Looking Good Info About Payables In Balance Sheet Wirecard Financial Statements

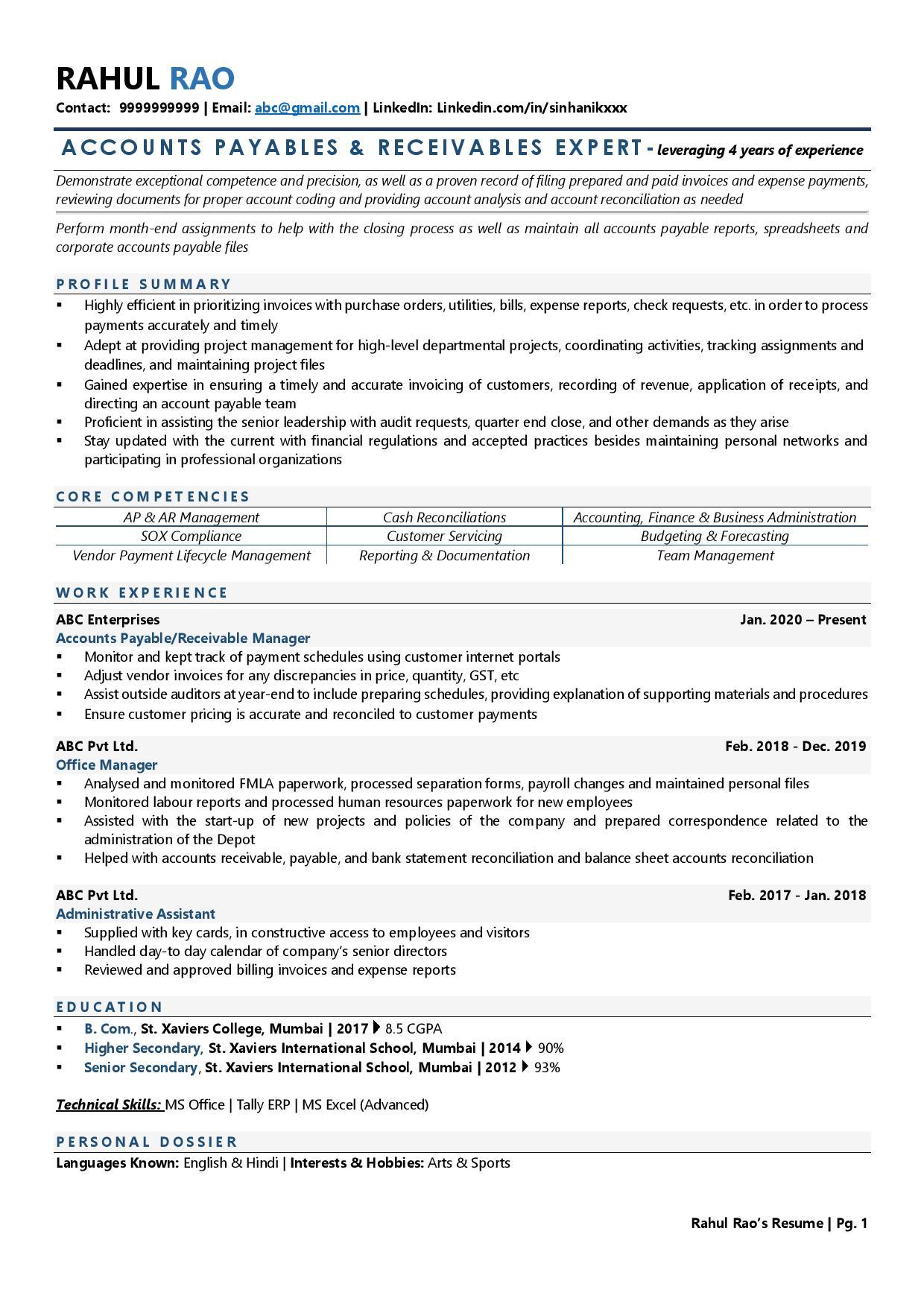

Accounts payable (ap) is a liability that appears on a company’s balance sheet.

