Matchless Tips About Accrued Income In Cash Flow Statement Sample Of Balance Sheet Formula For Profit Before Tax

The cash flow statement in accounting is one of the four basic financial statements.

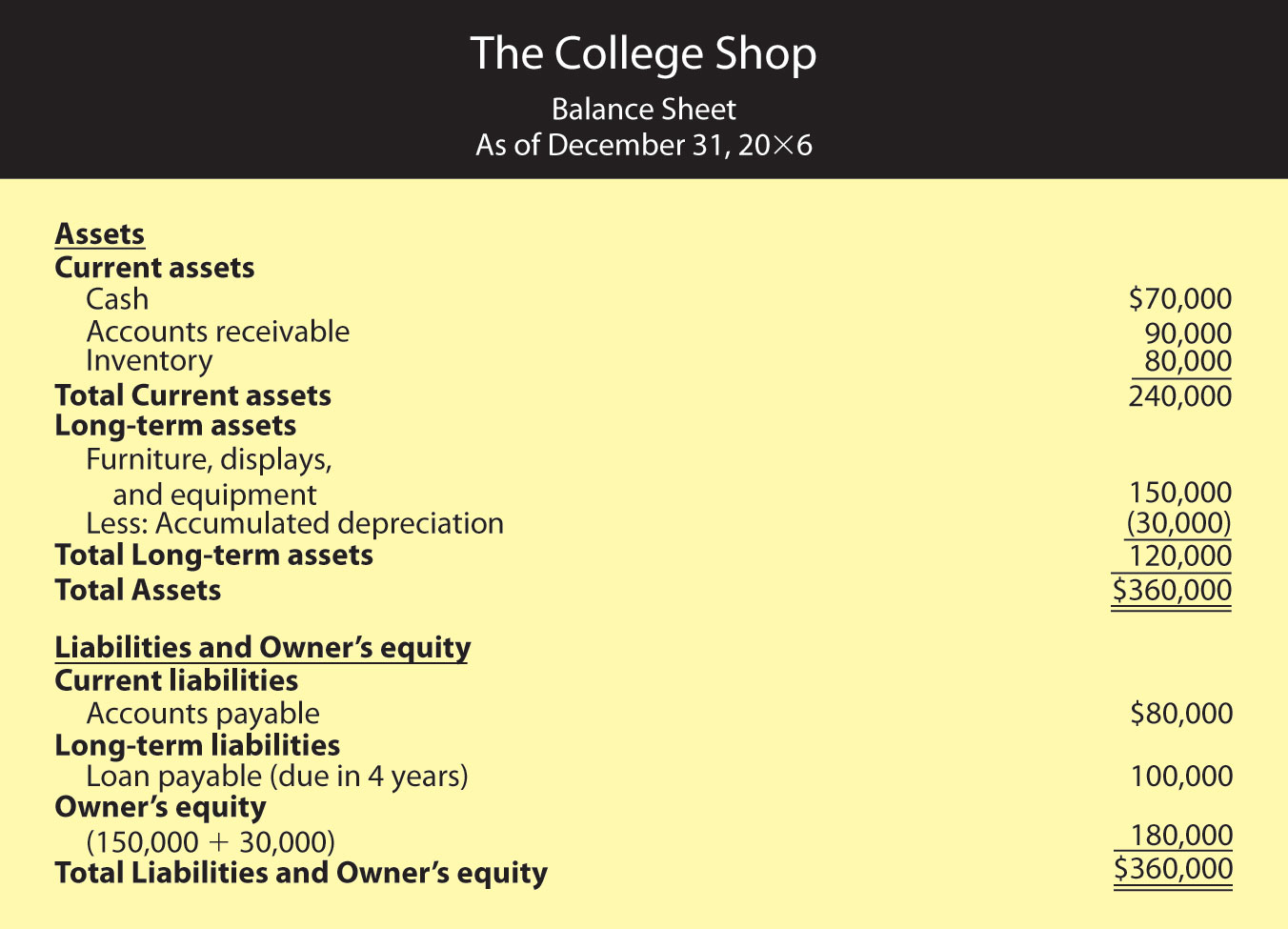

Accrued income in cash flow statement sample of balance sheet statement. Now that we’ve got a sense of what a statement of cash flows does and, broadly, how it’s created, let’s check out an example. Accruals are included in the expense amount on the income statement and reported as a current liability in the balance sheet. These three financial statements are intricately linked to one another.

