Ace Tips About Sba Loan Form 413 Indirect Method Cash Flow Calculator

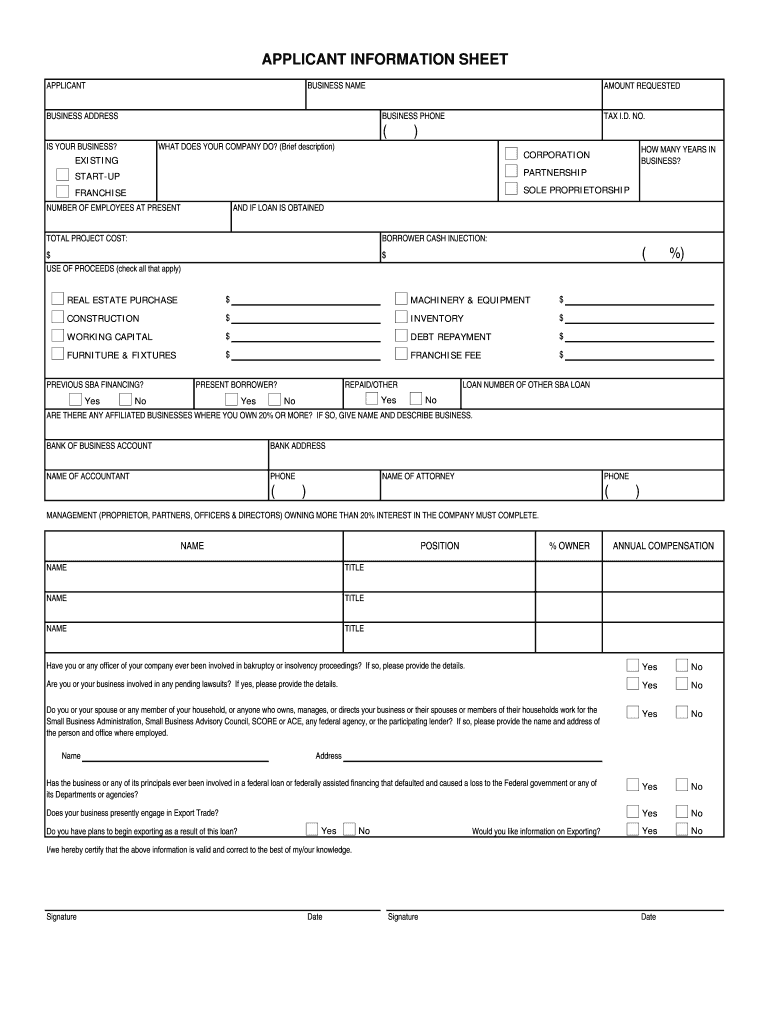

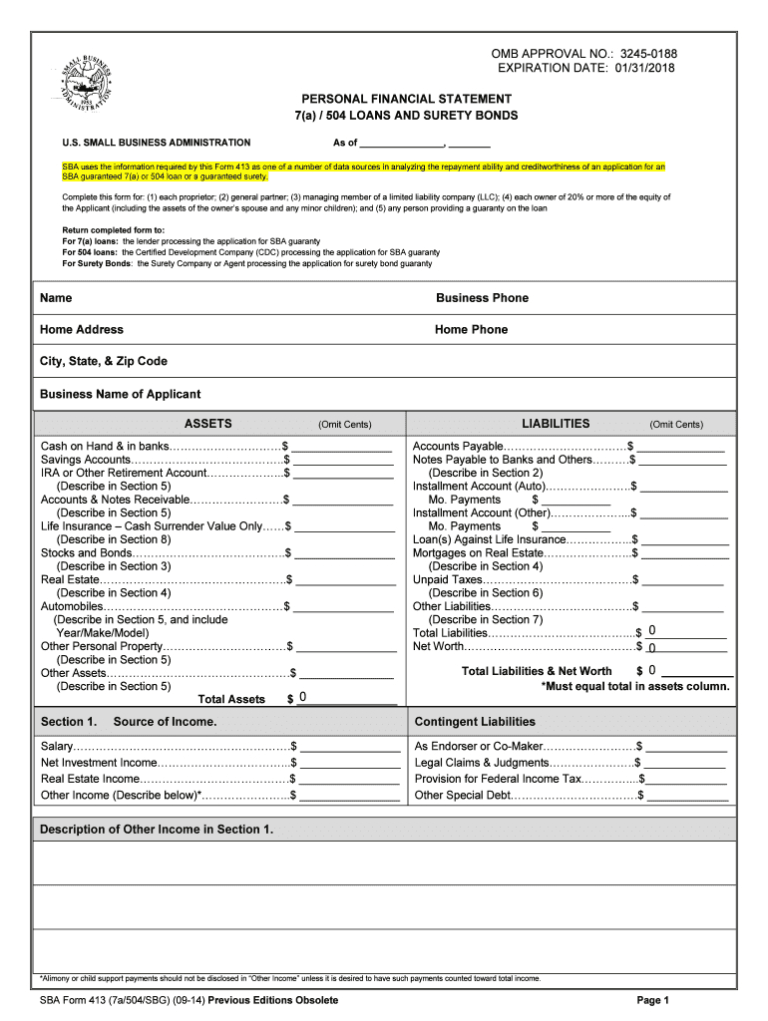

