First Class Tips About Financial Ratios For Dummies Reviewed Statements

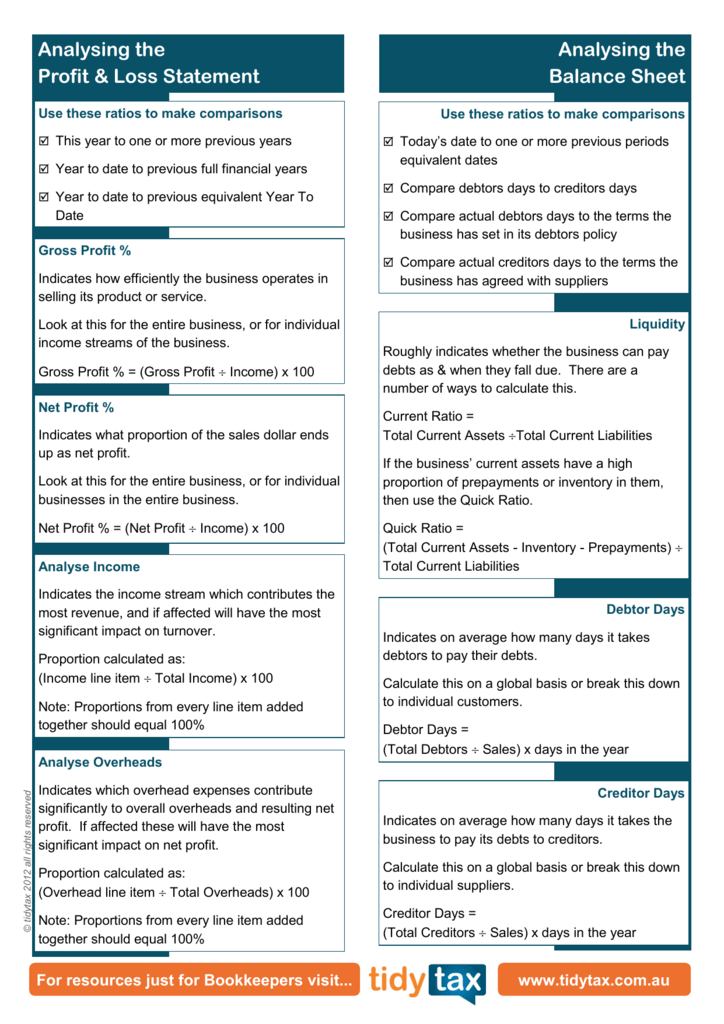

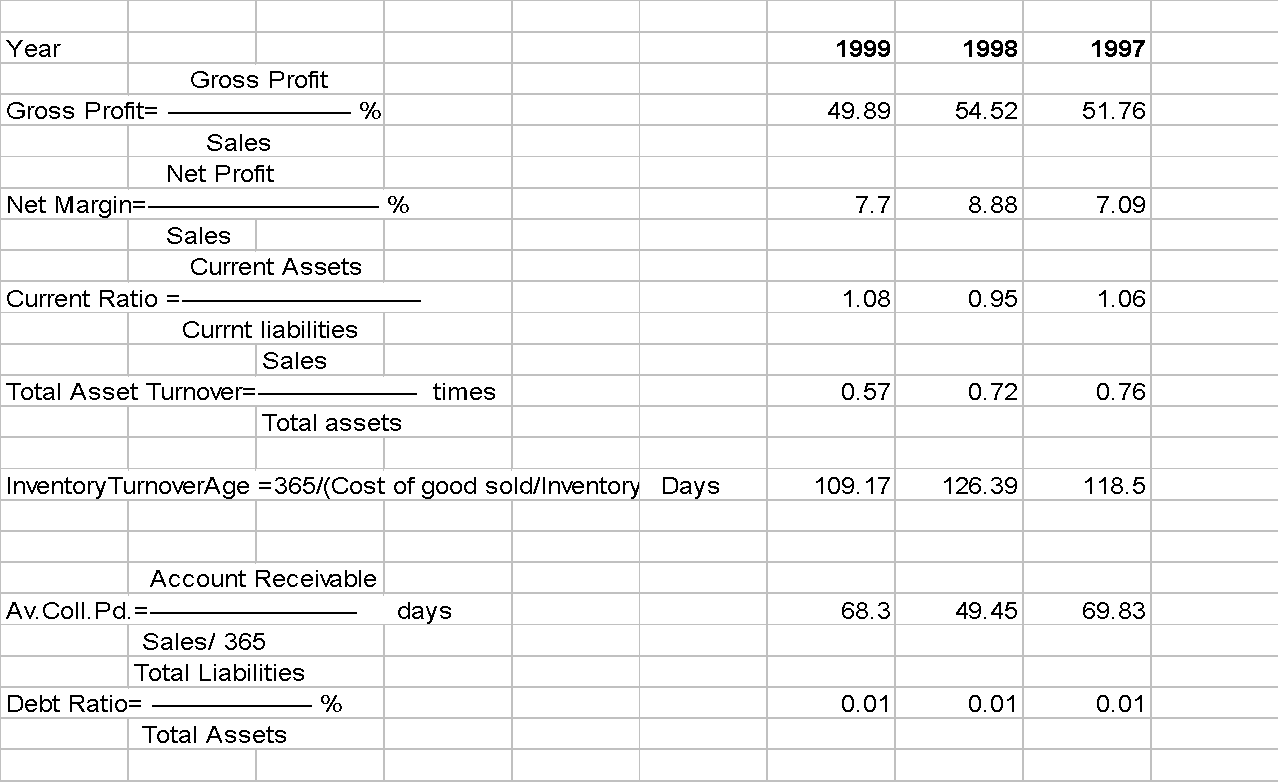

Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time, and provide key indicators of organizational performance.

