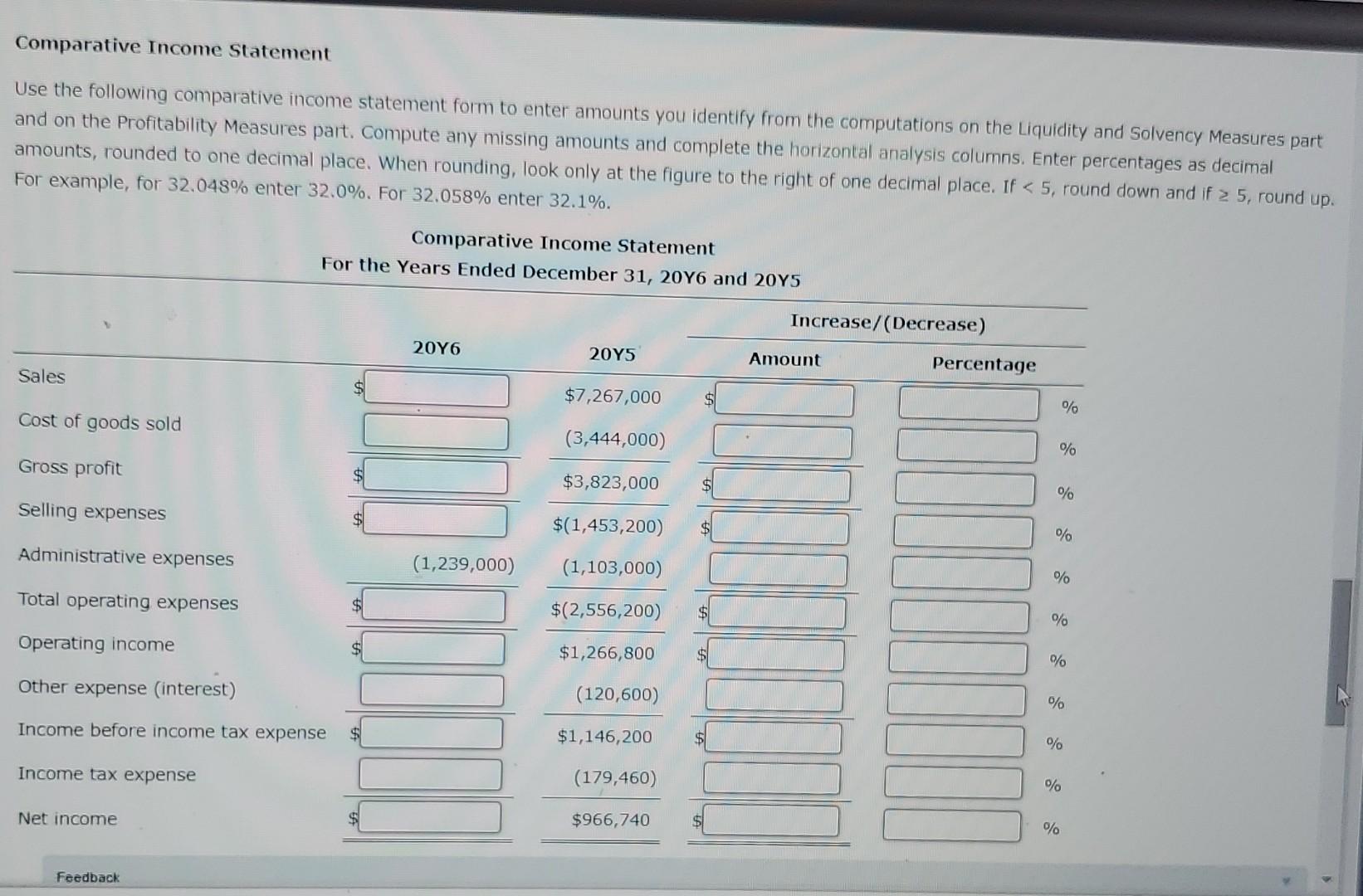

Unbelievable Tips About Fill In Balance Sheet Disclosure Of Bank Guarantee Financial Statements

