Nice Tips About Financial Report For Nonprofit Organization Kering Statements

Get our free guide to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Financial report for nonprofit organization. It had 76 cents for every dollar of promised pension. Wester’s report did not include any plan to permanently fund the new nonprofit. New research suggests that those sticks could soon batter the oil and gas industry, which is responsible for a third of all methane emissions in the u.s.

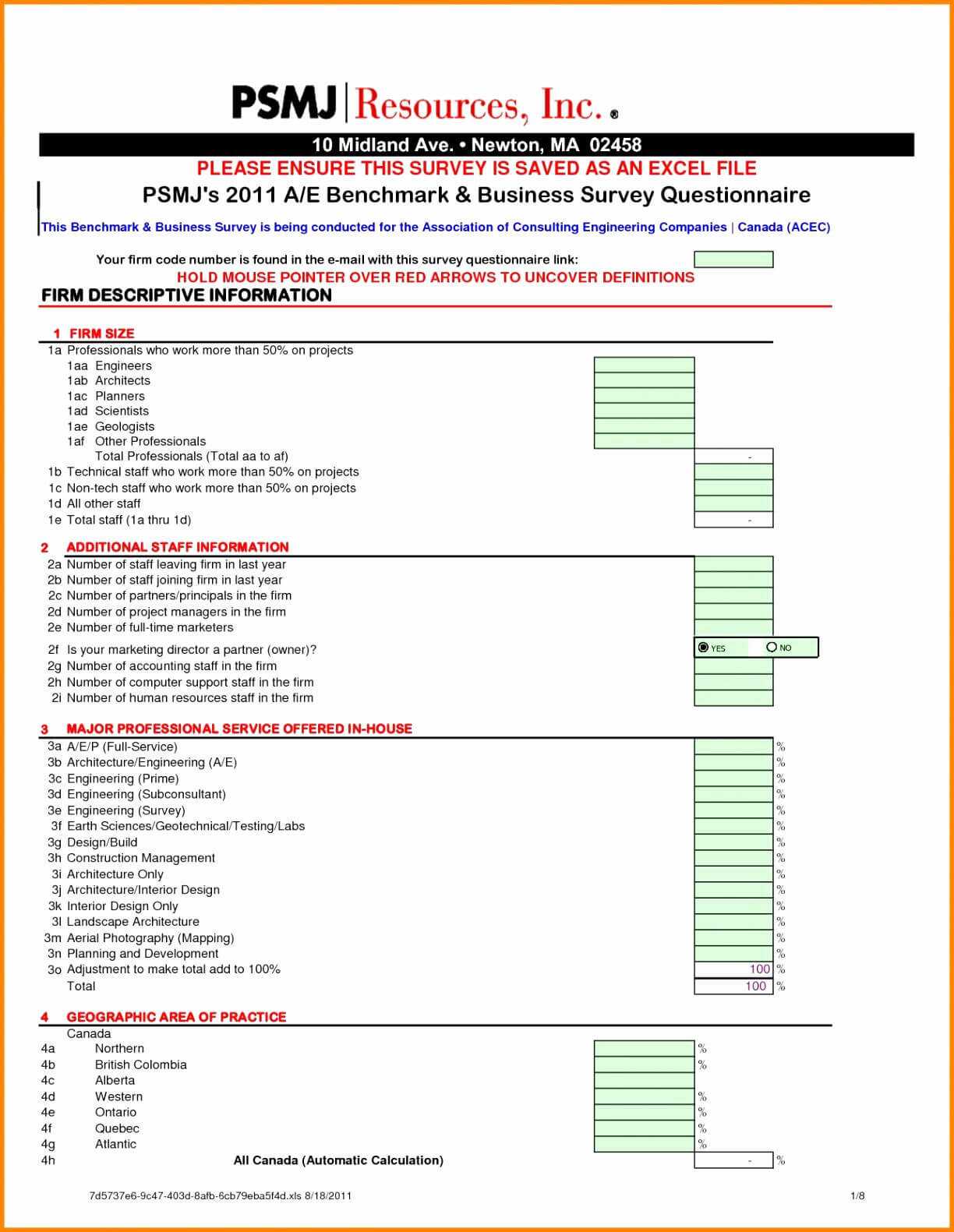

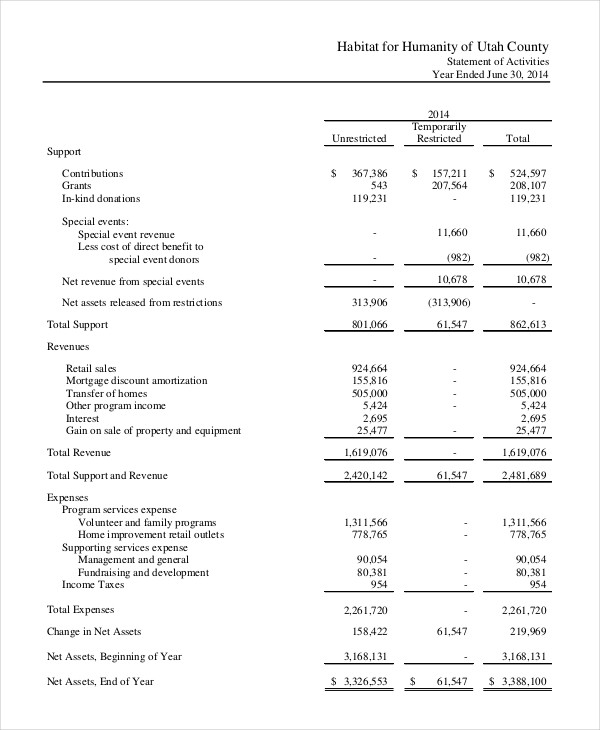

Include information that demonstrates the impact fundraising has on your organization. Contributed nonfinancial assets presentation and disclosures. For example, we can justify fundraising expenses by quantifying the return on investment towards programs.

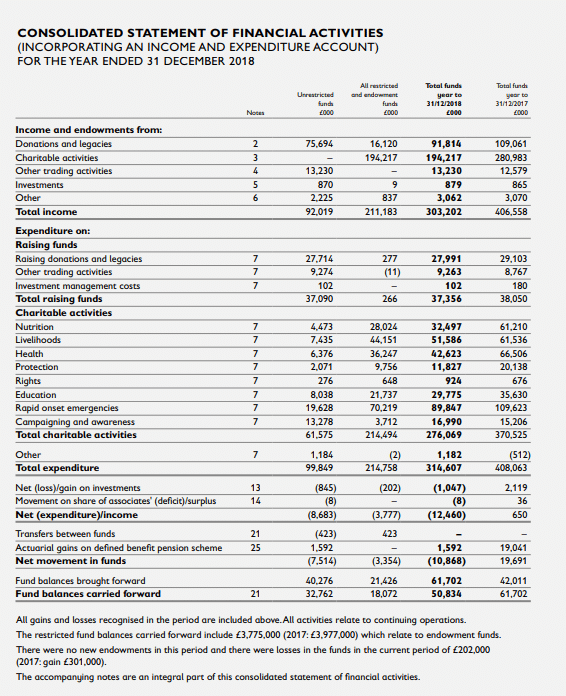

Here, we’ll take a further look into the four types of nonprofit financial reporting all organizations should prioritize (internal reporting, reporting to your board, reporting to the irs and reporting to external stakeholders), how they contribute to an organization’s financial health and why it’s all so important. Typically, expenses are broken into two distinct sections—overhead expenses and. Typically, this includes gifts, grants, membership fees, and/or income from fundraising events or investments.

Choosing a format for your annual report; Respond appropriately to requests for copies of financial reports, as required by the irs’s public disclosure requirements. The nra’s lawyer, meanwhile, said it could not be held accountable for lapierre’s actions.

Annual reports are created by the nonprofit and often provide more detailed information on their financial situation and program impact. Nonprofit annual report best practices; Tag meeting, agenda item 3.

