Brilliant Info About Cra Form T776 Finance Cost In Balance Sheet

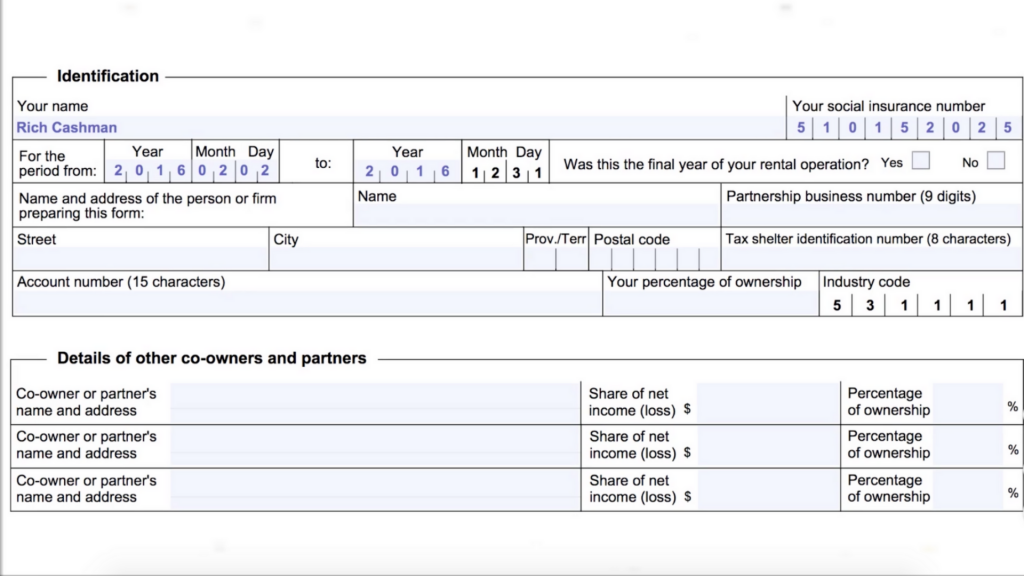

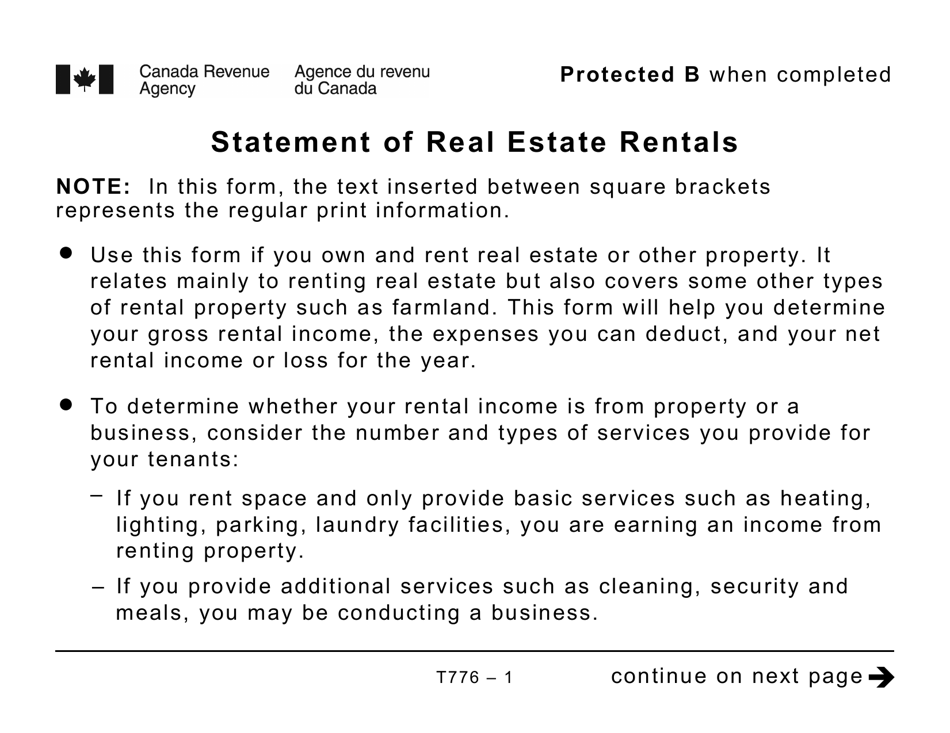

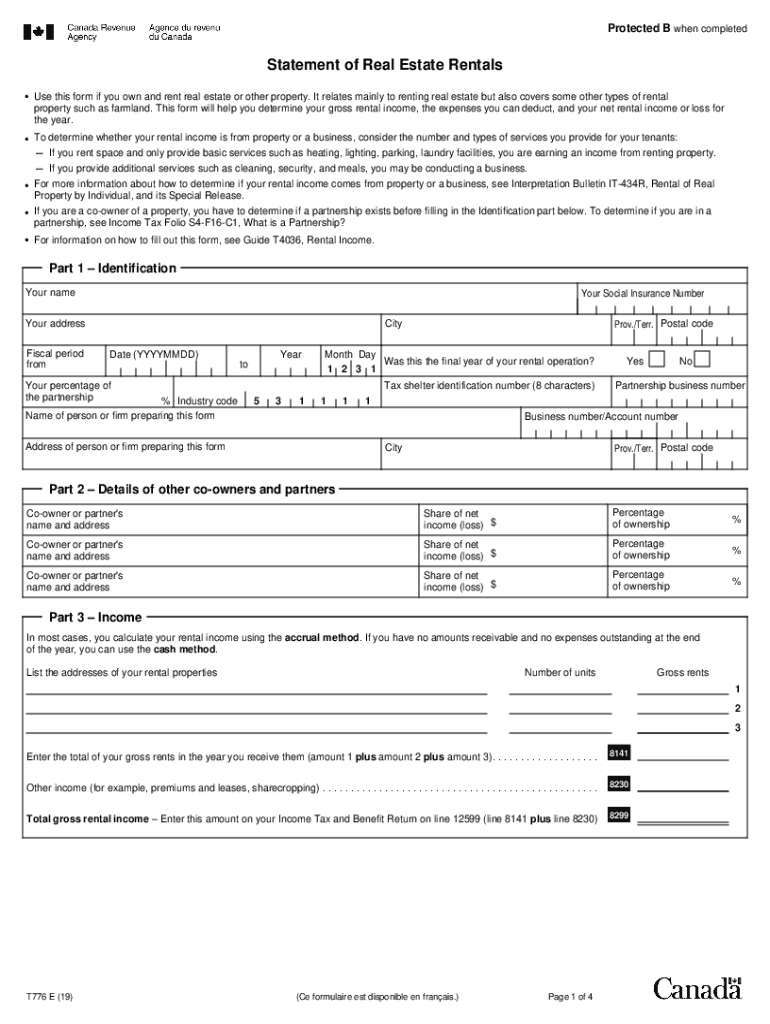

Form t776 should be submitted for each fiscal year, starting from january 1 to december 31 unless you have a unique year based on the time you rented the.

