Stunning Info About Debt Equity Ratio Calculation From Balance Sheet Horizontal And Vertical Analysis In Accounting

Calculating the debt ratio using a balance sheet provides valuable insight into a business’s financial leverage and risk.

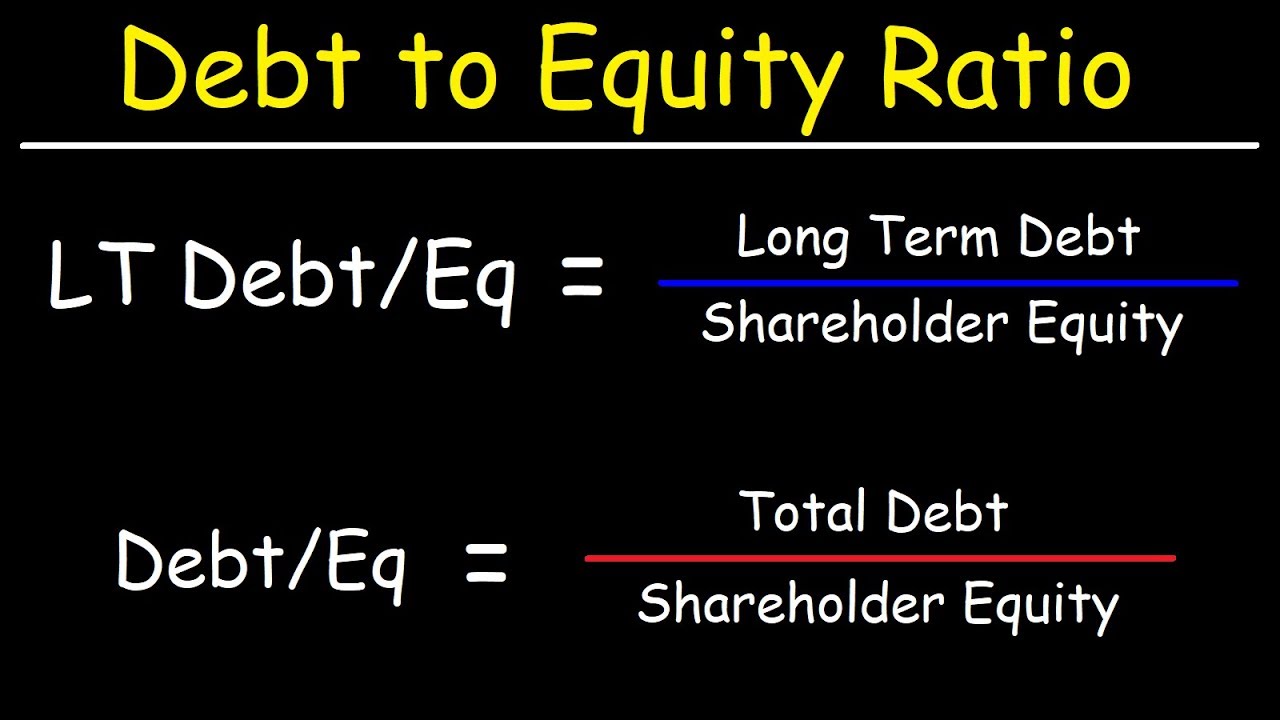

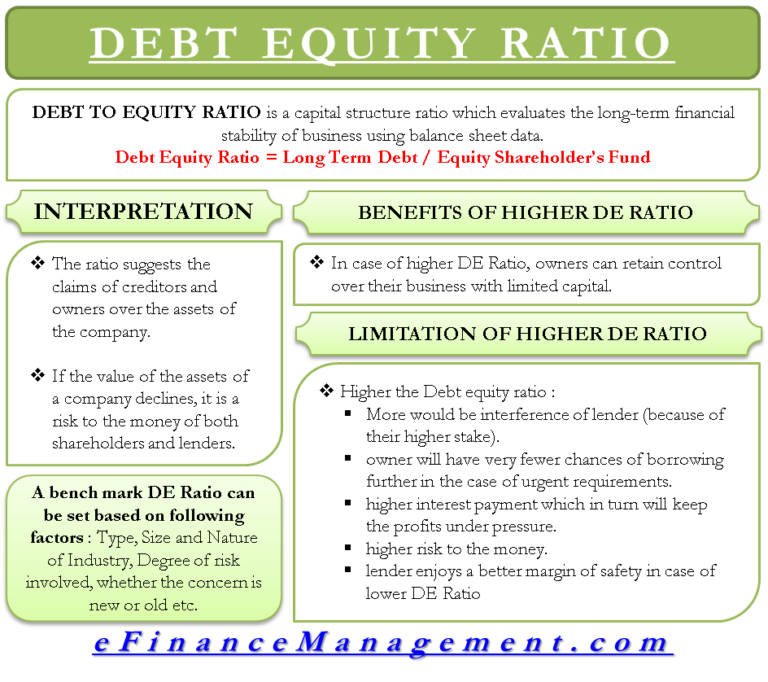

Debt equity ratio calculation from balance sheet. How to calculate debt from balance sheet? This ratio implies