Matchless Info About Accrued Expenses Payable Balance Sheet Supplies Expense Income Statement

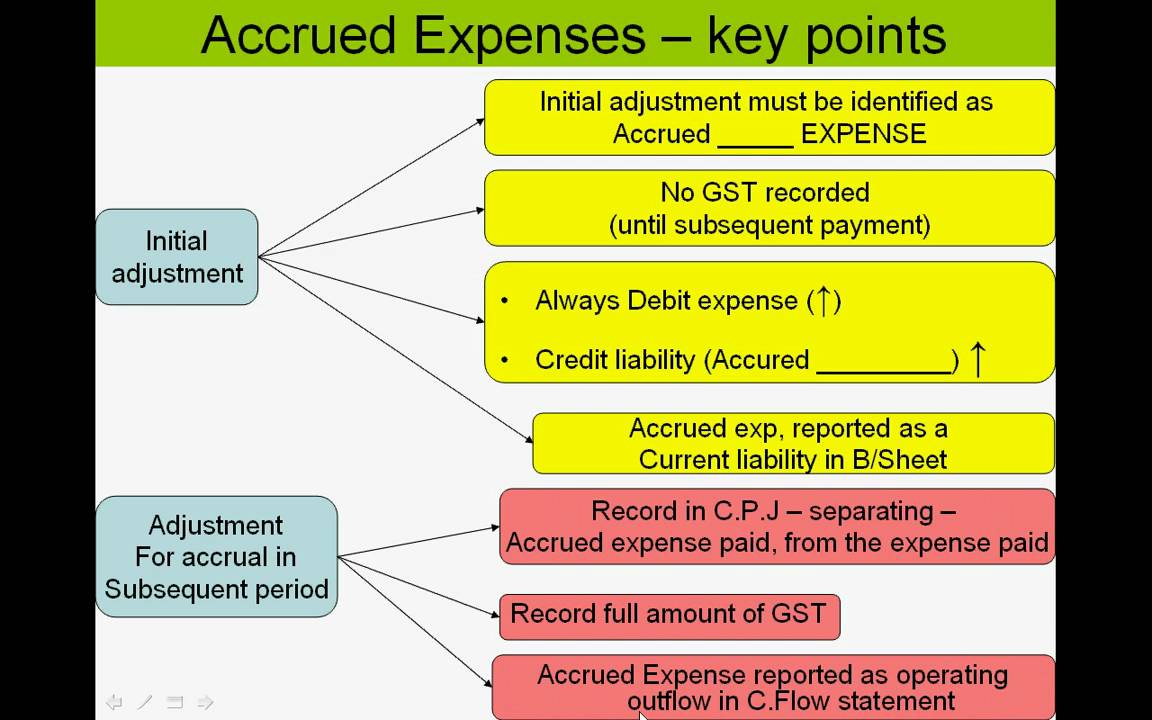

Is an accrued expense a debit or credit?

