Fun Info About Debt Footnote Disclosure Example Company Statement Of Changes In Equity

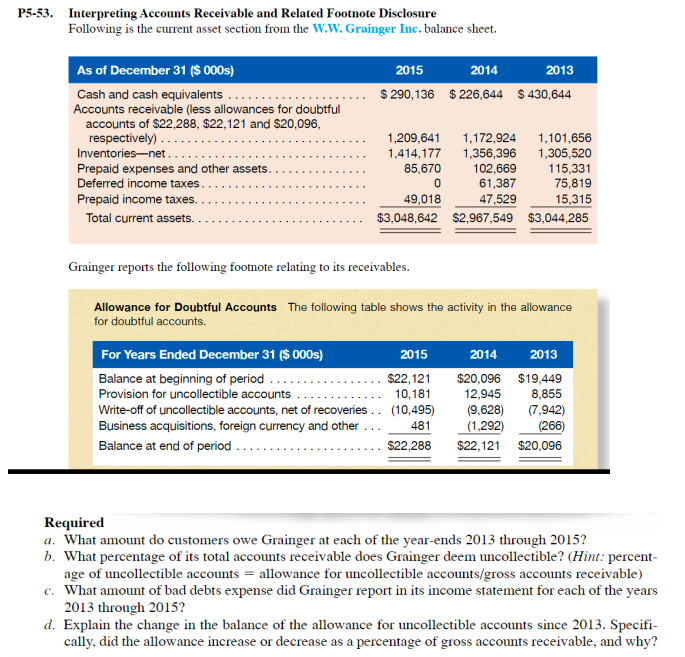

Financial statements and footnote disclosures can also help companies measure themselves.

