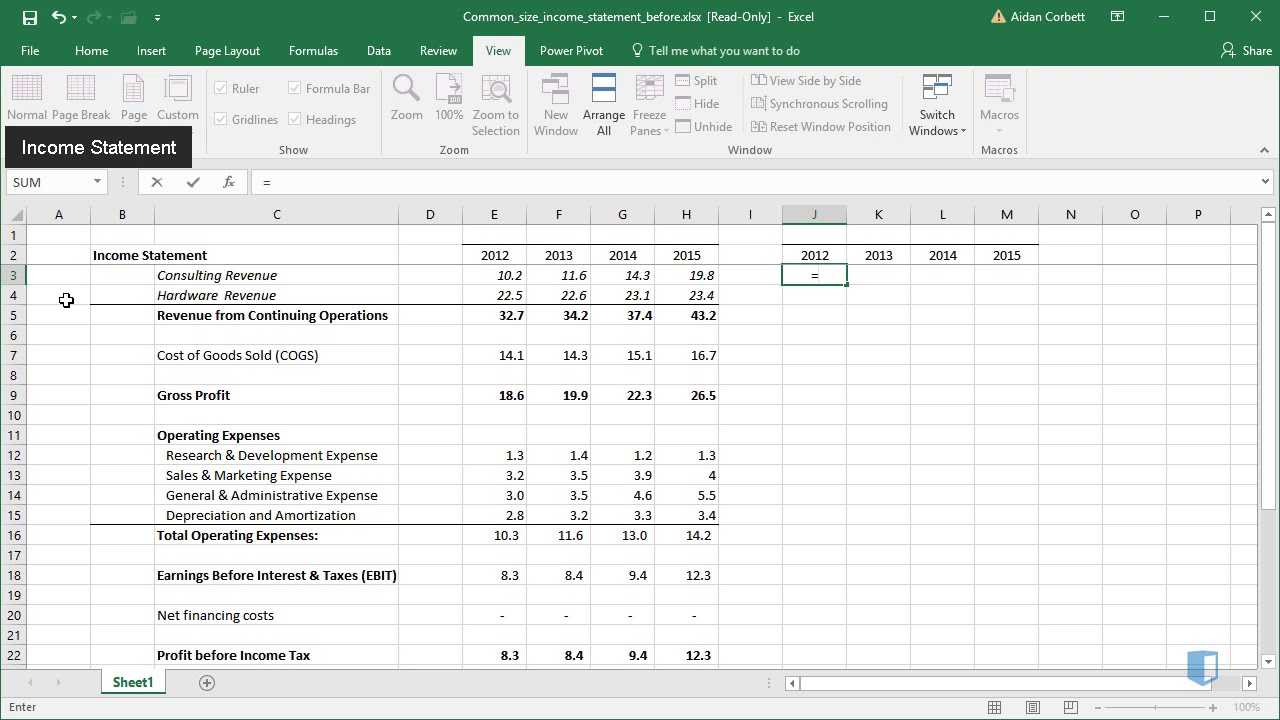

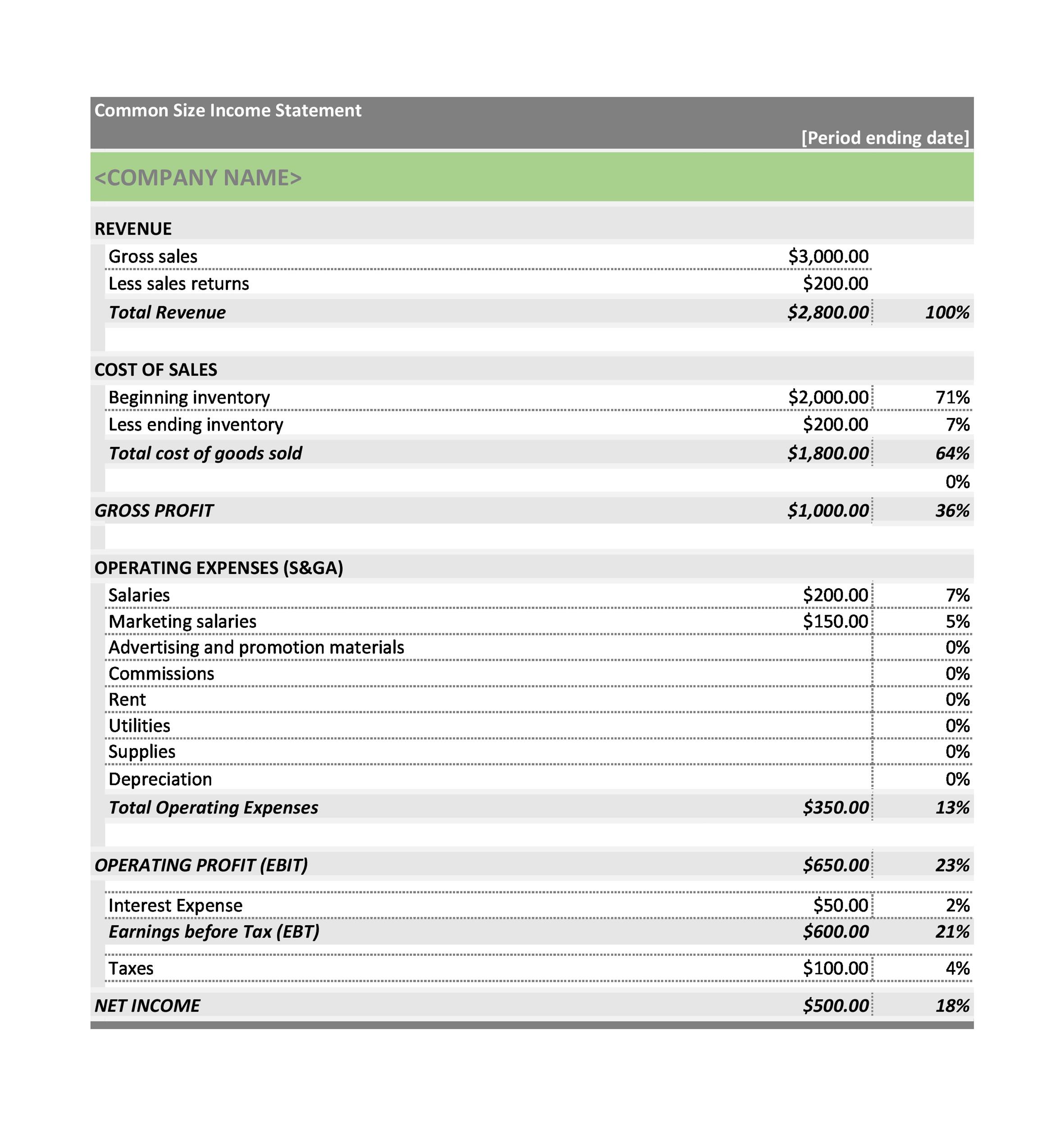

Fun Info About Income Statement Common Size Proprietary Fund Of Cash Flows

Gross profit, operating income, marketing expenses) by revenue or sales.

