Inspirating Info About Free Cash Flow For Banks Balance Sheet Of A Publicly Traded Company

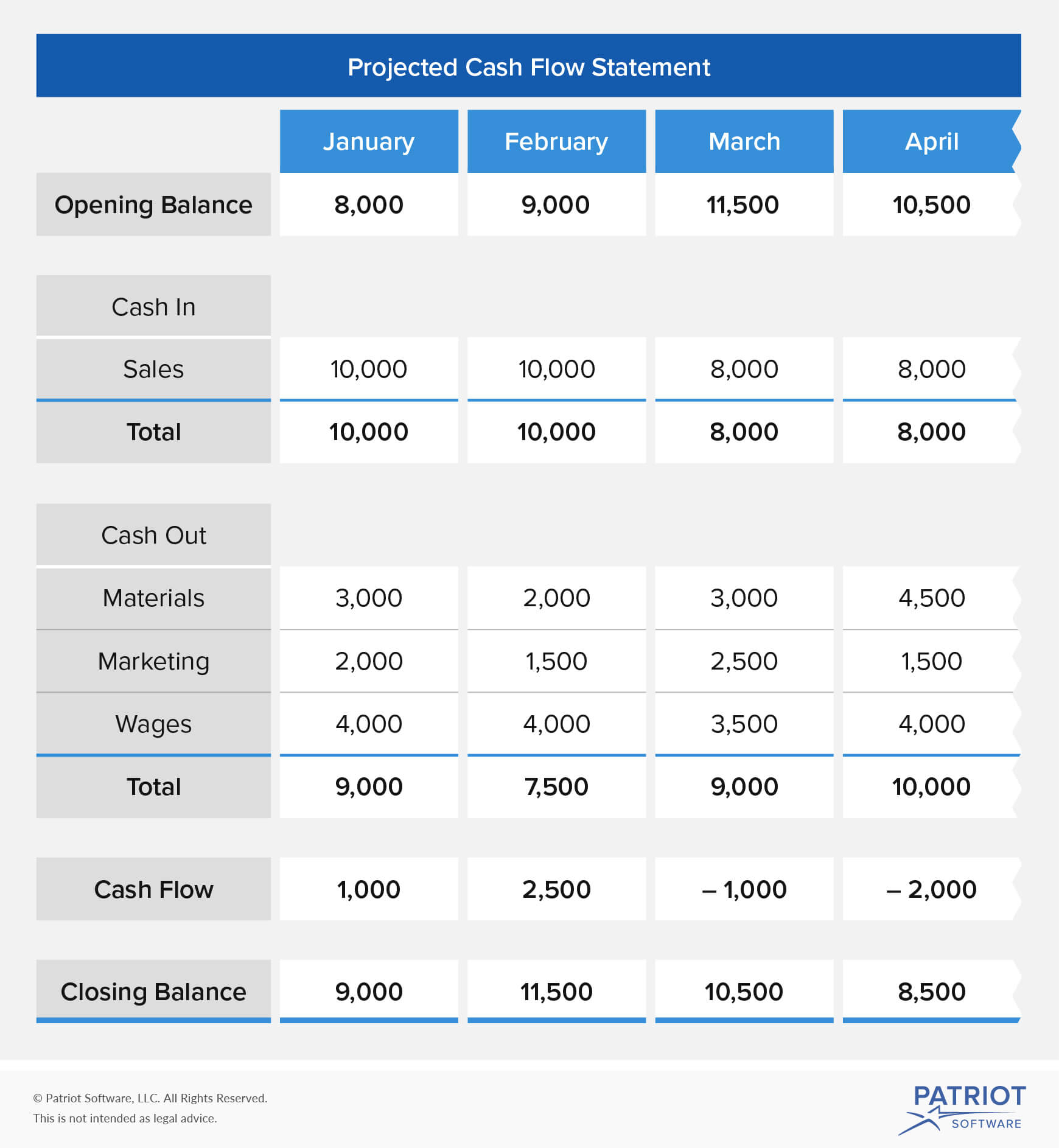

Free cash flow measures how much cash a company has at its disposal, after covering the costs associated with remaining in business.

