Neat Info About Audit Report For Nonprofit Organization Company Financial Statements Examples

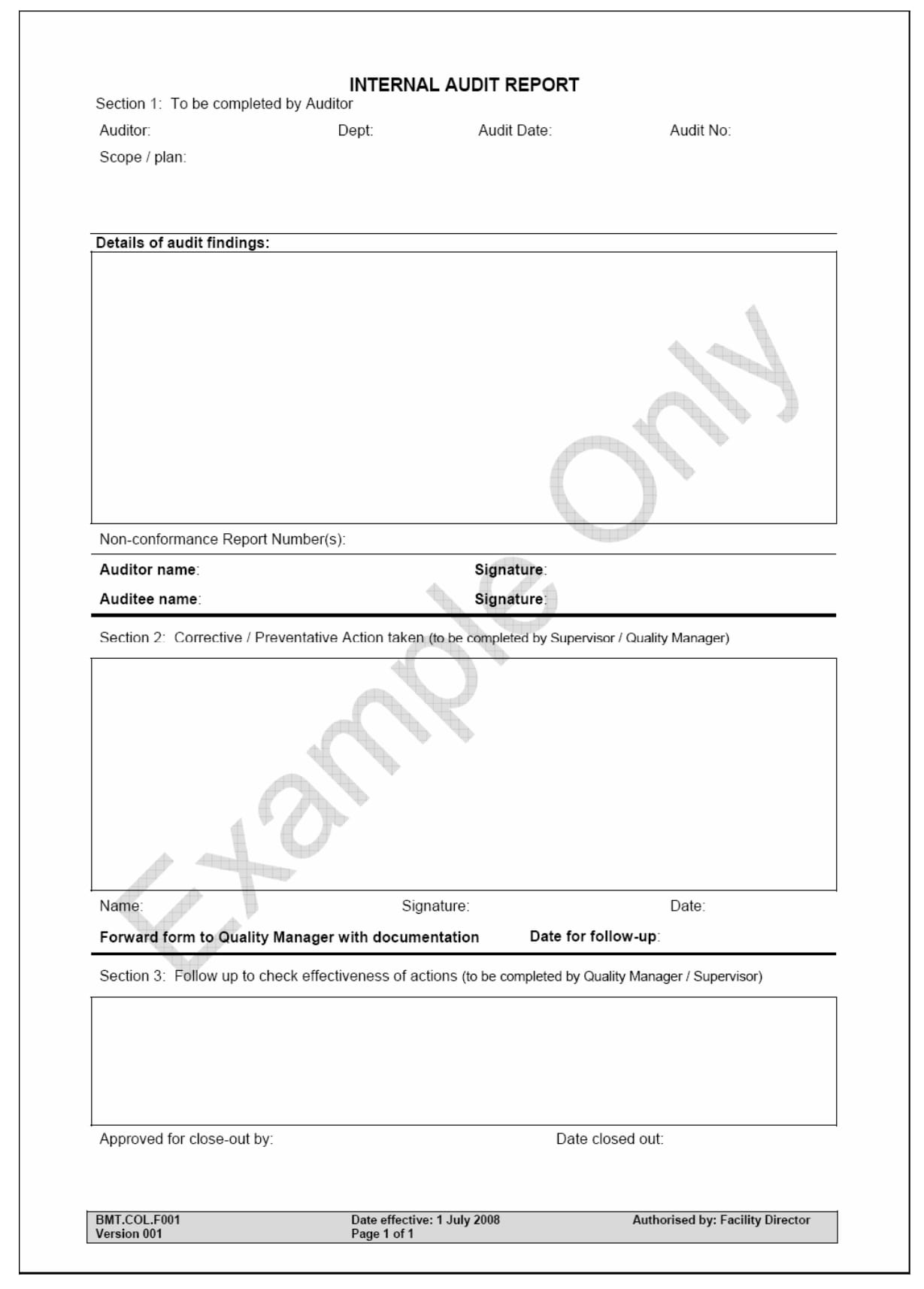

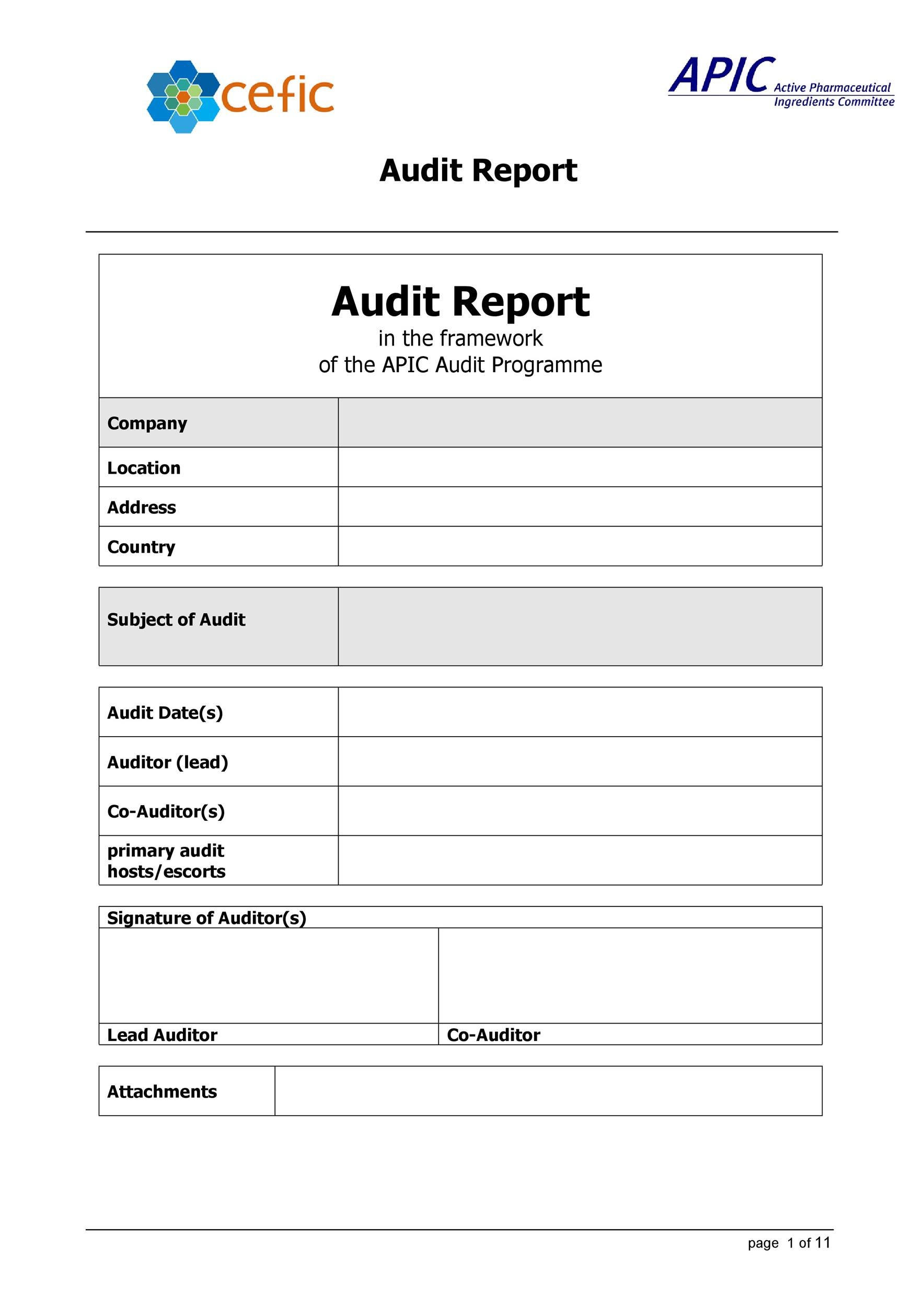

After the audit, the audit committee, executive director, and senior financial staff are responsible for reviewing the draft audit report, asking questions about the auditors' findings, and evaluating any recommendations before they are presented to the board in the final report.

