Best Of The Best Info About Other Comprehensive Income Format Oracle Trial Balance Query

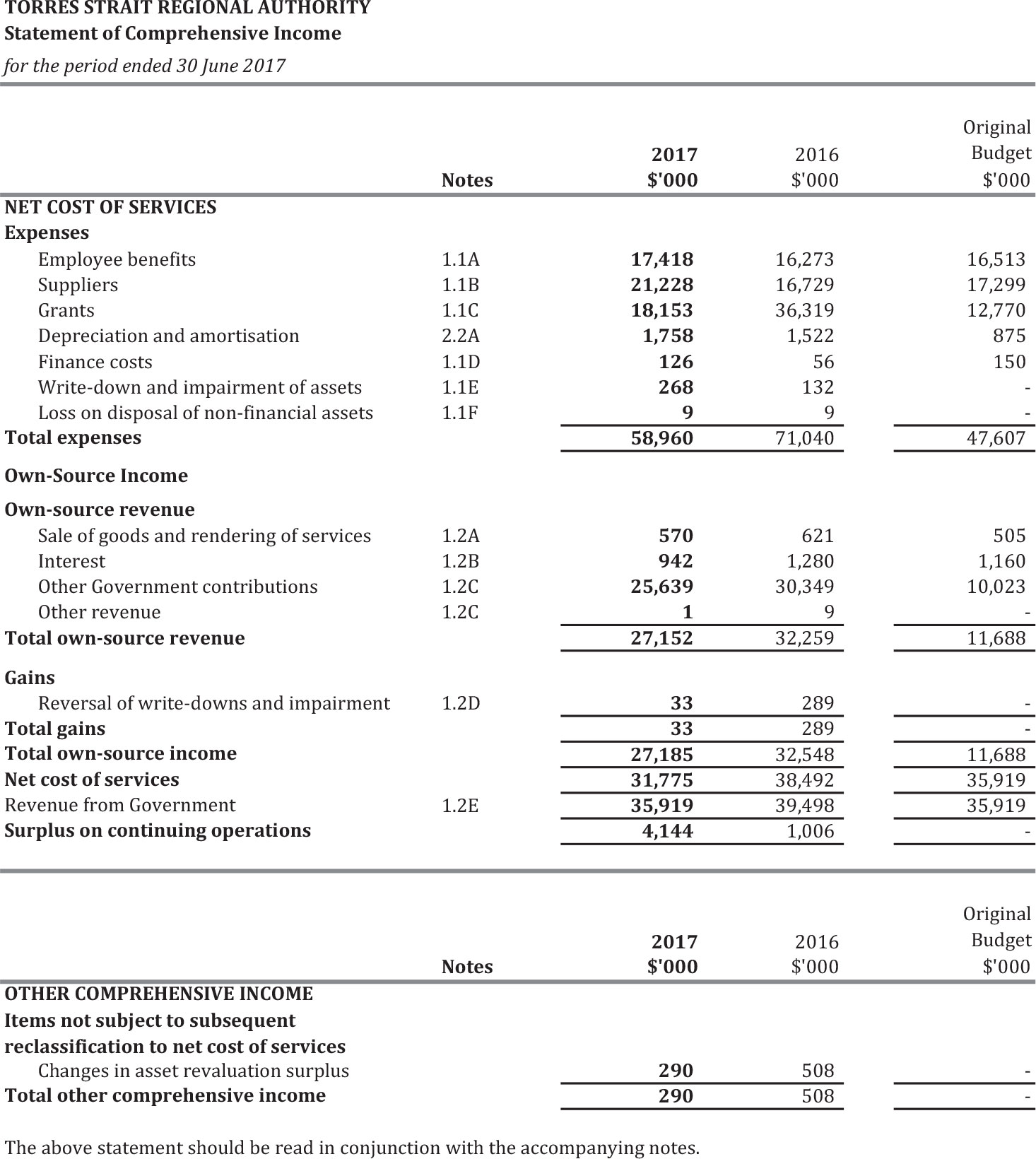

