Painstaking Lessons Of Info About Useful Financial Ratios Interest On Bank Loan In Balance Sheet

Financial ratios using balance sheet amounts.

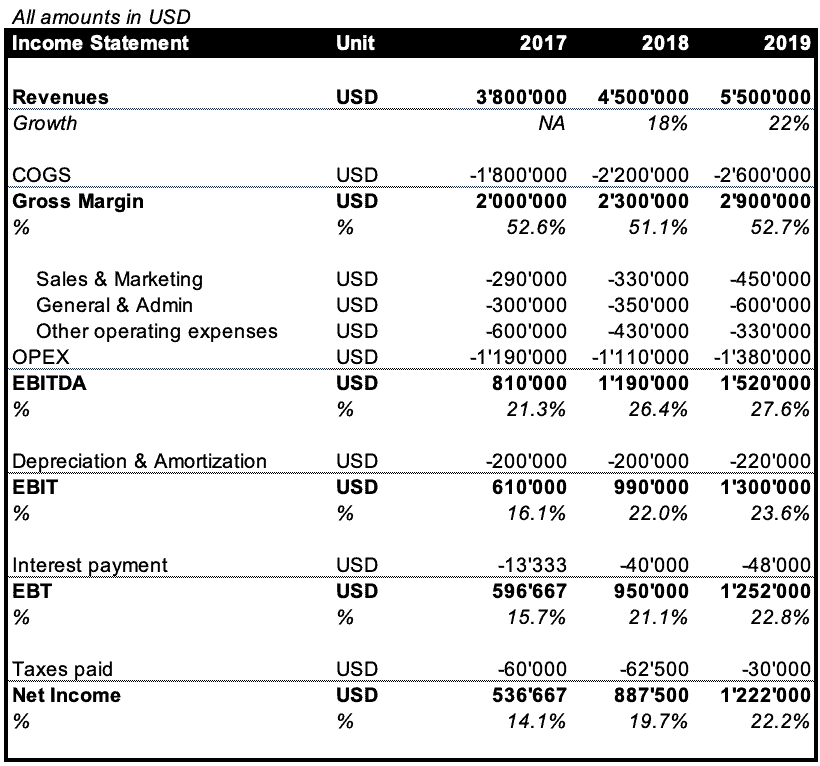

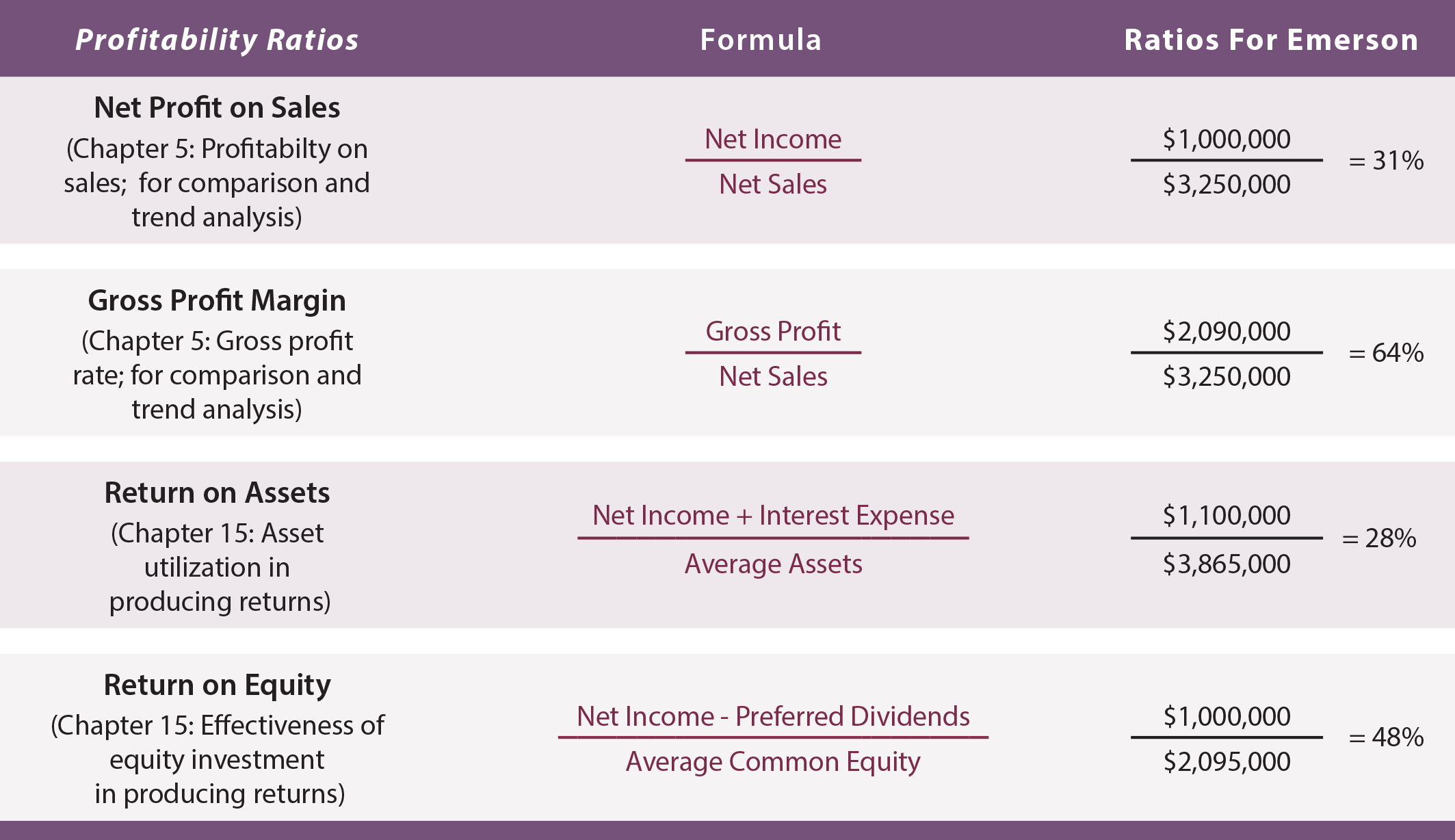

Useful financial ratios. Our explanation will involve the following 15 common financial ratios: The bottom line. Analysis of financial ratios serves two main purposes:

Track company performance see more One of the purposes of financial ratio analysis is to compare an. Financial ratios have the following uses:

Consequently, results on the usefulness of specific ratios vary. Our discussion of 15 financial ratios. To better understand a business's financial situation and level of solvency, you can do a few quick and easy calculations that use data found.

Uses of financial ratios. Eps = net profit / number of common shares to find net profit, you’d subtract total expenses from total revenue. Market ratios popular with current and potential.

Exhibit 1 summarizes a number of such studies and. Naturally, different researchers often include different ratios. These ratios are important because they.

Financial ratios are essential to solid fundamental analysis. Wharton has regained its position as the world’s leading provider of mbas in 2024, according to the latest ft ranking of the top 100 global business schools. Below is a brief rundown of the most important financial ratios for a company, including:

These can be useful indicators of how well your company is performing in a number of financial areas. Financial ratios are calculations used to measure and analyse various aspects of a company’s financial performance. You can use ratios to keep track of many different aspects of your financial situation—from cash flow to savings to retirement and more.