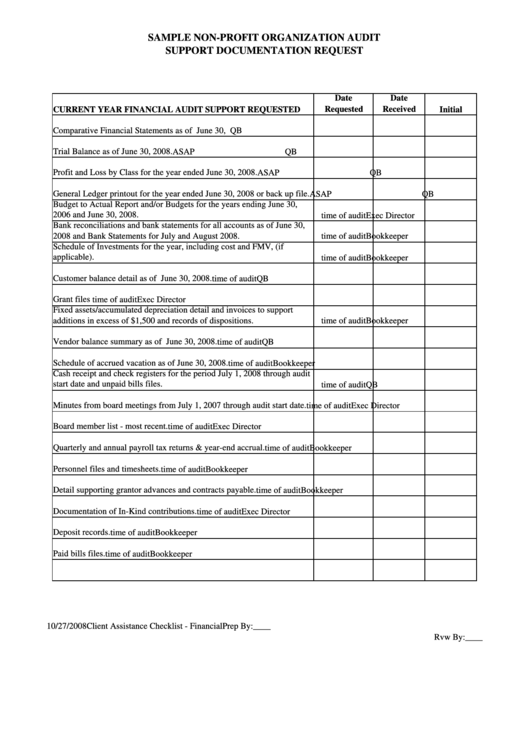

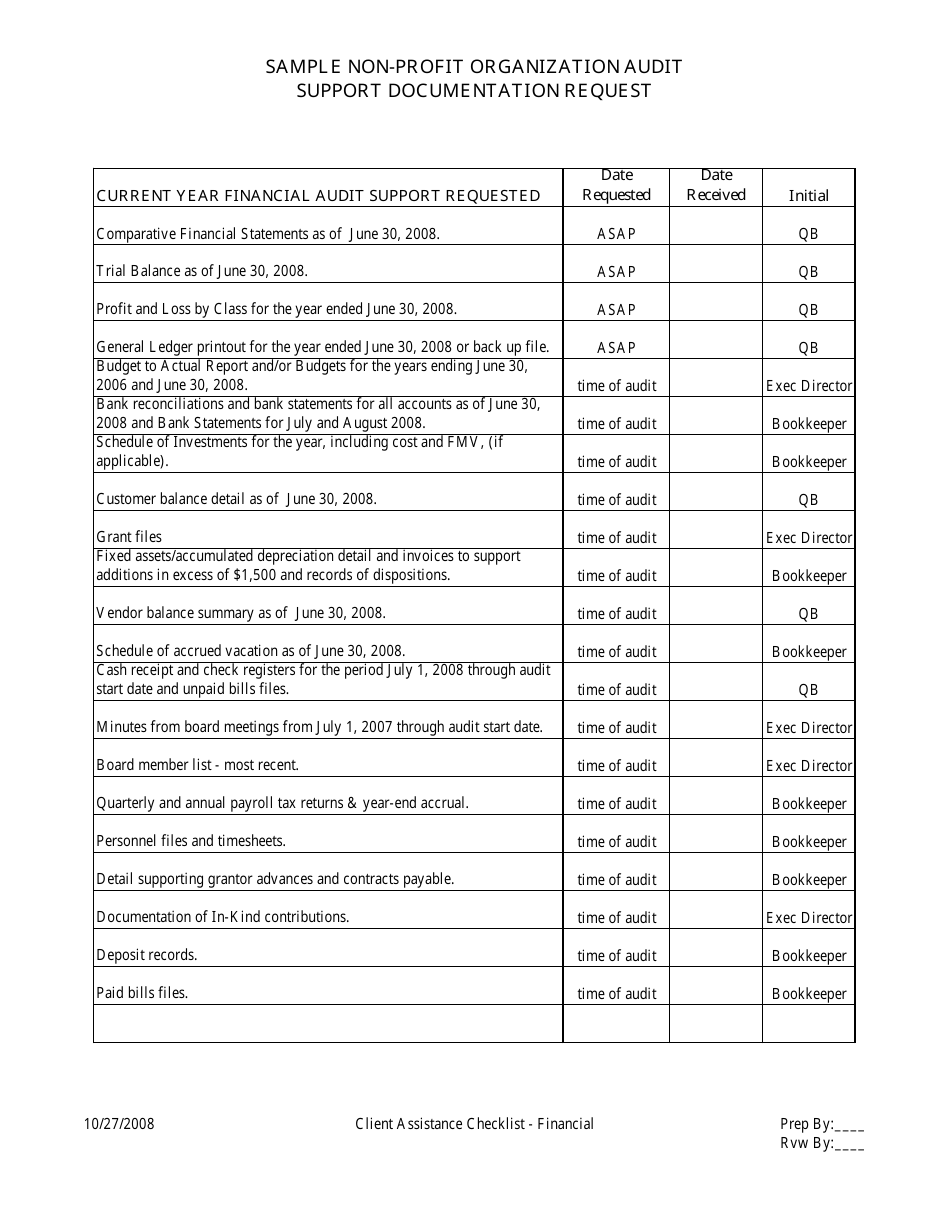

Audit report for nonprofit organization. Changing demands of the internal audit function. (“hope”) (a nonprofit organization), which comprise the consolidated statements of financial position as of december 31, 2021 and 2020, and the related consolidated statements of activities, functional expenses, and cash flows for the years then ended, and the. Journals that detail the organization’s business transactions and affected accounts ledgers for the fiscal year being audited bank statements and canceled checks payroll records and tax returns showing withholding for employees

This type of nonprofit audit can provide insight into why your organization is hitting or missing your goals and how to create a more efficient and effective organization. A nonprofit audit is an independent examination of a nonprofit organization’s financial statements and records to ensure compliance. Let’s first clarify what is meant by the nonprofit ‘audit report’.