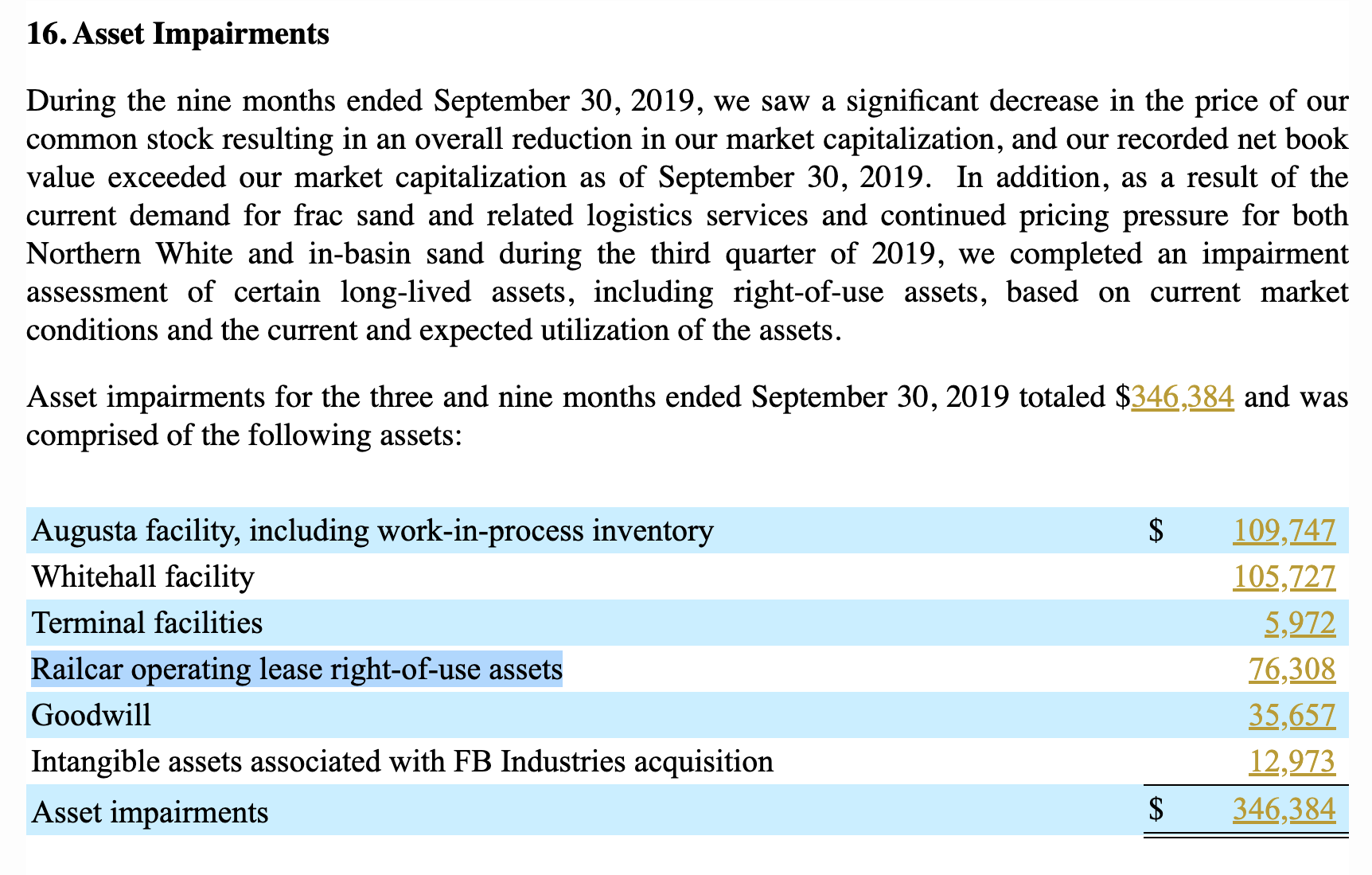

Debt footnote disclosure example. In the context of consolidated financial statements, the disclosures in respect of operating segments ( note 5) and eps (statement of profit or loss ; Deloitte’s roadmap fair value measurements and disclosures (including the fair value option) comprehensively discusses the scope, measurement, and disclosure guidance. These illustrative notes are a sample of what the board may wish to disclose.

