Exemplary Info About Irs Income Statement Management Discussion & Analysis

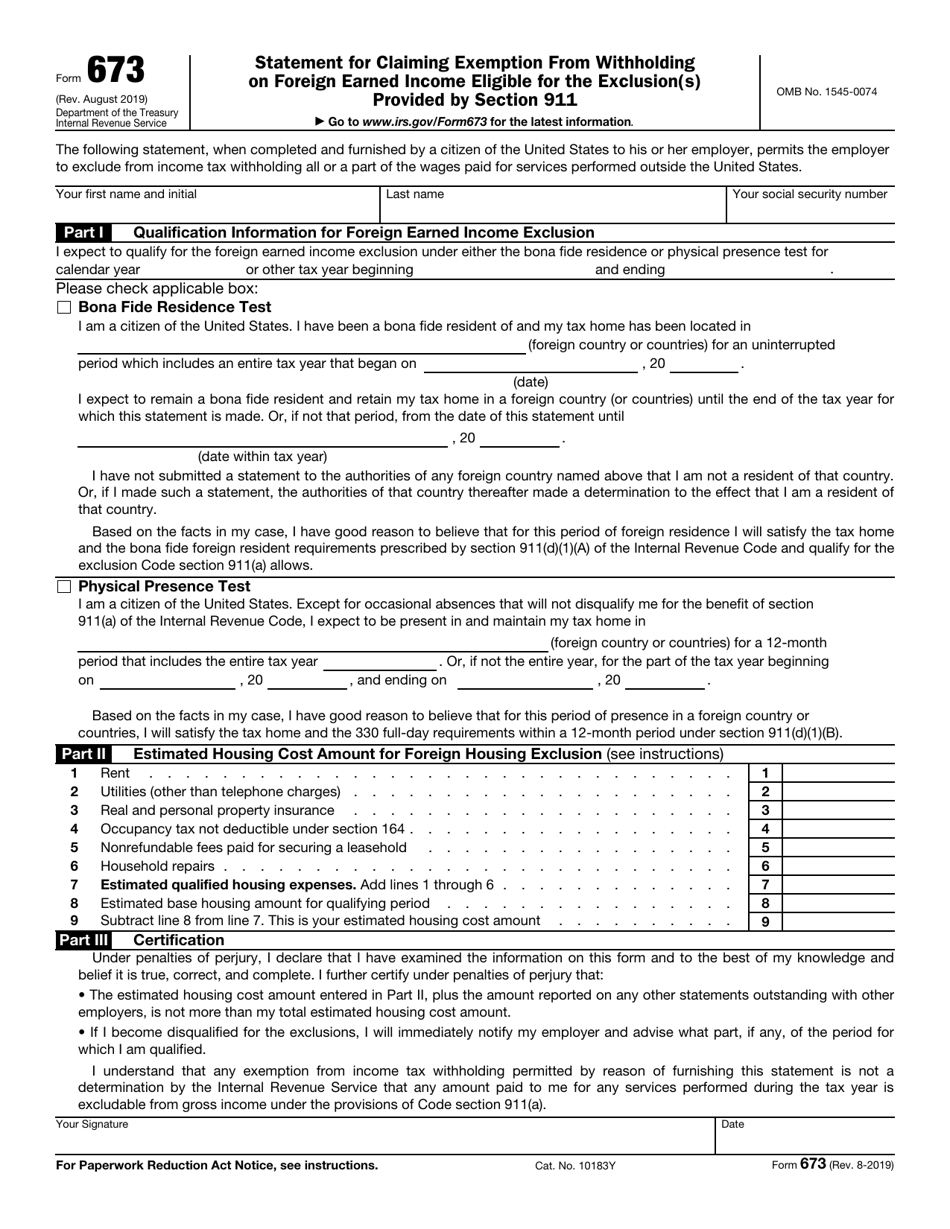

Tax season 2024 find out all you need to know about individual income tax filing and your tax filing obligations.;