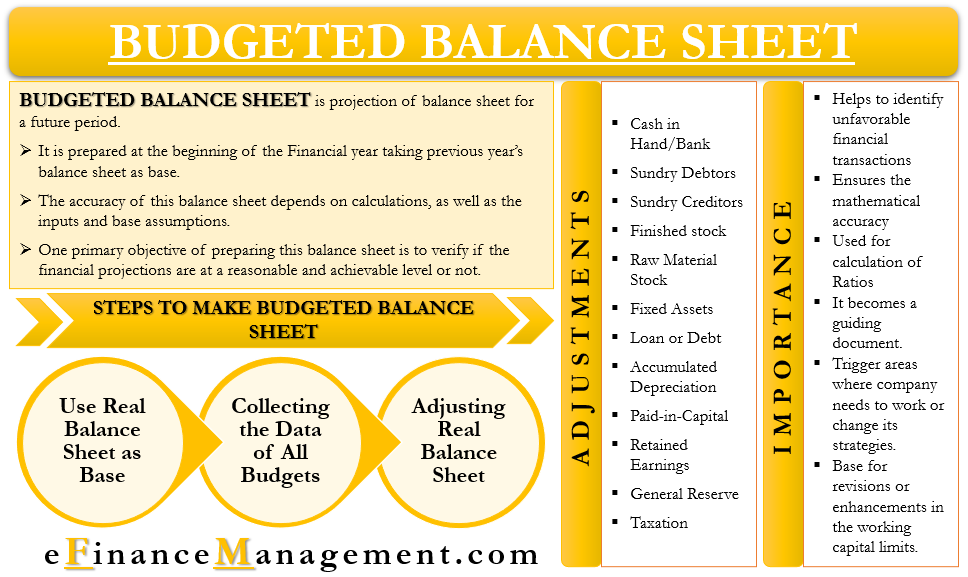

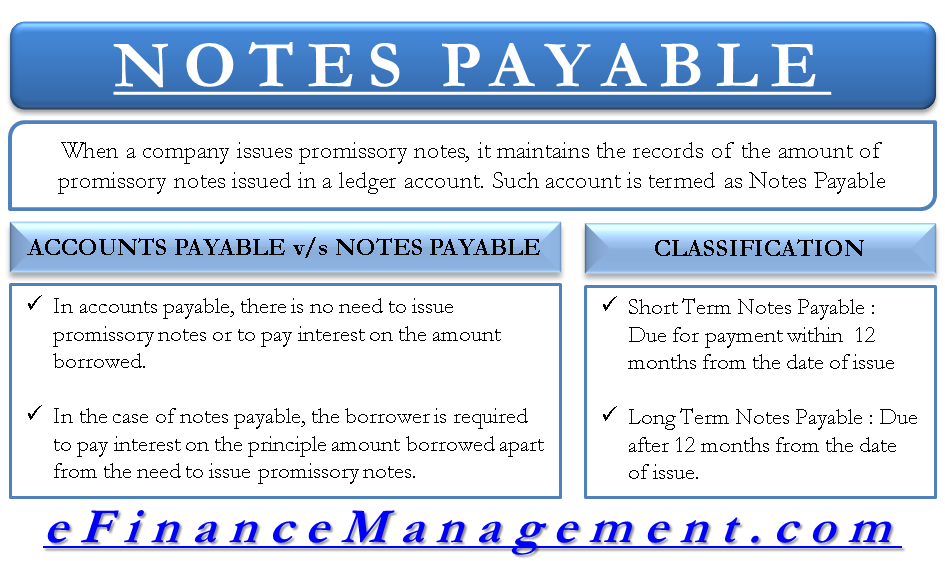

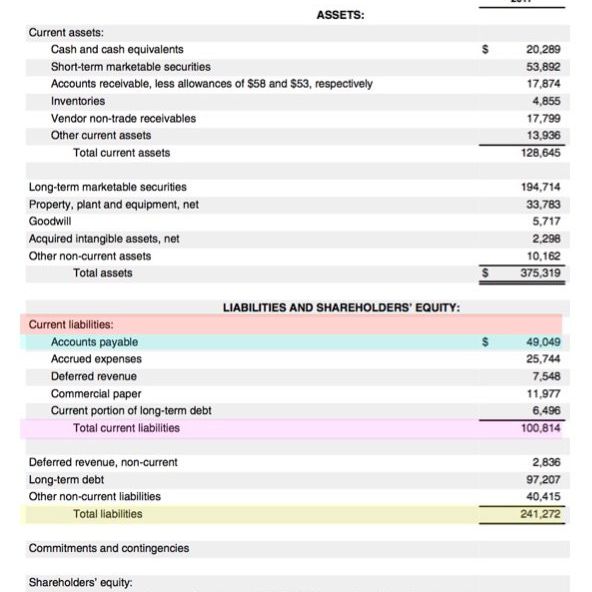

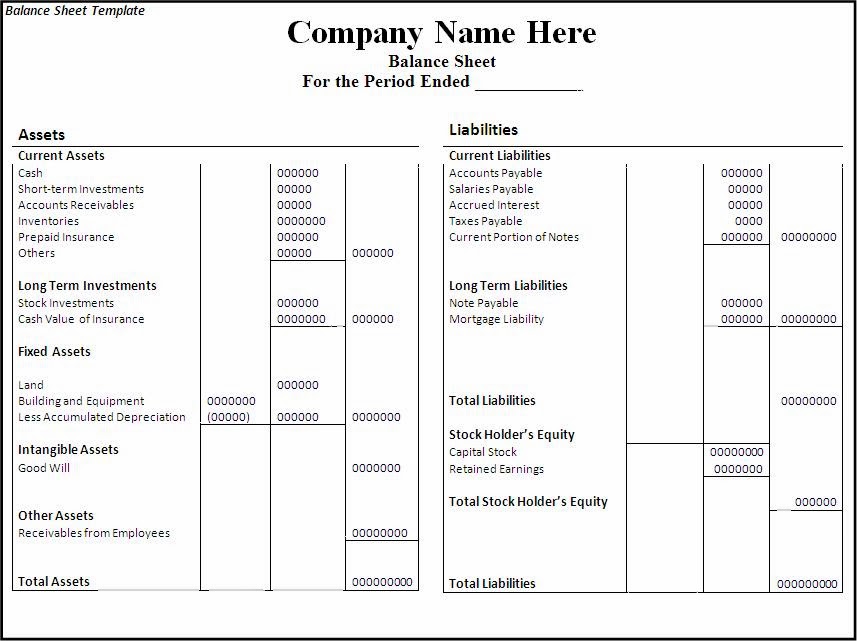

Payables in balance sheet. Accounts payable for apple was approximately $49 billion (highlighted in. Notes payable appear as liabilities on a balance sheet. Assets assets are items of value that your business owns and are further divided into.

Accounts payable (ap) is an account in a company's general ledger. Income taxes to be paid in a future year. It is acceptable, however, for a reporting entity to.

Income tax payable on a balance sheet equals the total tax due to be paid to government tax agencies within 12 months. It represents the amount of money owed by the business to its vendors for goods. At the beginning of the period, the accounts payable balance was $50 million, but the change in a/p was an increase of $10 million, so the ending balance is $60.

Additionally, they are classified as current liabilities when the amounts are due within a year. Current liabilities are highlighted in red. Accrued expenses are adjusted and recorded at the end of an accounting period while accounts payable appear on the balance sheet when goods and services.

Use in financial modeling in financial. Ap is considered one of the most current forms of the. Your company’s balance sheet is divided into three categories.

Accounts payable refers to the money your business owes to its vendors for providing goods or services to you on credit. Trade payables arise due to credit purchases. Classification accounts payable is classified as a current liability on the balance sheet.

Briefly, the definitions of the two terms, payables and receivables, are as follows: They are treated as a liability for the company and can be found on the balance sheet. Accounts payable is any sum of money owed by a business to its suppliers shown as a liability on a company's balance sheet.

Accounts payable is not a business. Accounts payable is expected to be paid off within a year’s time or within one operating cycle (whichever is shorter). When a note’s maturity is.

To see how accounts payable are listed on the balance sheet, below is an example of apple inc.'s balance sheet, as of the end of their fiscal year for 2017, from their annual 10k statement. In simple words, when you buy. Apply the formula to ascertain how effectively a company is settling its payables.

For example, a company’s payables turnover ratio of two will be more concerning if virtually all of its competitors have a ratio of at least four. Days payable outstanding (dpo) formula: Drafts payable should be netted against the cash balance, similar to the treatment for outstanding checks.