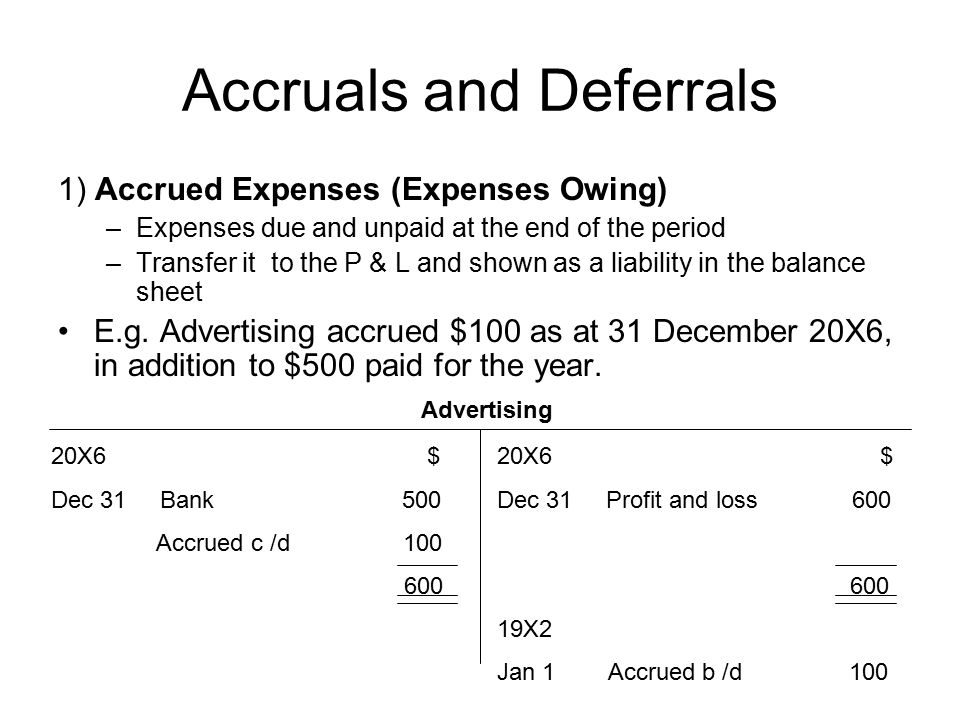

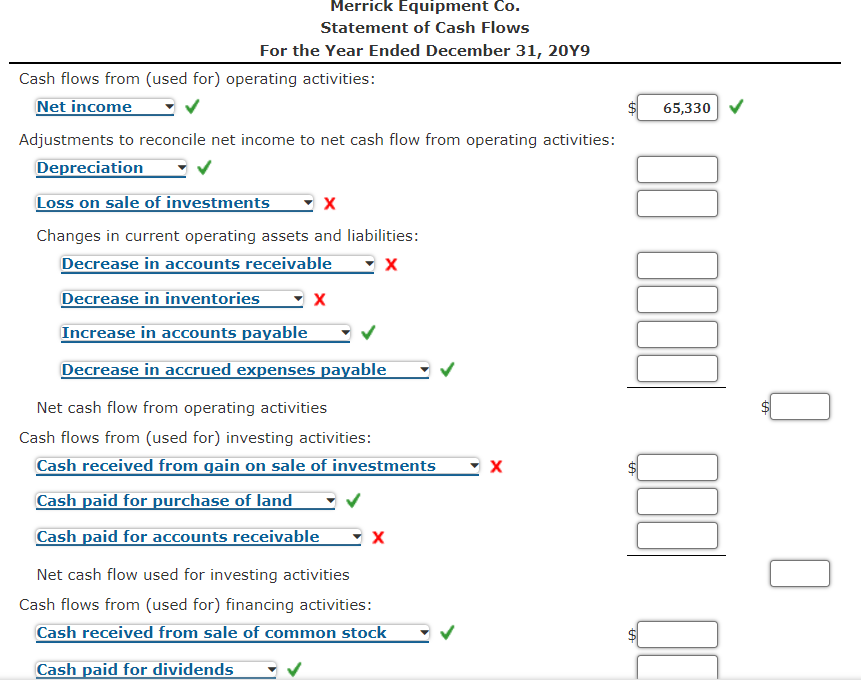

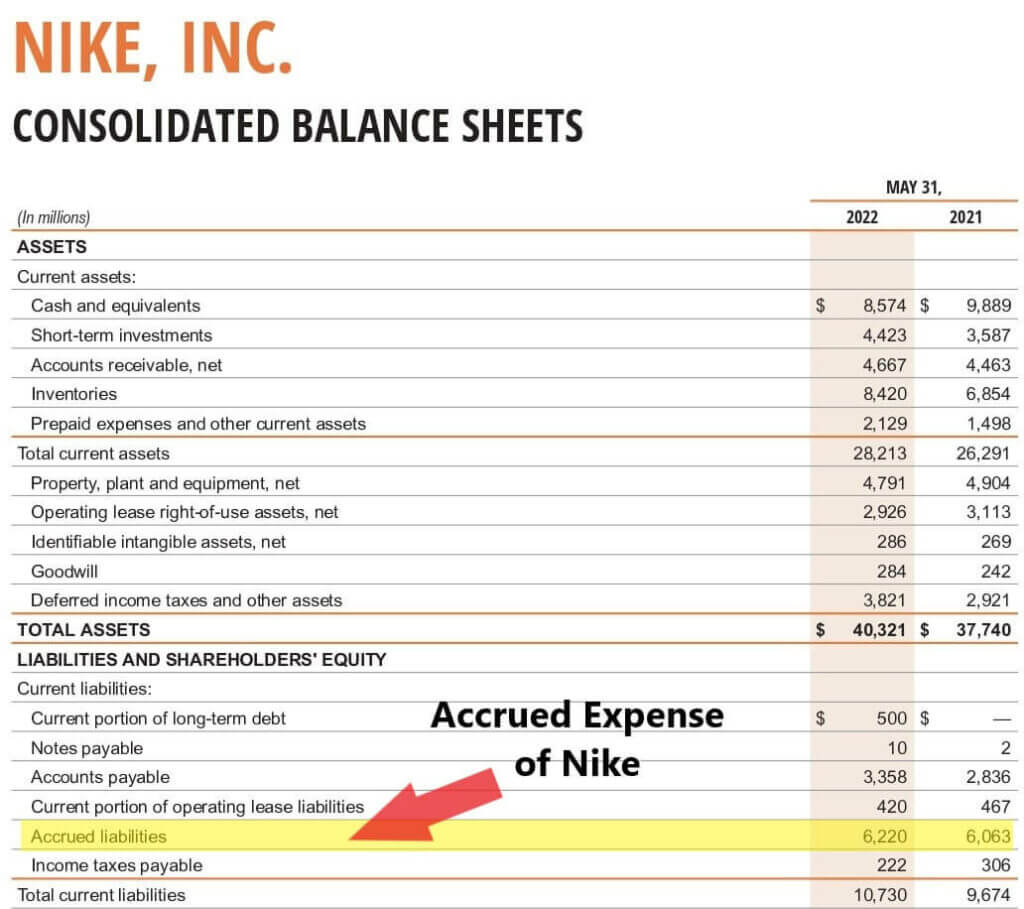

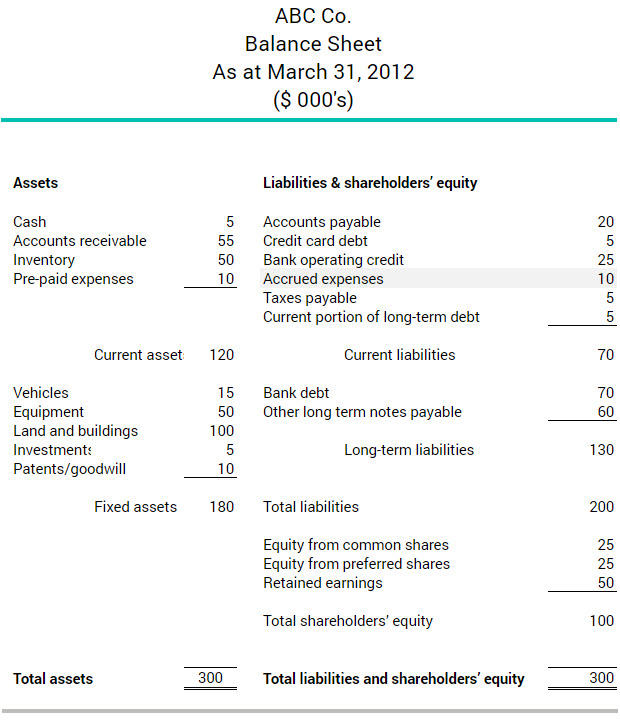

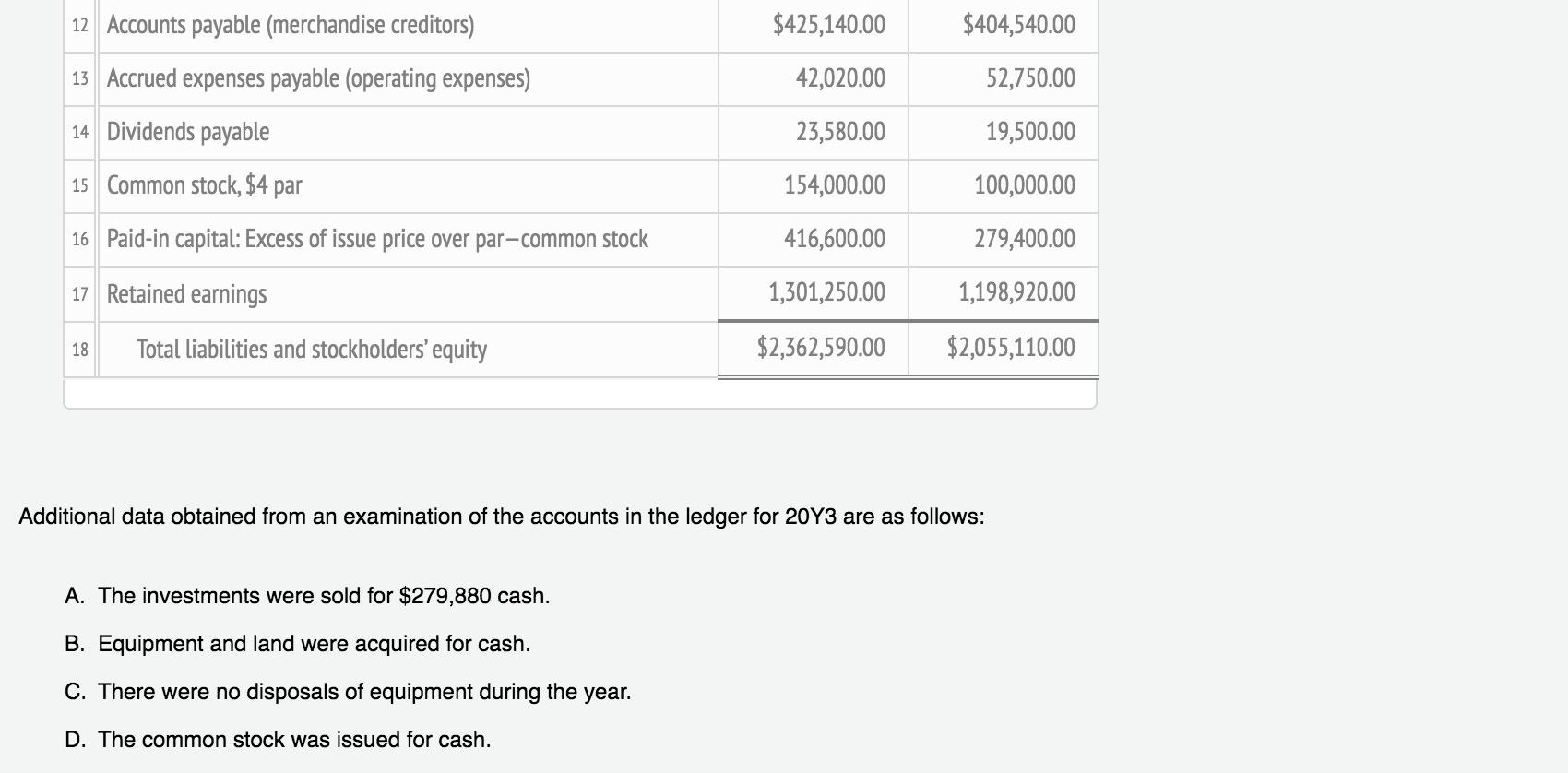

Accrued expenses payable balance sheet. Under accrual accounting, both accrued expenses (a/e) and accounts payable (a/p) are. Accrued expenses payable is a liability account that records amounts that are owed, but the vendors' invoices have not yet been received and/or have not yet been recorded in. Accrual accountingis the general accounting term that covers any of these liabilities and there are two methods that companies use to track these accumulated expenses:

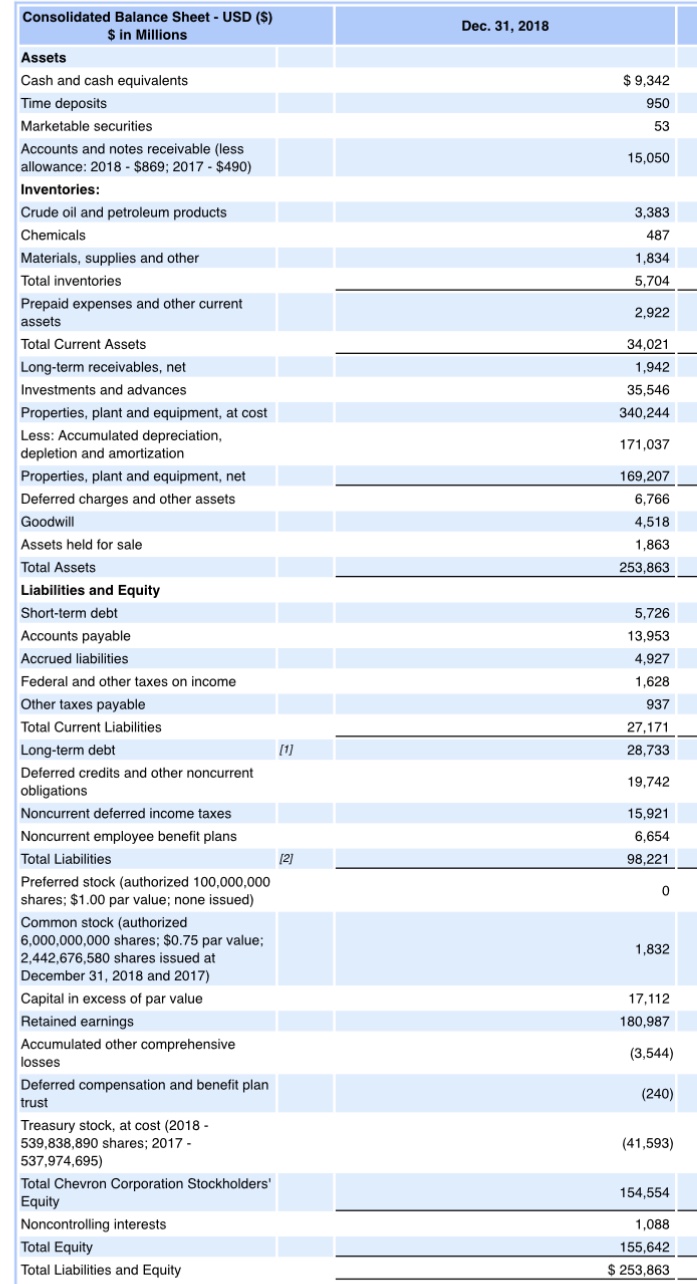

Accrued expenses is a term used in accounting where the expense is recorded in the books before it is paid for. An accrued expense is always recorded as a liability on your balance sheet. Accounts payables are recognized on the balance sheet when a company buys goods or services on credit.

An accrued expense—also called accrued liability—is an expense recognized as incurred but not yet paid. Prepaid expenses represent payments that have been made in advance of expenses incurred. So accrued expenses are a payable account that is a liability on your balance sheet.