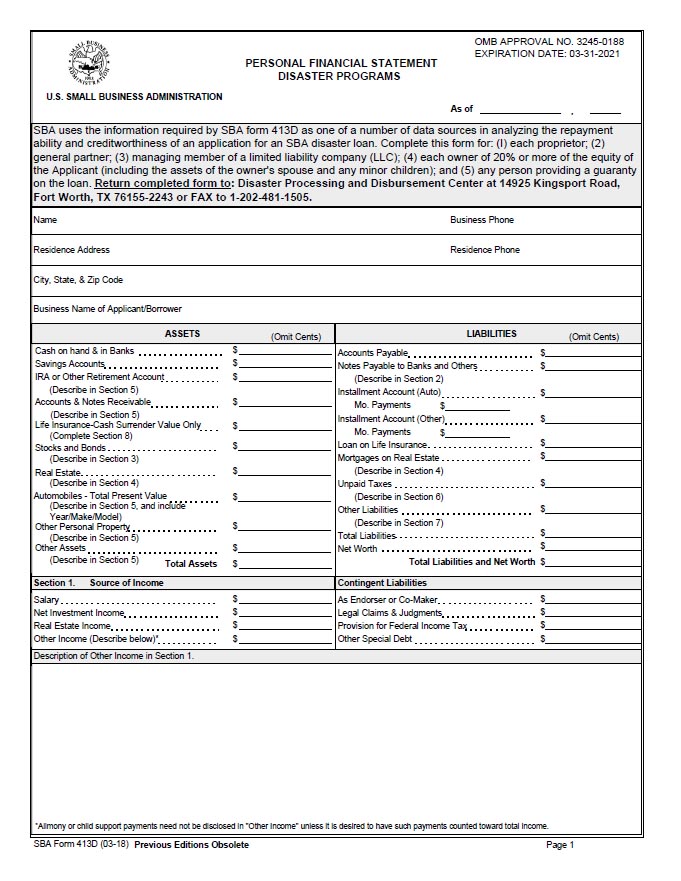

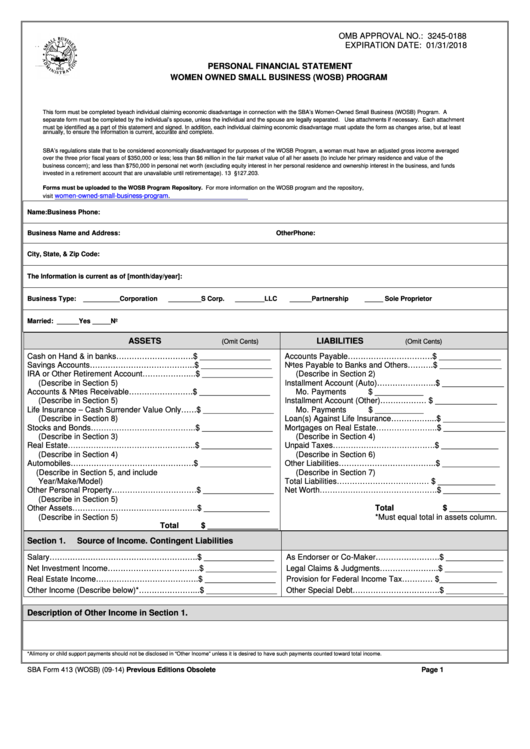

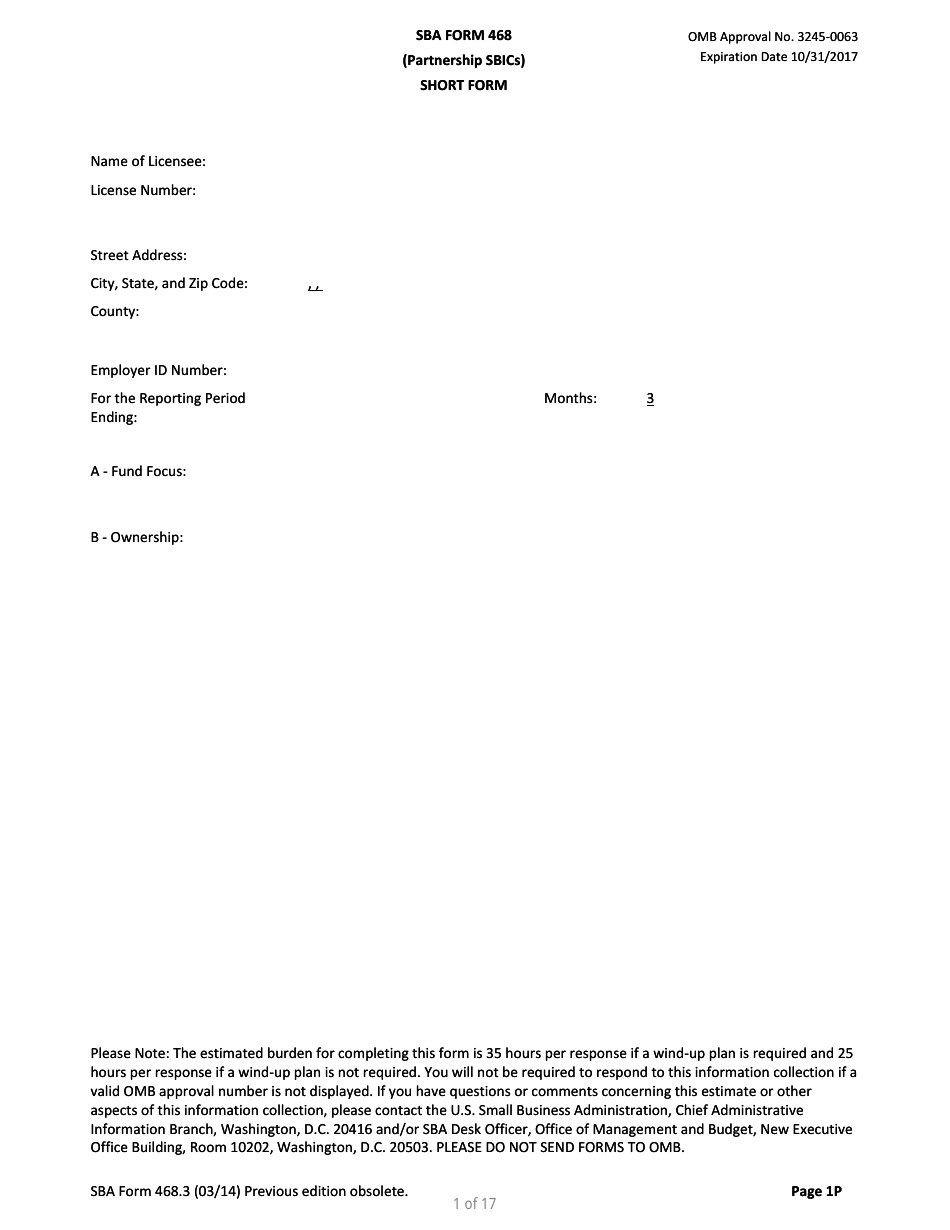

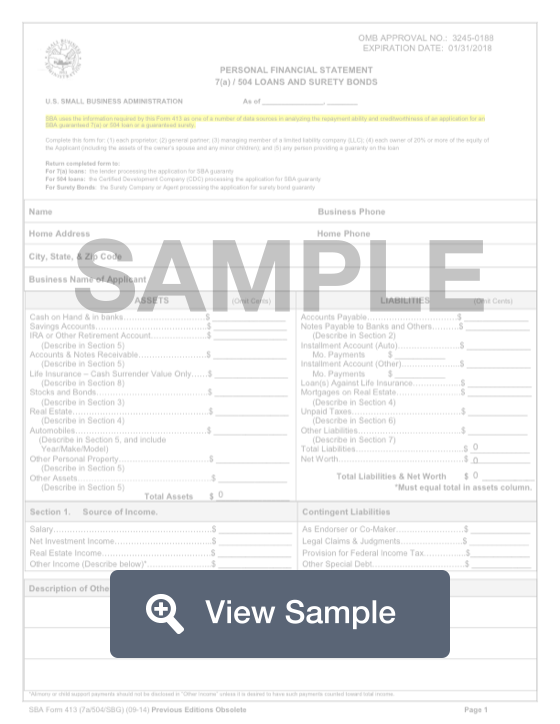

