Spectacular Info About Types Of Ratios In Financial Management Cash Flow Startup Template

:max_bytes(150000):strip_icc()/ratioanalysis-Final-6b8f05a58b3e4a8b9055000cb874305d.jpg)

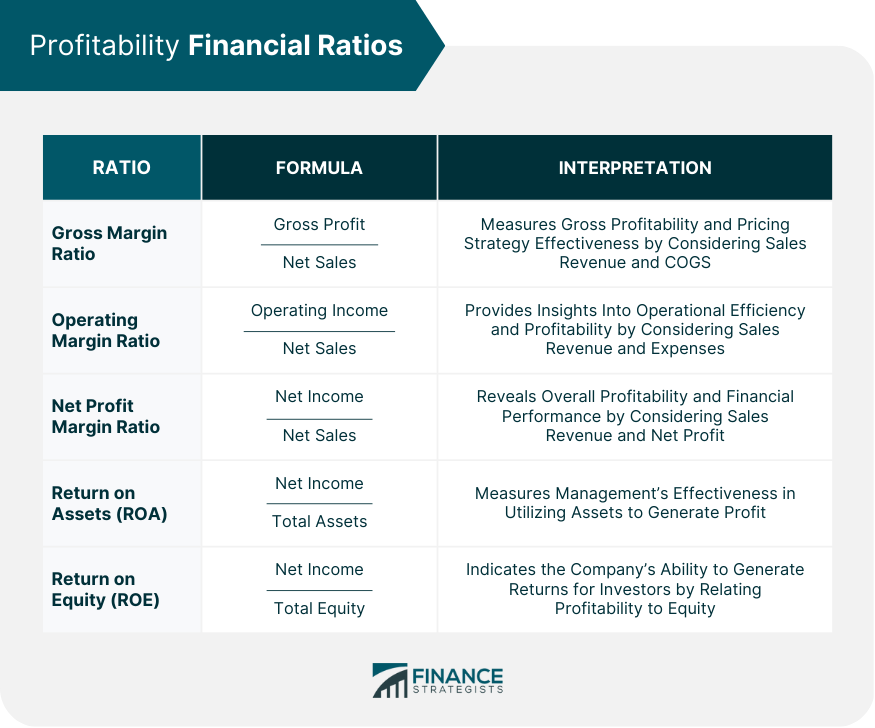

Profitability ratios gross profit rate = gross profit ÷ net sales evaluates how much gross profit is generated from sales.