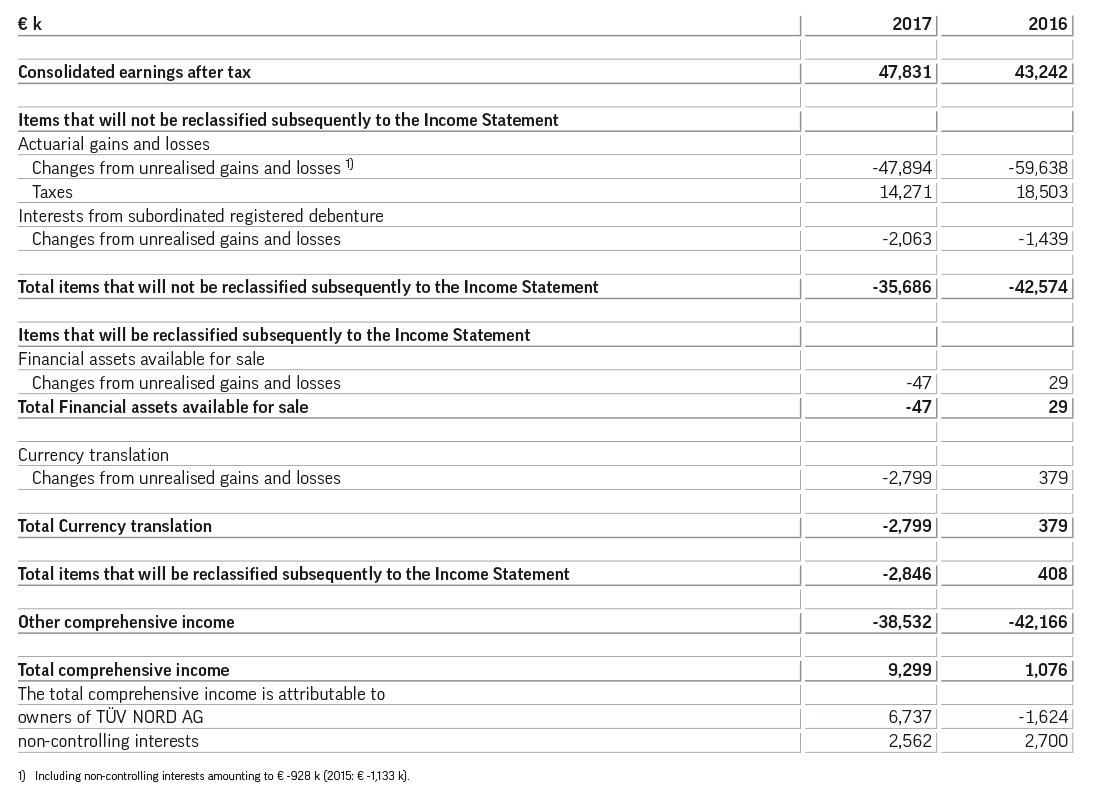

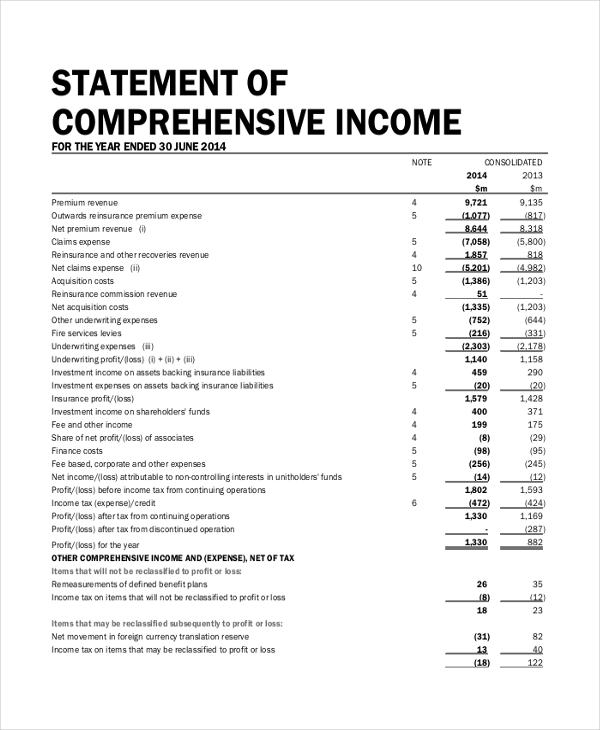

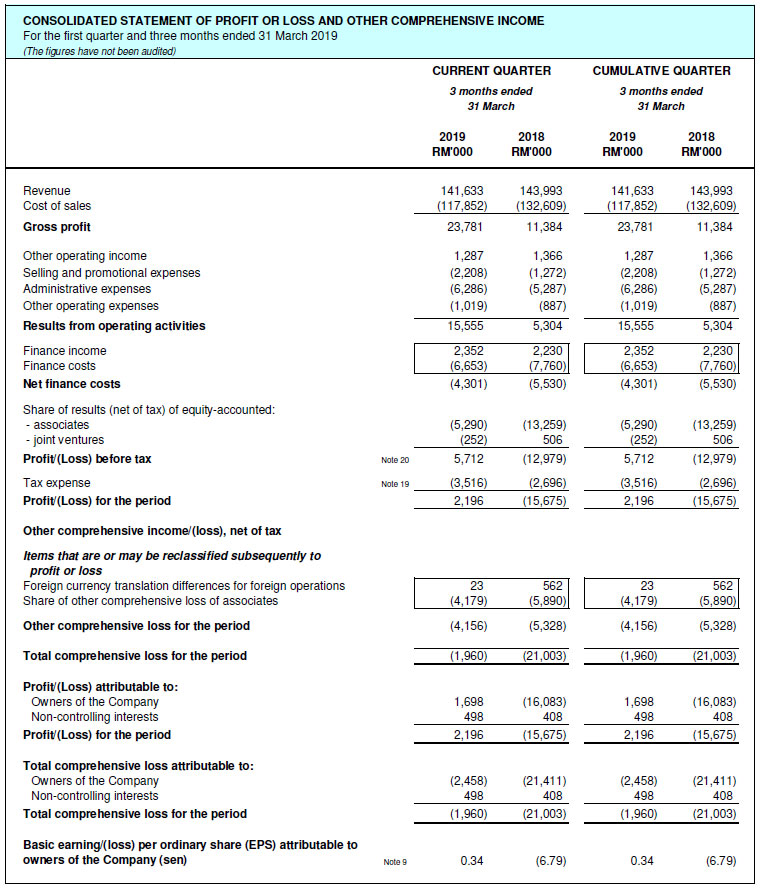

Other comprehensive income format. Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been realized. Those items of oci that will not be.