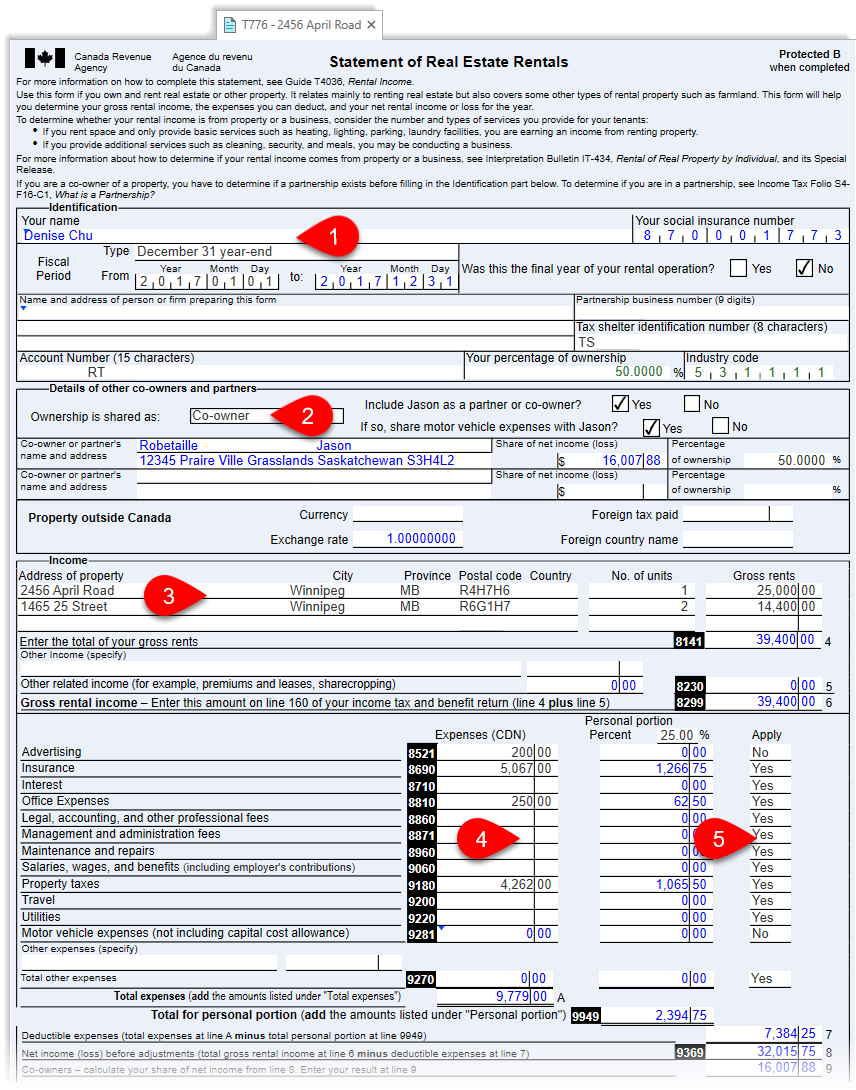

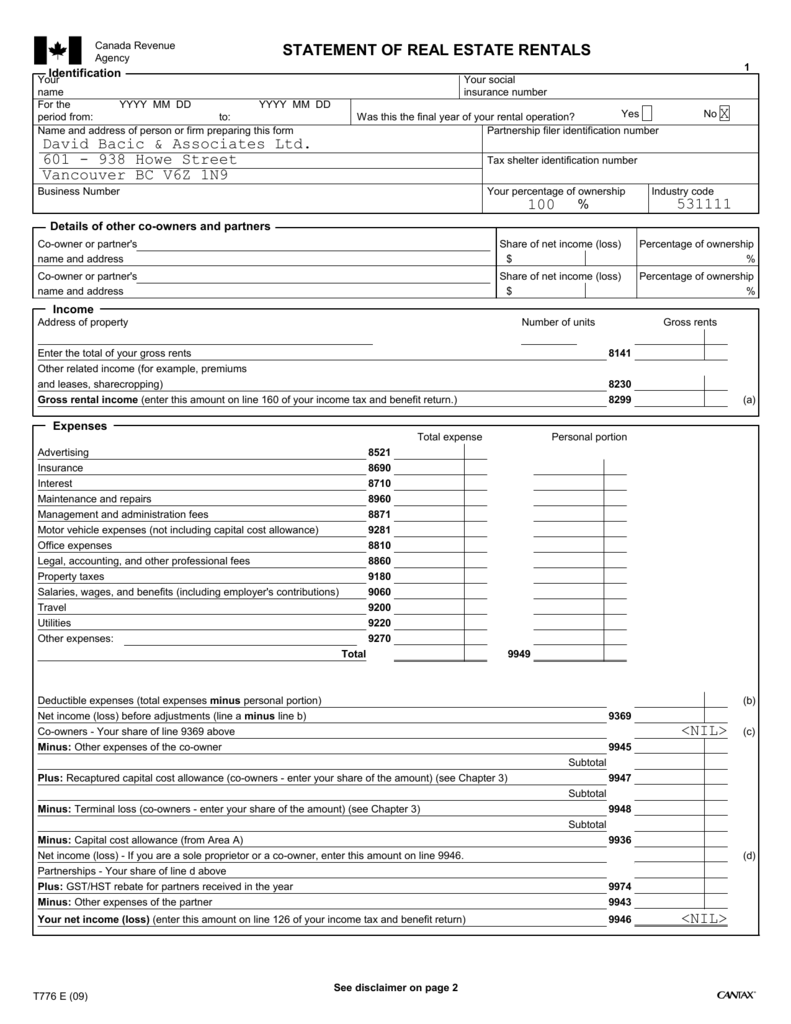

Cra form t776. Own and rent real estate). Form t776 statement of real estate rentals is used in canada to report rental income and expenses from real estate properties. The cost of the building is recorded in the capital cost.