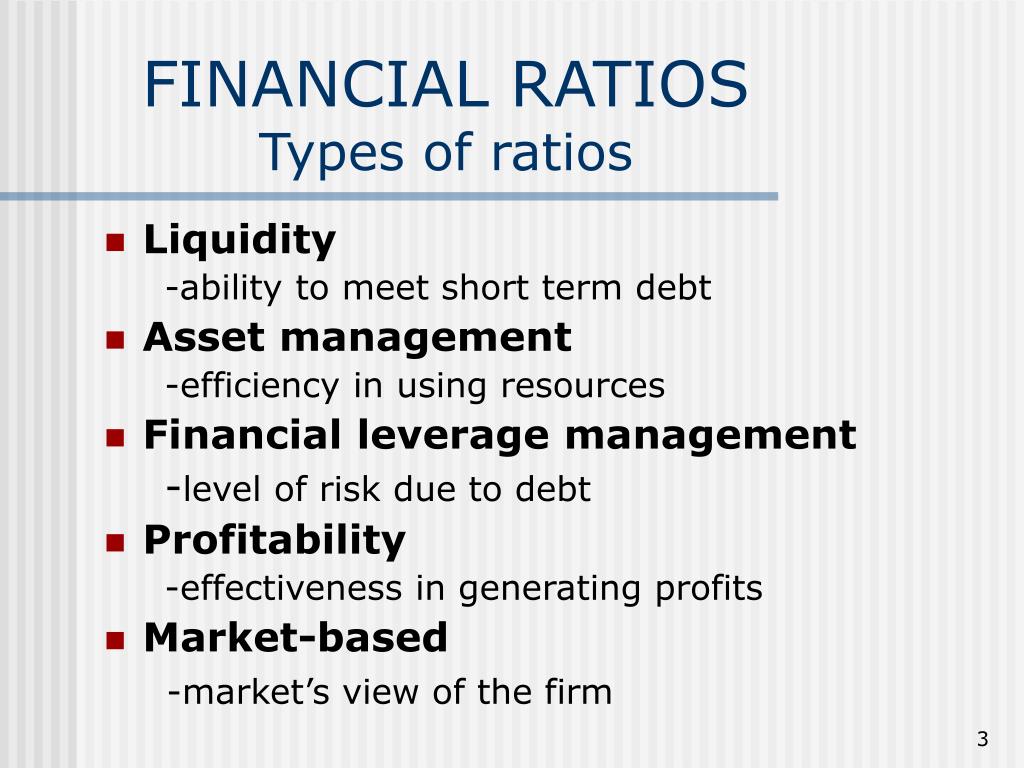

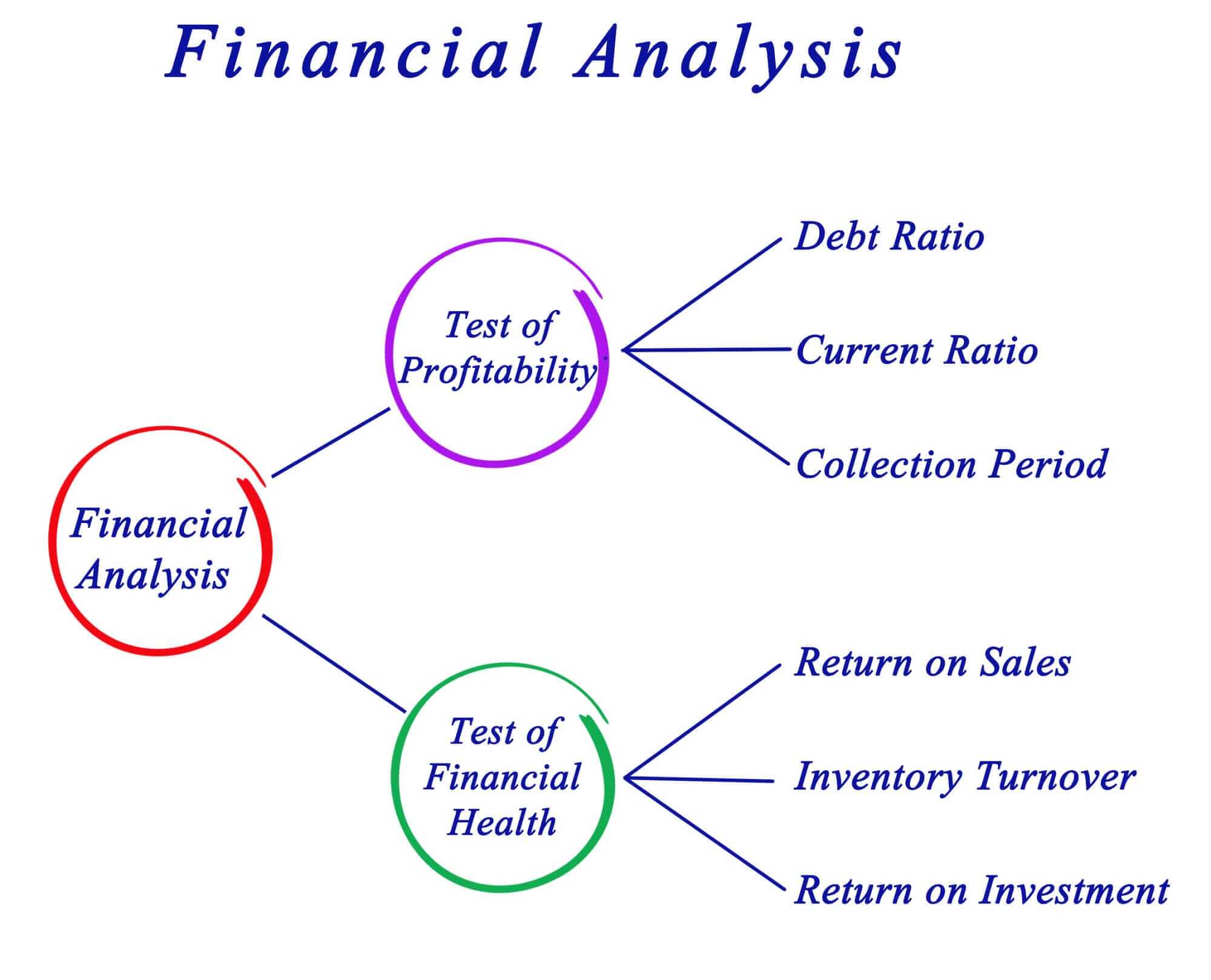

Types of ratios in financial management. While profitability helps understand how profitable a. Top management can use it as. (s)olvency ratios, (p)rofitability ratios, (e)fficiency ratios, (l)iquidity ratios, and (l)everage ratios.

