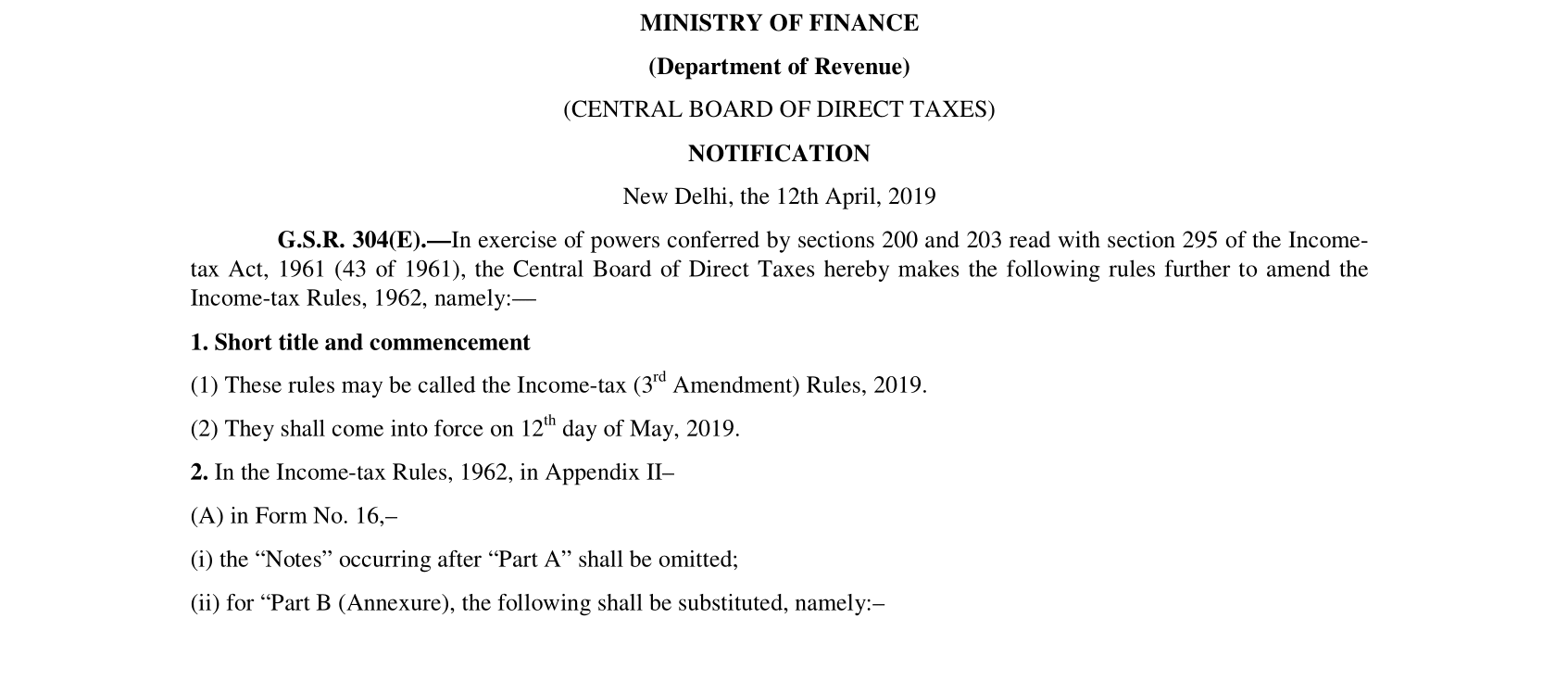

2023 versus 2024 tax brackets. Form 24q should be filed and submitted for return of tds on salary payments and form 26q should be filed and submitted for return of tax deducted at. 10 may 2019 151,272 views 42 comments as per cbdts notification 36/2019, dated 12th apr 2019 the format of tds statement in form no.

Contents [ show] at the time of paying salary to an employee, the employer deducts tds u/s 192. Form 24q is utilized by the taxpayers for the declaration of the tds returns of the citizen. The form would have the information on the salary and.