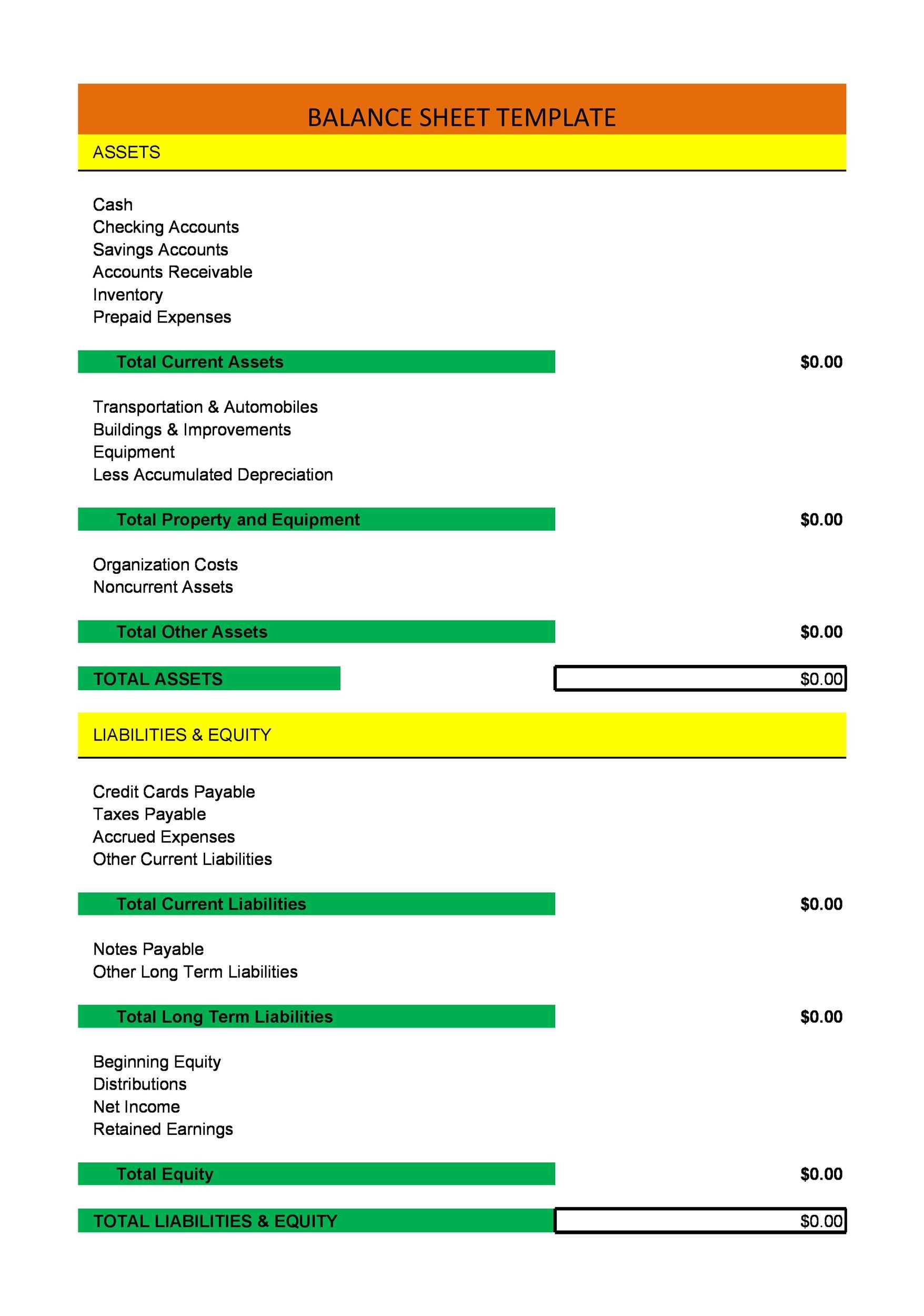

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year.

Fill in balance sheet. The balance sheet is one of the three core financial statements that are used to. How to create a balance sheet. After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000.

