Ideal Tips About Finance Projections In Business Plan Accumulated Depreciation Balance Sheet Example

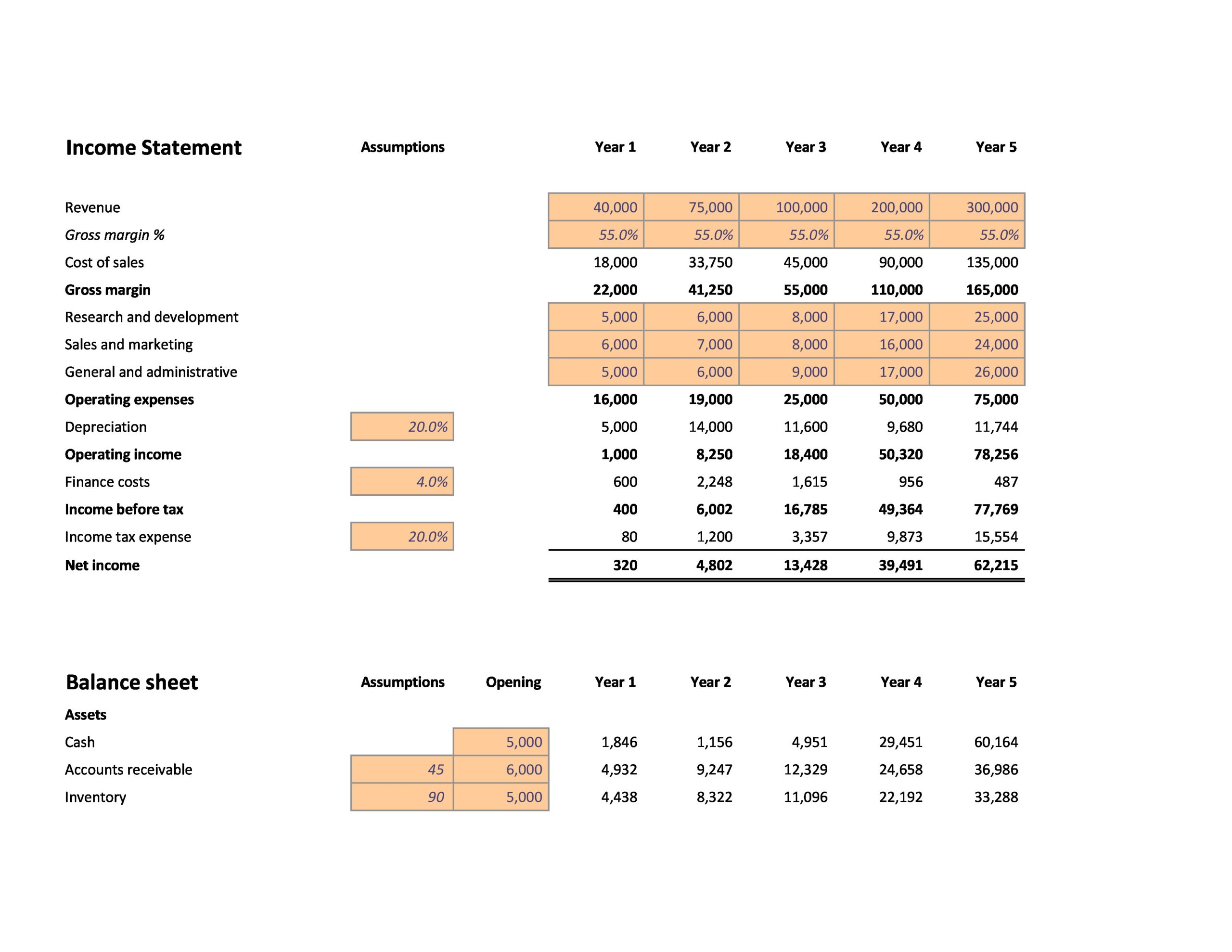

