The Secret Of Info About Research And Development On Income Statement Financial Reporting Notes

The accounting for treatment for r&d costs can materially impact a company's income statement and balance sheet.

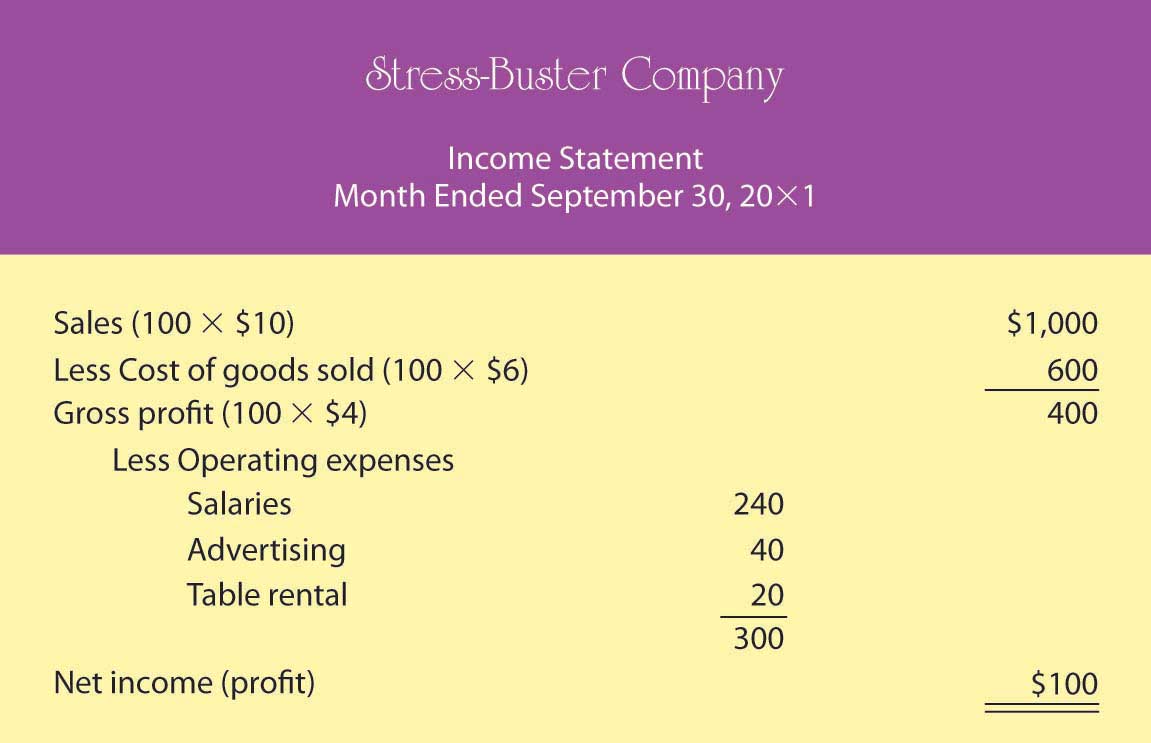

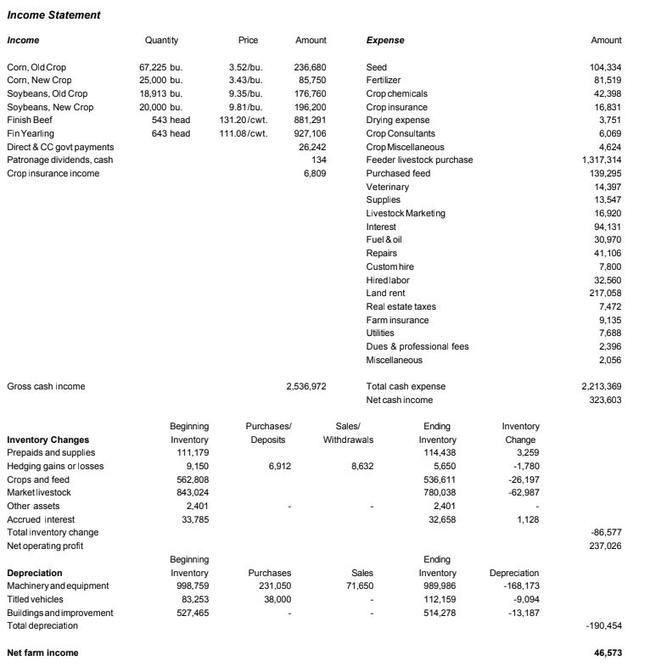

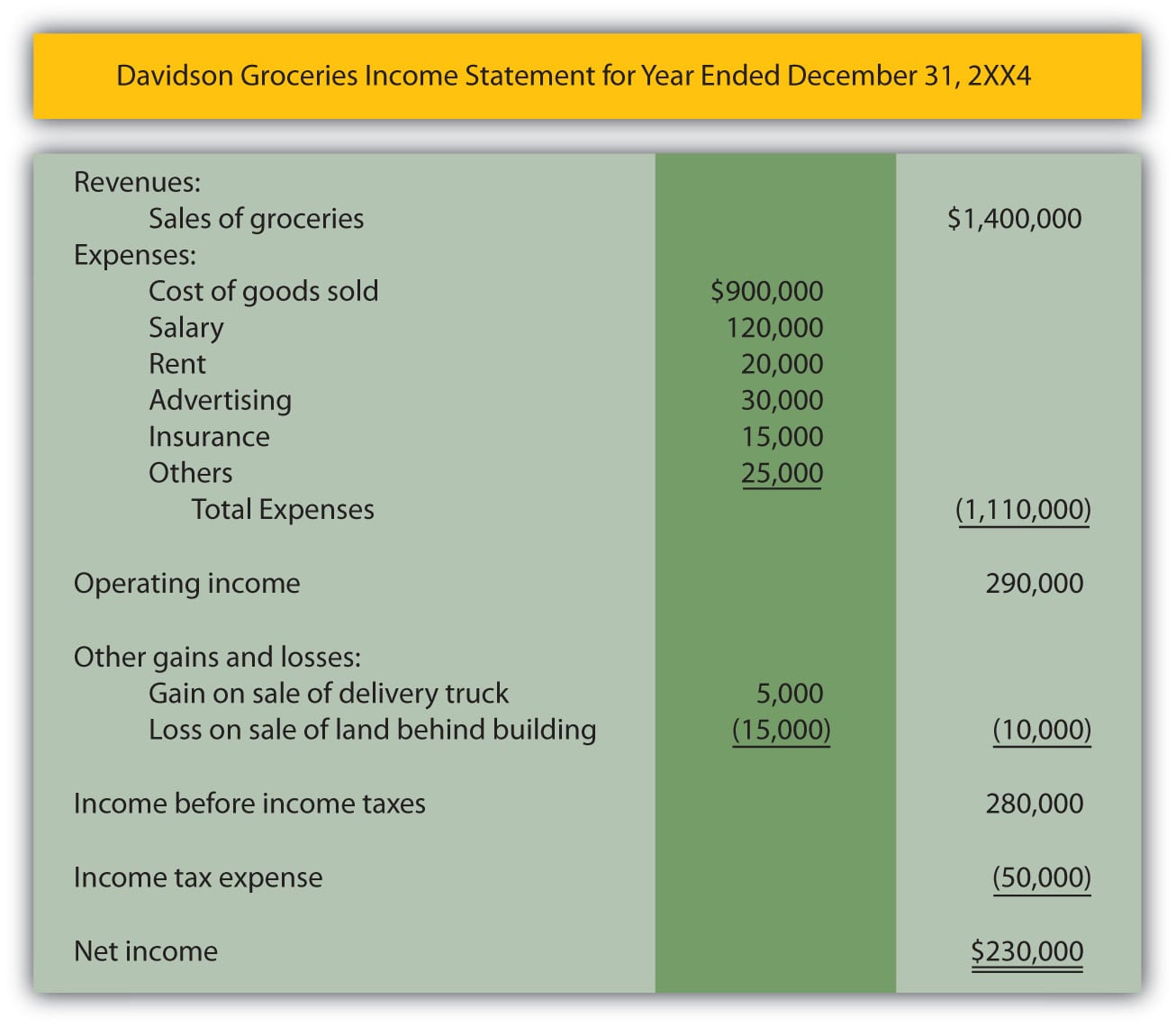

Research and development on income statement. The total cost incurred each period for research and development appears on the income statement as an expense regardless of the chance for success. A video tutorial by perfectstockalert.com designed to teach investors everything they need to know about. In this lesson, we will define research and development costs and explain how to identify, classify, and disclose these costs in the financial statements.