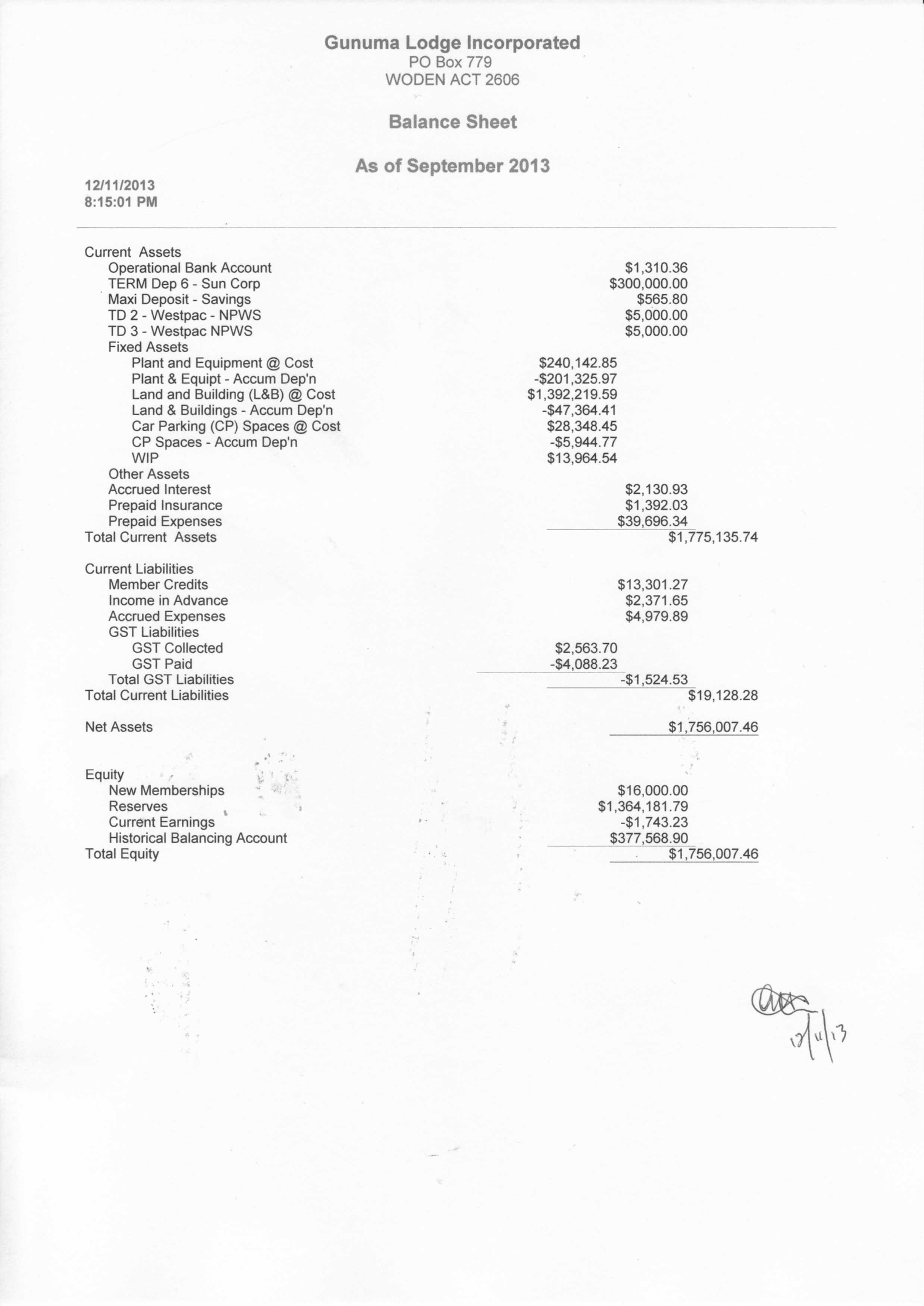

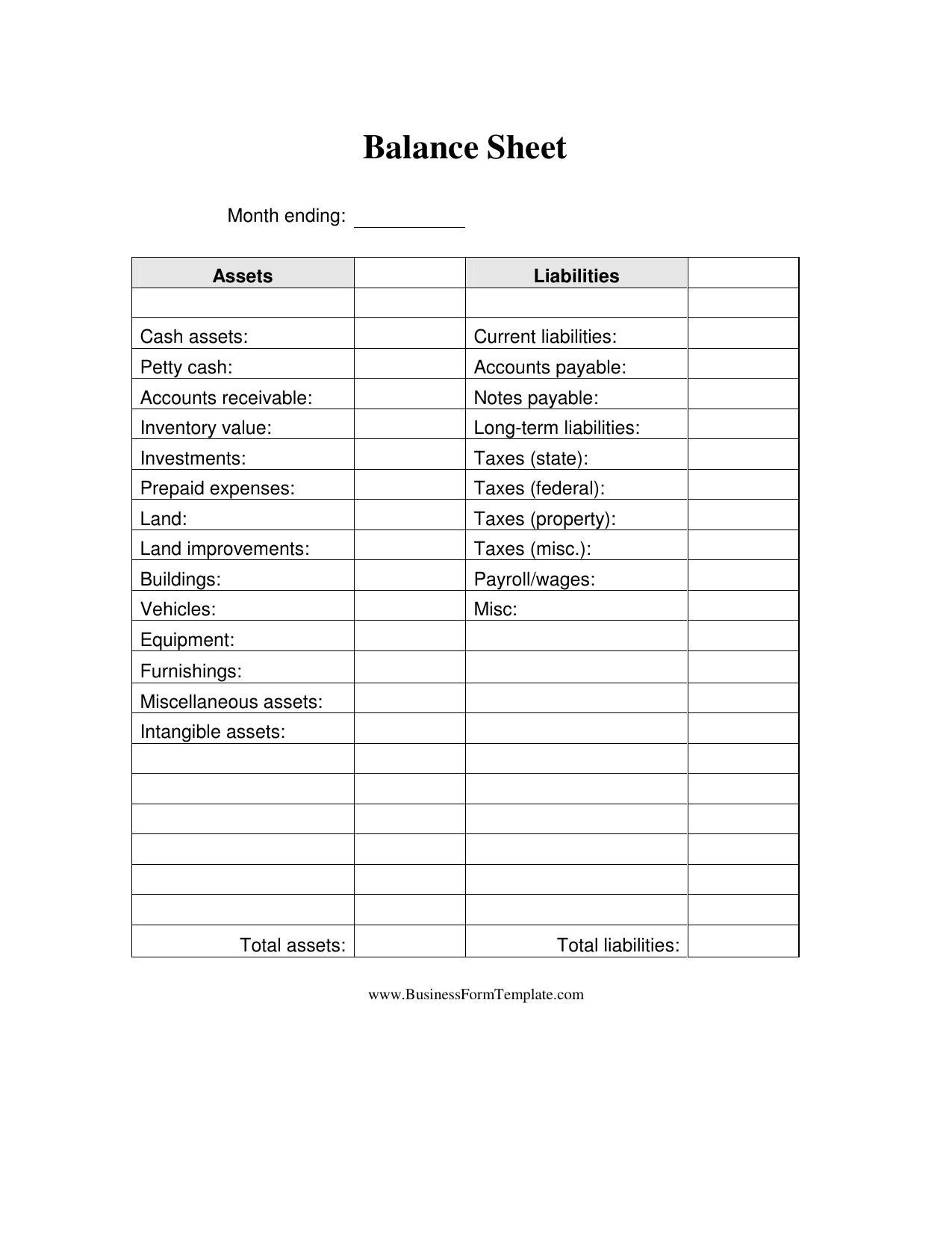

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. By kate christobek. Complete your balance sheet.