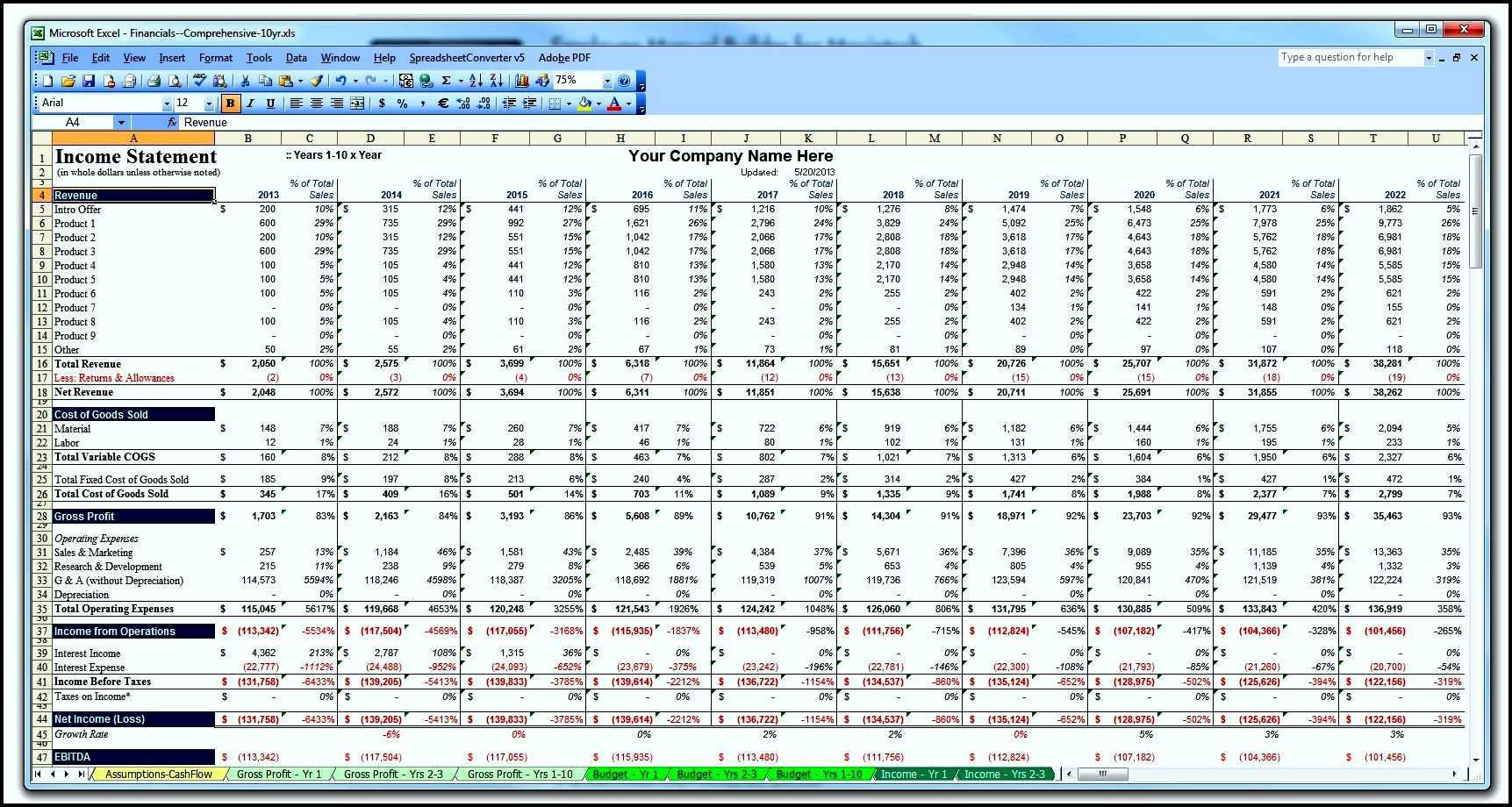

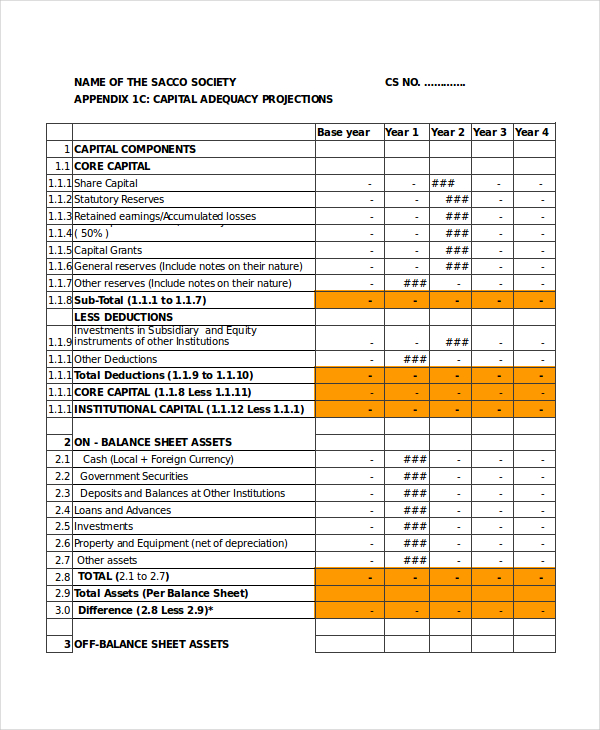