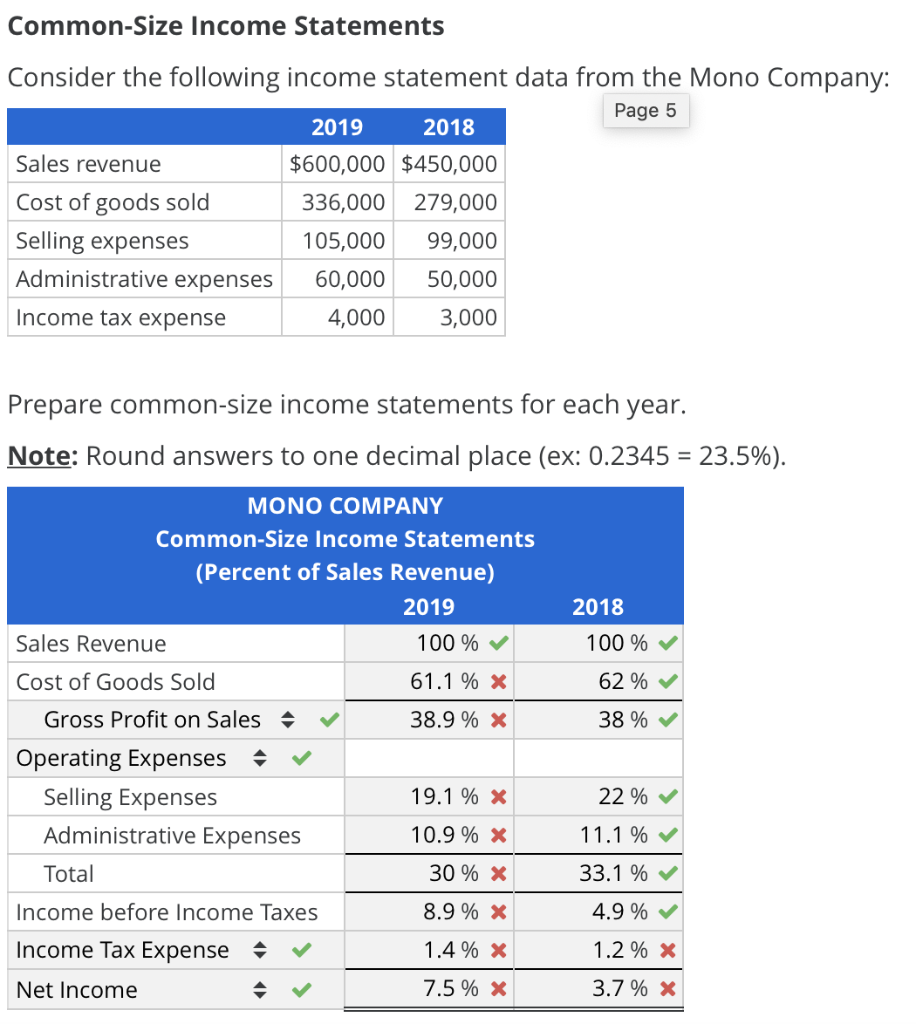

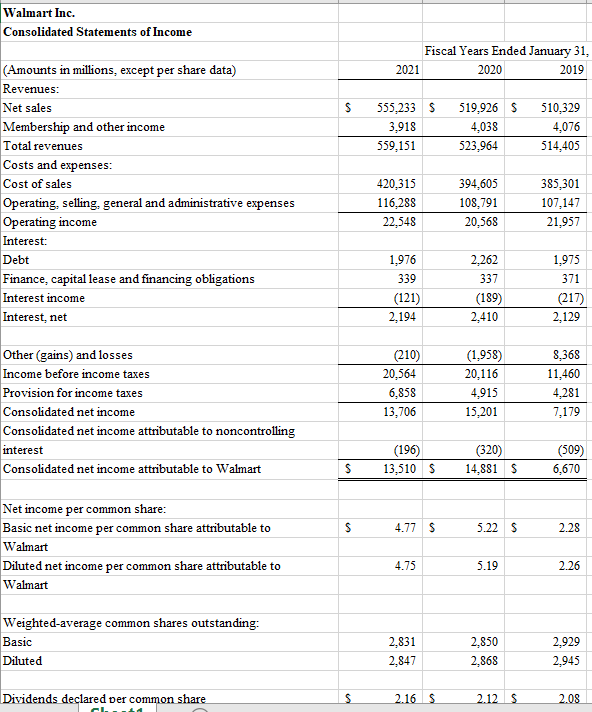

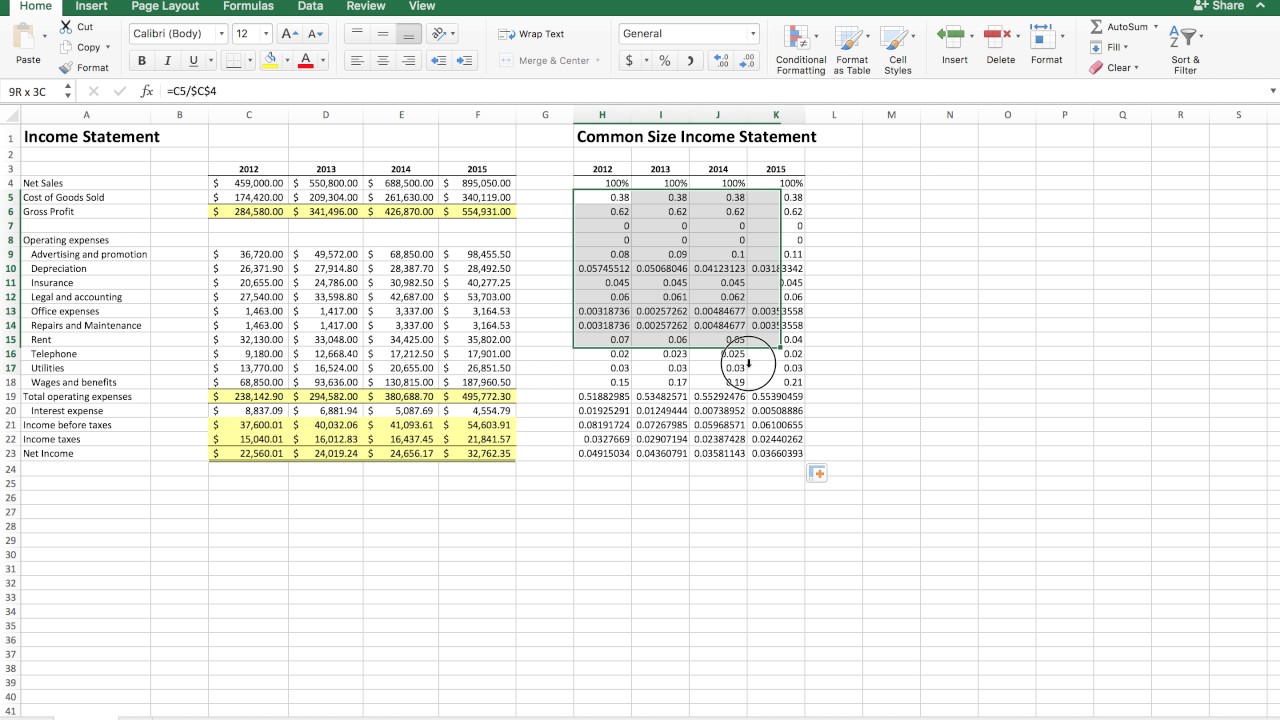

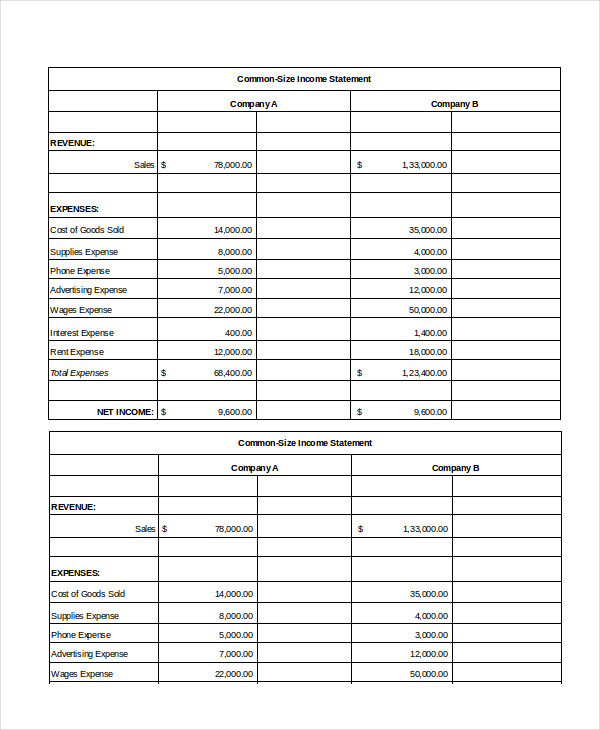

Income statement common size. The common size percentages also help to show how each line item or component affects the. A statement that shows the percentage relation of each income/expense to the revenue from operations (net sales), is known. Expressing each item on the income statement as a percentage rather than in.

To common size an income statement, analysts divide each line item (e.g. Common size income statement: Therefore, the calculation of each line.

A common size income statement makes it easier to see what's driving a company’s profits. Common size simply is when you take each line on the income statement and divide it by the revenue in the same period. This differs compared to traditional financial statements that would use.

A common size financial statement lists any entries as a percentage of a base figure. This type of analysis helps you see how revenue. All three of the primary financial statements — the income statement (or profit and loss statement), balance sheet and statement of cash flow — can be put.

A common size income statement is the presentation of a company’s income and expenses in percentage terms instead of dollar amounts.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)