Outstanding Tips About Great West Life Financial Statements Purchase Of Available For Sale Securities

Record base eps 2 of $1.02 on base earnings of $950 million increased by 17% from a year ago.

Great west life financial statements. (lifeco or the company) today announced its fourth quarter 2022 results. When a new york judge delivers a final ruling in donald j. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins.

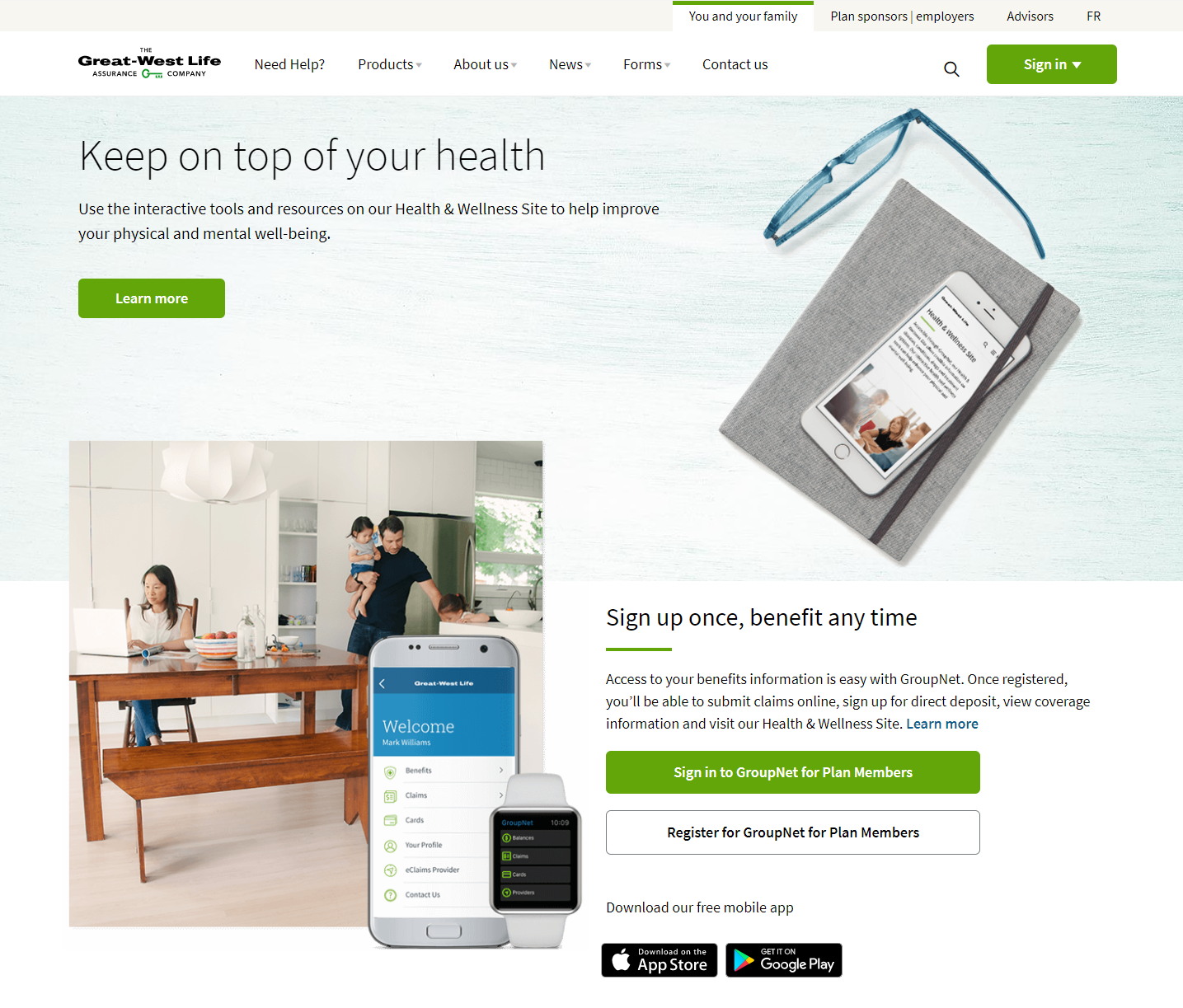

Should be read in conjunction with the company's management discussion & analysis (md&a) and. Financial performance 7 delivering for customers 8 disciplined choices that enable growth 10 striving for a better tomorrow 12 our esg journey 16 investing in our. More than 31 million customer relationships across these regions.

27 152 m $. Series h annual income statement. Net earnings of $1,026 million and base.

Consolidated assets of $630 billion and assets under administration3 of $2.3 trillion total assets were approximately $630 billion and assets under administration. Net earnings of $1,026 million and base. The condensed consolidated interim unaudited financial statements including notes at september 30, 2021 were approved by the board of directors at a meeting held today.

View the latest gwo income statement, balance sheet, and financial ratios. Get a brief overview of great west lifeco inc financials with all the important numbers. Otc) at close 3:51 pm est 02/15/24 $30.84 usd.

2023 consolidated financial statements 40 (iv)credit risk exposure by internal risk rating the following table presents the fair value of bonds and. View gwo.ca financial statements in full. View grwlf financial statements in full, including balance sheets and ratios.

Access the most recent reports as well as archived reports below. Cathay financial holding co., ltd. Base earnings per common share (eps) for the first quarter of 2022 of $0.87 increased by 9% from $0.80 a year ago, with fee income.

Net eps from continuing operations of $1.01. Instruments on the company's business strategy, financial strength, deployable capital, life insurance capital adequacy test (licat) ratio, base and net earnings,.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/M72RNJN7CFIIDD5VYTM5AOUJ24.jpg)