Marvelous Info About Difference Between Cash Flow And Balance Sheet Audit Compliance Reports

Do dividends go on the balance sheet?

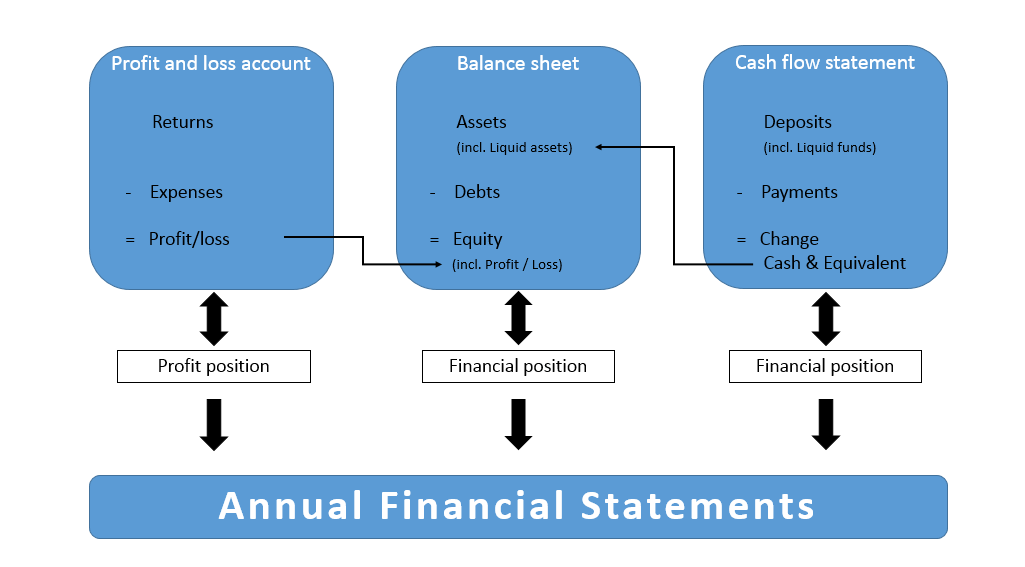

Difference between cash flow and balance sheet. Why do shareholders need financial. The cash flow statement reports the cash generated and. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

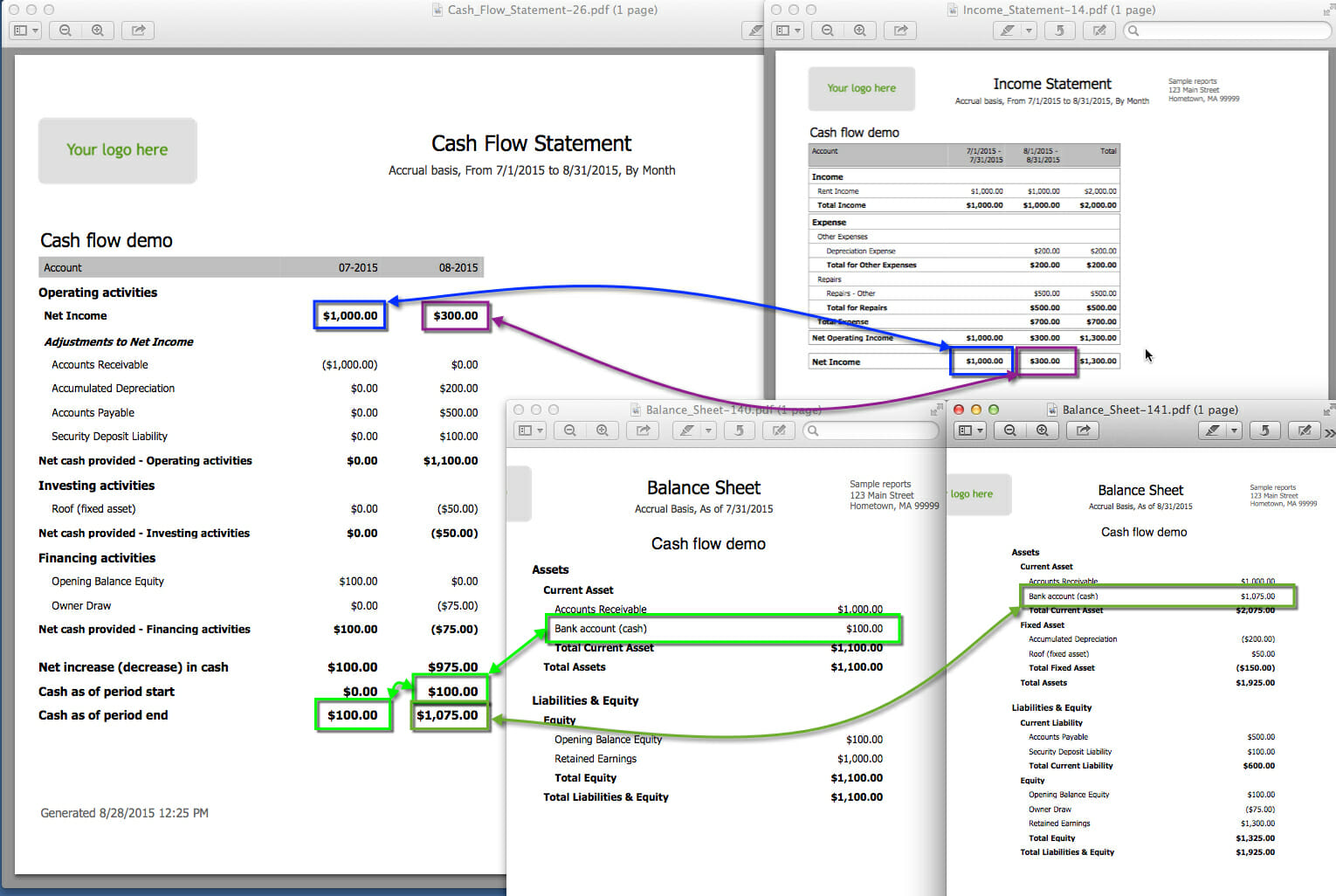

What’s the difference between a cash flow statement and an income statement? Fundamental analysis balance sheet vs. The table below shows the beginning and ending balance sheets of a.

