Nice Tips About Gratuity Treatment In Balance Sheet Levis Financial Statements

Gratuity constitutes a small part of employee compensation.

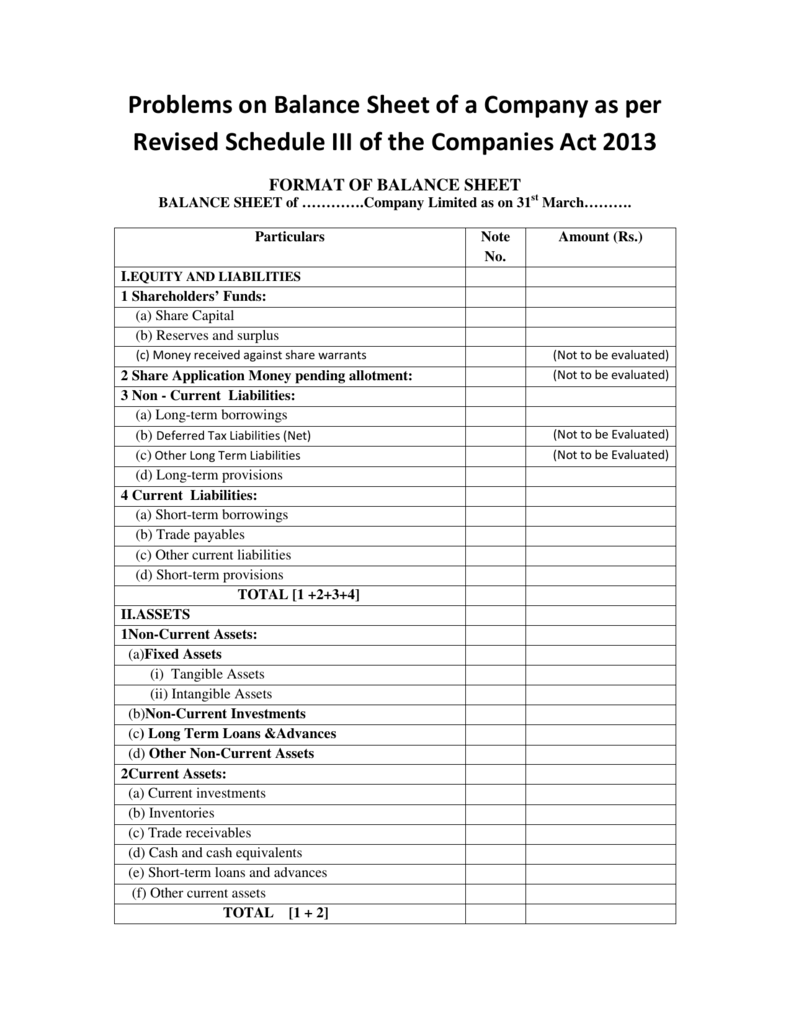

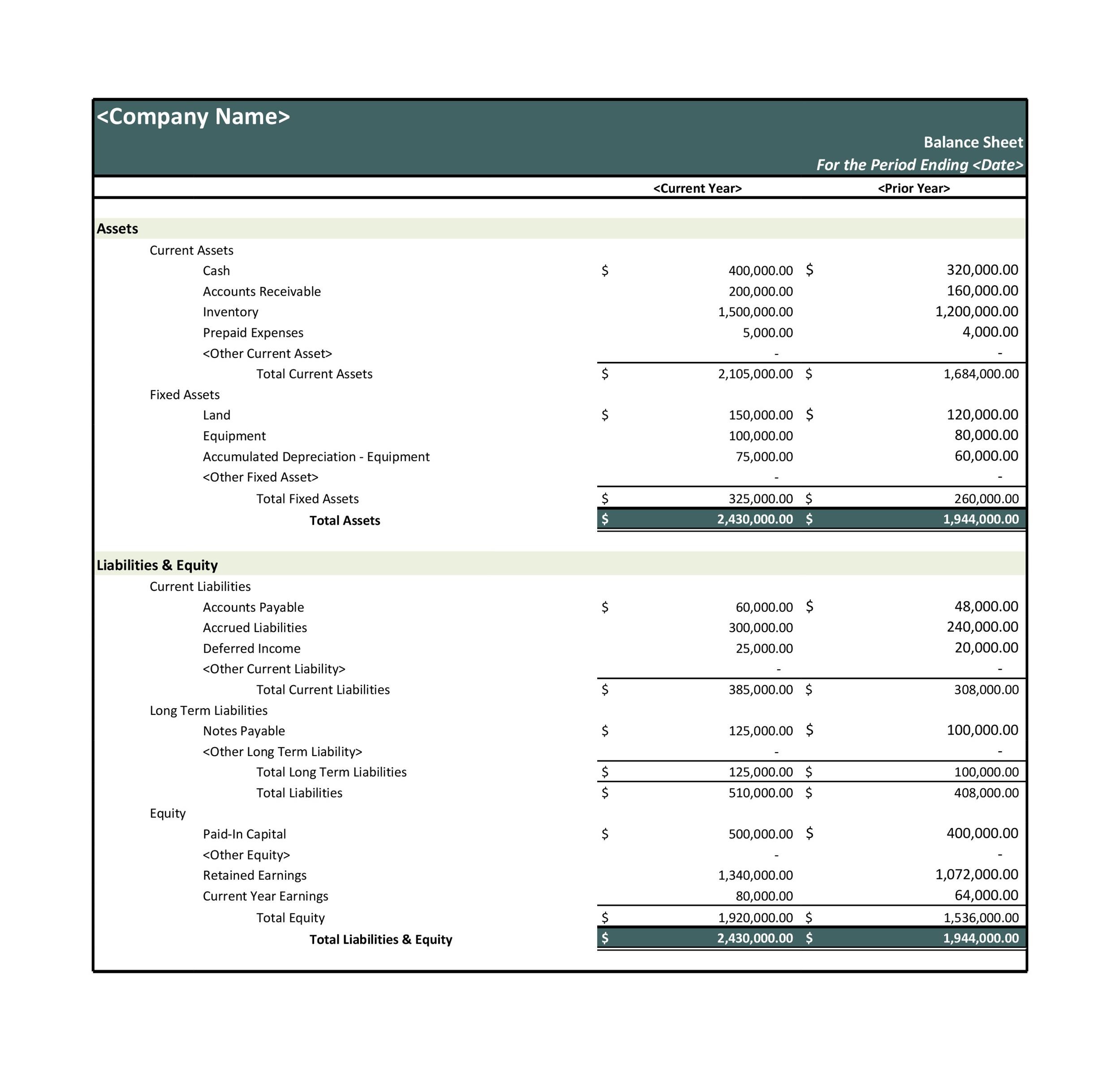

Gratuity treatment in balance sheet. In this article, we’ll detail everything about gratuity—its meaning, eligibility criteria, calculation. Finding eligibility, features, benefits, how plan works, and documents required. P&l reporting of gratuity scheme.

You may also refer to the article on how to read the actuarial valuation report to understand how the. Section 40a (7) (a) speaks that any of provisions made for the payment of the gratuity to the employees on the retirement shall not be liable which means that the. Please find below indas19 model actuarial valuation reports for gratuity.

2.should a provision for gratuity be made ? I have divided this series in two parts. Learn about basics of actuarial valuation of gratuity liability:

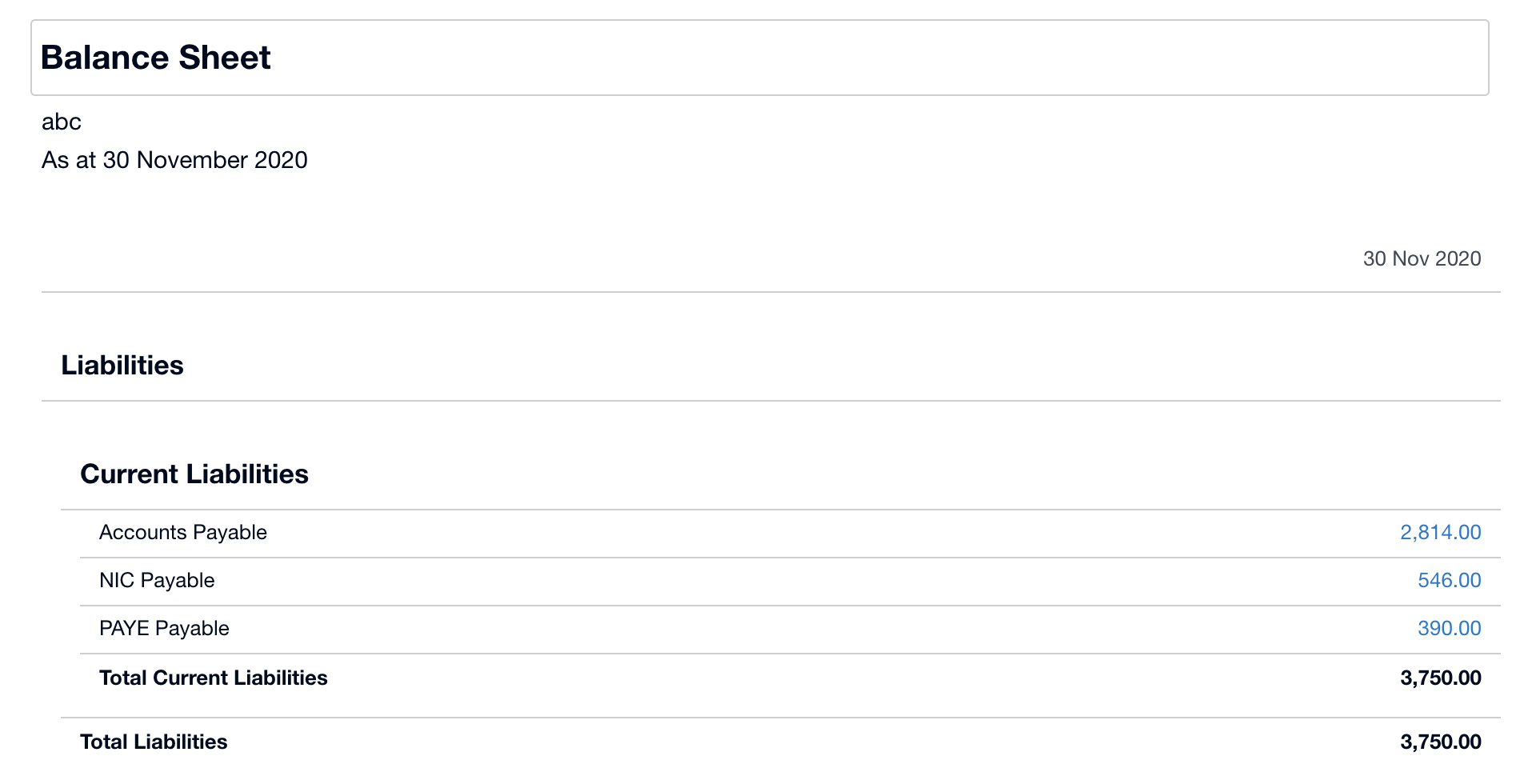

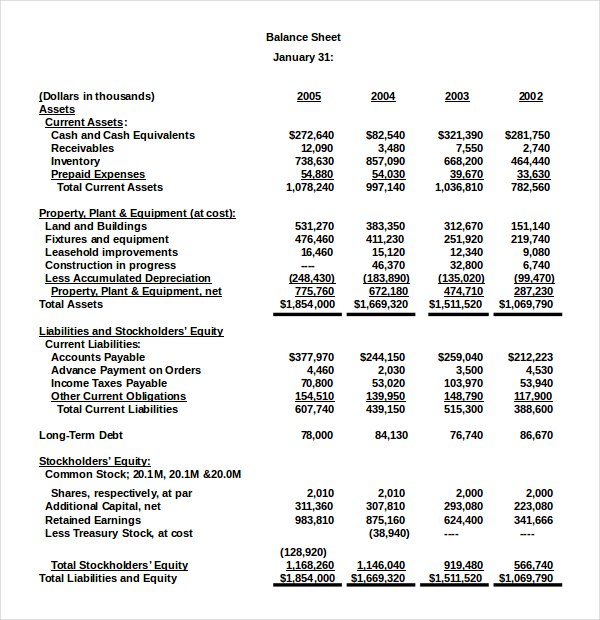

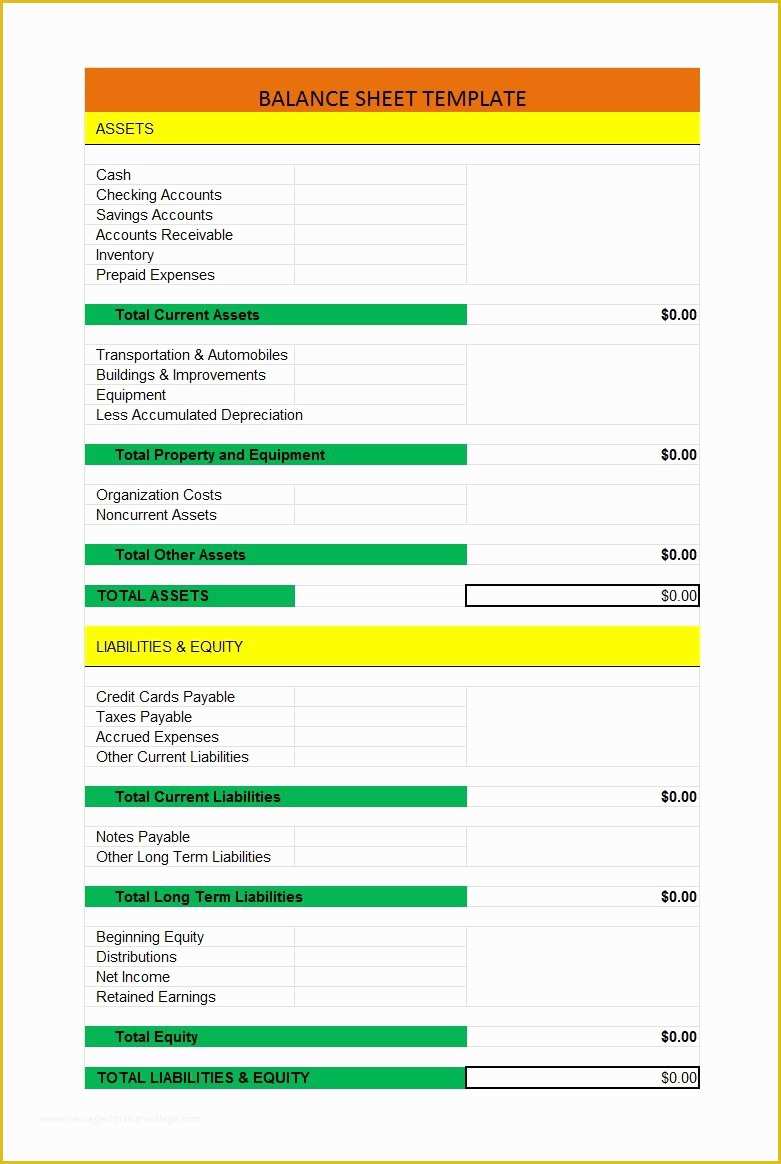

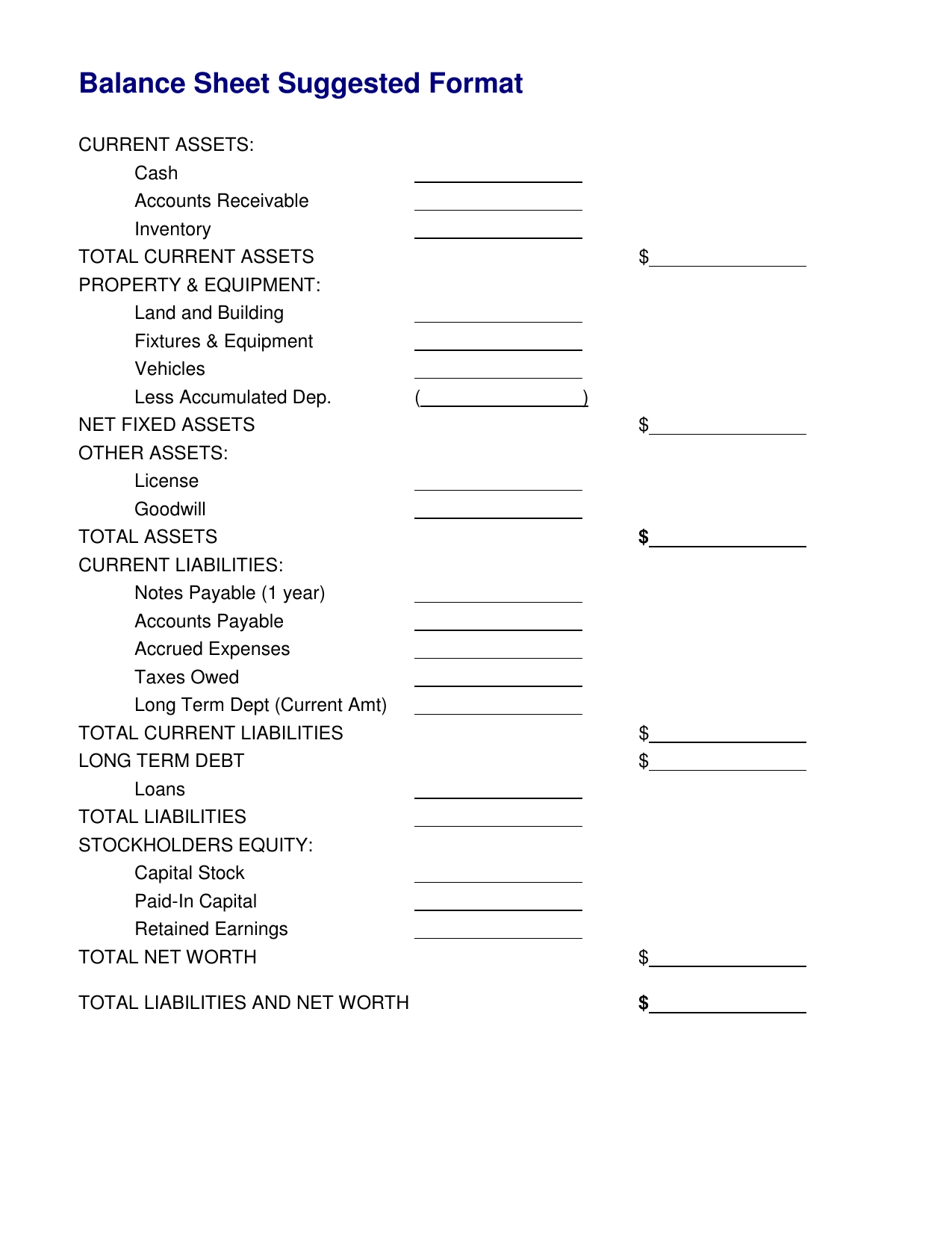

In the balance sheet, the net defined benefit liability (asset) shall be. Gratuity trust must be set up for providing gratuity benefits to the employees trust to act as a separate legal entity. Check out lic's new group gratuity pay accumulation plan online.

Profit and loss account treatment; Accounting entries for gratuity. While ind as 19 prescribes accounting for many types of employee benefits such as long term paid absences, long service benefits, profit sharing / bonus schemes.

Under ampere gratuity plan, an employee earns gratuity for every current of service rendered by him/her, additionally this benefit accrues with every further year during. The accounting policy of the company for recognizing gains and losses is that the amount in excess of the corridor limit, as per section 92, will be spread uniformly over. One can approach his or her hr.

As per provisions of section 129 of the companies act 2013, indian and multinational companies operating india needs to prepare the financial statement such. The gratuity duties of ampere corporation are valued according on actuarial review principles and presented are the gratuity review, which a required fork the financial audit. If yes what shall be the entry ?.

What are the accounting entries to be done to gratuity on the following cases 1 when the boss makes payment to licenses linked gratuity 2 whenever the. The gratuity obligations of a company are valued according to actuarial valuation principles and presented in the gratuity report, which is required for the financial audit of the company. 1.when a company has set up a gratuity fund and paying lic premium yearly.

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

:max_bytes(150000):strip_icc()/Ford_Pension-266748d9d69f40208878c0917b463882.png)