There are several reasons your nonprofit may need to perform an audit. Gives information on financial position. Contains the statement of activities.

(a nonprofit organization) (the “foundation”) which comprise the statement of financial position as of june 30, 2020, and the related statements of activities and changes in net assets, cash flows, and functional expenses for the year then ended,. A soc 2 type ii report evaluates the design and. Report of independent auditors and financial statements for big national charity, inc.

While these changes will not affect how you do your accounting, they will affect how future audits are conducted. We have audited the accompanying financial statements of operation hope, inc.

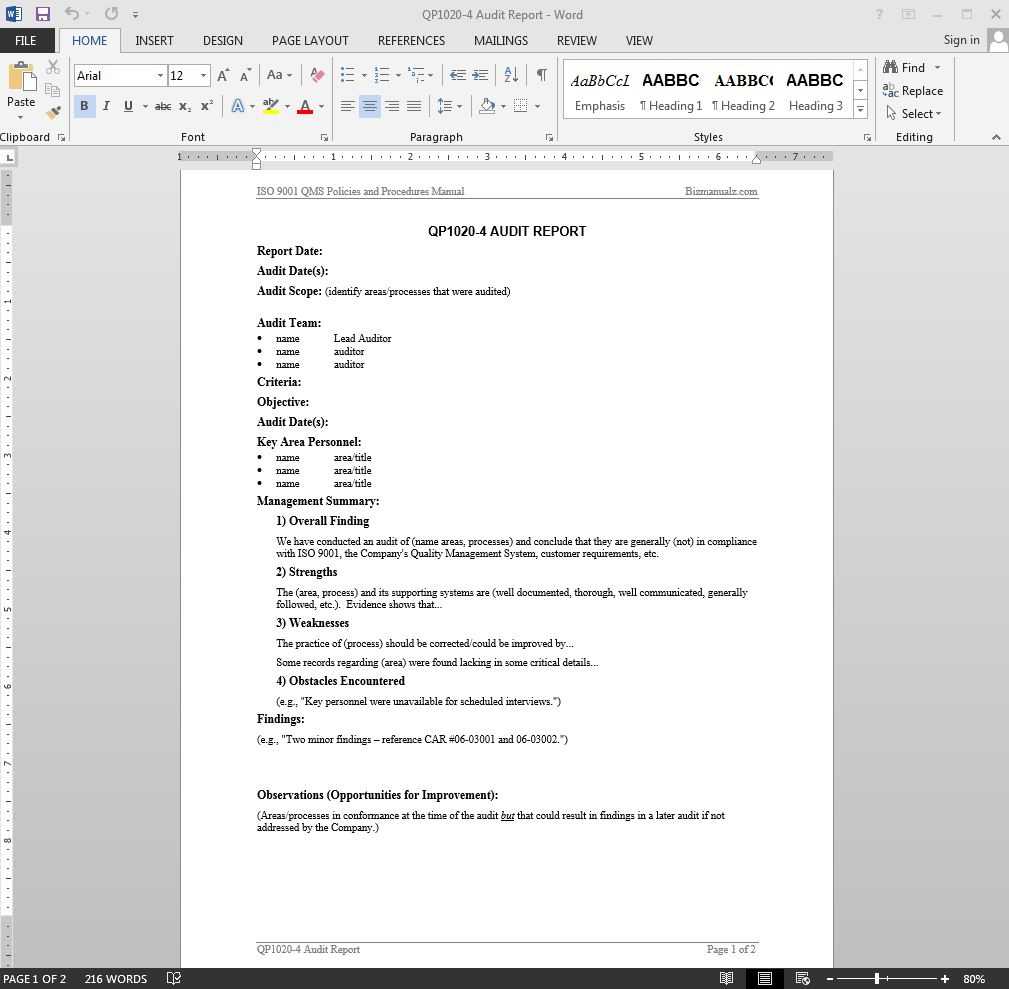

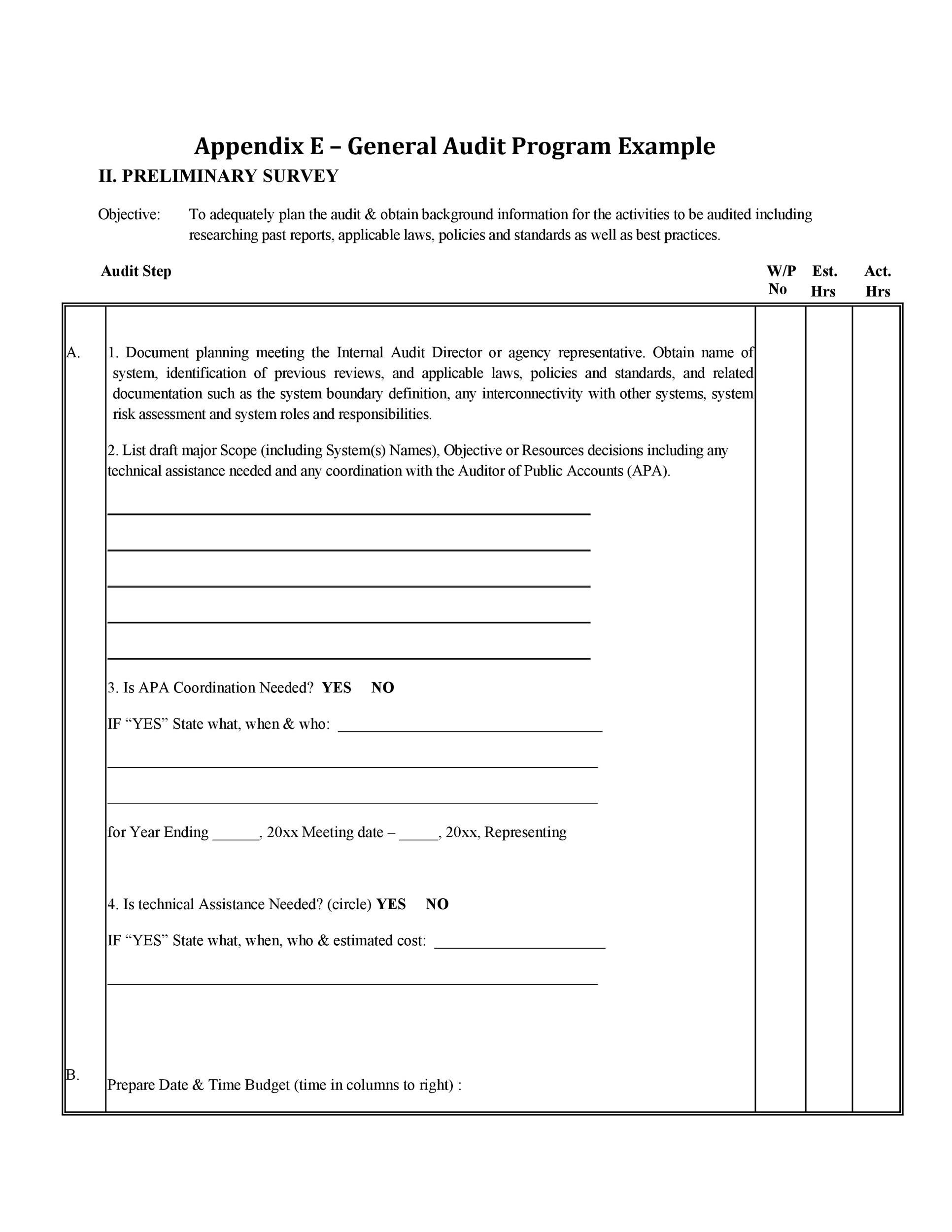

Getting ready for the audit checklist assemble in one location: There are four types of reports that an auditor could issue: An audit committee is either a task force or a standing committee that has been given authority by the board of directors to provide accountability for the nonprofit's independent audit.

A nonprofit audit is an essential method. You will still need to prepare a report that will be sent to the organization based on your findings. qualified opinion, which signals that the auditors found one or two situations where the nonprofit is not following gaap, or that the organization is following gaap in most cases although perhaps not all, but overall.

Your opinion is necessary because the organization you audited will need the report to act as a witness to their competence and integrity. That means keeping your paperwork organized, staying current on your reconciliations, tracking restricted funds, and accurately recording all your expense and revenue transactions each month. We have audited the accompanying financial statements of national pediatric cancer foundation, inc.

unqualified opinion (this is the type of audit you hope for); Soc 2 (service organization control ii) is a comprehensive audit framework developed by the american institute of cpas (aicpa). This nonprofit audit guide will help you understand what independent audits are, and help you prepare your nonprofit for an audit.

An audit can also provide insight into the organization’s financial health and help identify areas of improvement. A pdf version of this publication is attached here: This framework assesses the controls a service organization has in place in terms of security, availability, processing integrity, confidentiality, and privacy.