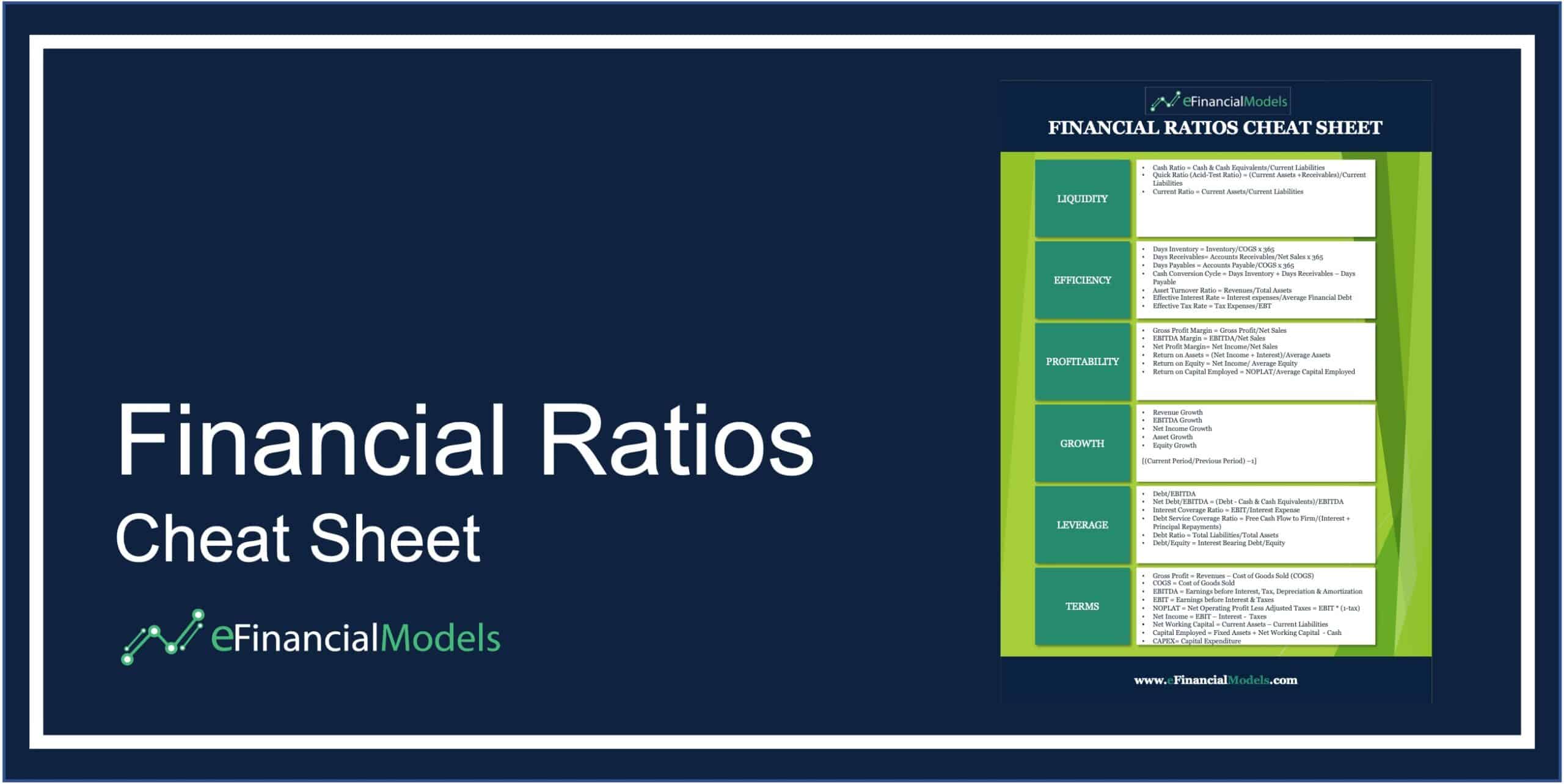

The common financial ratios every business should track are 1) liquidity ratios 2) leverage ratios 3)efficiency ratio 4) profitability ratios and 5) market value. Financial ratios are grouped into the following categories: Here’s a breakdown of important financial ratios, and why they’re so useful.

(investors might also refer to net. Uses and users of financial ratio analysis. Liquidity, profitability, solvency, efficiency, and valuation.