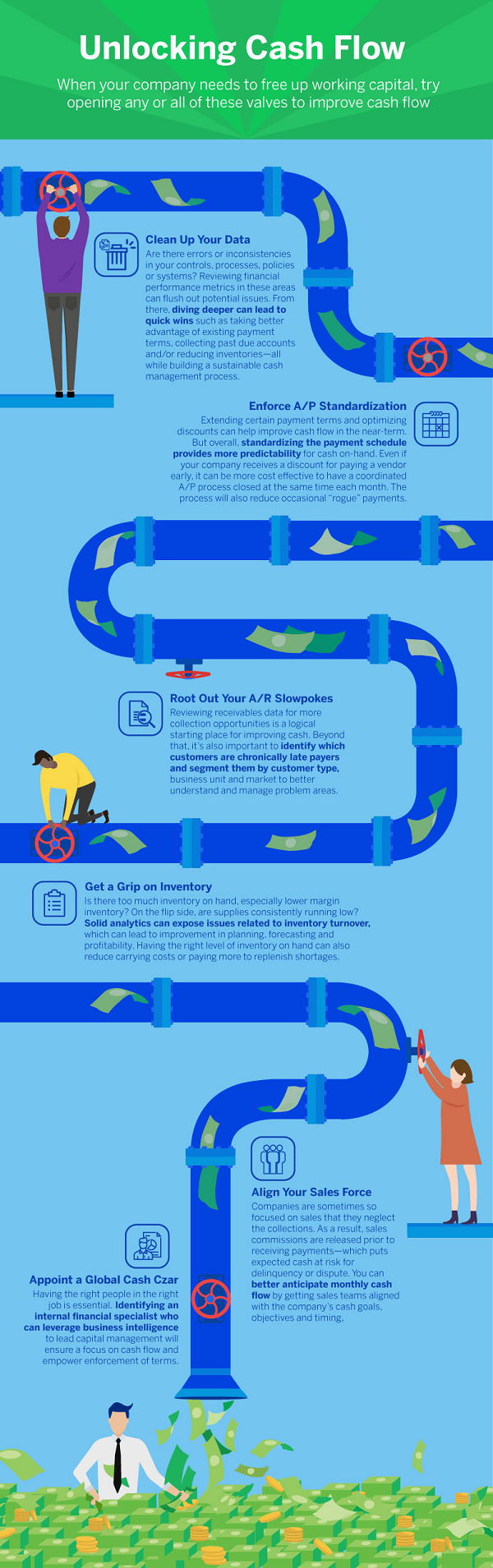

Free cash flow for banks. Compare ry with other stocks. Just like the title, i am wondering how you would go about trying to find free cash flow for banks, the cash provided by operating activities is easy to find. Higher free cash flow gives companies the ability to reinvest cash, pay dividends, or repay debts,” according to the issuer.

The loan process is simple and fast and promptly serves the cash needs of smes. So concepts like “working capital” and “free cash flow” are no longer applicable.and that also means that equity value is more meaningful than enterprise value. Project loans, deposits, and key iea/ibl 6:56:

Free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. Link and flesh out the cash flow statement The banks agree to lend to such smes on a cash flow basis by marking a lien on their receivables.