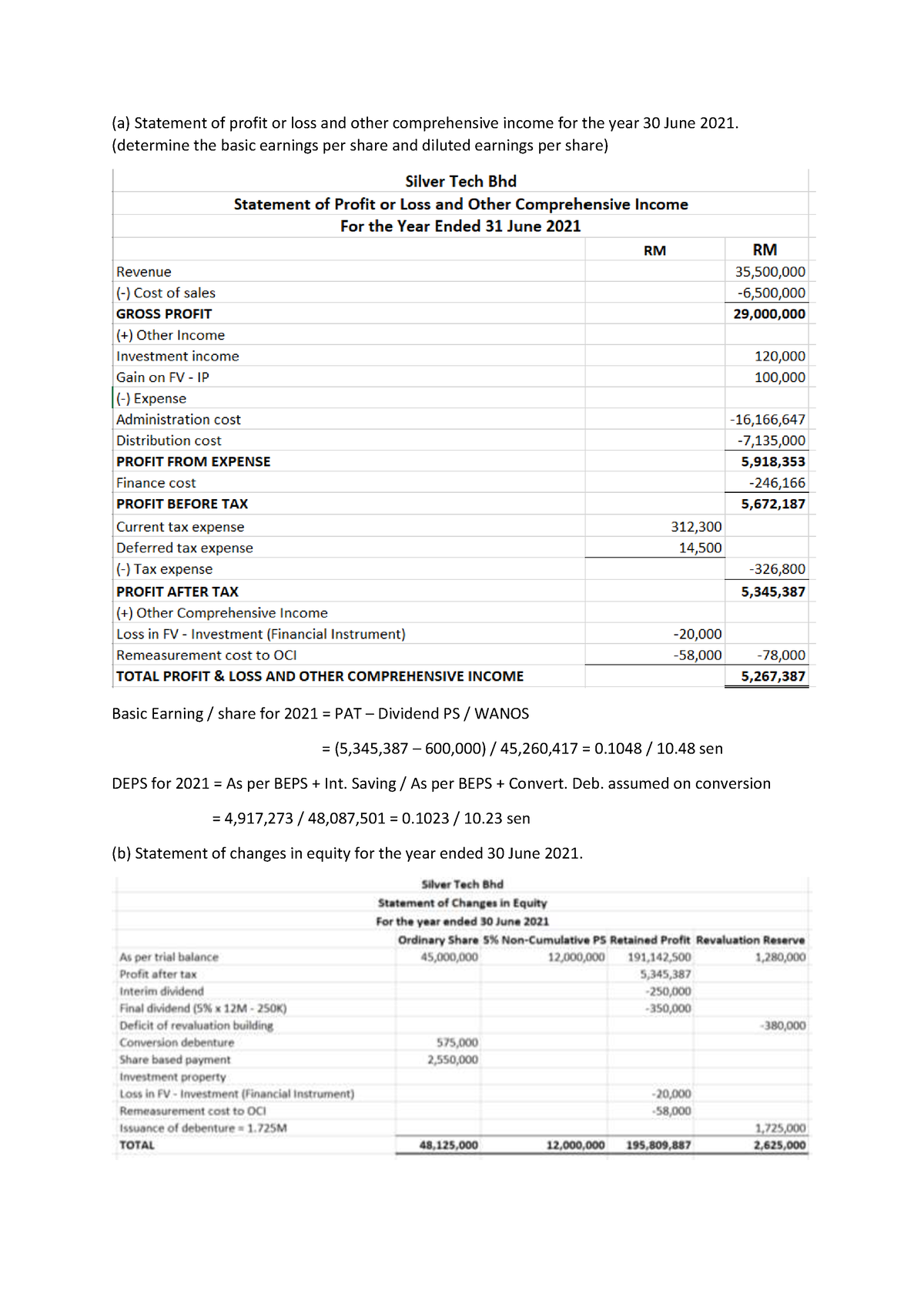

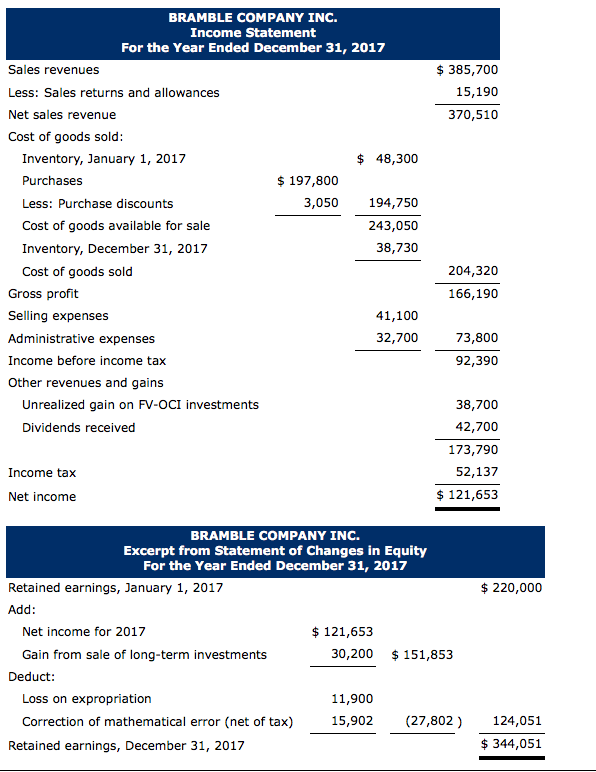

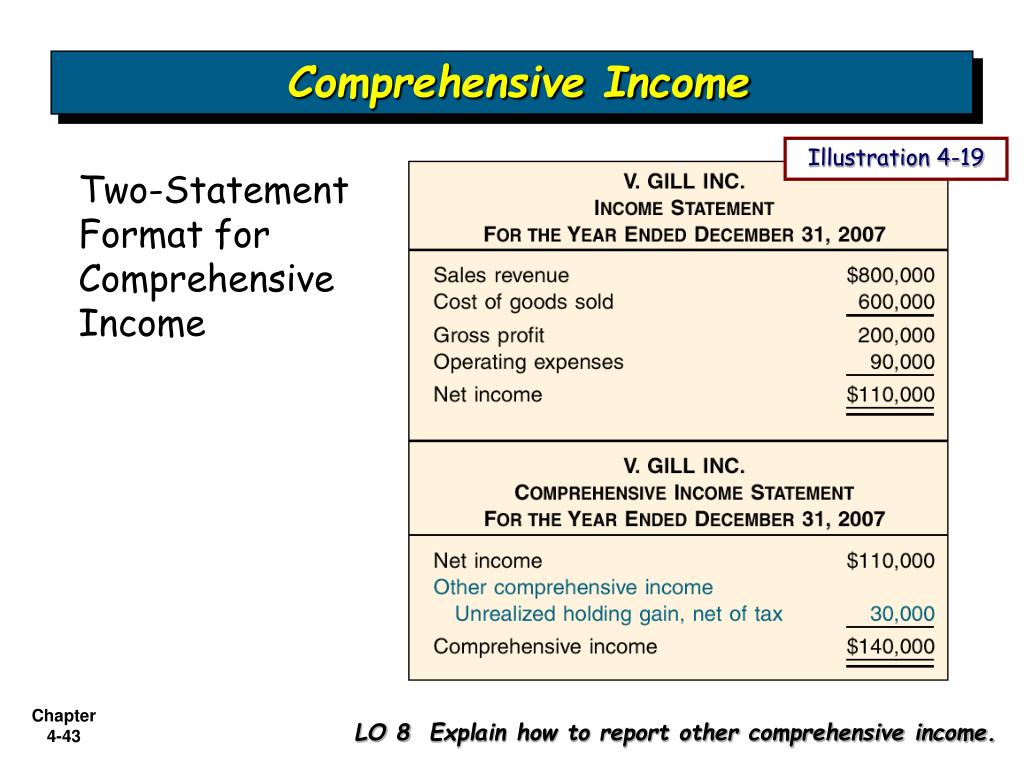

The international accounting standards board’s (iasb ®) conceptual framework for financial reporting (conceptual framework) includes guidelines on how to present. 9/21/22 as a company creates income, this changes its shareholder’s equity. One single statement statement of comprehensive income for the year ended 31 march 20x8 proforma 2:

This helps reduce the volatility of net income as the value of unrealized gains/losses moves up and down. Two separate statements statement of profit or loss for the. As part of its digital strategy, the eu wants to regulate artificial intelligence (ai) to ensure better conditions for the development and use of this innovative.