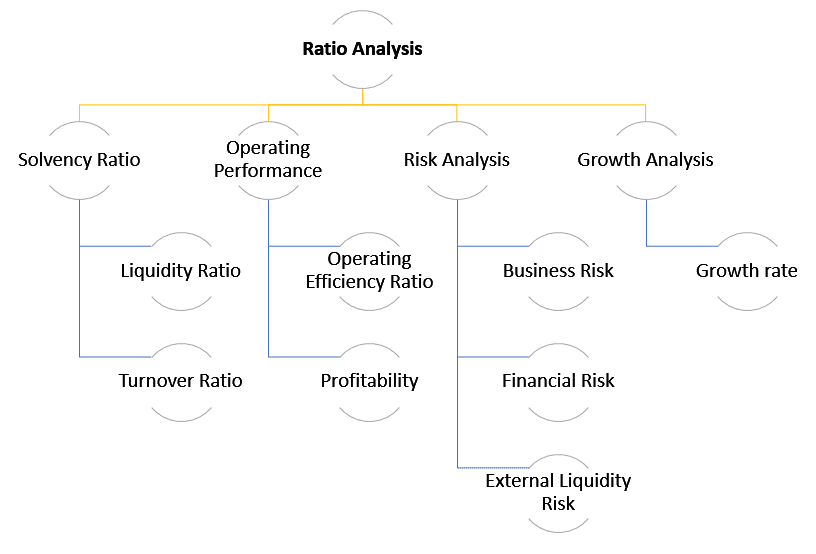

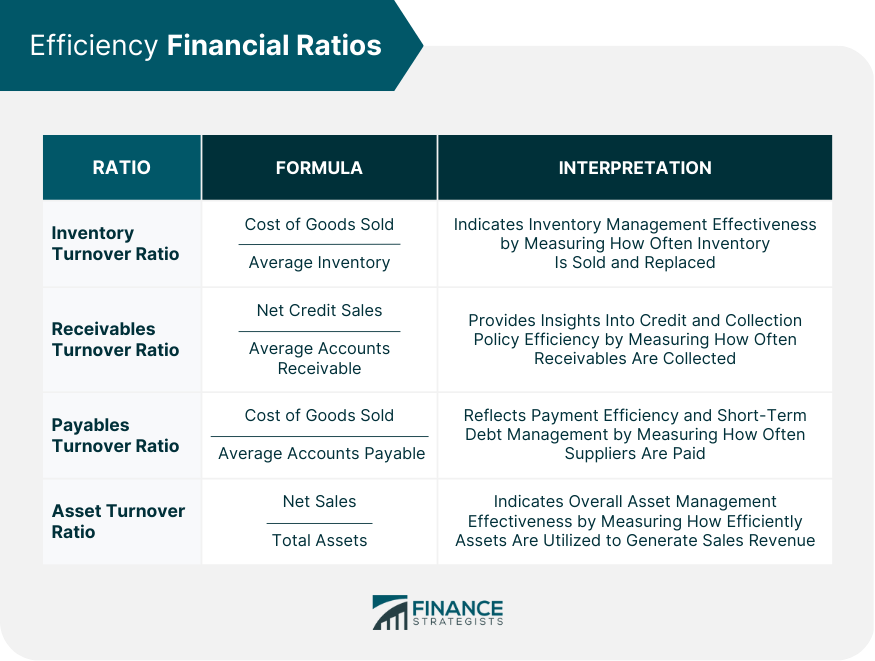

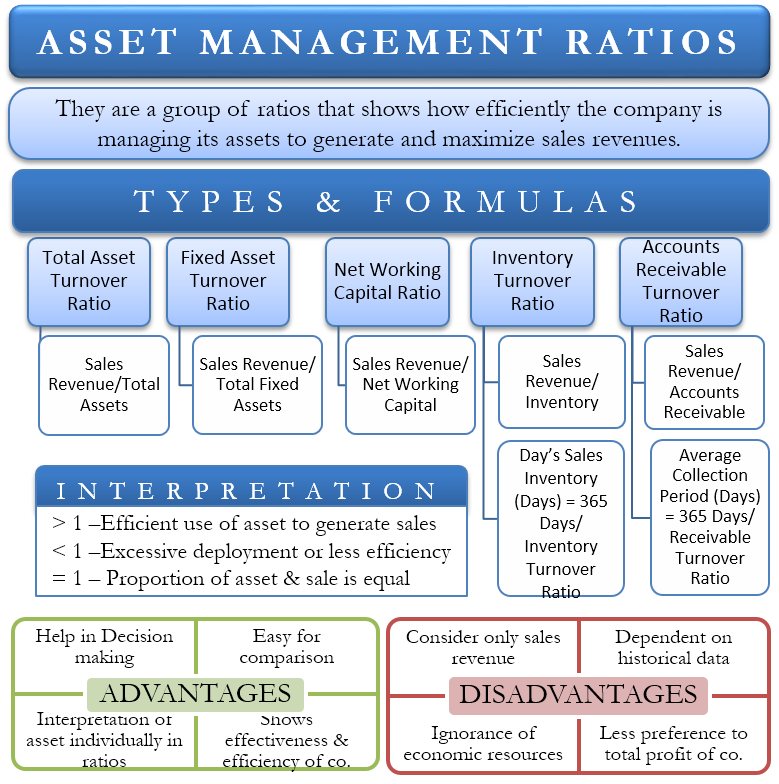

The differences between these categories are explained in the following graphic: Updated jan 27, 2024 frequently asked questions why are financial ratios critical in financial analysis? Liquidity ratios activity ratios (also called efficiency ratios) profitability ratios leverage ratios common ratios used to measure financial health liquidity ratios

This metric can tell you. Examples, formulas, how to calculate; Uses and users of financial ratio analysis.