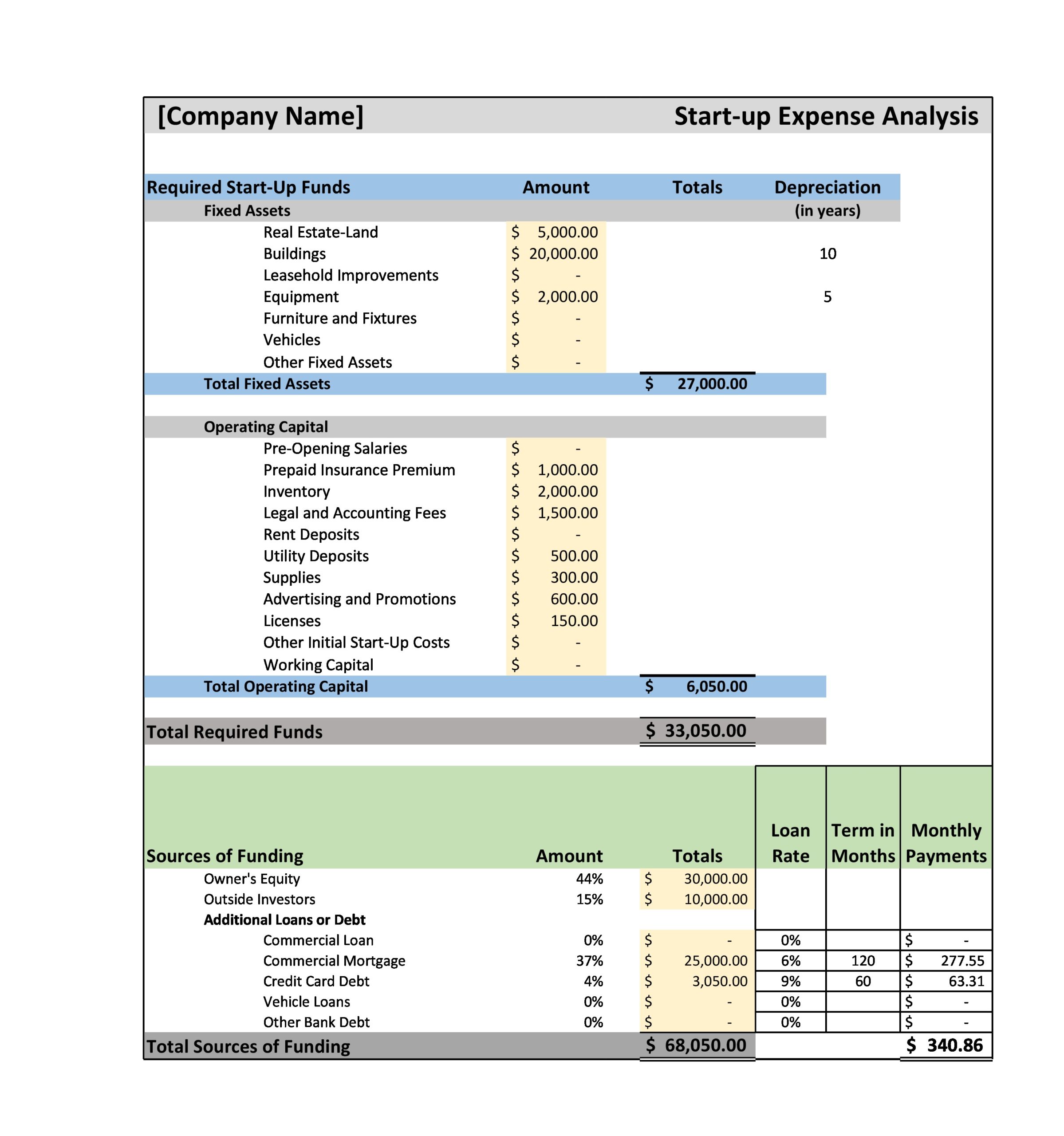

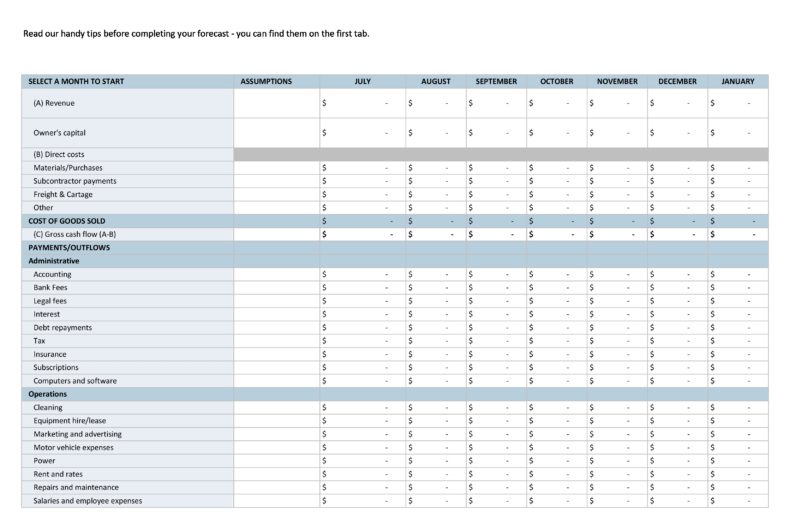

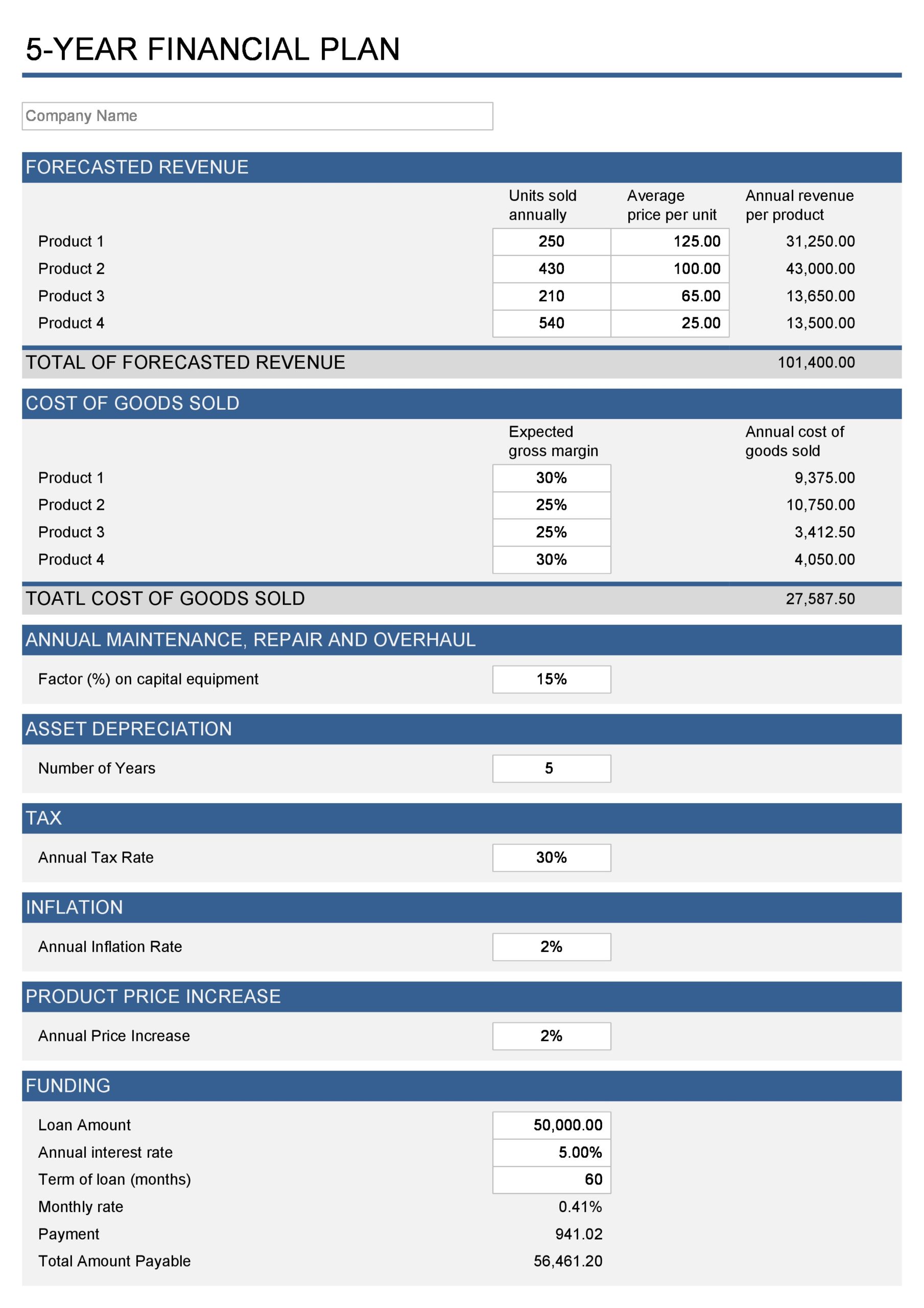