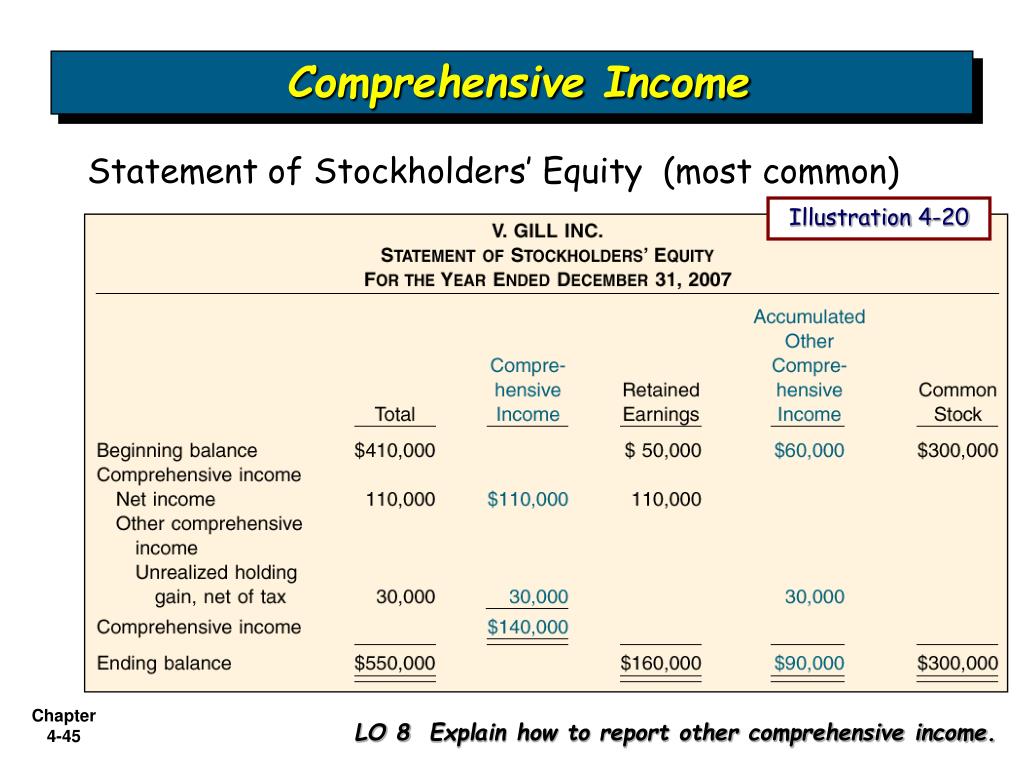

These items, such as a company’s. Add investment securities and it can get hairy. Report other comprehensive income and comprehensive income in a second separate, but consecutive, financial statement.

Those items of oci that might be recycled subsequently; Oci consists of revenues, expenses, gains, and losses to be included in comprehensive income but excluded from net income. Transactions related to changes in accumulated other comprehensive income (aoci), including reclassifications out of accumulated other comprehensive income.