that for every dollar of equity, tesla has $0.82 in debt. D/e ratio = total liabilities / shareholders’ equity.

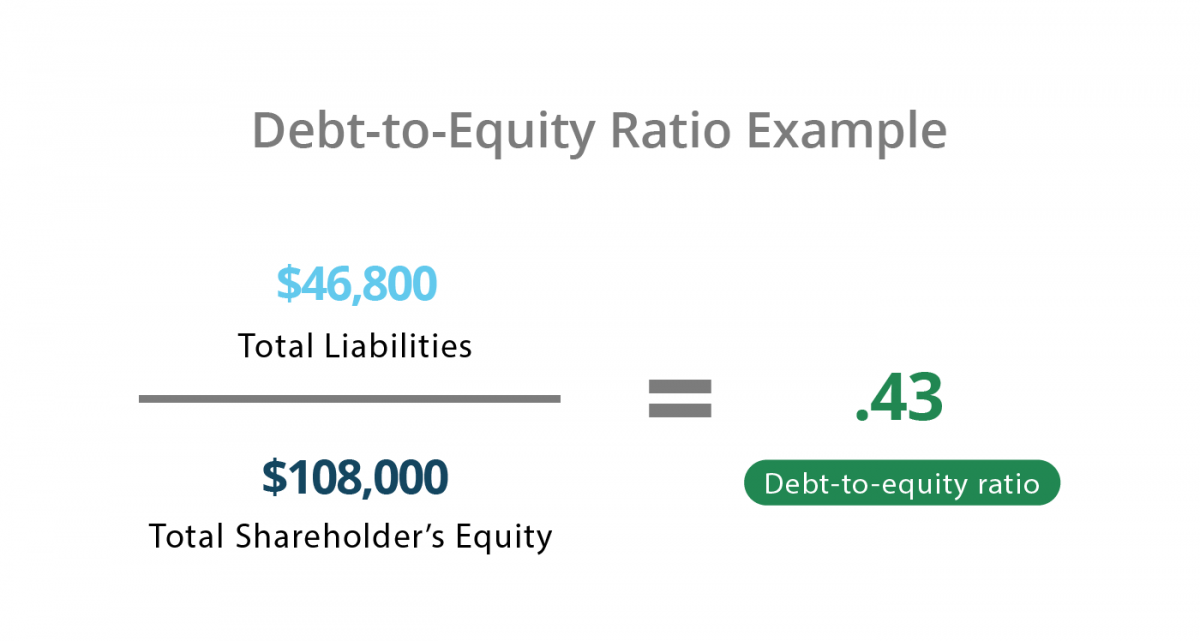

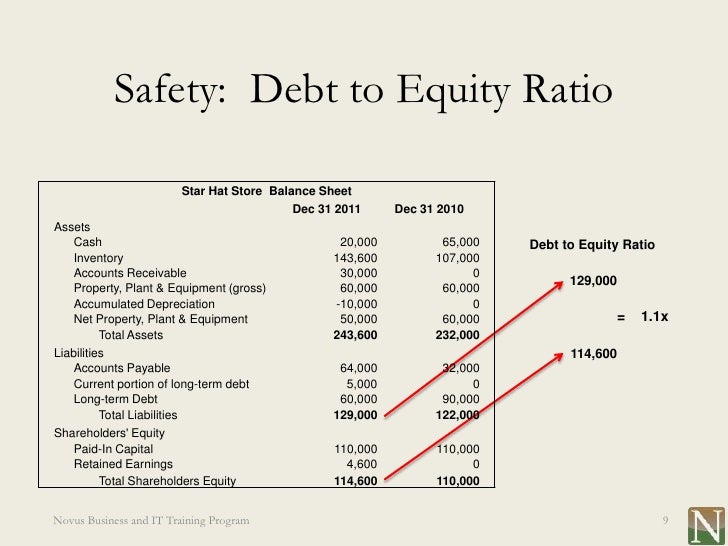

Debt to equity ratio = total liabilities / shareholders' equity Debt ratio = $300,000 / $500,000 = 0.60 or 60%. Debt to equity ratio signifies the proportion of the shareholder’s equity and the debt used to finance the firm’s assets.