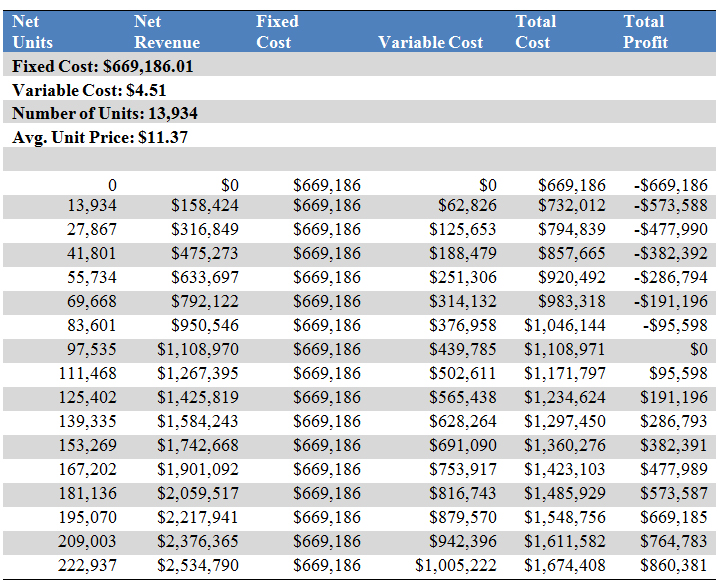

Any projection includes your cash inflows and outlays, your general income, and your balance sheet.