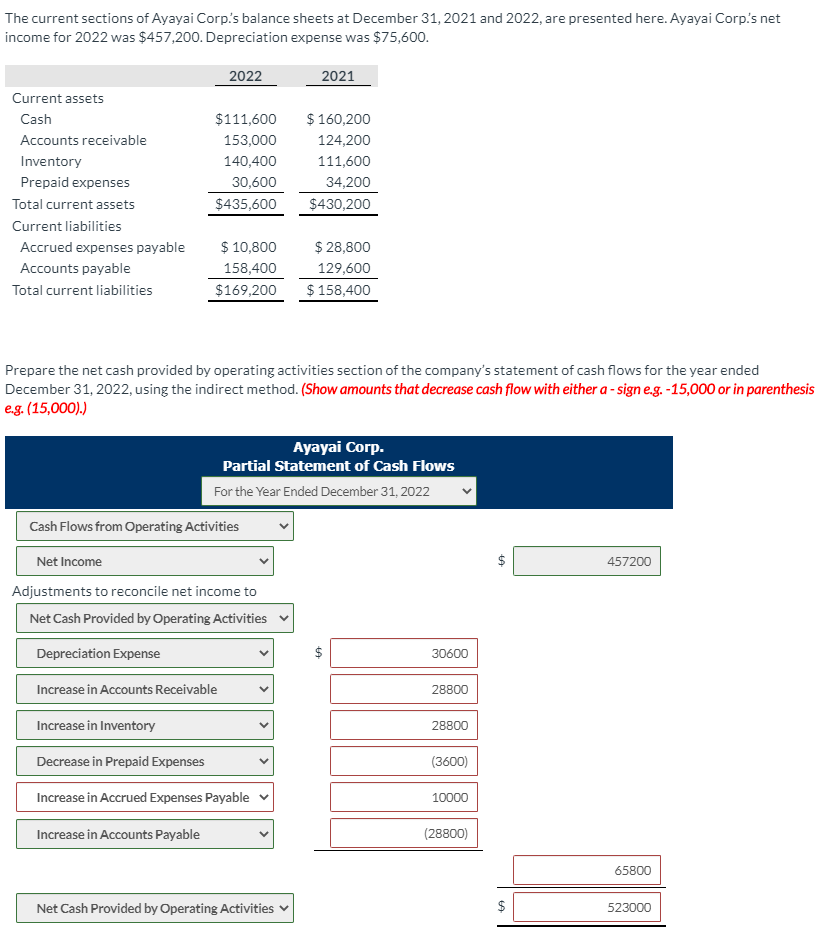

Accrued expense vs. A balance sheet shows what a company owns. Accounts payable, on the other hand, are current liabilities that will be.

The accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Are accrued expenses the same as accounts receivable? The matching principle of accounting requires.

Accrued expenses are those liabilities which have built up over time and are due to be paid. Accrued expenses, however, are generally paid off before the following financial statement is generated. Accrued expenses are recorded on the balance sheet as a current liability since they are expected to be paid within one year or one operating cycle, whichever is.

Balance sheet what are accrued expenses? Accrued expenses or accounts payable. What are accrued expenses on a balance sheet?

Accrued expenses accounts payable; Key differences between accounts payable and accrued liabilities. Accrued expenses (also called accrued liabilities) are payments that a company is obligated to pay in the future for which goods and services have already.

Companies must account for any expenses incurred in the past as these are costs that come due in the future. Accrued expenses go in the current liabilities column in a company's balance sheet to reflect future payments that have not been invoiced and are not yet. On the current liabilities section of the balance sheet, a line item that frequently appears is “accrued expenses,” also known as accrued liabilities.

A typical year in a business cycle constitutes several different expenses incurred evenly or unevenly during the course of the. An accrual is a record of revenue or expenses that have been earned or incurred but have not yet been recorded in the company's financial statements. An accrued expense is an expense that has been incurred but not yet paid by the time the books are closed for an accounting period.