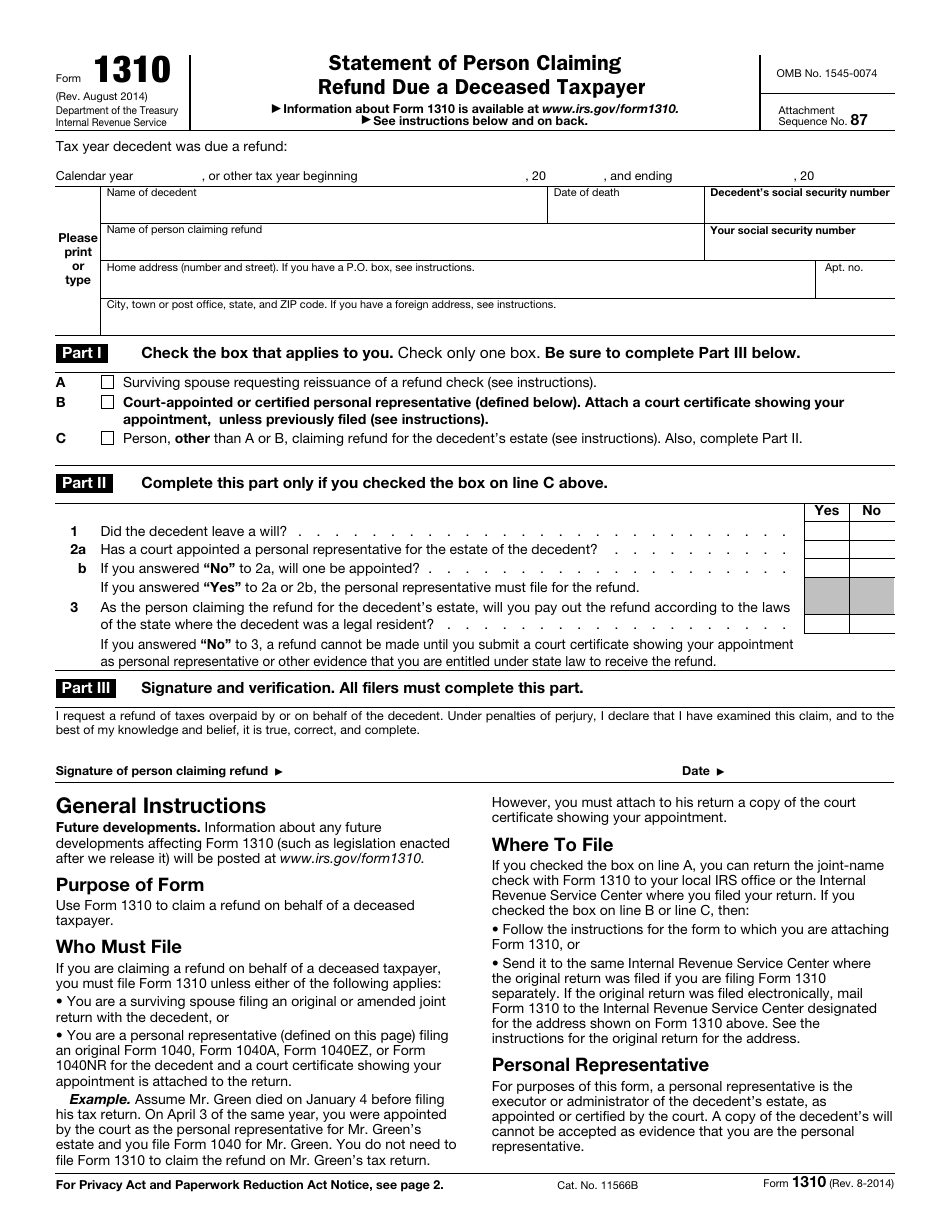

Irs income statement. Irs statement — irs commissioner charles rettig’s final message. November 10, 2022 — we are on the brink of an exciting new era for the irs, one that is desperately needed. You can use our get transcript tool to request your wage and income transcript.