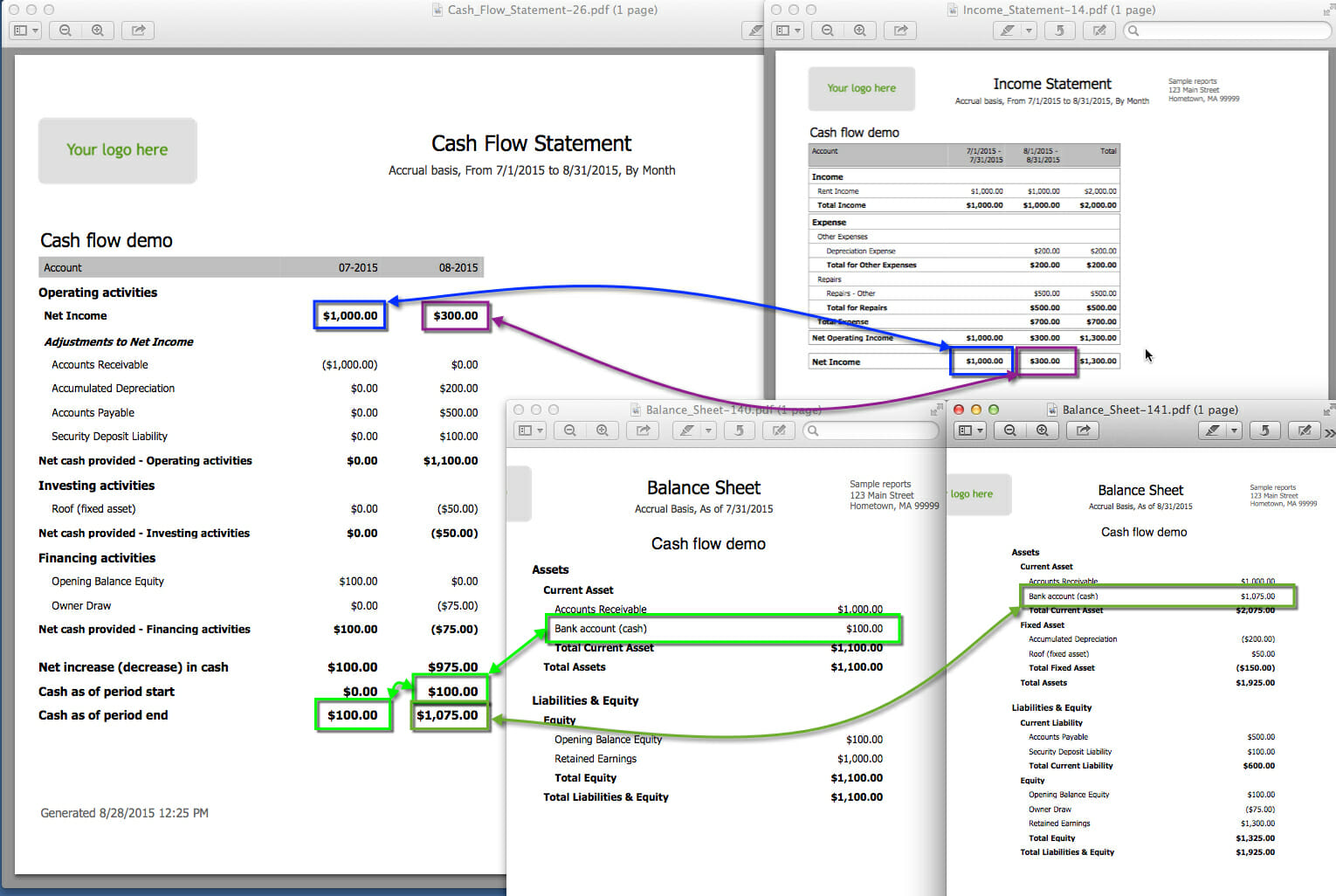

The two bases of accounting are the cash basis and the accrual basis, briefly introduced in describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate. Income statement + balance sheet = cash flow statement. In order to prepare the cash flow statement, we adjust the profit before tax with working capital adjustments and operating expenses and accrual is an operating expense payable.

What’s the difference between a cash flow statement and an income statement? Effect on the statement of cash flow: Key takeaways a cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. Add back noncash expenses, such as depreciation, amortization, and depletion. Statement of comprehensive income;

Key highlights since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period. Key takeaways the cash flow statement and the income statement, along with the balance sheet, are the three main financial statements. It can also reveal whether a company is going through transition or in a state of decline.

The statement of cash flows is prepared by following these steps: In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under accrual accounting. For example, cash flow statements can reveal what phase a business is in:

To prepare the statement of cash flows for clear lake sporting goods, we need the beginning cash balance from the balance sheet, net income and depreciation expense from the income statement, and a set of comparative balance sheets to see the change in asset and liability accounts (see figure 5.15). Why do shareholders need financial statements? This method of accounting best measures a company's sales, expenses, and earnings during.

Key things to know the income statement is presented on the “accrual basis” • the income statement reports the activities that happened during the period. Reviewing it can give you information about your cash flow as opposed to net income.

Begin with net income from the income statement. Do dividends go on the balance sheet? Below are examples of items listed on the balance sheet:

The cfs highlights a company's cash management, including how well it. Whereas both the income statement and balance sheet reflect an accrual basis of accounting, the cash flow statement starts with net income and translates the economic activity of the firm from an accrual basis to a cash basis. It could be described as accrued receivables or accrued income.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)