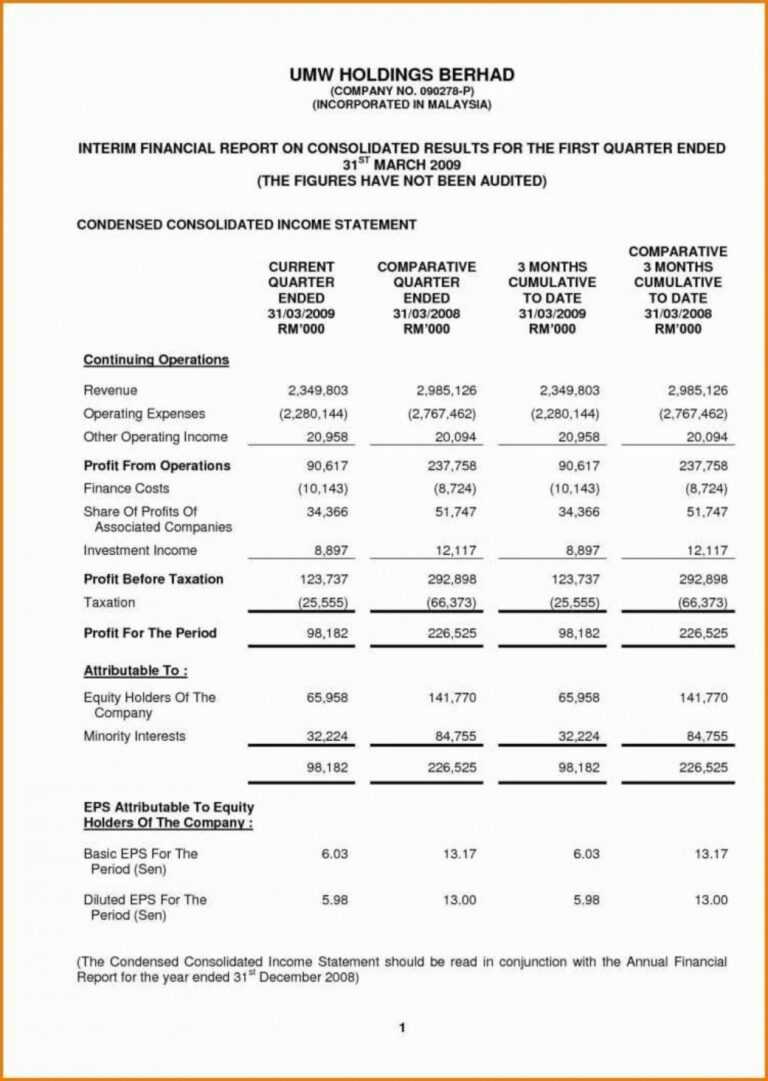

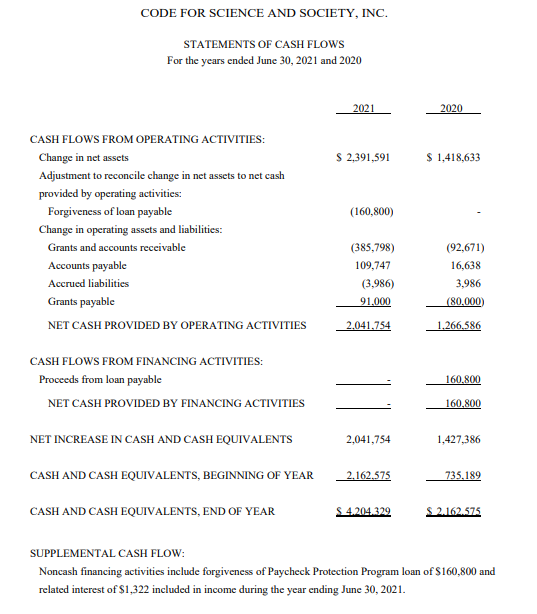

To help simplify financial reporting, genest tarnow offers the following top three financial reporting items that nonprofits should review each month. Exposure draft 1, see sections 7&8 of the summary. It measures your nonprofit’s assets, liabilities, and net assets in a single document.

Your financial statement should include: Annual reports usually document what your nonprofit has accomplished in the past year, but consider including a vision of what lies ahead. Best practices for your nonprofit’s financial annual reporting:

It resulted in a burden of $9,000 per taxpayer. Nonprofit annual report template & elements to include; In this article, we’ll explain more about each financial statement, why and when nonprofits need financial statements and share examples of how organizations have used them in their annual reports.

Kansas city’s financial condition declined by $84.2 million, according to the report. Financial statements can also serve as strategic tools to help you fulfill your nonprofit’s mission and make a bigger impact on the communities you serve. Proper reporting is a key aspect of effective nonprofit financial management.

Pag meeting agenda item 2. Discover the 5 essential nonprofit financial statements that your organization needs, regardless of your size, mission, or revenue. However, their importance goes beyond the need to jump through regulatory hoops.

![Free Printable Nonprofit Financial Statement Templates [Excel]](https://www.typecalendar.com/wp-content/uploads/2023/08/Nonprofit-Financial-Statement.jpg)