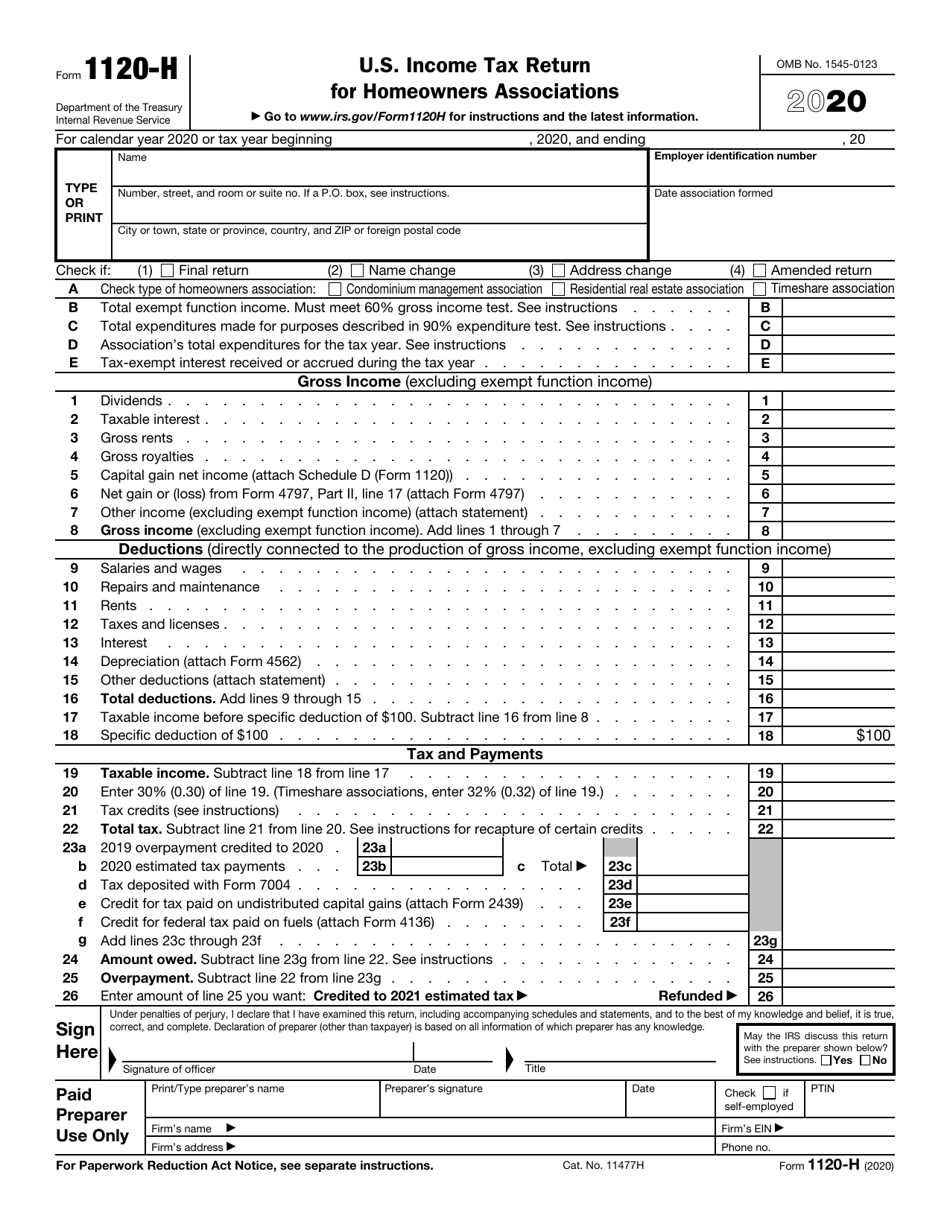

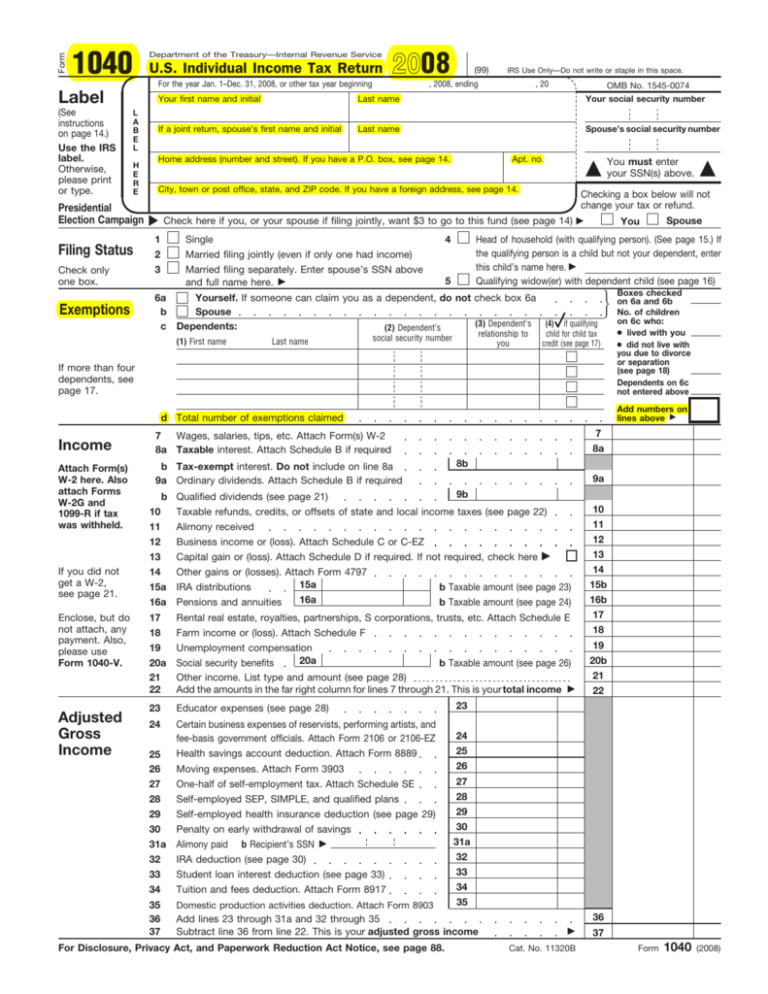

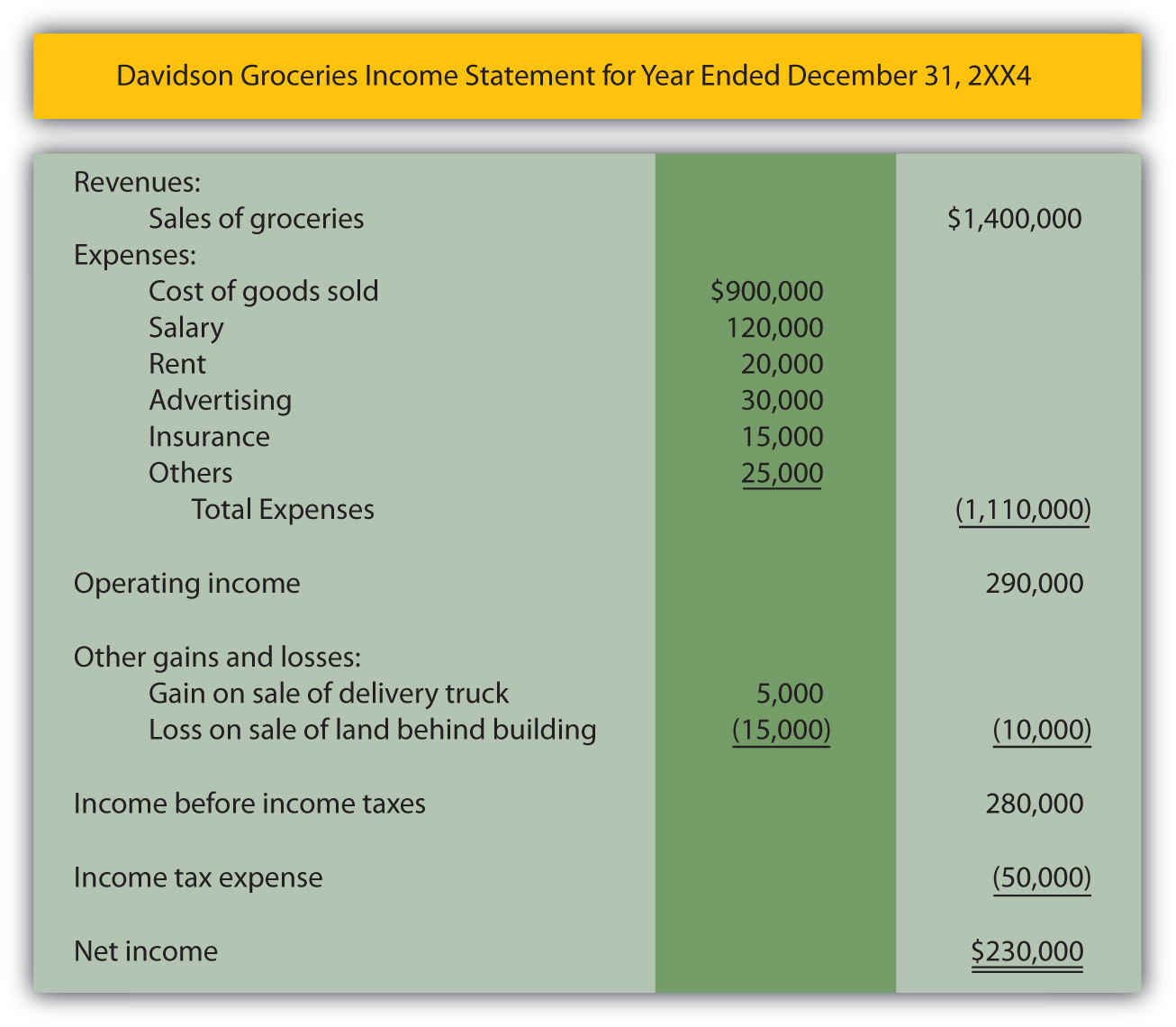

If you need a transcript for your. An income statement reports a company’s revenue, expenses and profit or loss during a specific accounting period. Check your federal tax withholding.

Form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Find forms & instructions. The income statement tells investors whether a company is generating a profit or loss.

Wage and tax statement. Lawrence wong, delivered the budget statement. Revenue, expenses, gains, and losses.

The income statement focuses on four key items: Income statements are also known as statements of. But you may need a copy of your tax return for other reasons, like filing an amended tax.

Also, the income statement provides valuable information about revenue,. The qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Calculate the revenue earned from the sale of goods and services.

It had revenue and gains of $500,000 and expenses and losses of. Apply for an employer id number (ein) view your tax records, adjusted. If you don’t have an.

Tax changes and enterprise disbursements. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. It helps prevent the misuse of the taxpayer’s social security.

Get your tax record. Get answers to your tax questions. Deputy prime minister and minister for finance, mr.

Accounting & taxes. An income statement, also known as a profit and loss statement (p&l statement), summarizes a business’s revenues and expenses over a. Calculate the cost of goods sold.