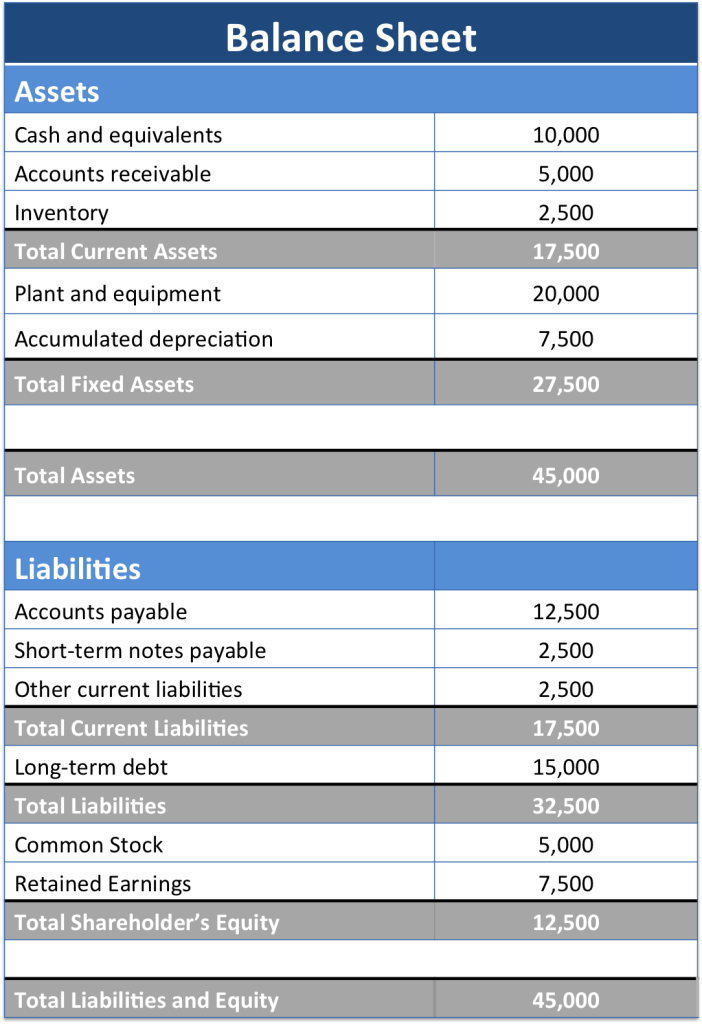

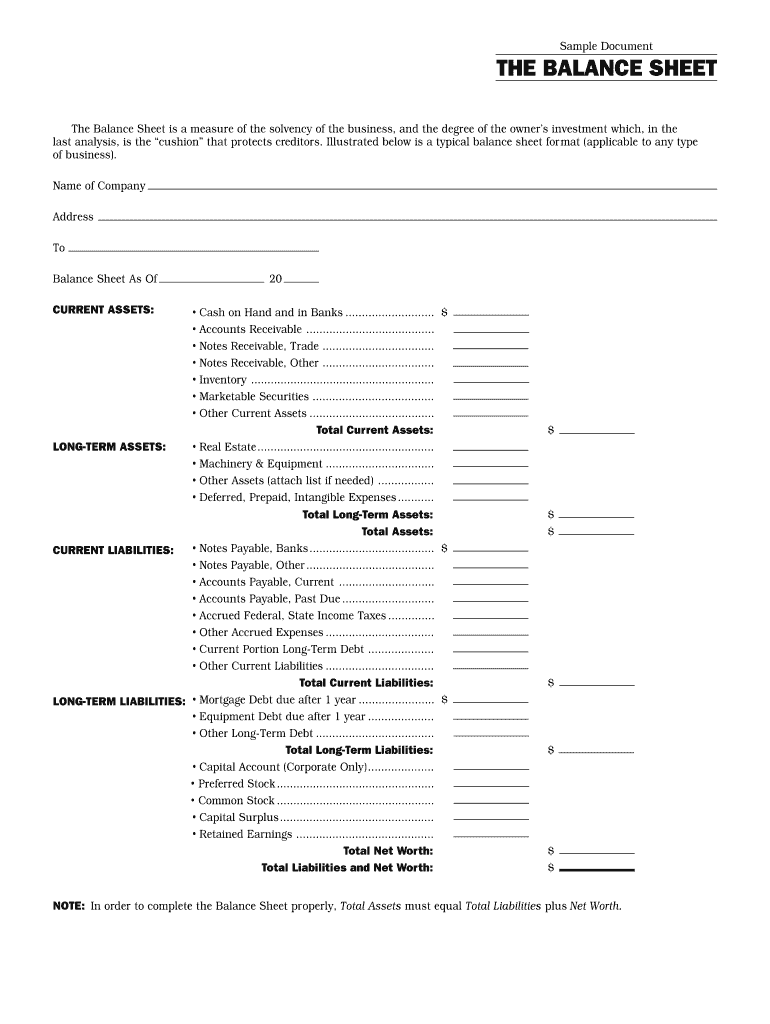

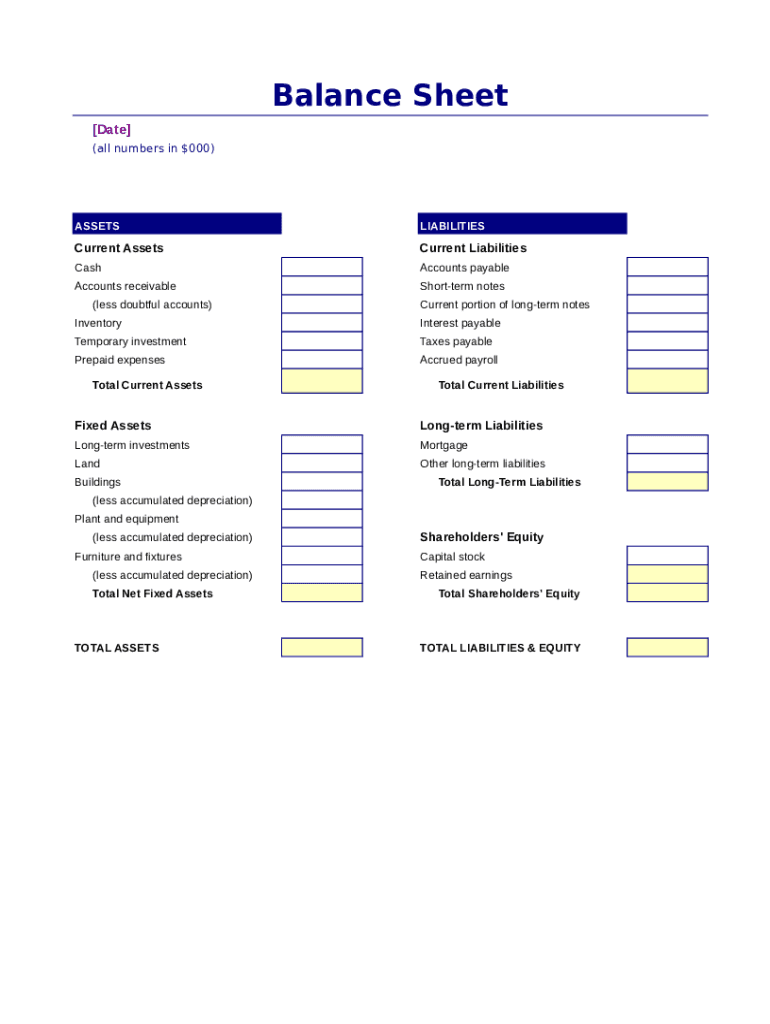

It shows the balance between the company’s assets against the sum of its liabilities and shareholders’ equity — what it owns versus what it owes. Determine the reporting date and period. Balance sheets include assets, liabilities, and shareholders’ equity.

You also need to clearly state on your balance sheet whether your figures are gst inclusive or exclusive. It keeps the spreadsheet format tidy and accurate, allowing you to balance numbers swiftly. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

Assets = liabilities + shareholders’ equity It is calculated by subtracting your total liabilities from your total assets. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date.

If you use estimated costs, make sure to label them clearly. Balance sheet template profit & loss statement template financial projection template and. Examples of assets are your home, car, bank account, savings, retirement accounts, or other investments.

Again, an asset is what you own. 1 use the basic accounting equation to make a balance sheets. Meredith hart published:

The balance sheet is based on the fundamental equation: Thus, a balance sheet has three sections: Fillable and printable balance sheet template 2024.

Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). Shareholders’ equity is the difference between a. Owner’s equity represents the owner’s investment in the business or the accumulated profits or losses.

If you run a limited company you won’t be able to use our balance sheet to complete statutory accounts. How to fill in your personal balance sheet 1. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned lawn mowing revenue, and common stock.