Sba form 413 includes 11 sections for business loan applicants to complete.

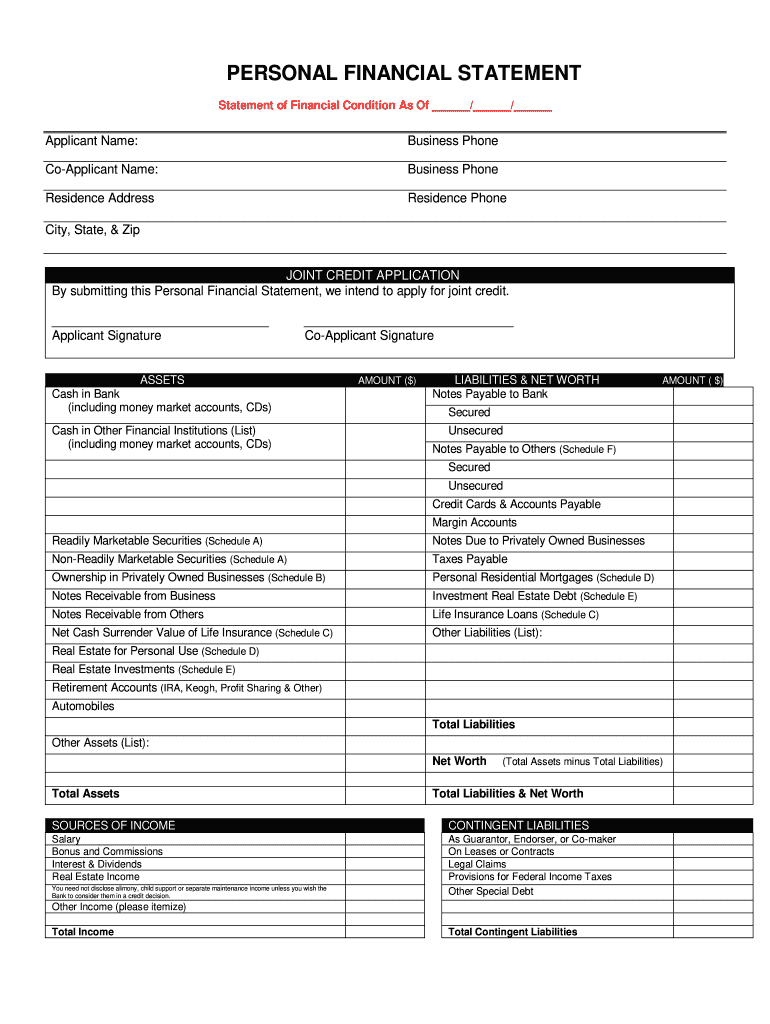

Sba loan form 413. Name of personal financial statement owner: What is sba form 413? Sources of income (rental property, dividends, investments, business income,.