Rental form t776 called the statement of real estate rentals must be completed for each rental property that you own in canada. Form t776, statement of real estate rentals. For personal tax return, rental income and expenses must be reported on the cra t776 rental income form.

Fill out online for free. Completing form t776, statement of real estate rentals income you can receive rental income in the form of: What is the t776?

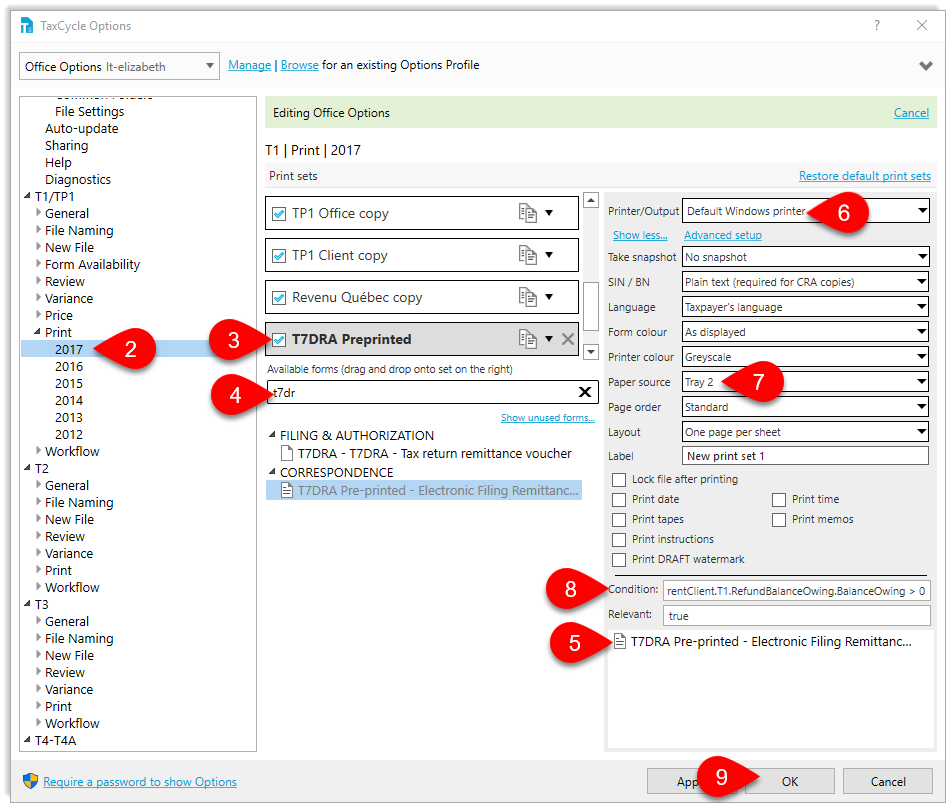

Learn how to deduct other rental expenses from your rental income on form t776, statement of real estate rentals. Enter rental income and expenses in taxcycle t1. A couple of tax preparers have asked me to help.

Form t776 is also called the statement of real estate rentals. Without registration or credit card. The canada revenue agency (cra) requires it be completed by those earning income from rental properties.

Form t776 is a tax form for reporting income and expenses from renting real estate or other property. This short guide covers the basics of filling out your t776 form for rental income. The t776 is also known as the statement of real estate rentals, which allows you to declare rental income and expenses (e.g.

To determine if your income is from property or from a business, see chapter 1. Who is the t776 tax form designed for? This form is specifically for individuals who own rental properties and need to declare their rental income and deduct any eligible expenses for tax.

You can deduct any reasonable expenses you incur to earn rental income, such as advertising, insurance, office expenses, travel and utilities. Enter the identifying information for your rental property in this tab. This form, statement of real estate rentals, is where you can declare income and expenses related to rental income.

The capital cost of your rental property is recorded in your personal tax return on form t776 statement of real estate rentals. In this article, i will go through how to prepare and calculate rental income, what expenses you can claim, where to enter rental income on the tax return, and the tax consequences of rental income or rental loss in the case of an individual. You can also deduct capital.

It helps you calculate your rental income and capital cost allowance (cca) for. Cash or cheques kind (goods or commodities instead of cash). Learn how to:• create a t776 form set• when to group or separate properties• choose between a partner and a.