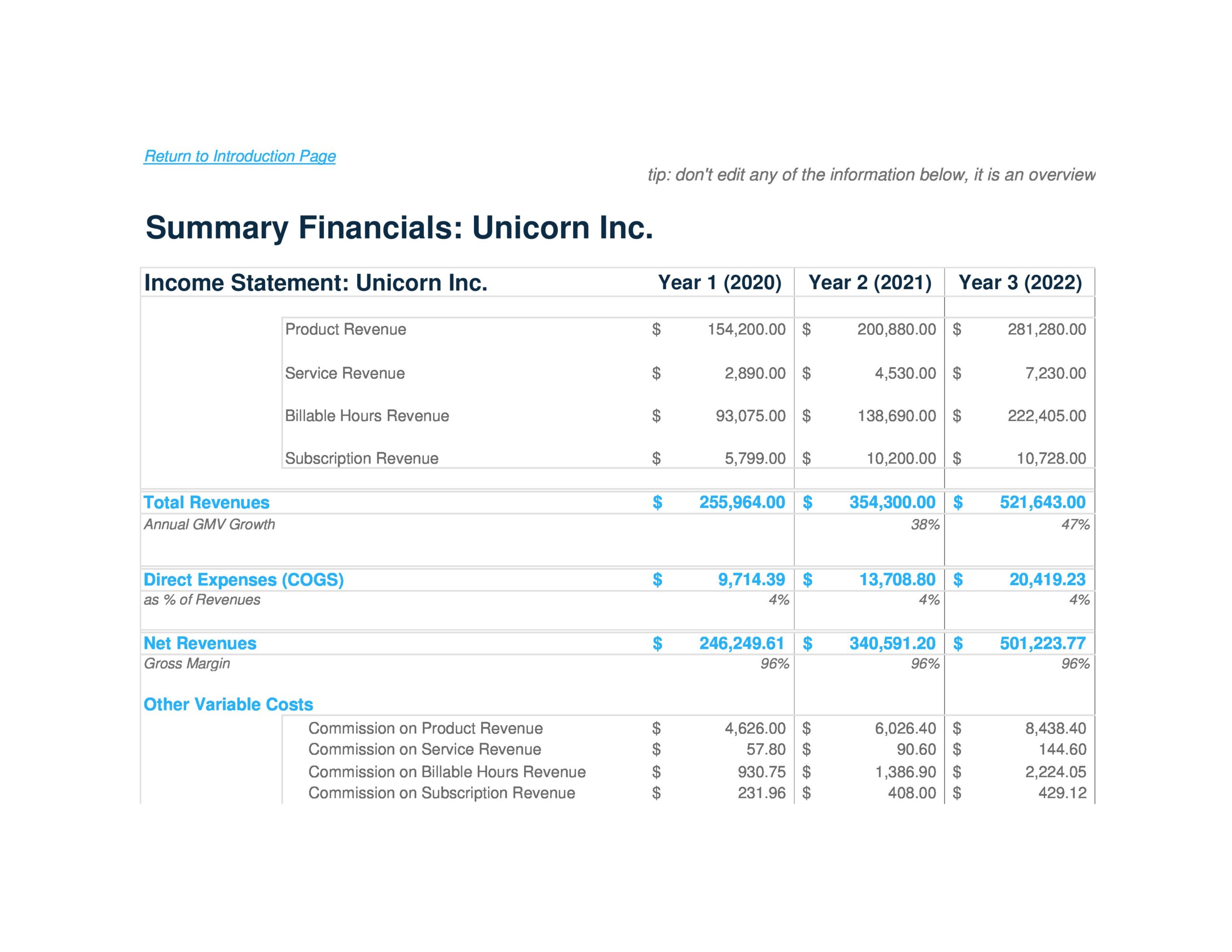

Finance projections in business plan. Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts. For existing businesses, draw on historical data to detail how your company expects metrics like revenue, expenses, profit, and cash flow to change over time. Learn how to create a financial plan to set goals and pursue business loans and investments as part of your business plan.