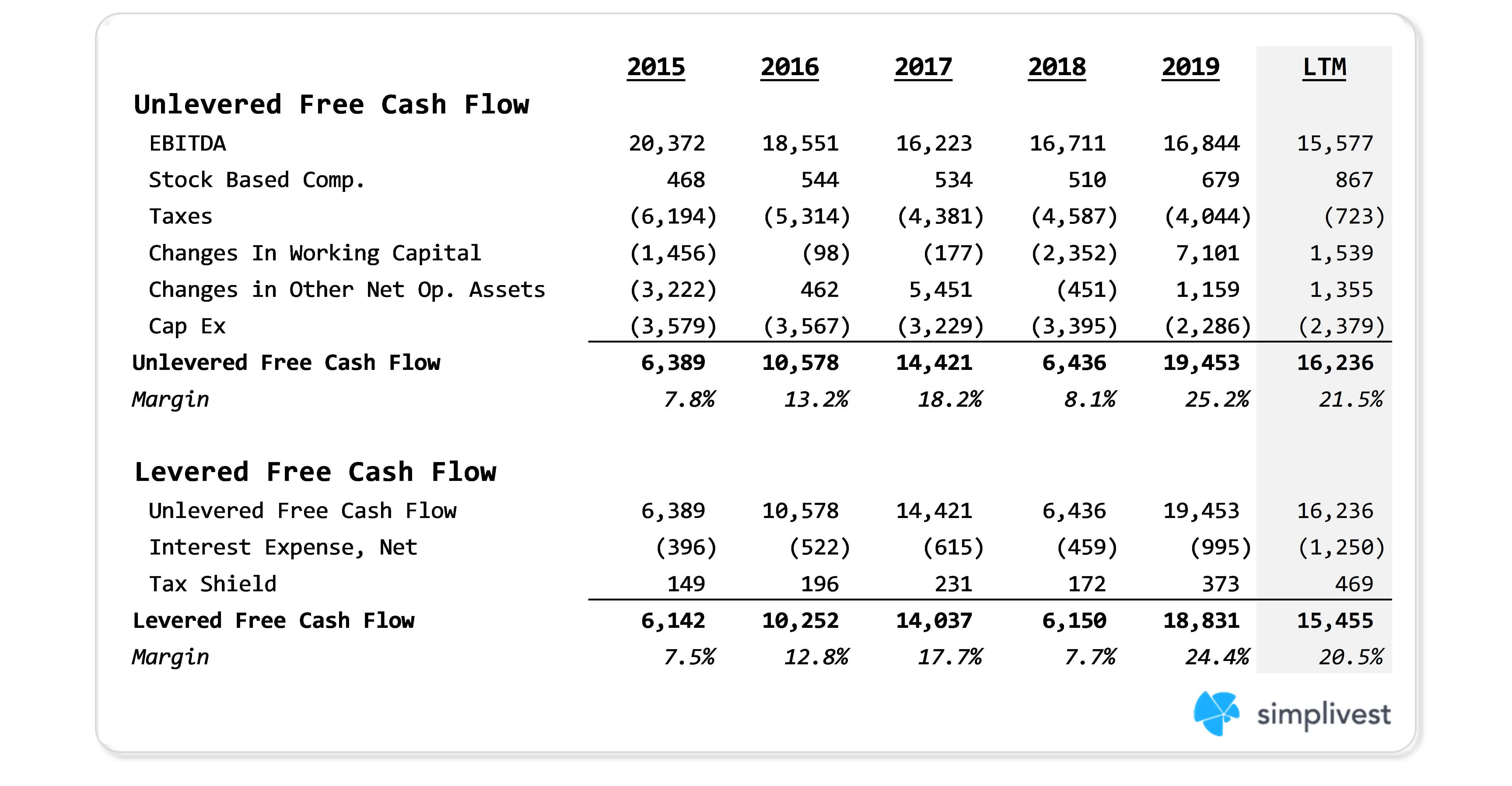

** free cash flow of more than dkk 1.8 billion is 26 per cent below. The net cash flow is the amount of profit the company. Free cash flow to the firm (fcff), also referred to as “unlevered” free cash flows.

** shares in flsmidth fls rise around 4% after the danish engineering group posted strong free cash flow in the fourth quarter as it reported results in line with preliminary figures released last month. What is free cash flow? Royal bank of canada annual free cash flow for 2023 was $18.58b, a 25.04% increase from 2022.

** flsmidth has a very strong free cash flow in the fourth quarter due to a drop in working capital, sydbank. Learn how to calculate free cash flow and how to utilize it for your business. 12, according to data and analytics firm ortex.

Free cash flow to equity (fcfe), also known as “levered” free cash flows. Apple's ( aapl, $125.43) free cash flow yield isn't one of the highest amongst the 10 stocks covered. Get quick cash with the 4 best fast business loans.

Feb 22, 202401:16 pst. Whether the company could face legal liability is unclear, experts. Free cash flow is the amount of cash that is available for stockholders after the extraction of all expenses from the total revenue.

By establishing how much cash a company has after paying its bills for ongoing activities and growth, fcf is a measure that aims to cut through the arbitrariness and. Assign interest rates & calculate interest income / (expense) 10:44: Feb 21, 202409:57 utc.

Jpmorgan chase annual free cash flow for 2021 was $78.084b, a 197.71% decline from 2020. Link and flesh out the income statement 13:20: John wiley & sons, 2002, 2002.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)