Profit is both a means and end to the organization. Financial ratio analysis is often broken into six different types: There are numerous financial ratios that are used for ratio analysis, and they are grouped into the following categories:

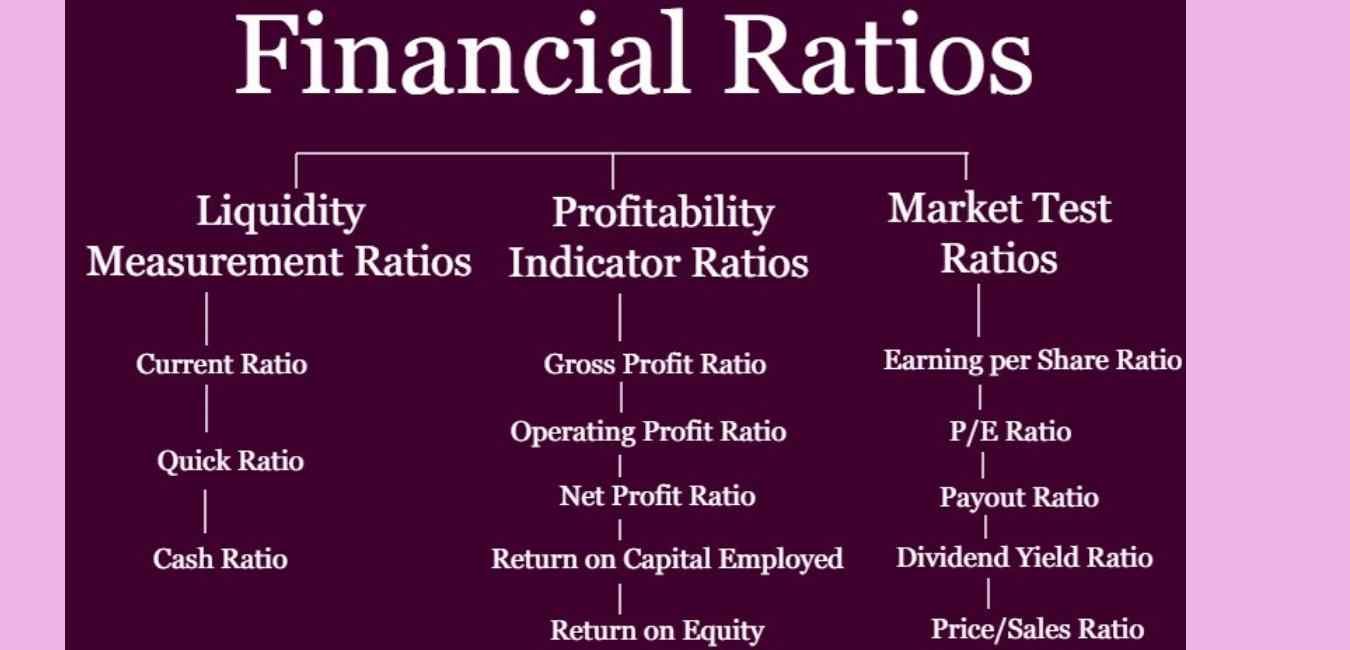

Corporate finance ratios can be broken down into four categories that measure different types of financial metrics for a business: Here we discuss the top 5 financial ratios, including liquidity ratios, leverage ratios, activity ratios, profitability ratios, and market value ratios. The cash ratio will tell you the amount of cash a company has, compared to its total assets.

Financial analysis in companies can benefit from various types of ratio analysis. Each ratio is also briefly described. The common financial ratios every business should track are 1) liquidity ratios 2) leverage ratios 3)efficiency ratio 4) profitability ratios and 5) market value ratios.

Analysts compare financial ratios to industry averages (benchmarking), industry standards or rules of thumbs and against internal trends (trends analysis). What are the four types of financial ratios? The common liquidity ratios are:

What financial ratio measures risk?. The five categories of financial ratios include: There are five main types of financial ratios:

Although there are many financial ratios businesses can use to measure their performance, they can be divided into four basic categories. What are the main uses of financial ratios? Liquidity ratios asses a business’s liquidity, i.e.

Earnings per share (eps) earnings per share or eps measures earnings and profitability. Based on the traditional classification, ratios are classified as: Still wondering what is a financial ratio?