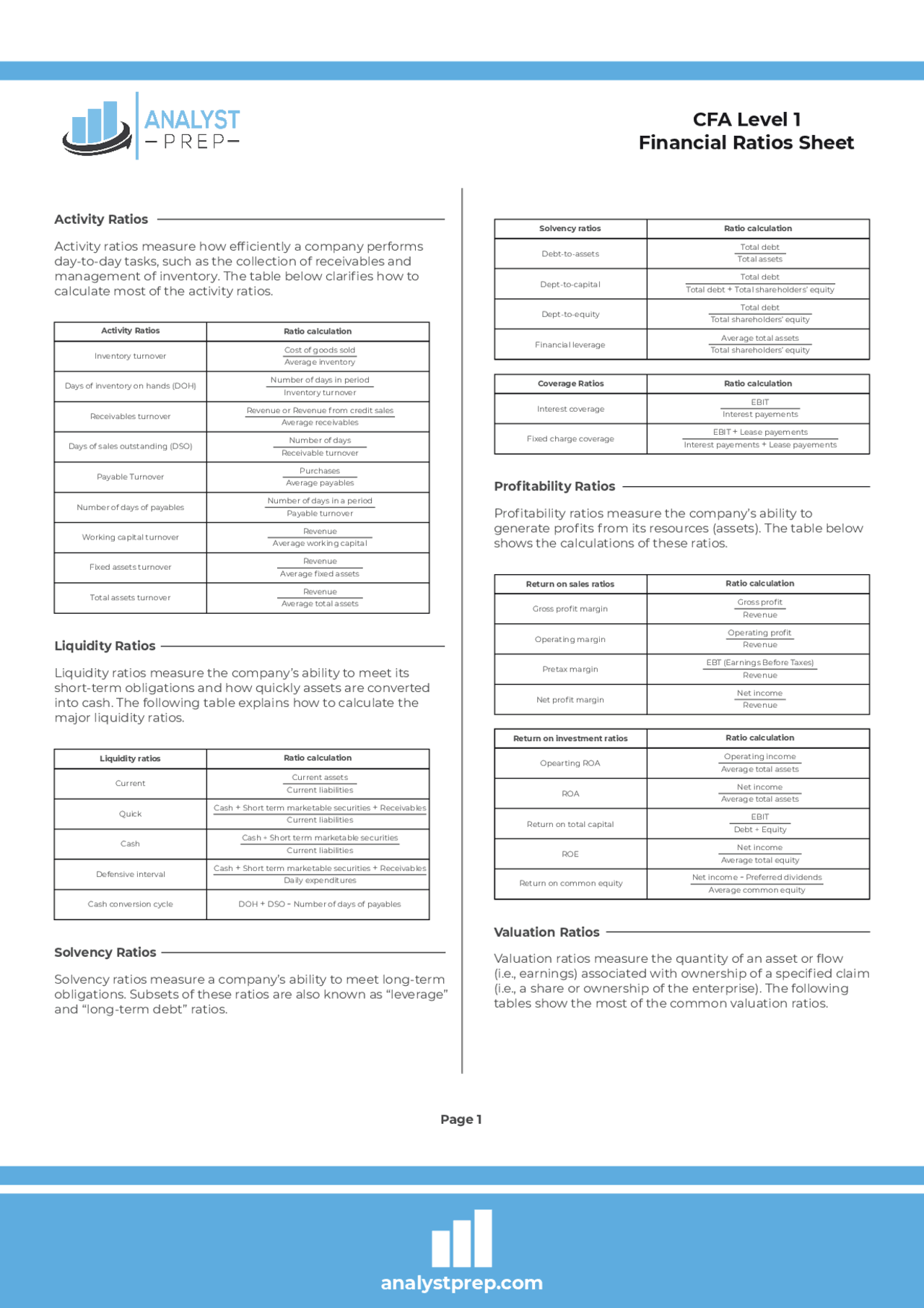

Financial ratios for dummies. Common liquidity ratios are the current ratio, the quick ratio, and the cash ratio. The use of ratios other than per is necessary for companies that are not profitable, highlighting the importance of considering different financial metrics for valuation. Managerial accounting for dummies explore book buy on amazon ratios and other performance indicators are often found using formulas (or formulae).

Price/earnings ratio = market value per. Financial ratios have the following uses: A ratio of 10 means that for every $1 in company earnings per share, people are willing to pay $10 per share to buy the stock.

A ratio of 10 means that for every $1 in company earnings per share, people are willing to pay $10 per share to buy the stock. Market value ratios are used to evaluate the share price of a company’s stock. Common market value ratios include the following:

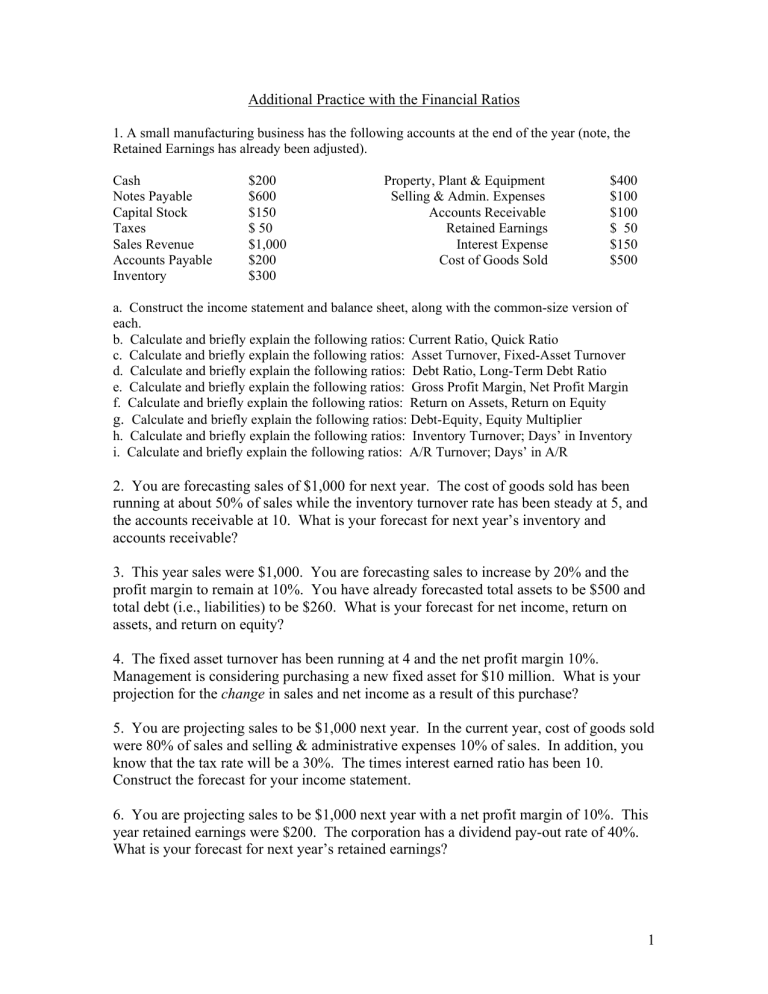

These ratios are used by financial analysts, equity research analysts, investors, and. Mattel $3,556,805,000 (current assets) ÷$1,716,012,000 (current liabilities) = 2.07 (current ratio) so mattel has $2.07 of current assets for every $1 of current. Debt ratio can also be computed using.

Debt ratio = total liabilities ÷ total assets. There are numerous financial ratios that are used for ratio analysis, and they are grouped into the following categories: For making comparisons one of the purposes of financial ratio analysis is to compare an organization's financial.

Corporate finance ratios are quantitative measures that are used to assess businesses. 1:2, 2:1, 5:8 and so on. Measures the portion of company assets that is financed by debt (obligations to third parties).

The balance sheet the balance sheet (also called the statement of financial position), provides insight into a company's financial position at a given date. Accounting ratios 🥇 explained for dummies | sa shares buy naspers shares buy phuthuma nathi shares buy steinhoff shares buy woolworths shares buy old mutual. Price/earnings ratio = market value per.