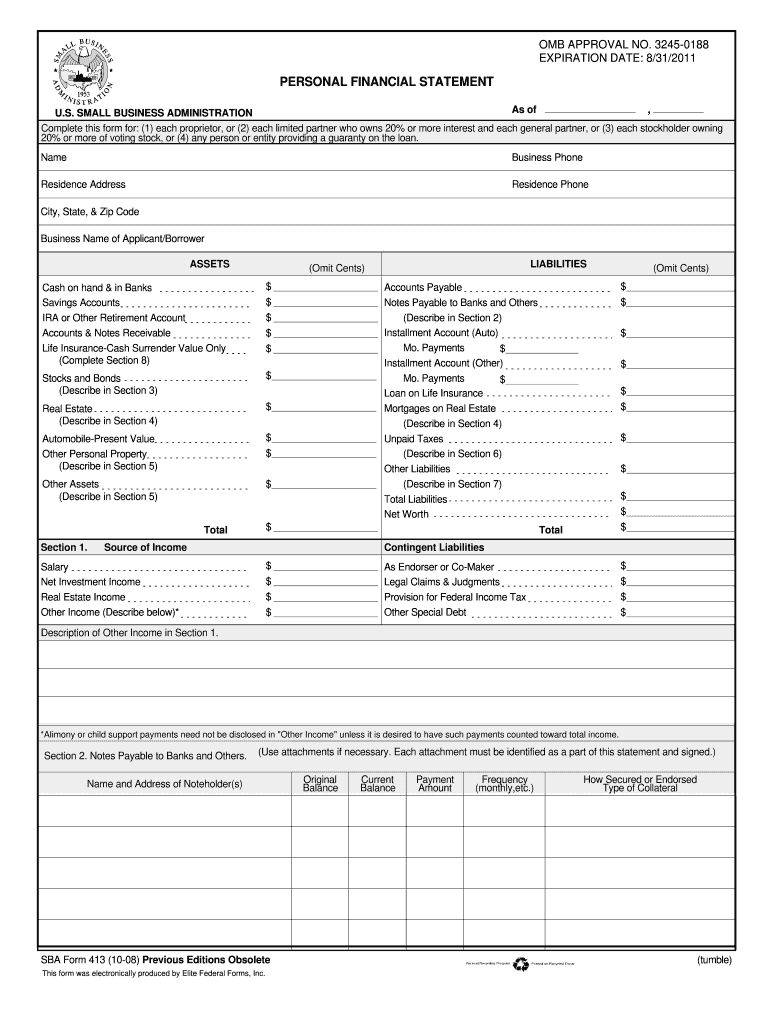

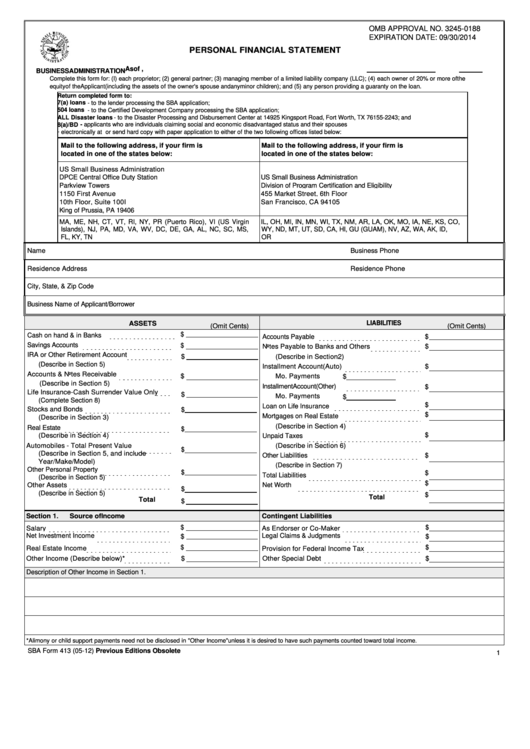

Why does the sba require form 413? Most sba loans and sba loan programs require you to complete the sba 413. Sba form 413 is required when applying for both sba 504 and sba 7 (a) loans , and is a personal financial statement.

It is also known as a personal financial statement. The sba uses this form to assess an applicant’s creditworthiness, as well as their ability to repay. The sba uses this form to assess an applicant’s creditworthiness, as well as their ability to repay.

(1) each proprietor, or (2) each limited partner who ow. Sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. It is completed when a small business owner wants.

Add the names listed on your sba personal. On an sba form 413, you’ll report your personal financial information, including: The final three sections of the form summarize the information you’re asked to.

How do i complete form 413? Completing sba form 413 is a required step for most sba loans. Money.co.uk has been visited by 10k+ users in the past month

Add the “as of” date of your sba personal financial statement here. Sba form 413 is a form used by the small business administration (sba). Form 413 is one of the most important factors when it comes to approval of an sba loan.

Sba 504 loans. This form provides a snapshot of your personal. Completing sba form 413 is a required step for most sba loans.

Small business administration’s office of disaster recovery & resilience today. Sba form 413 is the document used as one of the sources of data by the small business administration to analyze the repayment ability and creditworthiness of a. Money.co.uk has been visited by 10k+ users in the past month