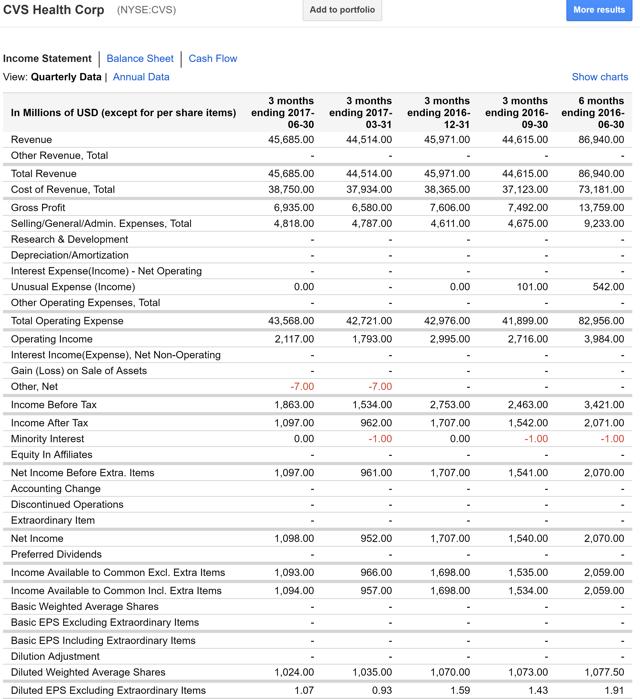

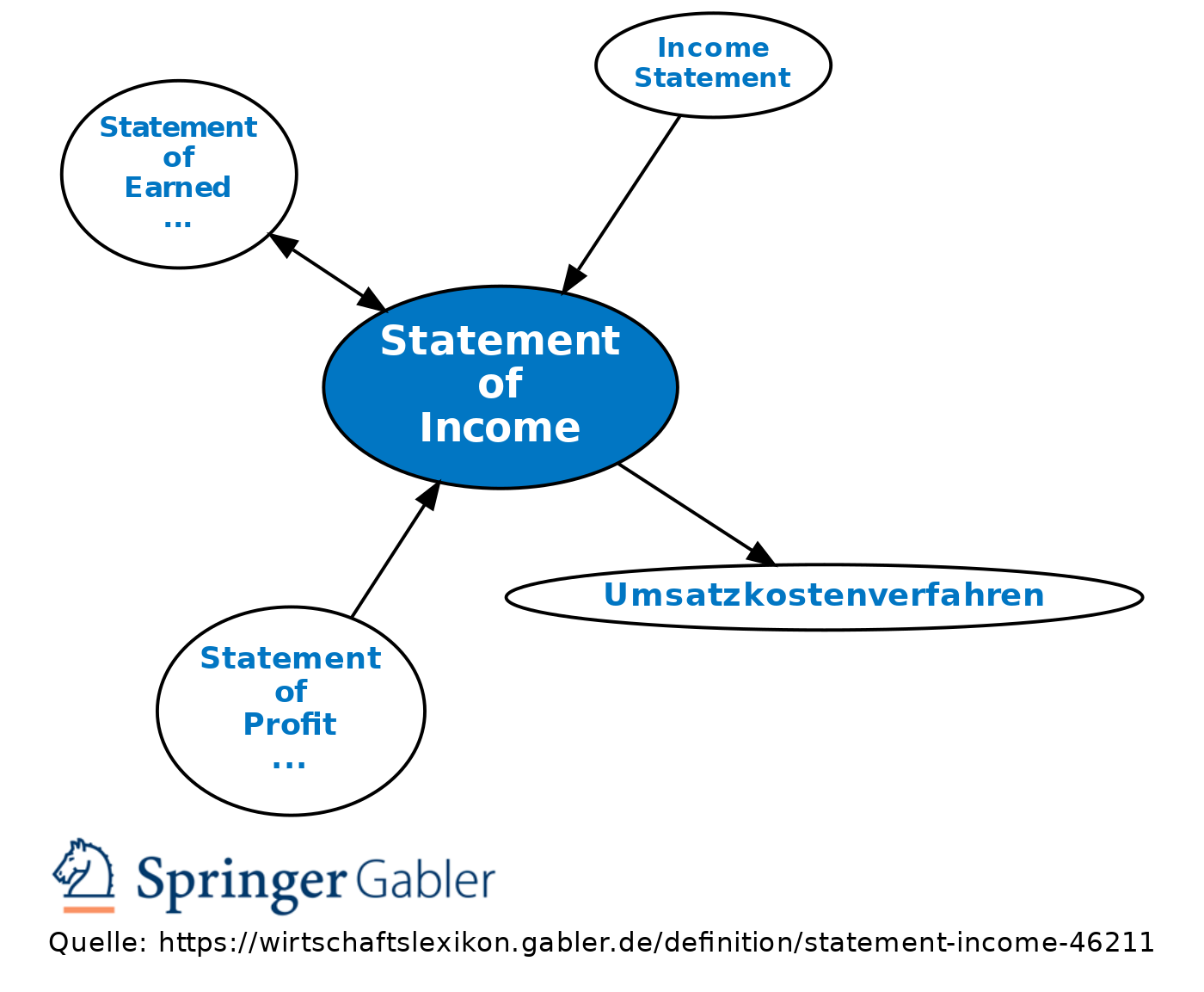

Research & development. Understanding the implications of research and development (r&d) spending for future profitability is important for financial statement users. An income statement is a financial report detailing a company’s income and expenses over a reporting period.

This item includes the operating expenses and employees’ benefits of the income statement by nature that are attributable to r&d. In general, research and development expenses are reported as part of the operating expenses on a company’s income statement. Research and development (r&d) costs are the costs you incur for activities intended to develop or improve a product or service.

Company a should expense the $3 million when incurred (normally when paid) as research and development costs since the technology has no alternative future uses. What is meant by the term “development”? What types of costs are likely included in these.

Gaap, the majority of research and. Research and development is a systematic activity that combines basic and applied research to discover solutions to new or existing problems or to create or update. R&d costs are defined in asc 730.

The 2009 income statement shows research and development expenses of sek 13,193 (millions of swedish krona). R&d expenses are included within the overall operating expenses and typically reflected as an individual line item on an income statement. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

This article explains the accounting treatment for research and development (r&d) costs under both uk and international accounting standards. As an expense, they have a big impact on the bottom line and. It can also be referred to as a profit and loss (p&l).

They tell you how much the company spends per year on. The literature extensively analyses research and development expenditures (rde) from the valuation perspective and documents its direct value relevance (vr). So, is the research and development (r&d) expense capitalized or expensed on the income statement?

Below is a list of examples of prominent companies that have very large research and development budgets: Research and development, or r&d, costs are expenses listed on an income statement. What is the income statement?

R&d costs are generally considered operating expenses and are reported on the income statement. 8.5k views 10 years ago income statement.