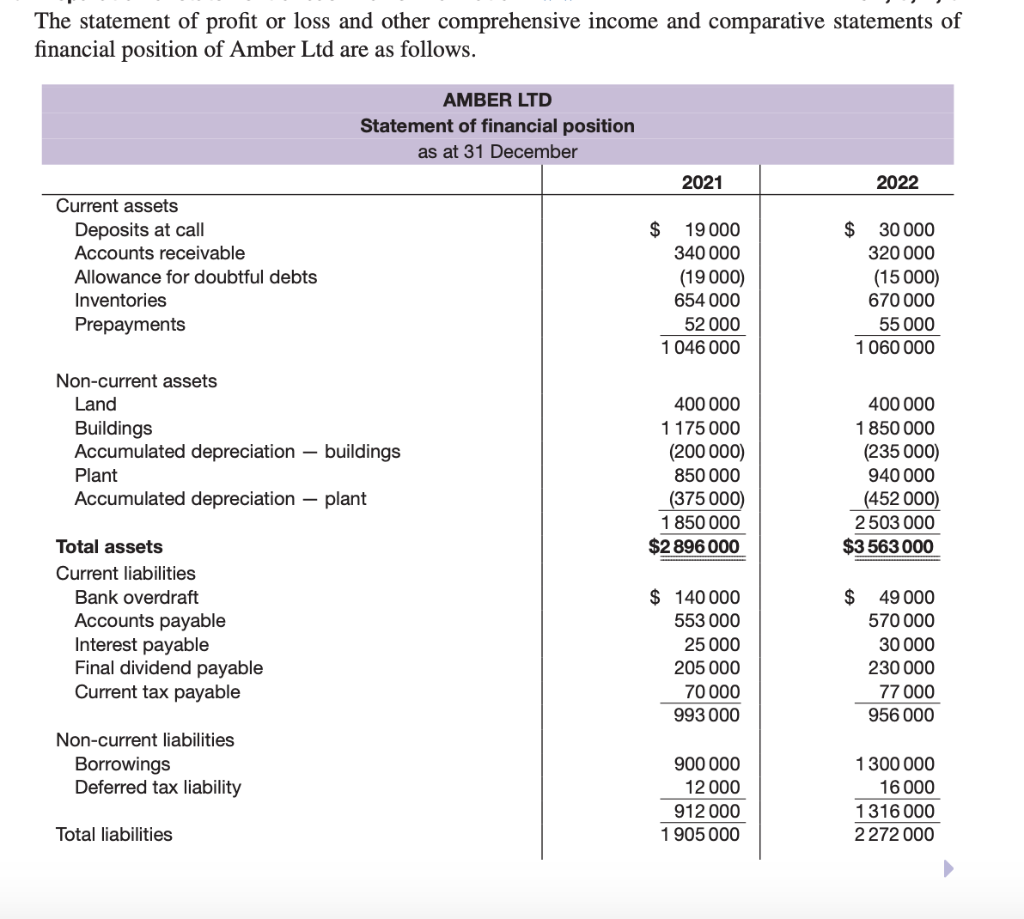

It is similar to retained earnings, which is impacted by net income, except it includes those items that are excludedfrom net income. Reporting entities should present each of the.

In june 2011 the board amended ias 1 to improve how items of other income. Other comprehensive income is those items of income and expense that are not recognised. Other comprehensive income refers to items of income and expenses that are not recognized as a part of the profit and loss account this income appears as.

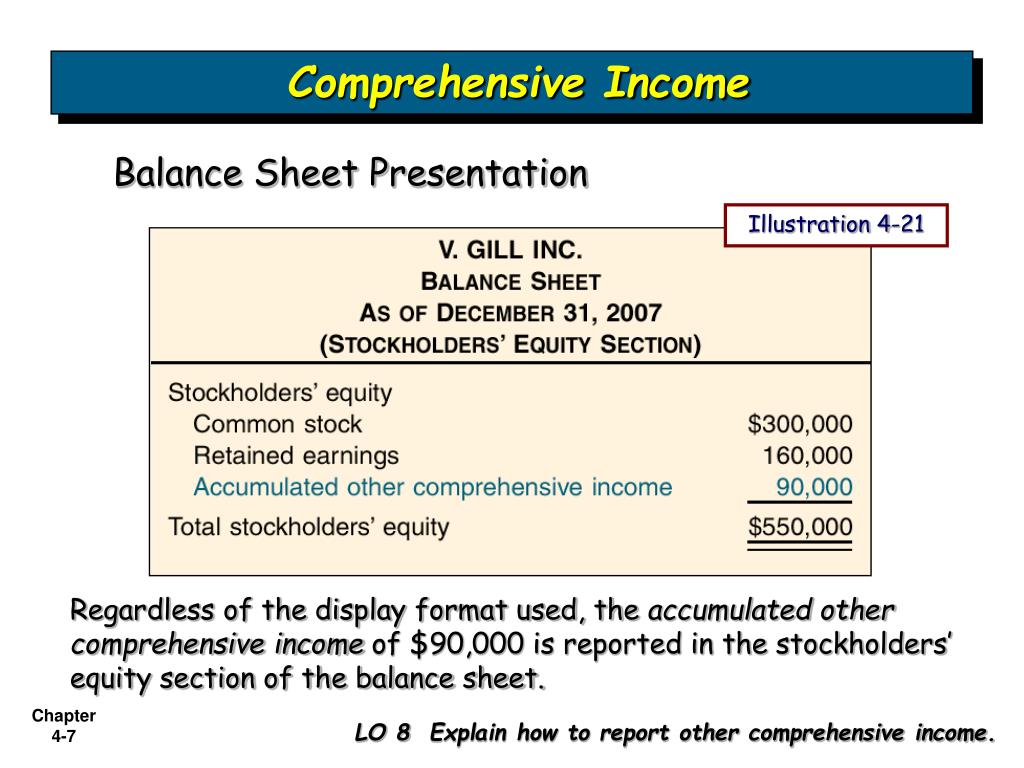

Accumulated other comprehensive income is an accumulator account that is located in the equity section of a company’s balance sheet. All items of ‘other comprehensive income’ (oci); Other comprehensive income is shown on a company’s balance sheet.

Edited for clarity: A statement of profit and loss and other comprehensive income for the period. A more complete view of a company's income and revenues.

As well as net income,. Other comprehensive income (net of taxes net of taxes the term net of taxes refers to the amount remaining after deducting taxes. The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users.