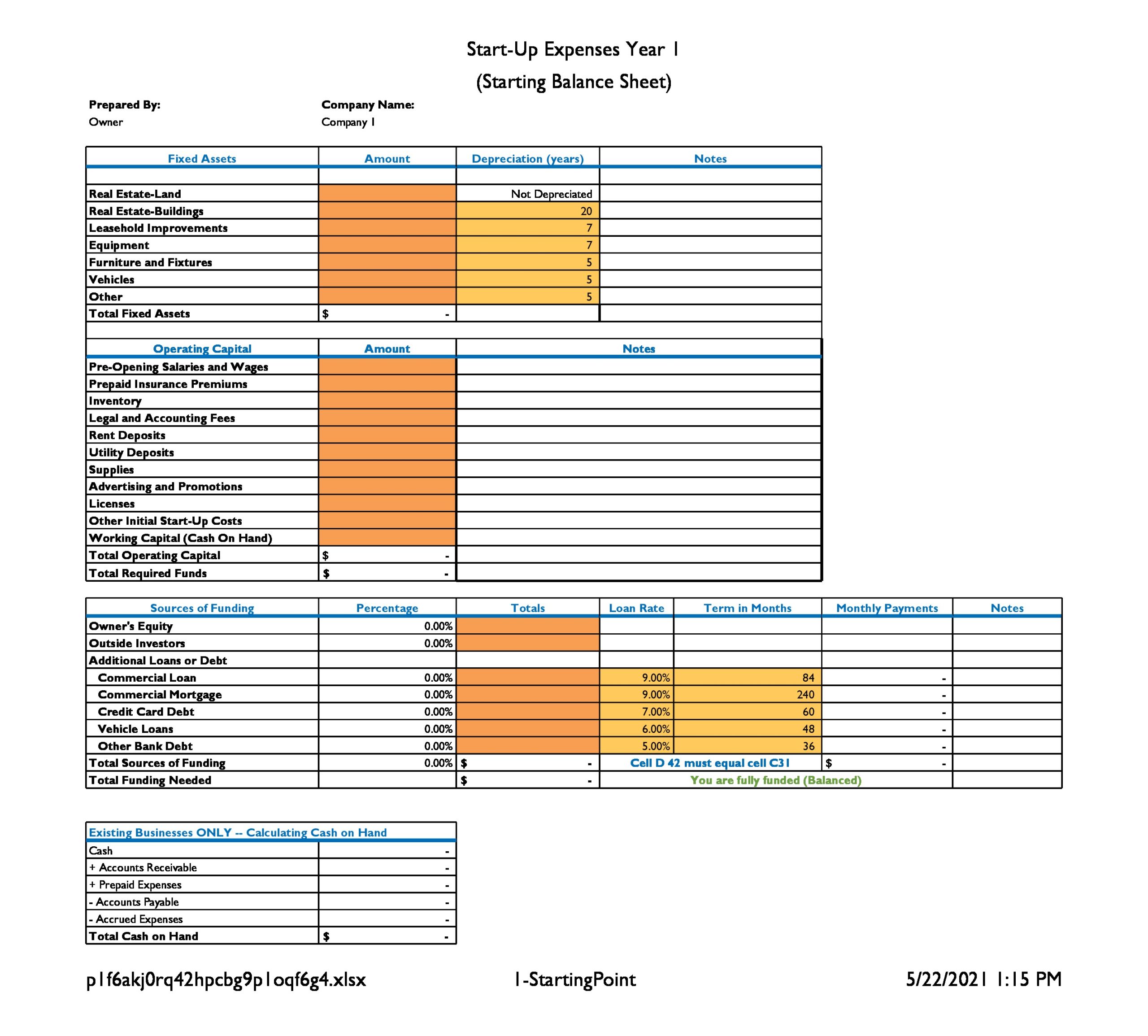

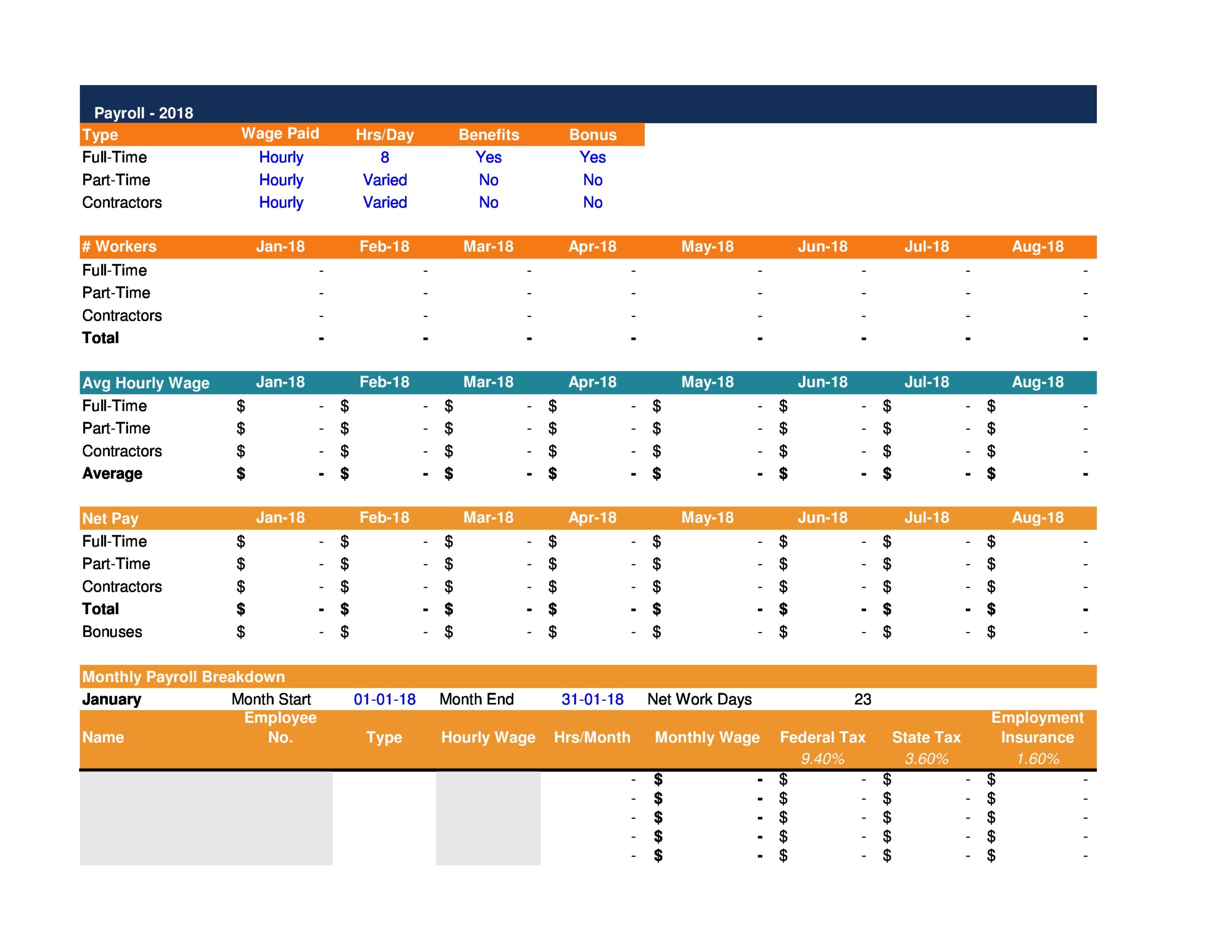

Cash flow statements for the first 3 years of business. Identify financial requirements and objectives. It also helps you budget for daily.

