Spectacular Tips About Income Tax Form 26as Statement Audit Executive Summary Example

Form 26as is an important tax filing as it is tax credit statement.

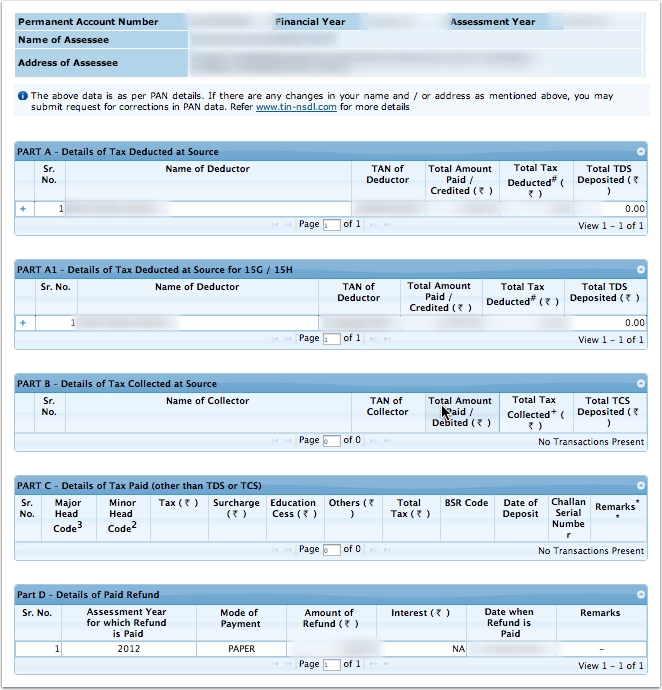

Income tax form 26as statement. Select the box on the screen and click on ‘proceed’. On 9 th september 2021, cbdt has announced enhancing the timelines for some compliance. Yow will get redirected to traces website.

The tax credit statement, also known as form 26as, is crucial documentation for file taxes. If you are an unmarried senior at least 65 years old and your gross income is more than $14,700. Form 26as is a consolidated statement from the income tax department that contains details of tax deductions and tax exemptions.

So all in all, form 26as is a document which captures all the taxes paid by you by way of deduction or otherwise in one place making it easier for you to claim the. Cancelling student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of. Click on the link view tax credit (form 26as) at the bottom of the.

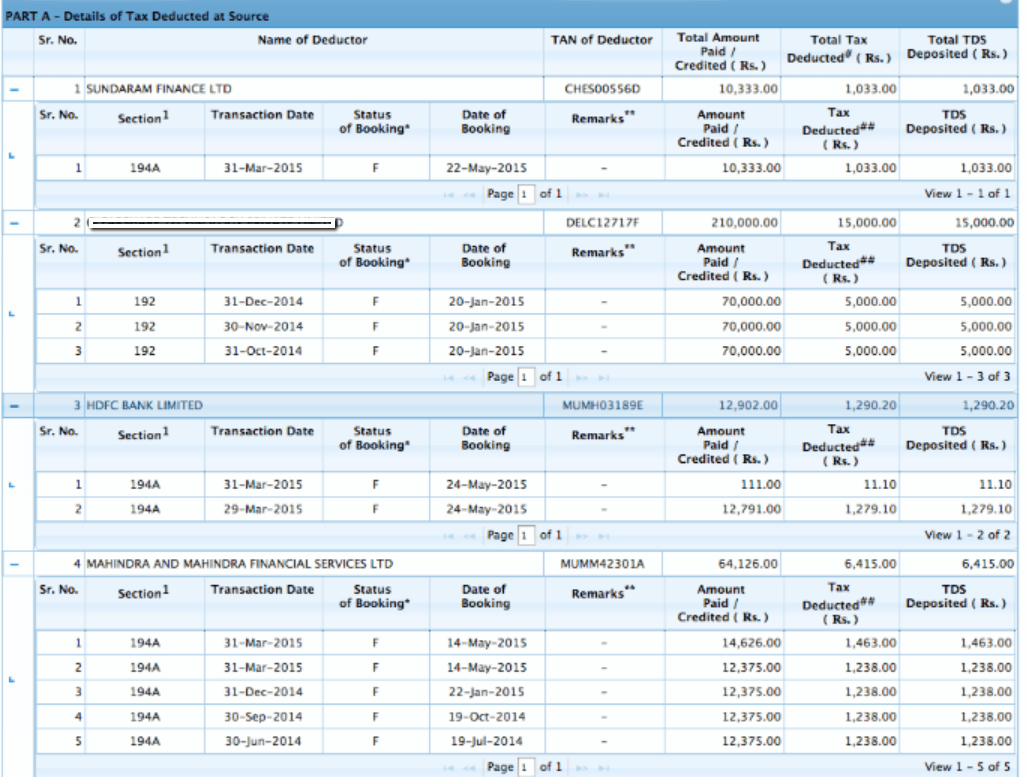

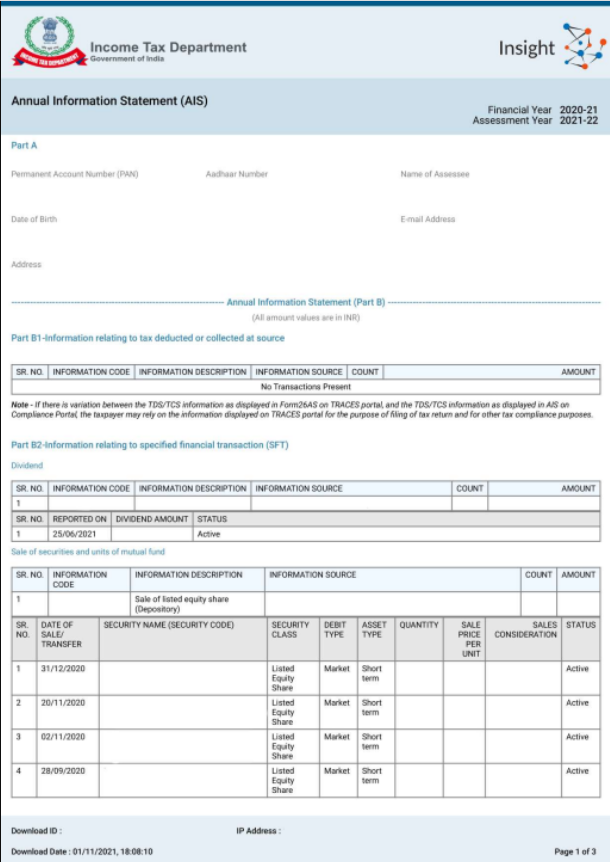

The form 26as (annual tax statement) is divided into three parts, namely; Form 26as is an annual consolidated credit statement issued by income tax department under section 203aa of income tax act, 1961 to help taxpayers to cross verify income. There are now 7.5 million borrowers enrolled in the save plan, of whom 4.3 million have a $0 payment.

Part a, b and c as under: You will need to file a return for the 2024 tax year: Initially, form 26as was synonymous with.

On the other hand, form 16 is a. Form 26as is a statement that provides details of any amount deducted as tds or tcs from various sources of income of a taxpayer. The tax credit statement, also known as form 26as, is an annual statement that consolidates information about tax deducted at source (tds), advance.

Form 26as is a tax credit statement that contains crucial details of taxes deducted from a taxpayer’s income. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. It is important to verify form 26as with the details.

The requirement to manually file it returns required the download of form 26as. Form 26as is an annual tax statement, specific to a permanent account number (pan) furnished under the income tax act, 1961. It is available for all taxpayers.