It’s evident that the cash flow statement and balance sheet offer two very. The main things that the two financial reports have in common come from the financing and. Comparing cash flow statement vs balance sheet:

Somer anderson fact checked by ariel courage the cash flow statement and the income statement are integral parts of a corporate balance sheet. A balance sheet shows a company's financial position in terms of how many assets it has, as opposed to liabilities. Both balance sheets and cash flow statements can be used to assess a company’s financial risk.

6 rows a balance sheet is a precise representation of the assets, liabilities, and equity of the. See them explained in detail. The difference between these two indicators is the owner's or stockholders' equity, and it is also shown on the balance sheet.

So the cash flow is simply the difference between the beginning and ending cash balances. To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories: Balance sheet your balance sheet is a snapshot of your business’s assets and liabilities at a specific point in time, such as the end of the month, quarter, or year.

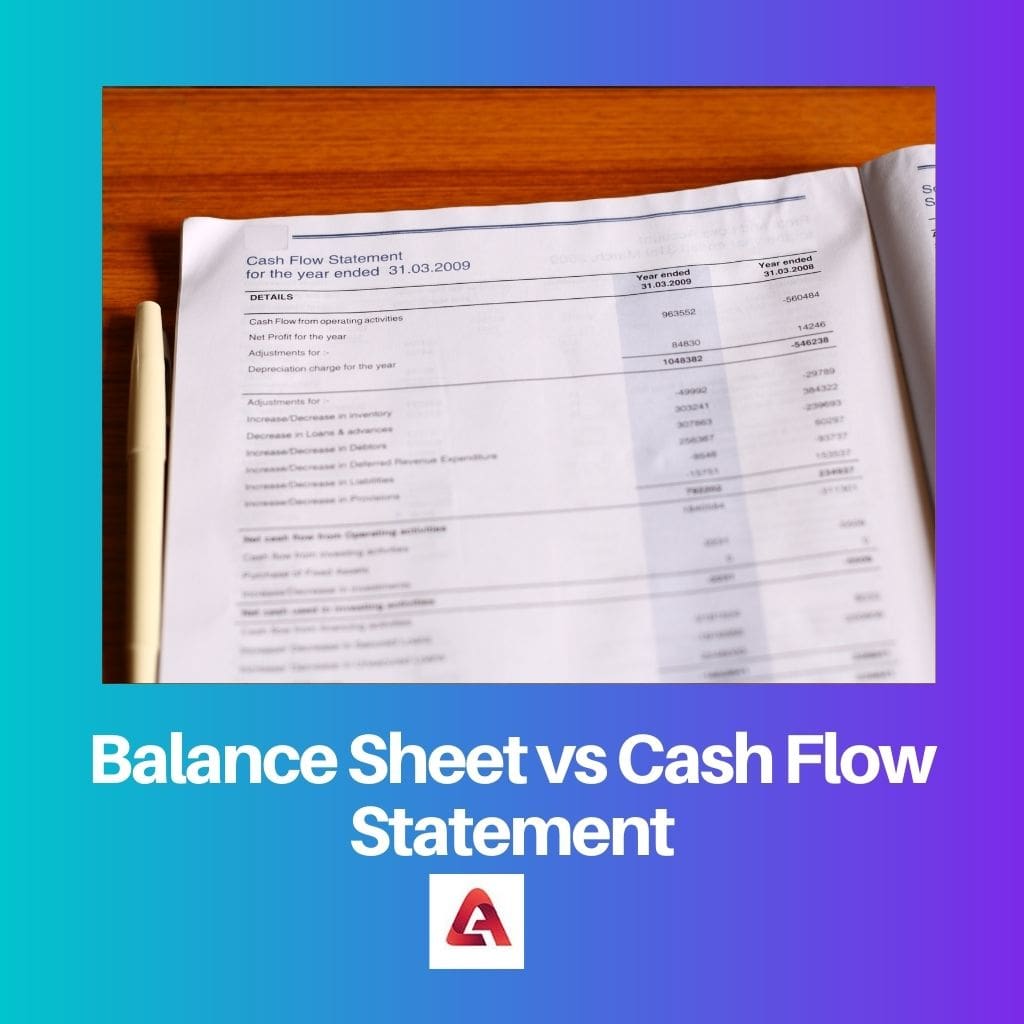

A balance sheet provides a snapshot of a company’s financial position, while a cash flow statement shows the movement of cash in and out of the company. The financial statements are used by investors, market analysts, and creditors to evaluate a company's financial health and earnings potential. The three financial statements are the income statement, the balance sheet, and the statement of cash flows.

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. The balance sheet mainly focuses on the company’s financial position at one particular period, whereas the cash flow statement report examines the company’s cash. Cash flow tracks the movement of money,.

It's also where the operations section of the cash flow statement begins. The biggest difference between a balance sheet and cash flow statement is businesses's financial information in each report.

![[Ultimate] Difference Between Balance Sheet and Cash Flow Statement](https://i.pinimg.com/originals/eb/78/b7/eb78b7fc2d01a284c36cc4ca3ca7bace.png)