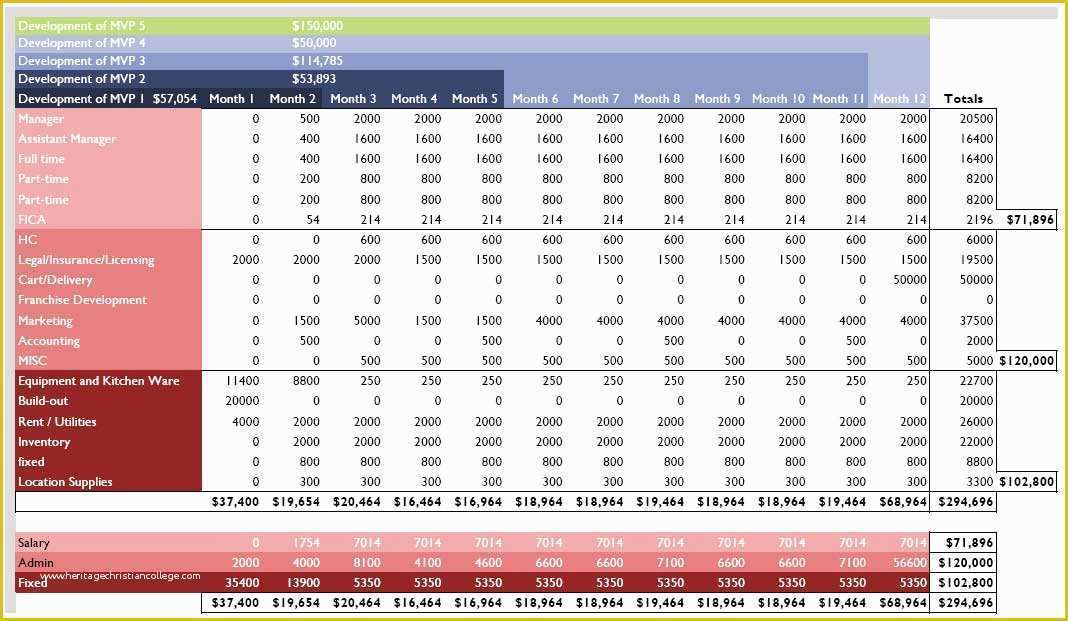

It automates data sourcing and analysis, improves risk. They are typically used for planning, budgeting, and assessing the financial feasibility or potential profitability of new business ventures. Similar to creating a budget, financial projections are a way to forecast future revenue and expenses for your business.

He highlighted a relatively new economic model that has proven to be more timely than the. They are perfect for showing bankers and investors how you plan to repay business loans. The central bank's 11 rate hikes since then have helped bring down the annual inflation rate to 3.1% in january from a high of 9.1% in june 2022, but january's number was higher than economists.

This financial plan projections template comes as a set of pro forma templates designed to help startups. A good financial plan helps you manage cash flow and accounts for months when revenue might be lower than expected. The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Find the latest zimmer biomet holdings, inc. Financial projections are an estimate of your company’s future financial performance through financial forecasting. Download our ultimate business plan template here

A business financial plan typically has six parts: It's a good practice to provide quarterly or monthly projections for the first year and annual projections for the four years after that. They can also be used to make informed decisions about the business’s plans.

(zbh) stock forecast based on top analyst's estimates, plus more investing and trading data from yahoo finance What are business plan financial projections? Financial projections are estimates or forecasts of a business’s revenue, expenses, and capital costs over a specific period in the future.

These projections are forecasts of your cash inflows and outlays, income and balance sheet. One of its main components should be financial projections for your first two years. Financial projections are the most common way to present financial information to investors.

Explore our comprehensive workflow for creating accurate and robust business plan financial projections, factoring in various economic scenarios and industry standards. If you’re applying for a business loan with a bank or other financial institution, they’ll likely want to see financial projections in your business plan. This projection signifies the financial health of your business and plays a vital role in.

![Faire son Business Plan le guide ultime + exemples [2020]](https://www.matthieu-tranvan.fr/wordpress/wp-content/uploads/2020/03/previsionnel-business-plan.png)