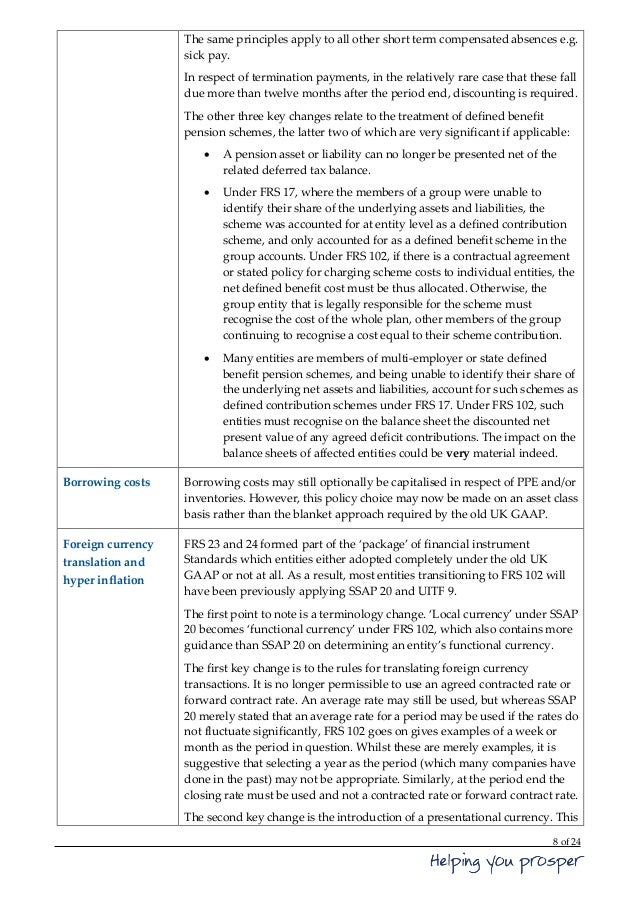

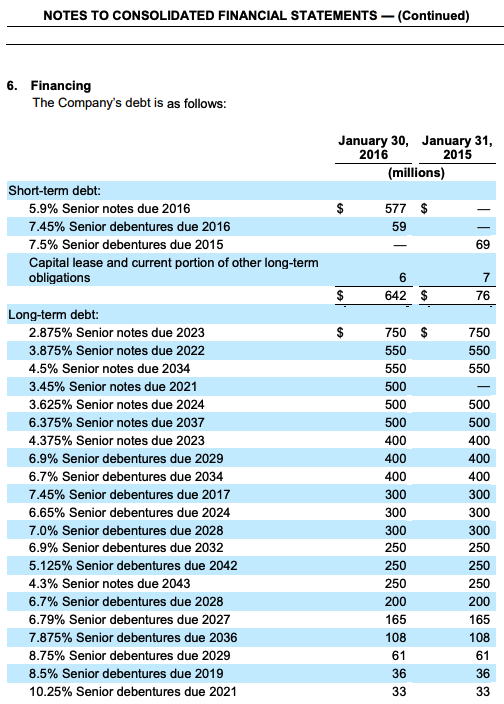

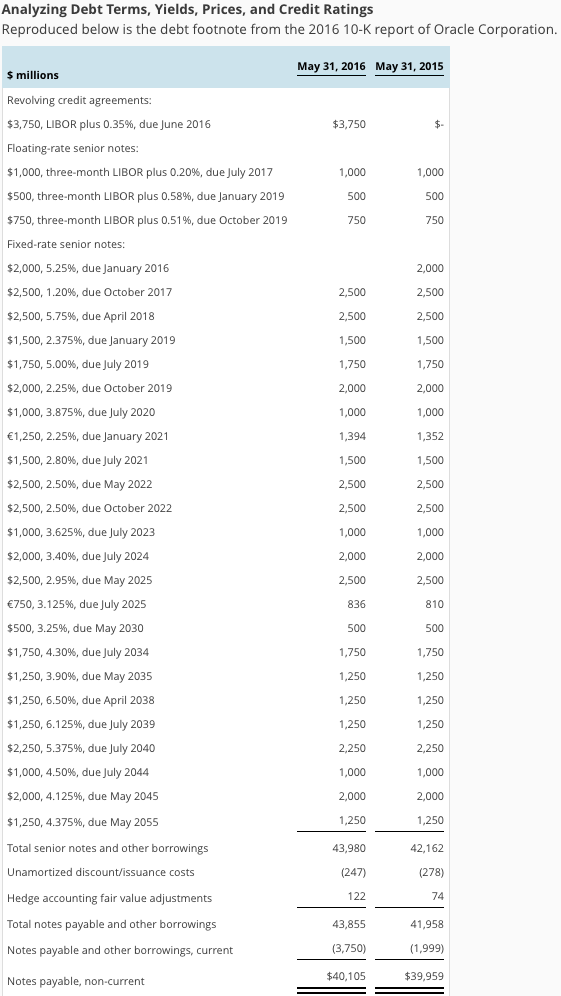

And oci, and note 10) apply. An sec registrant is required to disclose the following separately on the balance sheet or in a footnote for each issue or type of debt (including capital leases).

Show all in one page feature for viewing. The level of disaggregation will vary by reporting entity and the nature of its portfolio. These are only examples;

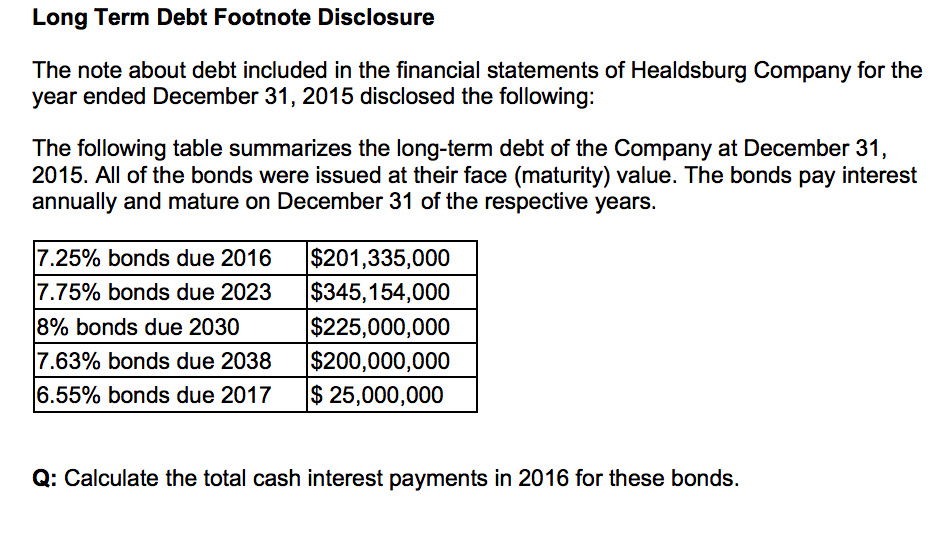

Long term debt (due in more than 12 months) is disclosed under a separate line item on the balance sheet, and further. The general character of each type of debt including the rate of interest A contingent payment depends upon certain factors set by the.