Shareholder’s equity represents the net assets that a company owns. A high debt ratio indicates a. This is because $100,000 (total liabilities) divided by $25,000 (total equity) is 4 (debt ratio).

Debt to equity ratio formula & example formula: Debt to equity ratio is calculated by dividing the company’s shareholder equity by the total debt, thereby reflecting the overall leverage of the company and thus its capacity to raise more debt. Microsoft excel provides a balance sheet template that automatically calculates financial ratios such as d/e ratio and debt ratio.

You must check the company’s debt on its balance sheet before investing in its shares. The easiest way to compare direct rivals or track changes in a company's reliance on debt over time is to utilize d/e ratios, which vary by industry. Input both figures into two adjacent cells, say b2 and b3.

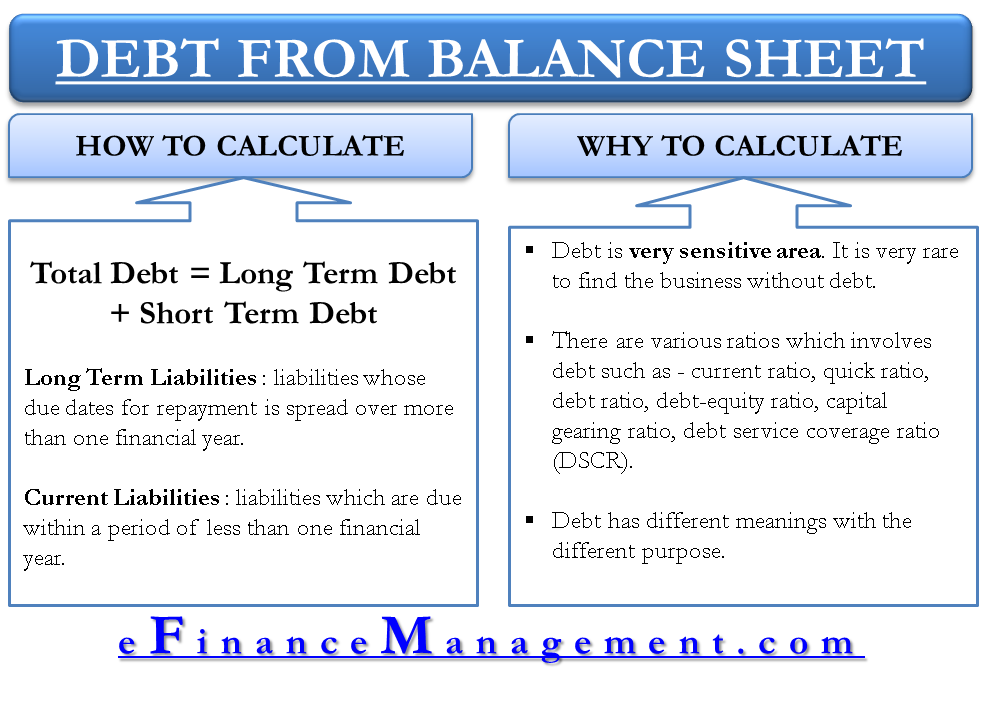

If you are clear on these terms, you can easily understand the calculation of debt. How to calculate debt to equity ratio (d/e)? De ratio= total liabilities / shareholder’s equity liabilities:

The d/e ratio represents the proportion of financing that came from creditors (debt) versus shareholders. Before we explain how to calculate total debt from the balance sheet, it would be necessary to understand the various definitions of debt patiently. D/e ratio calculation:

Here, all the liabilities that a company owes are taken into consideration. The use of borrowed funds with a contractually determined return to increase the ability of a business to invest and earn an expected higher return (usually at high risk). To calculate this ratio in excel, locate the total debt and total shareholder equity on the company's balance sheet.

$36.44 billion / $44.704 billion = 0.82; In this scenario, the company has a debt ratio of 60%, implying that 60% of its assets have been financed through borrowed funds. Or you could enter the values for total liabilities.

The formula of debt/ equity ratio: Both of these values can be found on a company’s balance sheet, which is a financial.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

![DebttoEquity Ratio Calculation and Interpretation Penpoin. [2023]](https://penpoin.com/wp-content/uploads/2022/04/Debt-to-Equity-Ratio-Calculation-and-Interpretation-972x572.jpg)