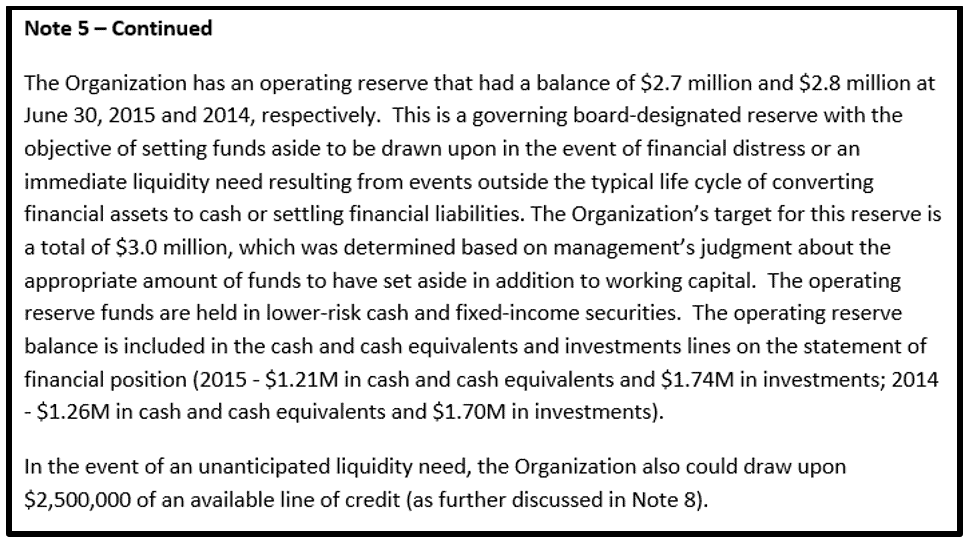

They are provided to aid the sector in the preparation of the financial statements. Although the interim footnote disclosures should be prepared using this overarching guidance, us gaap also requires specific interim disclosures. Insurance contracts, ifrs 6 exploration for and evaluation of mineral resources, ias 26 accounting and reporting by retirement benefit plans or ias 34 interim financial.

These sample disclosureares only meant to provide examples of the general disclosure requirements related to asc 326. This is one example where the “less is more” concept doesn’t apply.

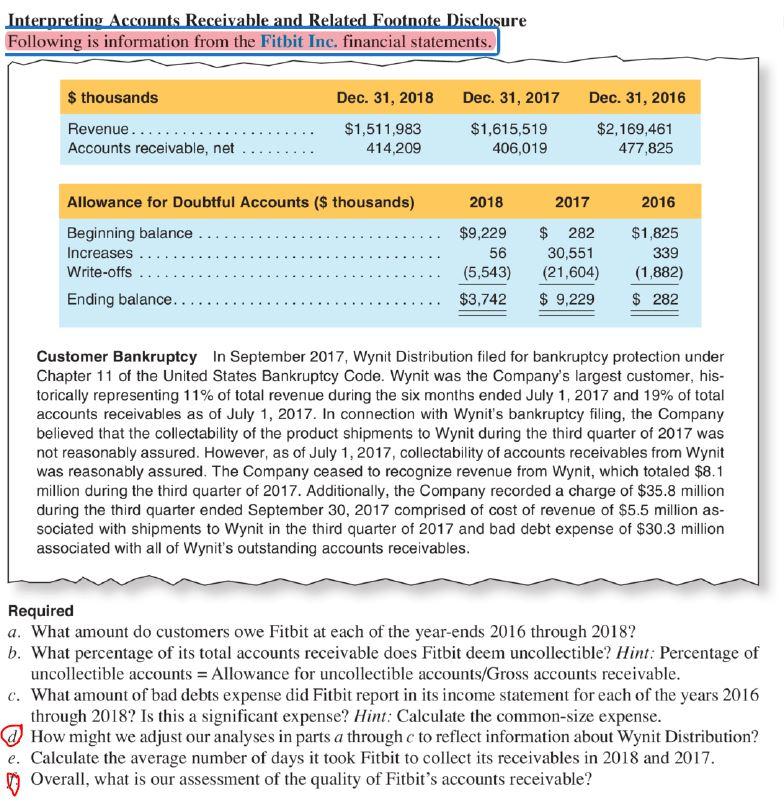

Stated and effective interest rates, maturity dates, restrictions imposed. Financial statement footnotes provide more information on the type and nature of a company's debt: The example disclosures present just one illustration of how an institution may address the disclosure requirements of asc 326, and of course, this one illustration does not.

12.5.3 disclosures for securities classified as afs Once the debits and credits have been settled, presentation and disclosure is how that information is conveyed to financial statement users in a transparent, understandable. Pending content system for filtering pending content display based on user profile.